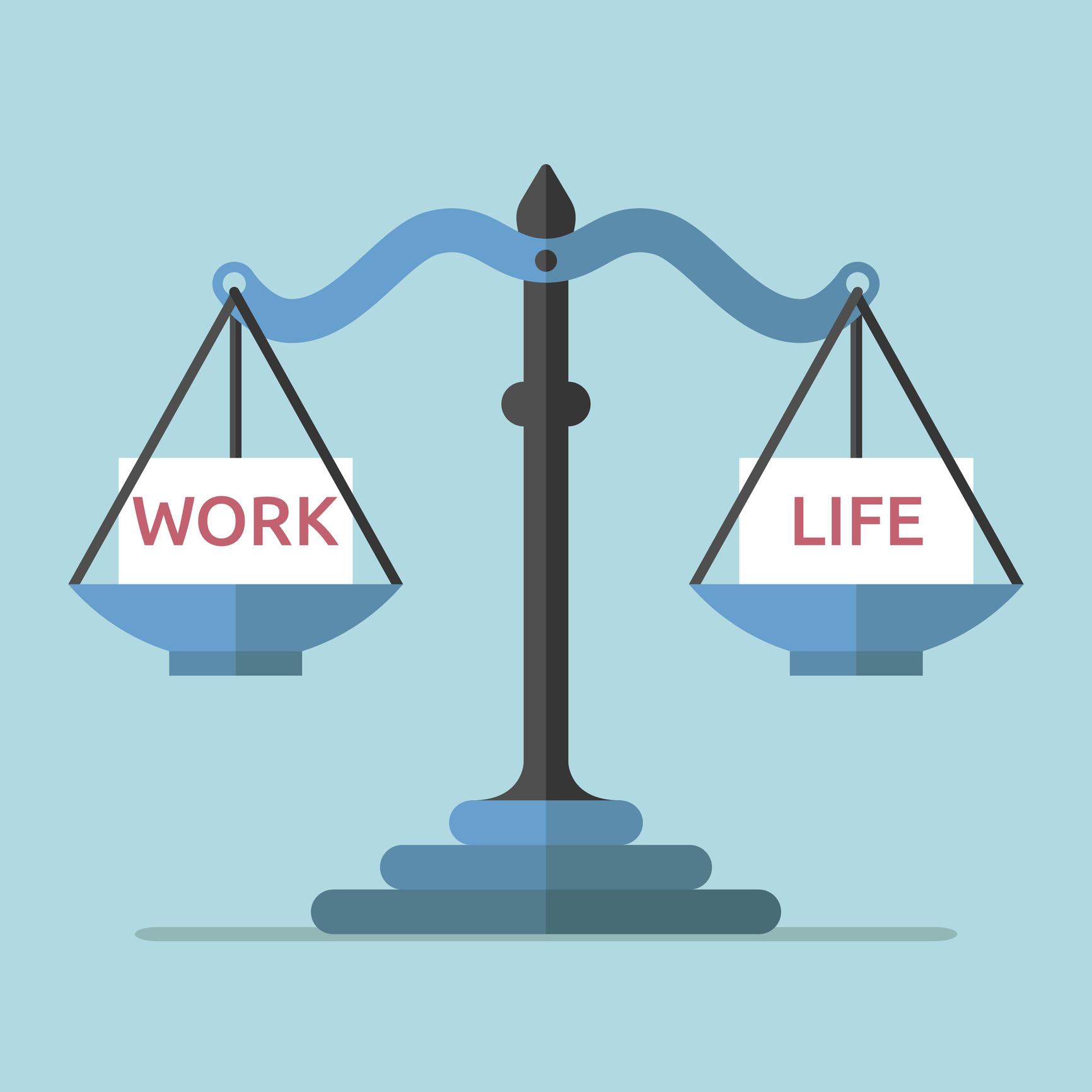

Closing a business can feel like an overwhelming and daunting task, especially for small business owners who’ve poured their hearts, souls, and countless hours into building their dreams. Whether it’s due to market changes, personal circumstances, or simply a realization that it’s time to move on, the decision to close your business is never easy. But here’s the good news: you’re not alone, and you don’t have to navigate this challenging process without a guide. In this complete guide, we’ll walk you through every step of the business closure journey, offering practical tips, emotional support, and insights that will help you conclude your venture with confidence and clarity. So grab a cup of coffee, take a deep breath, and let’s embark on this journey together—because while closing a business may mark the end of one chapter, it can also open the door to new beginnings.

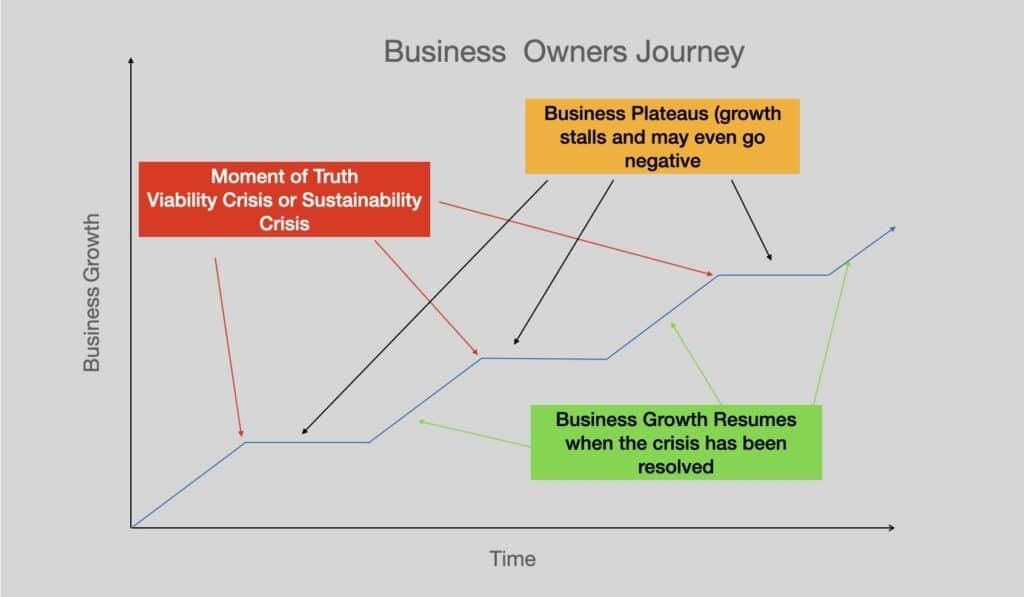

Understanding When Its Time to Close Your Business

Deciding to close your business is not easy, but recognizing the signs that it’s time to move on is crucial for your mental and financial well-being. Many small business owners face overwhelming challenges that can lead to this difficult decision. Understanding these indicators can help you approach the situation with clarity and confidence.

Here are some common signs that it might be time to consider closing your doors:

- Consistent Financial Losses: If your business has been operating at a loss for an extended period, it may be time to evaluate your options. Continuing to invest in a failing venture can drain your personal finances.

- Declining Customer Base: A steady decrease in sales or customer engagement can signal that your business is losing relevance. If marketing efforts haven’t reversed this trend, it might be time to reassess.

- Increased Competition: The landscape in which you operate can change rapidly. If competitors are consistently outperforming you, and you can’t keep pace, it might be a sign to consider exiting the market.

- Persistent Stress and Burnout: Running a business should be a fulfilling endeavor. If it’s causing you constant stress and impacting your health, it’s essential to evaluate whether it’s worth continuing.

Moreover, there are a few personal and emotional factors to consider:

- Loss of Passion: If you’ve lost your enthusiasm for the business, it may no longer be worth the effort. Passion fuels success; without it, motivation wanes.

- Shifting Life Priorities: Life events such as a new job, a move, or family changes can shift your focus. If your business no longer aligns with your personal goals, it may be time to step back.

To help you assess your situation more clearly, consider creating a simple pros and cons table:

| Pros of Closing | Cons of Closing |

|---|---|

| Reduces financial strain | Loss of investment |

| Opportunity for new ventures | Emotional toll of closure |

| Time for personal growth | Potential impact on employees |

Engaging with trusted advisors, mentors, or even a business consultant can provide additional perspectives. They can help you navigate the emotional landscape and offer practical solutions tailored to your situation. Remember, seeking help is a sign of strength, not weakness.

Ultimately, the decision to close your business should not be taken lightly. Weigh the signs, consider the pros and cons, and allow yourself the space to make a thoughtful decision. Transitioning out of business can lead to new opportunities and a fresh start.

Assessing the Financial Impact of Closing Your Business

Making the decision to close your business is never easy, and one of the most pressing concerns is the financial impact it will have on you. Understanding these implications can help you navigate this challenging transition more smoothly.

First, it’s crucial to determine your current financial status. Gather all relevant documents, including:

- Balance sheets – to see what you own and what you owe.

- Income statements – to assess your recent revenue and expenses.

- Cash flow statements – to gauge your liquidity position.

Once you have a clear picture of your finances, assess any outstanding debts. If you have loans or credit obligations, consider how closing will affect repayments. Will you have enough remaining assets to settle these debts, or will you need to negotiate with creditors? Having open discussions with them may lead to more manageable repayment plans or even debt forgiveness in some cases.

Another important aspect to consider is the potential loss of personal income. If your business provided your primary livelihood, plan for how you’ll sustain yourself moving forward. This might mean setting aside a portion of your remaining assets or seeking alternative income sources. Be sure to account for:

- Personal savings – Can you rely on these while you transition?

- Unemployment benefits - Are you eligible for assistance?

- Part-time opportunities – Will you need to explore freelance work or another job?

Moreover, you need to evaluate any potential tax implications. The closure of your business can lead to various tax considerations. This includes understanding how to handle the selling of assets, claiming losses, and the treatment of inventory. Consulting with a tax professional can provide clarity on how to optimize your tax situation during this transition.

| Financial Aspect | Considerations |

|---|---|

| Outstanding Debts | Assess total owed and negotiate terms. |

| Personal Income Loss | Plan for alternative income sources. |

| Tax Implications | Consult a professional for advice. |

don’t underestimate the emotional toll that financial impacts can have. Seek support from professional advisors, family, or business support groups to help manage not just your financial health, but your mental well-being during this challenging time.

Navigating the Legal Steps for Business Closure

Closing a business can feel overwhelming, but understanding the legal steps involved can help ease the process. Here’s a straightforward approach to ensure you meet all necessary requirements and minimize complications.

First, it’s essential to check your local, state, and federal regulations. Each jurisdiction may have specific rules governing business closures. Familiarizing yourself with the following can save you time and legal headaches:

- Business Licenses and Permits: Determine which licenses and permits need to be canceled.

- Tax Obligations: Understand your tax responsibilities, including any final filings.

- Employee Notifications: Know the laws regarding informing employees about the closure.

- Debts and Liabilities: Assess outstanding debts and how they will be managed.

Next, it’s critical to notify your employees about the closure. Transparency is key. You should provide them with information about how the closure will affect their jobs, and offer any available support, such as references or assistance with job placement. Depending on your location, you might also be legally required to give them a certain amount of notice.

When it comes to financial obligations, addressing debts and liabilities is vital. Here’s a simple table outlining the typical steps for managing these financial responsibilities:

| Step | Description |

|---|---|

| 1. Identify Debts | Compile a list of all business debts, including loans and unpaid bills. |

| 2. Contact Creditors | Inform creditors of your closure and discuss payment options. |

| 3. Settle Accounts | Pay off debts where possible and negotiate settlements for remaining balances. |

Don’t forget about your business’s assets. You may need to sell equipment, inventory, or property. Consult with a professional to determine the best method for asset liquidation to ensure you maximize their value. This may also help offset any debts you need to settle.

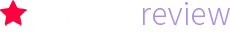

after ensuring everything is settled, it’s time to formally dissolve your business. This typically involves filing dissolution papers with your state’s business entity filing office. Make sure you:

- Complete Required Forms: Follow the state’s specific procedures for dissolution.

- Notify the IRS: File your final tax returns and indicate the closure.

- Cancel Your EIN: If applicable, inform the IRS that you are closing the business.

By carefully navigating these legal steps, you can close your business responsibly and with peace of mind. Remember, it’s advisable to consult with a legal professional to ensure you’re in compliance with all applicable laws, which can help you avoid any unexpected issues down the road.

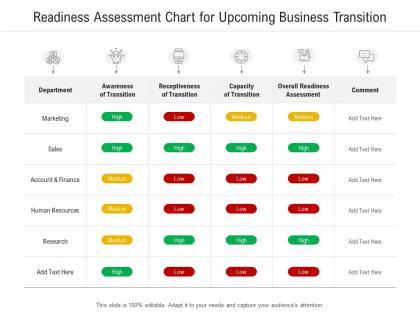

Communicating with Your Team: How to Break the News

Breaking difficult news to your team can be one of the most challenging aspects of closing your business. It’s essential to approach these conversations with tact, empathy, and transparency. Your team deserves to hear the news directly from you, and how you communicate this can affect not just their morale but also their perception of you as a leader.

Start by preparing for the conversation. Consider the following points:

- Timing: Choose a suitable time when your team can give their full attention.

- Setting: A private and comfortable setting can help ease the tension.

- Clarity: Be clear about the reasons for the business closure and the steps leading up to this decision.

When you gather your team, start with a brief overview of the situation. Clearly articulate why the decision was made, keeping the focus on the facts. People appreciate honesty, and providing a transparent explanation can help them process the news. Use phrases like:

- “I want to share some difficult news that affects all of us.”

- “Due to [specific reasons], we have made the tough decision to close the business.”

After delivering the news, allow your team space to react. They may have questions, concerns, or emotions to express. It’s crucial to listen actively and acknowledge their feelings. Respond to questions thoughtfully, as this shows that you value their input and concerns.

In addition to communicating the closure, discuss the next steps. This could involve:

- Providing information about final paychecks and benefits.

- Offering assistance with job searches or references.

- Outlining the timeline for the closure.

To help your team navigate through this transition, consider creating a simple support plan. Here’s an example:

| Support Type | Description | Timeline |

|---|---|---|

| Job Placement Assistance | Resources and connections to help with job searching. | Ongoing until closure date |

| Emotional Support | Access to counseling services if needed. | Available immediately |

| Networking Events | Opportunities to meet potential employers. | Scheduled bi-weekly |

remind your team of their accomplishments and the value they brought to the business. Ending on a positive note can help preserve relationships and keep the team motivated during this difficult transition. Remember, how you communicate this news will leave lasting impressions, so approach the conversation with care and compassion.

Informing Your Customers: Best Practices for Transparency

When it comes to closing your business, informing your customers should be a priority. Transparency not only helps maintain customer loyalty but also fosters goodwill even as you wind down your operations. Here are some best practices for keeping your customers in the loop:

- Be Honest and Direct: Don’t hide the reasons behind your business closure. Whether it’s due to financial difficulties, personal circumstances, or market dynamics, your customers will appreciate your honesty.

- Communicate Early: Inform your customers as soon as you know you’re closing. This gives them time to adjust and make alternative plans. A sudden closure can lead to frustration.

- Use Multiple Channels: Leverage various channels to reach your customers. Use email newsletters, social media updates, and your website to ensure the message is heard loud and clear.

- Offer Assistance: Consider providing resources or referrals to help customers find alternative suppliers or services. This gesture shows that you care about their needs even as you step back.

One effective method for communicating your closure is to create a well-structured announcement. Here’s a simple template to follow:

| Announcement Element | Description |

|---|---|

| Subject Line | Make it clear and direct, e.g., “Important Update: Business Closure Announcement.” |

| Opening Statement | Start with the closure news and express gratitude for their support. |

| Reason for Closure | Briefly explain the reasons without going into too much detail. |

| Key Dates | Provide important dates for the closure timeline and final transactions. |

| Customer Support | Include information about how customers can reach you for inquiries. |

Another critical aspect is to handle customer inquiries efficiently. Anticipate questions regarding refunds, outstanding services, or product availability. Consider setting up a dedicated FAQ section on your website that addresses common concerns. This proactive approach alleviates uncertainty and prevents frustration during the transition.

After the announcement, keep the lines of communication open. Regular updates on the status of the closure can help reassure customers that you are still available for support. A simple weekly email update can go a long way in maintaining trust.

consider a farewell gesture. A heartfelt thank-you email or a small token of appreciation can leave a lasting impression. Recognizing their loyalty will help in preserving the relationship, creating a positive memory of your business even as you close the doors.

Managing Inventory and Assets Before Closing

As you approach the end of your business journey, managing your inventory and assets effectively is crucial to ensure a smooth transition. This phase not only involves assessing what you have but also determining how to liquidate assets in a way that maximizes your return.

Start by conducting a thorough inventory audit. This means taking stock of all physical goods, supplies, and materials that your business holds. A detailed inventory will help you identify:

- Excess Stock: Items that are not selling well.

- High-Value Assets: Equipment or merchandise that could fetch a good price.

- Obsolete Items: Products that are outdated or no longer relevant.

Next, consider your liquidation strategy. There are various avenues you can pursue to sell off your inventory:

- Discount Sales: Offering discounts to clear stock.

- Online Marketplaces: Utilizing platforms like eBay or Amazon.

- Liquidation Auctions: Joining an auction for bulk sales.

Don’t forget about your assets. This includes everything from office furniture to specialized equipment. Creating a comprehensive list helps you to:

- Assess their current value.

- Determine the best method of sale.

- Decide if some items should be donated for a potential tax write-off.

To give you a clearer picture, here’s a simple table to evaluate your assets and their potential liquidation methods:

| Asset Description | Current Value | Potential Sale Method |

|---|---|---|

| Office Furniture | $2,000 | Online Marketplace |

| Computers | $1,500 | Liquidation Auction |

| Inventory Stock | $5,000 | Discount Sale |

Once you have a clear plan in place, it’s time to implement it. Start reaching out to potential buyers and spreading the word about your sales. Utilizing social media and your existing customer base can also help generate interest and drive sales.

Managing your inventory and assets efficiently during this closing phase is not only about ensuring you get the most value from what you have but also about making the process as streamlined as possible. With careful planning and strategic action, you can close your business on a positive note, leaving you better positioned for future endeavors.

Handling Debts and Obligations Responsibly

When it comes to closing your business, handling debts and obligations must be approached with careful consideration. Ignoring these financial responsibilities can lead to a multitude of complications, both personally and professionally. It’s crucial to adopt a proactive strategy to ensure that you transition out of your business without leaving a trail of unpaid debts.

First, take the time to assess your current financial situation. Make a comprehensive list of all outstanding debts and obligations. This includes loans, credit lines, unpaid invoices from suppliers, and any other financial commitments. Clarity in your financial landscape will allow you to devise a practical plan for addressing these debts.

Next, you should communicate with your creditors. Most creditors prefer to negotiate rather than face the uncertainty of a bankruptcy situation. Reach out to them to discuss your plans for closing and propose a payment plan. Many may be willing to work with you if you demonstrate good faith and an intention to pay off your debts.

It’s also wise to prioritize your debts. Consider categorizing them into essential and non-essential debts. Here’s a simple way to visualize this:

| Type of Debt | Priority Level |

|---|---|

| Secured Loans | High |

| Unsecured Loans | Medium |

| Supplier Payments | High |

| Credit Card Debt | Medium |

This table helps you identify where to direct your resources first. Always focus on high-priority debts like secured loans and payments to suppliers to prevent further complications during the closing process.

If your debts seem overwhelming, consider seeking the help of a financial advisor or a debt counselor. They can provide valuable insights into managing your finances effectively during this transition. These professionals can assist you in navigating complex situations, such as negotiating with creditors or even formulating a plan for bankruptcy if it becomes necessary.

keep meticulous records of all communications and transactions related to your debts. Documentation can serve as a protective measure in case of disputes later on. It also helps provide transparency and credibility when negotiating with creditors.

Finalizing Tax Responsibilities When Closing Your Business

As you navigate the process of closing your business, one of the most crucial steps is to finalize your tax responsibilities. Failing to properly settle these obligations can lead to complications down the road, including potential penalties or audits. Here’s what you need to know.

First, ensure that you file your final tax returns. This includes:

- Your business income tax return

- Payroll tax returns, if you had employees

- Sales tax returns, if applicable

It’s essential to indicate that these are your final returns. Depending on your business structure, the forms you need may vary, so double-check with a tax professional to ensure you’re using the right ones.

Next, consider the timing of your final payments. You’ll want to settle any outstanding taxes before formally closing your doors. This can help avoid lingering liabilities that may haunt you later. Use the following table to understand the different types of taxes you might need to pay:

| Type of Tax | Payment Deadline |

|---|---|

| Income Tax | April 15 (for most businesses) |

| Payroll Tax | Quarterly, based on your last payroll period |

| Sales Tax | Based on your reporting period (monthly, quarterly, etc.) |

It’s wise to keep detailed records of all your transactions until you’ve confirmed that the tax authorities have acknowledged your final filings. Retaining these documents not only supports your returns but also provides protection should any issues arise in the future.

Don’t forget about state and local taxes. Many entrepreneurs overlook these when closing, but they can carry their own set of requirements. Make sure you’ve addressed any specific obligations related to your state or municipality to avoid future headaches.

If your business had employees, you must also issue final W-2s and 1099s. This helps your employees and contractors accurately report their earnings for tax purposes. Ensure you comply with the deadlines for issuing these forms to avoid any penalties.

Lastly, consider consulting with a tax professional who specializes in business closures. Their expertise can help you navigate the complexities of tax regulations and ensure that you leave no stone unturned. Making informed decisions at this stage can save you significant time and resources in the long run.

Creating a Closure Timeline to Stay Organized

When it comes to closing your business, having a well-structured timeline can be your best friend. A closure timeline serves as a roadmap, guiding you step-by-step through the winding path of winding down your operations. It’s essential to be organized and stay focused during this challenging time, and a timeline helps ensure nothing is overlooked.

Start by identifying key milestones in your closure process. These milestones will serve as checkpoints to measure your progress. Consider the following crucial steps:

- Notify Stakeholders: Inform your employees, customers, and suppliers about your decision to close. Clear communication can help maintain relationships and uphold your reputation.

- Assess Assets and Liabilities: Take an inventory of your business’s assets and liabilities. This will be vital for understanding your financial position before closing.

- Settle Debts: Prioritize paying off any outstanding debts. This includes loans, credit lines, and unpaid invoices to vendors.

- Liquidate Inventory: Develop a plan to sell off remaining inventory. This could involve clearance sales, online auctions, or donations.

- Cancel Permits and Licenses: Ensure you properly cancel all business licenses, permits, and registrations to avoid future liabilities.

A practical way to visualize your timeline is to create a table that outlines these milestones along with their target completion dates. Here’s an example:

| Milestone | Target Date |

|---|---|

| Notify Stakeholders | Week 1 |

| Assess Assets and Liabilities | Week 2 |

| Settle Debts | Week 3 |

| Liquidate Inventory | Weeks 4-6 |

| Cancel Permits and Licenses | Week 7 |

Next, consider the emotional aspects of closing your business. Acknowledge that this can be a stressful time, and it’s okay to seek support from family, friends, or professional counselors. Establishing a timeline not only helps you stay organized but also provides a sense of control during a period of uncertainty.

set aside time for reflection. Once your business is closed, take a moment to evaluate what you learned throughout your entrepreneurial journey. Document these insights, as they can serve as valuable lessons for future endeavors. Creating a closure timeline isn’t merely about closing doors; it’s about preparing for new opportunities that lie ahead.

Emotional Challenges of Closing Your Business and How to Cope

Closing a business can feel like an emotional rollercoaster, and it’s completely normal to experience a multitude of feelings ranging from sadness to relief. As a small business owner, you’ve invested not just time and money into your venture, but also your heart and soul. Acknowledging these emotions is the first step in coping with the challenges that come with this significant transition.

One of the most common feelings during this process is grief. You might be mourning the loss of your dreams and aspirations that once seemed so bright. It’s important to allow yourself to feel this grief fully. Here are some strategies to help:

- Journal your feelings: Writing down your thoughts can provide clarity and serve as a therapeutic outlet.

- Talk it out: Share your feelings with family, friends, or a professional who can provide support.

- Reflect on the journey: Celebrate your successes, no matter how small, to remind yourself of what you’ve accomplished.

Along with grief, you may also encounter feelings of failure. It’s easy to fall into the trap of self-blame, but remember that many successful entrepreneurs have faced similar situations. Failure is often a stepping stone to greater achievements. Here’s how to manage these feelings:

- Reframe your narrative: Instead of viewing this as an end, consider it a chapter in your entrepreneurial journey.

- Seek mentorship: Connect with others who have navigated similar paths and can share their insights.

- Set new goals: Redirect your focus towards future opportunities and projects that excite you.

Another emotional challenge is anxiety about the future. Uncertainty can be daunting, especially if you’re unsure of what comes next. To alleviate this anxiety, try the following:

- Create a plan: Outline your next steps, whether it’s seeking new employment, starting another business, or pursuing a passion project.

- Stay informed: Educate yourself about the job market or industry trends to feel more prepared for your next venture.

- Practice mindfulness: Techniques such as meditation or yoga can help ground you and ease overwhelming thoughts.

It’s also important to recognize the impact of social stigma associated with closing a business. You might worry about how others perceive you. Remember, many people respect the courage it takes to make tough decisions. To combat this stigma:

- Surround yourself with a supportive community: Engage with others who understand the entrepreneurial journey.

- Focus on your strengths: Remind yourself of your skills and experiences that can lead to future opportunities.

- Share your story: Use your experience as a learning tool for others who may find themselves in a similar situation.

| Emotions | Strategies for Coping |

|---|---|

| Grief | Journal, Talk it out, Reflect |

| Failure | Reframe, Seek mentorship, Set goals |

| Anxiety | Create a plan, Stay informed, Mindfulness |

| Social Stigma | Supportive community, Focus on strengths, Share story |

Remember, it’s okay to seek professional help if you feel overwhelmed. Therapists and counselors can provide valuable tools and perspectives to help you navigate this transition. Embracing your emotions and taking proactive steps to cope will not only help you through this challenging time but also pave the way for a brighter future.

Exploring Future Opportunities After Closure

Closing a business can feel like an endpoint, but it’s also a moment ripe with potential for new beginnings. As you navigate this transition, it’s crucial to focus not just on the closure but also on the opportunities that lie ahead. The skills, experiences, and networks you’ve built during your business journey can serve as a launchpad for future endeavors.

First, consider the valuable lessons learned. Each challenge you faced has contributed to your growth as an entrepreneur. Reflecting on these experiences can provide you with a clearer understanding of what you want in your next venture. Ask yourself:

- What worked well in my business?

- What would I do differently next time?

- What passions did I discover during this process?

Networking is another powerful tool at your disposal. The relationships you’ve cultivated with clients, vendors, and fellow entrepreneurs can open doors to new opportunities. Stay connected through social media platforms and professional networks, letting your contacts know you’re exploring new avenues. You never know who might have a lead on a job or a collaboration that aligns perfectly with your skills.

Additionally, consider leveraging your expertise in consulting or freelancing. Many businesses seek the insights of someone who has firsthand experience navigating the challenges small business owners face. This can be a flexible way to generate income while you explore longer-term opportunities. Here are some fields where your experience can shine:

- Business Strategy

- Marketing & Branding

- Financial Planning

You might also want to invest time in personal development. This could mean taking courses to upskill, attending workshops, or even diving into new fields that pique your interest. The more you learn, the more equipped you’ll be to identify and seize new opportunities.

As you look ahead, it may be beneficial to assess the market landscape. Conduct a SWOT analysis—an evaluation of your Strengths, Weaknesses, Opportunities, and Threats. This exercise can help you identify gaps in the market where you can position yourself strategically. Here’s a simple template:

| Strengths | Weaknesses |

|---|---|

| Industry Knowledge | Lack of Funding |

| Established Network | Limited Resources |

| Opportunities | Threats |

|---|---|

| Emerging Markets | Increased Competition |

| Online Platforms | Shifting Consumer Behavior |

remember that your story isn’t over; it’s simply shifting chapters. Embrace the journey ahead, armed with the knowledge and experience you’ve gained. Whether you choose to dive into a new business, pivot your career, or take a moment to recharge, the possibilities are endless. The future is in your hands—make it count!

Learning from Your Business Journey: Taking Lessons Forward

Every business journey is a treasure trove of experiences, some bright and others less so. Closing a business, while often seen as a failure, can be one of the most enlightening chapters in an entrepreneur’s story. It provides a unique opportunity to reflect on what worked, what didn’t, and how these lessons can shape future endeavors.

Understanding Your Mistakes

Embracing your missteps is crucial. By analyzing the decisions that led to the closure, you can gain insight into your business’s weak points. Consider these aspects:

- Market Research: Did you fully understand your target audience?

- Financial Management: Were your expenses consistently higher than your revenue?

- Marketing Strategies: How effective were your promotional efforts?

Document Your Experience

Writing down lessons learned can be cathartic and beneficial. Create a journal or blog to articulate your journey. Here’s a simple structure to follow:

- What Happened: Briefly describe the situation leading to closure.

- What You Learned: Highlight key takeaways from the experience.

- Future Applications: How can these insights be applied to your next business venture?

Networking and Seeking Feedback

Engage with fellow entrepreneurs to discuss your experiences. They can offer valuable perspectives and feedback that you might not have considered. Attend workshops or networking events to connect with others in similar situations, which can often lead to unexpected opportunities.

Creating a Strategy for Future Success

As you process the closing of your business, start to map out a strategy for your next venture. Consider creating a table to outline your new business plan:

| Aspect | Current Understanding | Goals for Improvement |

|---|---|---|

| Market Analysis | Limited knowledge of audience | Conduct surveys and research |

| Budget Management | Overspending | Implement strict budgeting |

| Brand Positioning | Weak brand recognition | Enhance brand visibility |

Maintaining a Positive Mindset

Remember, many successful entrepreneurs have faced setbacks. Maintaining a positive outlook is essential. Celebrate your journey, no matter how it ended. Each experience adds to your growth, resilience, and understanding of the business landscape.

In closing, while the end of a business can feel like a defeat, it’s merely a stepping stone to greater success. Use this time to reflect, learn, and prepare for your next venture. The knowledge gained from your journey is invaluable and can pave the way for future accomplishments.

Resources and Support Available for Business Owners in Transition

Transitioning out of a business can feel overwhelming, but you’re not alone. A wealth of resources and support systems are available to help business owners navigate this challenging time. Whether you’re considering closing your business due to financial strain, personal reasons, or market changes, understanding the support available can make the process smoother.

Here are some valuable resources you can tap into:

- Small Business Administration (SBA): The SBA provides guidance on how to close a business, including legal obligations and financial responsibilities.

- Local Small Business Development Centers (SBDCs): These centers offer free business consulting and training programs, tailored to your specific needs.

- Industry Associations: Many industries have associations that provide resources, support, and networking opportunities for members facing transitions.

- Legal Advisors: Consulting with a lawyer experienced in business law can help you understand your rights and responsibilities as you close your business.

- Financial Advisors: Professional advice can help you manage your finances, settle debts, and prepare for your next steps.

In addition to these resources, local community organizations often have programs designed to support small business owners during transitions. These organizations may offer workshops, networking events, and one-on-one counseling to help you find your way.

Consider exploring the following options:

| Organization Type | Support Offered | Contact Information |

|---|---|---|

| Community Colleges | Business courses, mentoring | (555) 123-4567 |

| Local Chambers of Commerce | Networking events, resources | [email protected] |

| Nonprofit Organizations | Grants, training programs | (555) 765-4321 |

Many business owners find success through peer support groups. Connecting with others who are also in the process of closing their businesses can provide emotional support, shared experiences, and practical advice. Look for local meetups or online forums that focus on entrepreneurship and business transition.

don’t overlook the power of online resources. Numerous websites and platforms offer articles, webinars, and forums specifically tailored to business closures. These can be invaluable for gaining insights and strategies from those who have been in your shoes.

Planning for Life After Business: What’s Next for You?

As you approach the closure of your business, it’s essential to take a moment to reflect on what lies ahead. Transitioning from entrepreneurship can be both liberating and daunting. To ensure a smooth shift into this new chapter, consider the following aspects:

- Identify Your Passions: Post-business life offers a golden opportunity to explore what truly excites you. Whether it’s traveling, writing, or community service, take time to discover your interests.

- Financial Planning: Assess your financial situation, including savings, investments, and any outstanding debts. Engaging a financial advisor could be invaluable in creating a sustainable plan.

- Networking: Stay connected with former colleagues and business contacts. Networking can lead to new opportunities in consulting, part-time jobs, or even new ventures.

- Skill Development: Use this time to enhance your skills or learn new ones. Online courses and workshops can help you pivot to new industries or interests.

In addition to self-reflection, consider how you want to give back to the community. Many former business owners find fulfillment in mentoring aspiring entrepreneurs or volunteering their expertise in local organizations. Establishing a mentorship program can also help you stay engaged in the business world while contributing meaningfully.

Another critical aspect of planning is to chart out personal goals. Whether it’s traveling to new destinations, writing a book, or starting a blog, setting concrete goals can provide a roadmap for your future. Here’s a simple table to help visualize your aspirations:

| Goal | Action Steps | Timeline |

|---|---|---|

| Travel the World | Research destinations, create a budget | 1-2 years |

| Write a Book | Outline ideas, set writing schedule | 6 months |

| Volunteer | Identify local organizations, reach out | Ongoing |

Embrace the potential for reinvention; consider starting a new venture that leverages your experience and passions. Whether it’s consulting, teaching, or advising, there are numerous ways to apply your knowledge in a fresh context. This can also serve as a way to keep your entrepreneurial spirit alive while maintaining a balanced lifestyle.

Lastly, don’t underestimate the power of self-care during this transition. Closing a business can be emotionally taxing, so allow yourself time to process the changes. Whether through meditation, exercise, or simply spending time with loved ones, prioritize your well-being as you embark on this new journey.

Frequently Asked Questions (FAQ)

Q&A: Closing a Business – A Complete Guide for Small Business Owners

Q: Why would a small business owner consider closing their business?

A: There are many reasons a small business owner might consider closing their business. It could be due to financial struggles, personal circumstances, market changes, or simply realizing that the business doesn’t align with their goals anymore. Whatever the reason, it’s important to approach the closing process thoughtfully.

Q: What are the first steps I should take if I’ve decided to close my business?

A: First, take a deep breath! Closing a business is a big decision, but it doesn’t have to be overwhelming. Start by assessing your finances, reviewing contracts, and understanding your obligations. Then, create a timeline for the closure process to keep things organized and on track.

Q: Do I need to notify anyone before closing my business?

A: Absolutely! You’ll need to inform your employees, customers, suppliers, and any other stakeholders. Communication is key to maintaining relationships and ensuring a smooth transition. Plus, certain legal requirements may necessitate notifying creditors and local authorities too.

Q: What about my business debts? What should I do?

A: Dealing with business debts is crucial during this process. You should contact your creditors to inform them of your decision. It’s often possible to negotiate repayment plans or settlements. Be transparent; most creditors would prefer to work with you rather than take legal action.

Q: How do I handle employee layoffs?

A: Laying off employees is one of the toughest parts of closing a business. Be empathetic and clear about the situation. Provide as much notice as possible, offer severance if you can, and help them with job placement resources. Not only is this the right thing to do, but it also helps maintain your professional reputation.

Q: Do I need to cancel my business licenses and permits?

A: Yes, you’ll need to cancel any business licenses and permits at the local, state, and federal levels. This helps avoid unnecessary fees and keeps your records clean. Make sure to check if there are any final reports or filings required as part of the cancellation process.

Q: What should I do about my business assets?

A: Depending on your situation, you might want to sell your business assets to recoup some funds. This can include equipment, inventory, and even intellectual property. Just be sure to follow any legal obligations regarding the sale and transfer of these assets.

Q: How can I ensure I leave on good terms?

A: Leaving on good terms involves honest communication, fulfilling your obligations, and providing support to employees and customers when possible. Consider sending a farewell message that thanks everyone for their support. This leaves the door open for future opportunities and maintains your professional network.

Q: What if I want to start a new business later?

A: Closing one door can certainly open another! Keep your experiences in mind as valuable lessons. Make connections with individuals in your industry, stay informed about market trends, and when you’re ready to venture out again, you’ll be better equipped for success.

Q: What resources are available to assist me in closing my business?

A: There are plenty of resources available! Consider consulting with a business attorney, accountant, or business advisor who specializes in closure processes. Additionally, check out local small business associations and government resources—they often have guides and support for businesses in transition.

Q: What’s your final piece of advice for small business owners contemplating closure?

A: Remember that closing a business doesn’t equate to failure. It’s a decision that can lead to new beginnings! Approach the process with a clear strategy, seek support from professionals, and keep your long-term goals in mind. You’ve built something valuable; treat the closing process with the respect it deserves, and don’t hesitate to reach out for help along the way.

In Summary

As we wrap up this comprehensive guide on closing a business, it’s important to remember that this decision, while often difficult, can be a necessary step towards new opportunities and growth. Whether you’re facing financial challenges, personal reasons, or simply a change in direction, taking the time to close your business properly can set you up for future success.

Don’t view this as the end of your entrepreneurial journey; instead, see it as a transition. By following the steps outlined in this guide—from assessing your situation and understanding your legal obligations to communicating transparently with your team and customers—you can ensure a smooth closure that respects the hard work you’ve put in.

Remember, every great entrepreneur faces obstacles and setbacks. What matters is how you respond. As you close this chapter, keep your eyes open for new ventures, lessons learned, and the potential that lies ahead. Embrace the freedom that comes with a fresh start, and don’t hesitate to reach out for support or advice along the way. You’ve got this! Your next adventure awaits, and who knows what amazing opportunities are right around the corner? Happy closing!