Thinking of starting your own business? One of the first big decisions you’ll face is where to form your Limited Liability Company (LLC). While it might seem like a small detail, the state you choose can have a significant impact on your business’s success, tax obligations, and legal protections. Some states offer incredible advantages for LLCs, from low fees and favorable tax structures to business-friendly regulations. In this article, we’ll explore the best states to form an LLC and why selecting the right location matters more than you might think. So grab a cup of coffee, and let’s dive into the world of LLC formation and uncover the benefits of making the right choice!

The Importance of Choosing the Right State for Your LLC

When it comes to forming your Limited Liability Company (LLC), the state you choose can significantly impact your business in various ways. Each state has its own set of regulations, fees, and tax structures that can either facilitate your business growth or create unnecessary hurdles. Let’s explore some of the critical factors that make the choice of state so crucial.

Tax Considerations

One of the primary reasons to evaluate different states is the tax implications. Some states impose high income taxes or franchise taxes on LLCs, while others offer more favorable tax environments. For instance:

- Wyoming: No state income tax and low fees.

- Nevada: No corporate income tax, but does have a business license fee.

- Texas: No state income tax but does levy a franchise tax on certain businesses.

Legal Protections

The legal landscape can vary significantly from state to state. Some states offer stronger protections for LLC owners against personal liability. For example, states like Delaware are known for their business-friendly laws and experienced judicial system that specializes in corporate matters. This makes Delaware a popular choice among entrepreneurs seeking peace of mind.

Regulatory Environment

Each state has its own regulatory framework governing LLCs, which can affect how easily you can operate your business. States like Florida and North Carolina have streamlined processes for business formation, making it easier for entrepreneurs to get started. In contrast, some states may have more bureaucratic hoops to jump through, which can delay your business launch.

Annual Fees and Reporting Requirements

Another vital factor is the ongoing costs associated with maintaining your LLC. States vary in their annual fees and reporting requirements. For example:

| State | Annual Fee | Reporting Requirement |

|---|---|---|

| Delaware | $300 | Annual report required |

| California | $800 | Biennial report required |

| Wyoming | $50 | No annual report required |

Location of Operations

If you plan to operate primarily in one state but form your LLC in another, be aware that you may still have to register your LLC as a foreign entity in your primary state. This can lead to additional fees and complexity. For many small business owners, it often makes sense to form the LLC in the state where they reside or where the business operates, simplifying compliance and reducing costs.

Ultimately, the choice of state for your LLC formation is not just about initial costs or convenience; it’s a strategic decision that can influence your business’s long-term success. Take the time to research and weigh your options carefully, and you’ll set a solid foundation for your entrepreneurial journey.

Tax Benefits That Can Boost Your Bottom Line

When it comes to maximizing your business’s financial efficiency, understanding the tax benefits inherent in forming an LLC in the right state can make a world of difference. Let’s dive into how these advantages can significantly enhance your bottom line.

One of the key benefits of forming an LLC is pass-through taxation. This means that profits are only taxed at the individual owner level, avoiding the double taxation that corporations often face. By choosing a state with favorable tax laws, you can keep more of your earnings. Here are a few states known for their advantageous tax structures:

- Wyoming: No corporate or personal income taxes.

- Delaware: No sales tax and flexible tax incentives.

- New Hampshire: No sales tax and low business profits tax.

In addition to pass-through taxation, some states offer deductions that can reduce your overall tax liability. For instance, many regions allow LLCs to deduct business expenses, such as:

- Operational costs

- Home office expenses

- Health insurance premiums

Moreover, certain states provide tax credits for LLCs that contribute to community development or engage in environmentally friendly practices. By taking advantage of these incentives, you can further decrease your tax burden while promoting positive initiatives. Here’s a glimpse of some states with attractive tax credits:

| State | Type of Tax Credit |

|---|---|

| California | Film and Television Tax Credit |

| Texas | Renewable Energy Tax Credit |

| Oregon | Business Energy Tax Credit |

Additionally, if you’re planning to expand your LLC, consider states that offer incentives for job creation. For example, some states may provide grants or tax rebates for businesses that hire new employees, which can ease the financial pressures of scaling up operations.

forming an LLC in a state with lower franchise taxes can save your business significant money. Franchise taxes are levied based on the income or revenue of the business, and some states have minimal rates or even exemptions for smaller businesses. Selecting a state with a favorable franchise tax structure could mean substantial savings over time.

the right state can provide a myriad of tax benefits that not only support your current operations but also pave the way for future growth. Whether it’s through lower taxes, deductions, credits, or incentives, understanding these advantages is crucial for enhancing your business’s profitability.

Understanding the Regulatory Environment in Different States

When it comes to forming an LLC, the regulatory landscape can vary significantly from one state to another. Understanding these differences is crucial for entrepreneurs looking to establish their businesses in environments that foster growth and minimize red tape. Each state has its own set of rules concerning formation fees, ongoing compliance requirements, and tax structures, all of which can impact your bottom line.

Key Factors to Consider:

- Formation Fees: The cost of forming an LLC varies widely. Some states, like Delaware and Nevada, are known for their business-friendly environments and relatively low initial filing fees.

- Annual Reporting: Certain states require annual reports and fees. For instance, California imposes a minimum franchise tax, which can be a burden for new businesses.

- Tax Structure: The tax implications of an LLC can differ greatly. States like Wyoming have no state income tax, making them attractive for LLC formation.

- Privacy Protections: Some states offer greater privacy for LLC members. Delaware, for example, does not require the disclosure of member names in public records.

In states like Nevada, entrepreneurs enjoy the benefits of no state income tax, as well as privacy protections. Nevada doesn’t require LLCs to disclose their owners, making it a popular choice for those valuing anonymity. However, it’s essential to consider that while the perks are enticing, some may face challenges in navigating the state’s unique regulatory requirements.

Conversely, Delaware has established itself as the go-to state for many LLCs, particularly due to its well-developed body of corporate law and business-friendly judicial system. The state offers an efficient filing process and a supportive legal framework, which can be particularly beneficial for startups and larger corporations alike. However, Delaware does require an annual franchise tax and a registered agent, which can add to ongoing costs.

When evaluating your options, it’s also important to consider states with robust support systems for small businesses. States like Florida and Texas not only offer flexibility in forming an LLC but also provide a wealth of resources and networking opportunities for entrepreneurs. Both states lack personal income tax, attracting many business owners looking to maximize their profits.

| State | Formation Fee | Annual Report Requirement | State Income Tax |

|---|---|---|---|

| Delaware | $90 | Yes | No |

| Nevada | $75 | Yes | No |

| Wyoming | $100 | No | No |

| California | $70 | Yes | Yes |

| Texas | $300 | No | No |

Ultimately, the right state for your LLC hinges on your unique business needs and objectives. Consider your industry, target market, and long-term goals when making this important decision. By , you can position your LLC for success and ensure that you’re not only compliant but also thriving in a supportive business climate.

Delving into Formation Fees and Ongoing Costs

Forming an LLC is an exciting step for entrepreneurs, but it’s crucial to understand the costs that come with it. The formation fees can vary significantly from state to state, impacting your overall budget as you embark on this journey. When considering where to establish your LLC, it’s essential to evaluate the initial fees associated with formation, as these can range from as low as $50 to upwards of $500, depending on the chosen state.

Many states also have annual fees or franchise taxes that need to be considered. For example, while a state might have a low formation fee, its ongoing costs can significantly increase the overall expenditure. A few states charge a flat annual fee, while others impose a percentage of the LLC’s revenue. This makes it vital to factor in not just initial costs but also what you’ll be paying year after year.

Here’s a brief breakdown of formation fees and ongoing costs in some popular states for LLC formation:

| State | Formation Fee | Annual Fee |

|---|---|---|

| Delaware | $90 | $300 |

| Wyoming | $100 | $60 |

| Nevada | $75 | $350 |

| Florida | $125 | $138.75 |

Apart from these fees, there are additional costs associated with maintaining your LLC. Some common ongoing expenses include:

- Registered Agent Fees: Many states require you to appoint a registered agent, which typically costs between $100 to $300 annually.

- Business Licenses and Permits: Depending on your industry, you may need to secure various licenses, adding to your ongoing expenses.

- Accounting and Legal Fees: Hiring professionals for bookkeeping and legal advice can help you stay compliant, but it also increases your operational costs.

It’s also worth noting that some states offer incentives or exemptions for small businesses that can significantly reduce ongoing costs. For instance, certain states have programs aimed at attracting new businesses, which can lead to lower fees during the initial years of operation.

understanding the nuances of formation fees and ongoing costs is essential for making an informed decision about where to form your LLC. Being proactive in researching these expenses can save you money down the line and help you build a successful business foundation. Whether you prioritize low startup costs, minimal ongoing fees, or a business-friendly environment, evaluating these factors will guide you toward the best state for your LLC formation.

Business-Friendly States: A Closer Look at Top Contenders

When you’re considering where to form an LLC, it’s essential to look beyond just the basics. Different states offer diverse benefits that can significantly influence your business’s success. Here’s a closer look at some of the top contenders that provide a business-friendly environment.

Delaware is often hailed as the gold standard for LLC formation. One of its standout features is a well-established legal framework that favors businesses, particularly when it comes to dispute resolution. Additionally, the state does not impose a sales tax, which can be a substantial saving for many entrepreneurs. The ease of forming an LLC in Delaware and the state’s strong privacy protections make it a top choice.

Next on the list is Wyoming, which has gained immense popularity for its low fees and minimal compliance requirements. Beyond affordability, Wyoming LLCs benefit from no state income tax, which means more of your hard-earned revenue stays in your pocket. The state also offers strong asset protection laws, making it a wise choice for those looking to shield their personal wealth.

Nevada deserves a mention as well, particularly for its business-friendly climate. Nevada not only has no corporate income tax but also protects business owners from personal liability. This state is ideal for startups and established firms alike, especially those in industries that are subject to significant scrutiny, as it offers strong privacy protections for business owners.

Texas, known for its robust economy and entrepreneurial spirit, is another excellent option for forming an LLC. With no state income tax and a straightforward formation process, Texas allows businesses to thrive. The state’s vast resources, combined with a growing job market, create an environment conducive to success for new enterprises.

Lastly, consider Florida for its favorable business conditions. With no personal income tax and a large consumer market, Florida presents enticing opportunities for entrepreneurs. The state also boasts a diverse economy, which helps mitigate risks and offers various avenues for growth.

| State | No State Income Tax | Privacy Protection | Corporate Friendly |

|---|---|---|---|

| Delaware | ✔️ | ✔️ | ✔️ |

| Wyoming | ✔️ | ✔️ | ✔️ |

| Nevada | ✔️ | ✔️ | ✔️ |

| Texas | ✔️ | ❌ | ✔️ |

| Florida | ✔️ | ❌ | ✔️ |

Choosing the right state to form your LLC is a critical decision that can pave the way for your business’s prosperity. Each of these states offers unique advantages that cater to various business needs, so take the time to evaluate which aligns best with your entrepreneurial goals.

Why Privacy Protection Matters and Which States Offer It

In today’s digital age, the importance of privacy protection cannot be overstated, especially for business owners and entrepreneurs forming a Limited Liability Company (LLC). Your personal information is often required during the registration process, which can expose you to unwanted attention, solicitation, and even identity theft. By choosing a state that prioritizes privacy protection, you can safeguard your personal details while reaping the benefits of an LLC.

Many states offer varying levels of privacy protection for LLC owners. Here are some essential aspects to consider when evaluating the privacy laws of different states:

- Anonymous Ownership: Some states allow for anonymous ownership, meaning your name does not have to appear in public records.

- Limited Disclosure: Certain jurisdictions require minimal information disclosure, protecting your personal address and contact details.

- Privacy of Business Records: Look for states that maintain confidentiality around business documents and filings.

States such as Delaware, Nevada, and Wyoming are often regarded as top choices for LLC formation due to their robust privacy protections. Let’s take a closer look at what each of these states offers:

| State | Anonymous Ownership | Privacy of Records | Filing Fees |

|---|---|---|---|

| Delaware | Yes | Highly Confidential | $90 |

| Nevada | Yes | High Privacy | $200 |

| Wyoming | Yes | Confidential | $100 |

Delaware is a popular choice for many entrepreneurs, primarily because it allows for anonymous ownership and offers strong protections for business owners. The state has a well-established legal framework that is favorable to businesses, making it attractive for LLC formation.

Nevada, on the other hand, is known for its minimal disclosure requirements and lack of state income tax, which further enhances privacy. Additionally, Nevada protects the identities of LLC members, making it an appealing option for those looking to keep their ownership confidential.

Wyoming rounds out the trio with its focus on privacy and minimal filing requirements. With no personal information publicly available, members can maintain their anonymity while enjoying the benefits of limited liability.

Choosing the right state for your LLC formation plays a crucial role in how well you can protect your privacy. By considering the privacy protections offered by each state, you can not only keep your personal information secure but also position your business for growth without unnecessary distractions.

The Role of Economic Climate in Your LLCs Success

The economic climate plays a pivotal role in shaping the landscape for any business, including Limited Liability Companies (LLCs). Understanding how various economic factors influence your LLC’s success can help you make informed decisions about where to establish your business.

One of the most influential elements is the state of the local economy. A thriving economy often translates into increased consumer spending, which can directly benefit your LLC. Conversely, in a sluggish economy, businesses may struggle due to reduced demand. Thus, selecting a state with a robust economic outlook can provide a solid foundation for your LLC.

In addition to the overall economic health, you should consider the industry-specific trends in the state you’re eyeing for your LLC. Certain regions may be more favorable for particular industries due to local demand, resources, or government support. For example:

- Technology: States like California and Texas offer vibrant tech hubs.

- Agriculture: States such as Iowa and Nebraska are known for their agricultural opportunities.

- Tourism: Florida and Nevada attract millions of visitors each year, presenting unique opportunities for service-based LLCs.

Your decision also hinges on taxation policies. Different states have varying tax structures that can significantly impact your bottom line. States with lower tax rates or favorable incentives can provide a competitive edge. For instance, some states offer exemptions or reductions on certain business taxes, which can encourage entrepreneurship and attract more LLCs.

Another essential factor to consider is the availability of funding and resources. States with a strong network of investors, grants, and incubators can offer more opportunities for growth. Local governments that prioritize economic development often provide resources that can give your LLC a substantial boost, so pay close attention to these aspects when choosing a location.

it’s crucial to think about the labor market in your chosen state. A talented workforce is often the backbone of a successful LLC. States with leading educational institutions and training programs can supply skilled employees, reducing your hiring challenges and enhancing your company’s productivity. A state’s unemployment rate can also indicate the availability of potential hires.

To summarize, when considering the best states to form your LLC, look beyond just the legal advantages. The economic climate—encompassing local economic health, industry trends, taxation, funding availability, and the labor market—plays an integral role in determining your LLC’s potential for success.

Accessibility to Resources and Networks in Key States

When considering the best states to form an LLC, accessibility to resources and networks can significantly influence the success of your business. Some states stand out not only for their favorable business regulations but also for the robust support systems they offer to entrepreneurs.

Silicon Valley in California is a prime example. Known as the tech capital of the world, it provides access to cutting-edge technology and venture capital. Networking opportunities abound here, enabling new business owners to connect with seasoned professionals and potential investors. Incubators and accelerators thrive in this ecosystem, making it easier for startups to gain momentum.

Similarly, New York offers a dynamic marketplace with an extensive network of business resources. The state boasts a diverse industry landscape, which can be advantageous for networking and collaboration. From financial services to creative arts, entrepreneurs can tap into a variety of resources. Additionally, numerous co-working spaces and community organizations are available to support startups.

On the other hand, states like Texas and Florida provide a different kind of advantage. The business-friendly environment in Texas is complemented by a low tax burden and a growing pool of talent. Cities like Austin are becoming hubs for startups, particularly in the tech and health sectors, making it an attractive option for new businesses. Furthermore, Florida’s strategic location and favorable climate for tourism and hospitality provide unique opportunities for entrepreneurs in those industries.

Here’s a quick comparison of some of the key states that excel in accessibility to resources and networks:

| State | Key Resources | Networking Opportunities |

|---|---|---|

| California | Venture capital, tech hubs | Conferences, incubators |

| New York | Diverse industries, co-working spaces | Networking events, trade shows |

| Texas | Low taxes, skilled workforce | Industry meetups, startup pitches |

| Florida | Tourism resources, business incentives | Local business groups, expos |

Having access to mentorship programs, business incubators, and local chambers of commerce can also play a crucial role in a startup’s development. Many states prioritize creating environments where entrepreneurs can thrive, offering resources that are often a game-changer for new businesses. Whether it’s through access to funding, expert advice, or community support, these resources can help streamline the path to success.

Ultimately, choosing the right state for your LLC formation goes beyond just favorable tax rates or business regulations. The availability of networks and resources tailored to your industry can provide the crucial support you need to turn your business idea into a reality. So, if you’re on the fence about where to establish your LLC, consider not only the economic factors but also the vibrant ecosystems that can nurture your growth.

Navigating State-Specific Compliance Requirements

When considering where to form your LLC, understanding the state-specific compliance requirements is crucial. Every state has its unique set of regulations, which not only dictate how you operate but also impact your business’s overall success and sustainability. Taking the time to navigate these requirements can save you from costly penalties and legal headaches down the road.

One of the primary compliance aspects to consider is the annual reporting obligations. Some states, like Delaware and Nevada, have minimal reporting requirements, making them attractive for LLC formation. In contrast, states like California and New York impose more rigorous reporting standards that can be burdensome for small businesses. Understanding these differences can help you select a state that aligns with your operational capacity and growth ambitions.

Another essential factor is the filing fees and taxes associated with maintaining your LLC. States like Wyoming boast low initial filing fees and no state income tax, which can be a significant advantage for new entrepreneurs. Conversely, states such as New Jersey and Illinois have higher fees and taxes that can eat into your profits. Evaluating these costs against your business model is vital for long-term financial planning.

| State | Annual Fee | Income Tax |

|---|---|---|

| Wyoming | $50 | 0% |

| Delaware | $300 | 0% |

| California | $800 | 8.84% |

| New York | $25 | 6.5% |

| Illinois | $250 | 9.5% |

Don’t overlook business licenses and permits, which vary widely by state and industry. For example, some states, like Florida, may require specific local business licenses that others do not. Failing to obtain necessary permits can lead to fines and jeopardize your ability to operate legally. It’s essential to research these requirements based on your business’s location and activities to ensure compliance.

In addition to financial and operational factors, consider the legal environment of each state. Some states provide stronger protections for LLCs, such as charging order protection for members. This legal buffer can be beneficial in safeguarding your personal assets against business liabilities. States like Nevada and Wyoming are known for offering robust protections, making them popular choices for forming an LLC.

Lastly, state reputation can influence your business’s credibility and relationships. Forming an LLC in a well-respected state can enhance your brand’s image and provide a competitive edge. States like Delaware are not only recognized for their business-friendly laws but also carry a prestigious reputation that appeals to investors and partners.

The Impact of Business Incentives and Grants

When considering where to form an LLC, the influence of business incentives and grants cannot be overlooked. These financial boosts not only help businesses get off the ground but also play a significant role in a state’s economic development strategy. By choosing to establish your LLC in a state with robust incentive programs, you can enhance your startup’s potential for growth and sustainability.

Many states offer a variety of business incentives designed to attract new companies. These can include:

- Tax Credits: Financial reductions that directly lower your tax burden.

- Grants: Non-repayable funds that can be used for various business expenses.

- Low-Interest Loans: Affordable financing options that can ease cash flow concerns.

- Workforce Development Programs: Assistance in training your employees, making your workforce more skilled and competitive.

For instance, states like Texas and Florida provide numerous advantages, not only due to their favorable tax structures but also because they actively promote business development through grants and incentives. These states understand that fostering local businesses can lead to job creation and economic stability.

| State | Key Incentive | Grant Availability |

|---|---|---|

| Texas | Franchise Tax Exemption | Yes |

| Florida | Economic Development Incentives | Yes |

| Nevada | No Corporate Income Tax | No |

| Wyoming | No State Income Tax | Limited |

Moreover, some states are particularly aggressive in offering incentives for specific industries. For example, if you’re in the tech sector, states like California and Massachusetts can provide significant funding opportunities aimed at fostering innovation. The right incentives can not only lessen initial costs but also provide a runway for long-term growth.

It’s essential to consider the long-term implications of these incentives. While upfront grants and tax credits may help you establish your LLC, think about how these incentives will evolve as your business scales. Some states have progressively designed their incentives to support businesses at various growth stages, ensuring continuous support.

Choosing the right state to form your LLC based on available business incentives can significantly impact your financial health and operational success. Not only do these incentives reduce initial barriers, but they also enhance your competitiveness in the market. An informed decision can ultimately lead to a thriving business environment, making your LLC not just a legal entity but a vital participant in the economic landscape.

Exploring the Best States for E-Commerce LLCs

When it comes to launching an e-commerce LLC, the state where you choose to register can significantly impact your business operations, tax obligations, and overall success. Each state has its unique benefits, making some particularly advantageous for online ventures. Let’s dive into some of the best states for e-commerce LLCs, highlighting what makes them stand out.

Delaware is often touted as the gold standard for LLC formation, especially for e-commerce businesses. The state boasts a flexible business-friendly environment, including no sales tax and minimal annual fees. Additionally, Delaware’s Court of Chancery is renowned for its expertise in corporate law, providing a layer of legal protection for business owners. Plus, the quick and easy formation process is a bonus for entrepreneurs eager to launch their online stores.

Wyoming is another favorite among e-commerce owners, largely due to its zero state income tax and low fees. The state offers strong privacy protection for LLC members, ensuring that personal information remains confidential. Furthermore, Wyoming is known for its pro-business regulations and minimal compliance requirements, making it an excellent choice for startup e-commerce companies looking to minimize overhead costs.

Nevada is a strong contender as well, offering no state income tax and a business-friendly regulatory environment. E-commerce businesses can benefit from the state’s favorable tax structure, which promotes growth and profitability. Additionally, Nevada’s lack of corporate income tax means that online retailers can reinvest more of their profits back into their business, fueling expansion and innovation.

On the flip side, states like Texas and Florida are emerging as attractive options for e-commerce LLCs. Both states feature large populations and robust economies, providing a significant market for online retailers. Texas has no personal income tax, while Florida offers a relatively low corporate tax rate. These benefits, combined with their extensive logistics networks and access to major ports, make them formidable contenders for new e-commerce businesses.

| State | Key Benefits |

|---|---|

| Delaware | Flexible laws, no sales tax, quick formation |

| Wyoming | No income tax, strong privacy, low fees |

| Nevada | No income tax, pro-business regulations |

| Texas | Large market, no personal income tax |

| Florida | Low corporate tax, access to logistics |

In making your choice, it’s essential to consider not only the tax implications but also the logistics of operating in a specific state. Factors like shipping times, proximity to suppliers, and target customer demographics play a crucial role in the success of your e-commerce venture. Selecting the right state can provide your business with a competitive edge, enabling you to serve your customers better and grow your bottom line.

Ultimately, the best state for your e-commerce LLC will depend on your specific business needs, goals, and long-term vision. Take the time to research each option thoroughly and consider consulting with a professional to ensure that you make the most informed decision possible. The right location can set the foundation for your e-commerce success!

Choosing a State Based on Your Industry Needs

When selecting a state to form your LLC, it’s essential to align your choice with the specific needs of your industry. Every state has its own regulatory environment, tax structure, and business climate that can significantly impact your operations. Here are some critical factors to consider based on your industry:

- Tax Structure: Some states offer lower corporate taxes or no income tax, which can be particularly beneficial for startups and tech companies. States like Texas and Florida are often favored for their tax advantages.

- Industry Regulations: If you’re in a heavily regulated industry, such as healthcare or finance, consider states known for a business-friendly regulatory environment. For example, Delaware is preferred by many due to its flexible laws and business-friendly court system.

- Access to Talent: Some industries thrive in urban hubs where a specialized workforce is readily available. If you’re in tech, states like California or New York provide access to a rich talent pool.

- Market Accessibility: Depending on your business model, proximity to key markets can be crucial. For example, if you’re in manufacturing, locating in states like Ohio or Michigan can provide strategic advantages.

For tech startups, states like California and Massachusetts are often at the top of the list due to their established tech ecosystems and access to venture capital. However, emerging markets such as Austin, Texas are becoming increasingly popular for their lower cost of living and vibrant tech scene.

If your industry is retail or e-commerce, consider states that are logistical hubs. States like Illinois and New Jersey offer excellent transportation infrastructure, which can enhance distribution and supply chain efficiency.

Small businesses in the service industry may find states like North Carolina and Tennessee attractive due to their low cost of doing business and growing customer bases. These states are known for their friendly business environments and supportive local governments.

| State | Industry | Key Benefits |

|---|---|---|

| California | Tech | Access to VC, Talent Pool |

| Delaware | Corporate | Business-friendly Laws, Low Fees |

| Texas | Various | No Income Tax, Growing Economy |

| Florida | Tourism | Low Taxes, High Visitor Numbers |

your industry needs can greatly influence your choice of state when forming an LLC. Understanding the nuances of each state’s advantages will not only help you comply with regulations but can also position your business for sustainable growth and success.

The Future of Your LLC: Considering Growth and Expansion

As your LLC begins to flourish, the potential for future growth and expansion becomes a pivotal consideration. The state in which you formed your LLC can play a significant role in this journey, influencing everything from taxation to regulatory compliance. It’s essential to recognize that not all states are created equal when it comes to supporting business growth.

When evaluating your options, think about the business ecosystem each state provides. Here are a few crucial factors to consider:

- Tax Incentives: Some states offer attractive tax breaks that can significantly reduce your operating costs.

- Business Environment: A supportive regulatory framework can ease the path for expansion, while a challenging one can stifle growth.

- Access to Resources: Consider whether your state has a robust network of suppliers, skilled labor, and funding opportunities.

- Market Size: States with larger populations may present greater opportunities for customer acquisition and sales growth.

Understanding these elements can help you make informed decisions about whether to stay in your current state or consider relocating your LLC to a more advantageous environment. For instance, states like Texas and Florida are often lauded for their business-friendly climates, featuring no personal income tax and a strong emphasis on entrepreneurship.

Let’s take a closer look at some states that have consistently ranked high for LLC formation, particularly when considering future growth:

| State | Key Advantages |

|---|---|

| Wyoming | Low fees, no state income tax, strong privacy protections |

| Delaware | Business-friendly laws, established legal precedent, flexible operating agreements |

| Nevada | No state income tax, strong asset protection laws |

| Texas | Diverse economy, no personal income tax, pro-business regulations |

| Florida | Growing market, no personal income tax, favorable climate for various industries |

In addition to tax benefits, the right state can also provide a vibrant business community that fosters collaboration and innovation. Networking opportunities can lead to potential partnerships and mentorships, ultimately driving your LLC towards success.

Lastly, don’t overlook the importance of scalability in your state selection. As your business grows, you may need to hire more employees, increase your physical presence, or even branch into new markets. Choosing a state with a favorable business landscape can significantly ease these transitions.

Your LLC’s future hinges on the choices you make today. By carefully considering the state of formation and its impact on your expansion plans, you can position your business for long-term success and sustainability.

Making the Final Decision: Weighing Pros and Cons

When you’re on the brink of deciding where to form your LLC, it’s crucial to weigh the benefits and drawbacks of each state. This decision can shape the future of your business, affecting everything from taxes to legal protections. Here are some key factors to consider:

- Tax Structure: Some states, like Wyoming and Nevada, offer no state income tax, which can lead to significant savings. On the other hand, states with higher taxes, such as California, may provide more robust infrastructure and services.

- Formation Fees: The initial costs to set up your LLC vary widely. For example, Delaware has a reputation for being business-friendly but also has annual franchise taxes that can add up. Compare these fees across states to see where your budget aligns.

- Ongoing Compliance Requirements: Some states impose strict regulations and reporting requirements. If you’re looking for simplicity, states like Wyoming and New Mexico offer minimal paperwork, allowing you to focus more on business growth.

- Legal Environment: States like Delaware are known for their business-friendly court systems, which can be crucial if you ever find yourself in a legal dispute. Understanding the legal landscape can help you make an informed choice.

It’s also essential to consider the overall business climate of the state. A state with a thriving economy and resources for entrepreneurs, such as networking events and support services, can make a significant difference. Here’s a quick comparison of some popular states for LLC formation:

| State | State Income Tax | Formation Fee | Annual Report Fee | Pros |

|---|---|---|---|---|

| Delaware | No | $90 | $300 | Business-friendly laws, well-established legal infrastructure |

| Wyoming | No | $100 | $50 | Low fees, minimal reporting requirements, privacy |

| Nevada | No | $425 | $350 | Strong asset protection laws, no corporate income tax |

| California | Yes | $70 | $800 | Large market, access to talent, extensive resources |

don’t forget to consider the long-term implications of your choice. The state you select can affect your ability to attract investors, hire employees, and operate efficiently. By thoroughly evaluating the pros and cons, you set your LLC up for success and peace of mind. Think about your business goals and how the state aligns with your vision, ensuring your decision supports not just the present but the future as well.

Frequently Asked Questions (FAQ)

Q&A: Best States to Form an LLC: Where and Why It Matters

Q1: Why should I consider forming an LLC instead of a sole proprietorship or corporation?

A1: Great question! Forming an LLC (Limited Liability Company) provides personal liability protection, meaning your personal assets are generally safe from business debts or lawsuits. Plus, LLCs offer flexibility in management and tax options that sole proprietorships and corporations don’t. It’s like having the best of both worlds!

Q2: What are the best states to form an LLC?

A2: The top contenders often include Delaware, Wyoming, and Nevada. Delaware is famous for its business-friendly laws and court system. Wyoming and Nevada offer strong privacy protections and no state income tax! Choosing the right state can save you money and hassle in the long run.

Q3: Why is Delaware often considered the best state for forming an LLC?

A3: Delaware has a robust legal framework that’s very favorable for businesses. It boasts a well-established court system, known as the Court of Chancery, which handles business disputes efficiently. Plus, their laws are flexible and protective of business interests, which is a huge draw for many entrepreneurs.

Q4: What about Wyoming? Why is it a popular choice?

A4: Wyoming is a fantastic option for those seeking privacy. They don’t require you to list member names in public records, which keeps your information private. Also, there’s no state income tax, and the fees to maintain an LLC are quite low. If you want to keep things simple and cost-effective, Wyoming’s a great pick!

Q5: Is Nevada a good choice for forming an LLC?

A5: Absolutely! Nevada offers strong privacy protections and no state income tax. It’s also known for being business-friendly, with flexible management structures. However, be aware that it can be a bit pricier than other states due to initial filing fees and ongoing requirements. Worth it if privacy and low taxes are your priorities!

Q6: Are there any downsides to forming an LLC in these states?

A6: Yes, there can be! If you form your LLC in a state like Delaware or Nevada but operate your business elsewhere, you may need to register as a foreign LLC in your home state, which can mean extra fees and paperwork. Always consider where you’ll be doing business and what makes sense for your specific situation.

Q7: What factors should I consider when choosing a state to form my LLC?

A7: Think about several key factors: taxation, privacy, administrative requirements, and the nature of your business. Do you need strong asset protection? Are you looking for low fees? Consider how much time and money you’re willing to invest in compliance. Choosing the right state can lead to significant savings and peace of mind!

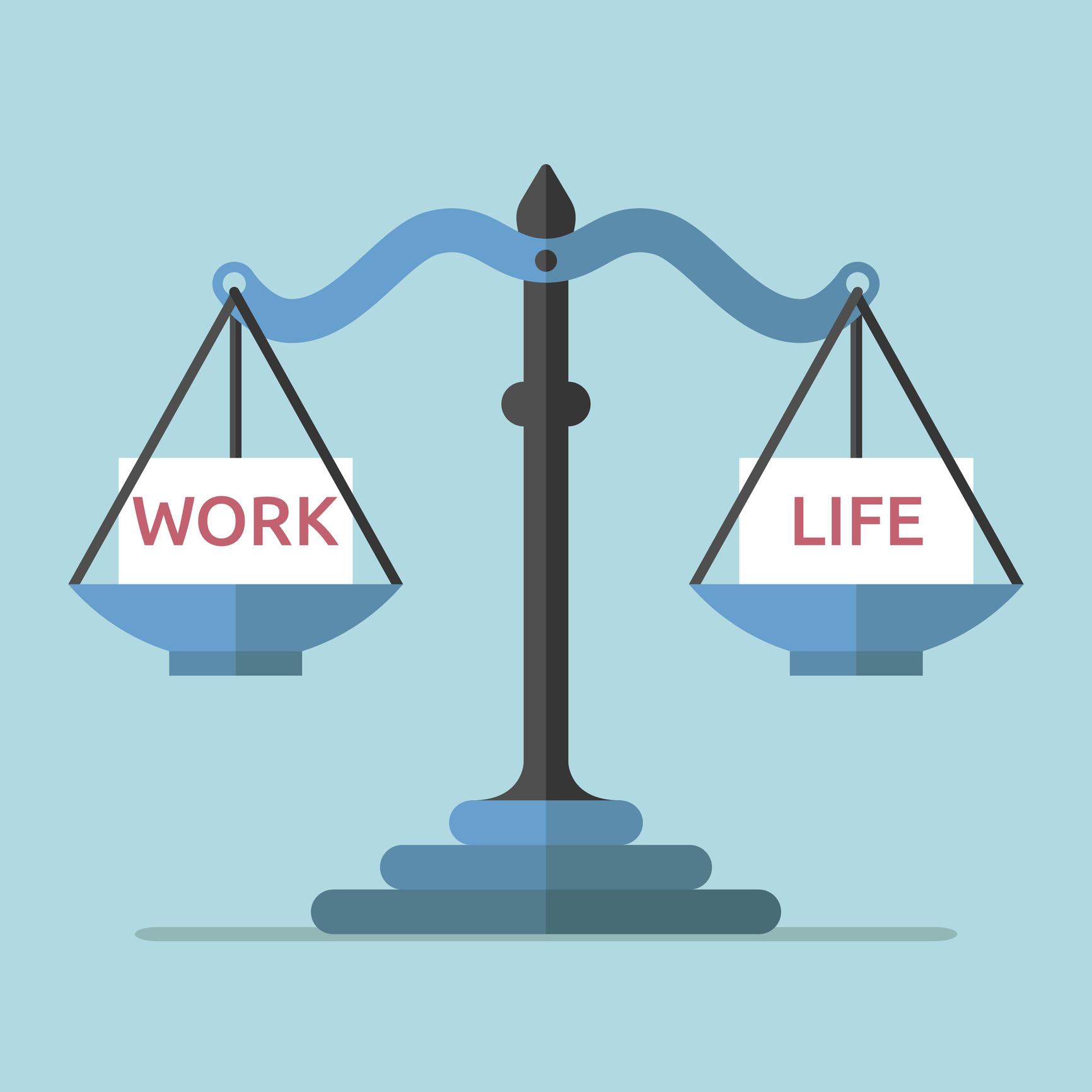

Q8: How can I get started with forming my LLC?

A8: First, research and decide on the best state for your LLC based on your needs. Next, choose a unique name for your business, file the necessary paperwork with the state, and pay any required fees. Lastly, consider creating an operating agreement to outline the management structure and rules for your LLC. You’ve got this!

Q9: Do I need a lawyer to form an LLC?

A9: While it’s not a requirement, consulting with a lawyer can be very beneficial, especially if you’re not familiar with legal jargon or business structures. They can guide you through the process, help you avoid potential pitfalls, and ensure that you’re compliant with local laws. It’s an investment that can pay off!

Q10: Any final tips for entrepreneurs looking to form an LLC?

A10: Definitely! Take your time researching your options, and don’t rush into it. Understanding the implications of your choice is crucial. Also, consider long-term plans for your business and how each state’s laws may affect growth. And remember, forming an LLC is just the beginning—stay informed and proactive about compliance to keep your business thriving!

We hope this Q&A has sparked your interest and provided valuable insights into forming an LLC. Choosing the right state can make all the difference in your entrepreneurial journey!

Concluding Remarks

Conclusion: Making the Right Choice for Your LLC

As we’ve explored, choosing the right state to form your LLC isn’t just a matter of geography; it’s a strategic decision that can significantly impact your business’s future. From tax benefits to regulatory environments, the state you choose can either bolster your entrepreneurial dreams or hinder your progress.

So, whether you’re drawn to the business-friendly atmosphere of Delaware, the low fees in Wyoming, or the vibrant market of California, take the time to weigh your options. Remember, it’s not just about where you live—it’s about where you can thrive.

Don’t forget to consider your business model, growth plans, and even your personal preferences. With the right choice, you can set the foundation for success and give your LLC the best chance to flourish.

Ready to take the plunge? Research, engage with professionals, and make that decision with confidence. Your LLC deserves a great start, and the perfect state could be just a click away. Here’s to your entrepreneurial journey—may it be prosperous, fulfilling, and full of exciting possibilities!