In today’s digital shopping landscape, where convenience reigns supreme and a click can bring the world to your doorstep, there lurks a shadowy adversary: eCommerce fraud. Whether you’re a seasoned online retailer or just stepping into the vibrant realm of eCommerce, the threat of fraud is ever-present, and it’s evolving faster than we can keep up. But fear not! In this article, we’re diving into the essentials of eCommerce fraud prevention. We’re not just throwing around technical jargon; instead, we’re here to arm you with 19 practical strategies that can shield your business from various types of fraud. From identity theft to chargebacks, we’ll explore methods that not only protect your bottom line but also enhance your customers’ trust and shopping experience. So, let’s roll up our sleeves and discover how to keep your online store safe and sound, ensuring that your hard-earned success stays intact. Ready to turn the tables on fraud? Let’s get started!

Understanding the Landscape of Ecommerce Fraud

Ecommerce fraud is a multifaceted challenge that continues to evolve as technology advances and online shopping becomes more prevalent. Understanding the various types of fraud that can occur is crucial for businesses seeking to protect themselves and their customers.

First, let’s consider card-not-present (CNP) fraud, which has become increasingly common in the world of online transactions. This type of fraud typically involves stolen credit card information used to make purchases without the cardholder’s knowledge. Merchants face significant risks, as chargebacks can lead to financial losses and damage to their reputations.

Another prevalent issue is account takeover fraud, where an attacker gains unauthorized access to a customer’s account. This can occur through phishing attacks, data breaches, or the use of stolen credentials. Once an account is compromised, fraudsters can make purchases, change shipping addresses, and even siphon off sensitive personal information.

There is also return fraud, which can manifest in various forms. Fraudsters may exploit generous return policies to return stolen merchandise or use counterfeit receipts. This type of fraud not only affects a retailer’s bottom line but can also complicate inventory management and customer relations.

Additionally, friendly fraud poses a unique challenge. In these scenarios, legitimate customers make a purchase and then dispute the charge, claiming they never received the product or didn’t authorize the transaction. This not only results in lost revenue for the merchant but can also lead to increased processing fees and penalties from banks.

Understanding the psychology behind ecommerce fraud is equally important. Fraudsters often leverage consumer behavior, exploiting feelings of urgency or excitement to facilitate theft. Awareness of these tactics can help businesses better prepare their defenses.

The landscape of ecommerce fraud also varies by industry. For instance, luxury goods retailers may face higher risks of fraud due to the high value of their products, while subscription-based services might experience different fraud patterns based on user behavior. Here’s a brief overview:

| Industry | Common Fraud Types |

|---|---|

| Fashion | Account Takeover, Return Fraud |

| Electronics | Card-Not-Present, Return Fraud |

| Subscriptions | Friendly Fraud, Account Takeover |

| Travel | Account Takeover, CNP Fraud |

By understanding the different facets of ecommerce fraud, businesses can tailor their prevention strategies more effectively. This not only involves employing advanced technological solutions but also fostering a culture of security awareness among employees and customers alike. The battle against fraud is ongoing, and staying informed is essential.

The Importance of a Proactive Fraud Prevention Strategy

In an ever-evolving digital landscape, the stakes of online transactions have never been higher. With increasing reports of ecommerce fraud, businesses must shift their mindset from reactive measures to a proactive approach. This means identifying vulnerabilities before they can be exploited. By implementing a robust fraud prevention strategy, companies can safeguard their assets and build trust with their customers.

One of the first steps in crafting this strategy is understanding the different types of fraud that can impact ecommerce. Account takeover, payment fraud, and friendly fraud are just a few examples. Each requires a tailored approach to prevention, emphasizing the need for a comprehensive strategy that addresses all potential threats. Here are some key elements to consider:

- Data Analysis: Regularly analyze transaction data to recognize patterns and anomalies that could indicate fraudulent activity.

- Customer Education: Inform customers about safe online practices and how to recognize potential scams, thus empowering them as part of the prevention effort.

- Multi-Factor Authentication: Implement this security measure to add an extra layer of protection for sensitive transactions.

Moreover, collaboration among different departments can enhance the effectiveness of any fraud prevention strategy. The integration of IT, customer service, and finance teams can lead to a more comprehensive understanding of fraud risks. For instance, a seamless flow of information can help identify unusual activity and respond more swiftly.

| Team | Role in Fraud Prevention |

|---|---|

| IT Department | Monitors technical vulnerabilities and implements security protocols. |

| Customer Service | Identifies suspicious behavior through customer interactions. |

| Finance | Tracks financial discrepancies and unusual transactions. |

Additionally, investing in advanced fraud detection tools can significantly strengthen your defenses. Machine learning algorithms and AI-driven analytics can rapidly assess transactions for risk factors, providing real-time alerts to suspicious activities. This technology not only detects fraud but can also adapt to emerging threats, ensuring your strategy remains relevant.

Implementing a proactive fraud prevention strategy also includes regular training for staff. Empowering employees with knowledge about the latest fraud trends and prevention techniques can make a substantial difference. A well-informed team is more likely to spot potential issues early, reducing the chance of fraud slipping through the cracks.

Ultimately, a proactive approach not only protects your business but also enhances customer loyalty. When customers feel secure while shopping online, they are more likely to return. By prioritizing fraud prevention, businesses not only mitigate risks but also create a positive shopping experience that encourages repeat business. The landscape of ecommerce is competitive, and those who invest in comprehensive fraud prevention strategies are setting themselves up for success in the long run.

Identifying the Different Types of Ecommerce Fraud

Ecommerce fraud is a growing concern for online retailers, and understanding its various forms is essential for effective prevention. By identifying the different types of fraud, businesses can implement tailored strategies to safeguard their operations.

1. Credit Card Fraud: This is one of the most common types of ecommerce fraud. It involves the unauthorized use of someone else’s credit card information to make purchases. Fraudsters often obtain this information through data breaches or phishing attacks. To combat this, retailers should consider using 3D Secure technology and monitoring transactions for signs of suspicious activity.

2. Account Takeover: In this scenario, fraudsters gain access to user accounts, often through stolen login credentials. Once they have control, they can change account details, access personal information, and make unauthorized purchases. Preventive measures include implementing two-factor authentication and regularly advising customers to update their passwords.

3. Friendly Fraud: This type occurs when a customer makes a legitimate purchase but later disputes the transaction with their bank, claiming they did not authorize it. This can lead to chargebacks and loss of revenue for merchants. To minimize friendly fraud, businesses should maintain clear records of transactions and provide excellent customer service to address any concerns before they escalate.

4. Affiliate Fraud: In affiliate programs, fraudsters can exploit the system by generating fake leads or sales. They may use deceptive practices to earn commissions on non-genuine transactions. Retailers can prevent this by setting strict guidelines for affiliate marketing and regularly monitoring affiliate performance and compliance.

5. Return Fraud: This type of fraud involves customers abusing return policies to gain refunds on items they never purchased or have already used. Implementing strict return policies and tracking return patterns can help identify suspicious behavior.

| Fraud Type | Common Indicators | Preventive Measures |

|---|---|---|

| Credit Card Fraud | Multiple transactions from different locations | Use 3D Secure technology |

| Account Takeover | Unusual login attempts | Implement two-factor authentication |

| Friendly Fraud | Frequent chargebacks | Maintain clear transaction records |

| Affiliate Fraud | Suspicious affiliate activity | Monitor affiliate performance |

| Return Fraud | High return rates | Set strict return policies |

By recognizing these various types of ecommerce fraud, businesses can better prepare themselves against potential threats. It’s crucial to stay informed about the evolving tactics used by fraudsters and continuously adapt prevention measures to protect both the business and its customers.

Building a Strong Foundation with Secure Payment Gateways

In the fast-paced world of ecommerce, ensuring that your business is equipped with the right tools to prevent fraud is essential. Secure payment gateways serve as a critical line of defense against fraudulent transactions, helping to protect not only your revenue but also your customers’ sensitive information. By implementing a reliable payment solution, you create an environment of trust, which is vital for customer retention and brand loyalty.

When selecting a payment gateway, consider these key features that enhance security:

- Encryption Technology: Look for gateways that utilize advanced encryption protocols to safeguard sensitive data during transactions. This ensures that customer information remains confidential and secure.

- Fraud Detection Tools: Many gateways offer integrated fraud detection and prevention features, such as machine learning algorithms that analyze transaction patterns for suspicious activity.

- PCI Compliance: Ensure that the payment gateway adheres to Payment Card Industry Data Security Standards (PCI DSS). This compliance is crucial for protecting cardholder data and minimizing the risk of data breaches.

- Two-Factor Authentication: Implementing two-factor authentication adds an extra layer of security by requiring users to provide additional verification methods before completing a transaction.

Additionally, it’s beneficial to establish a multi-gateway strategy. Relying on a single payment processor can expose your business to vulnerabilities should that provider experience a security breach. By diversifying your payment options, you ensure that your business can continue to operate even if one gateway encounters issues. Integrating multiple gateways also allows you to cater to a broader audience, accommodating different customer preferences.

Consider creating a simple comparison table to evaluate various payment gateways you might be interested in:

| Payment Gateway | Transaction Fees | Security Features | Customer Support |

|---|---|---|---|

| Gateway A | 2.9% + $0.30 | Encryption, PCI Compliance | 24/7 Live Chat |

| Gateway B | 2.7% + $0.25 | Fraud Detection, 2FA | Email Support |

| Gateway C | 3.0% + $0.15 | Tokenization, PCI Compliance | Phone & Chat Support |

training your team to recognize potential fraud signals is an often-overlooked aspect of effective fraud prevention. Regular training sessions can equip your staff with the knowledge they need to spot red flags, such as unusual transaction sizes, or rapid transactions from the same IP address. Encouraging a culture of awareness and vigilance among your team can significantly bolster your overall security posture.

In a world where ecommerce fraud is constantly evolving, building a robust framework with secure payment gateways is not just a smart move; it’s essential for sustaining your business’s integrity and profitability. By prioritizing security and customer trust, you’ll pave the way for a more successful online venture.

Implementing Two-Factor Authentication for Extra Security

To bolster the security of your ecommerce platform, implementing two-factor authentication (2FA) is essential. This extra layer of protection safeguards both your customers’ sensitive information and your business from potential fraud. By requiring a second form of verification in addition to the usual password, you significantly decrease the likelihood of unauthorized access.

Here’s how two-factor authentication works:

- After entering their password, users receive a code via SMS, email, or an authenticator app.

- They must input this code to gain access, proving their identity beyond just the password.

- Even if a password is compromised, the account remains secure without the second factor.

Choosing the right method for authentication is crucial:

- SMS Codes: Quick and simple but susceptible to interception.

- Email Codes: Similar to SMS, though email accounts can also be hacked.

- Authenticator Apps: More secure, as they generate time-sensitive codes that are harder to intercept.

When setting up two-factor authentication, it’s vital to ensure that your customers understand its importance. A clear notification explaining the benefits of 2FA can enhance user buy-in. Consider adding a pop-up or a banner on your site highlighting the security improvements and encouraging users to enable this feature.

Additionally, consider offering incentives for customers who opt into 2FA. Discounts or loyalty points can entice users to take this extra step in protecting their accounts. It not only makes them feel more secure but also builds trust in your brand.

monitor the effectiveness of your two-factor authentication implementation. Keep track of login attempts, recognized devices, and usage patterns. This data can help you identify potential security threats and refine your authentication process over time.

Here’s a quick comparison of the various 2FA methods:

| Method | Security Level | User Experience |

|---|---|---|

| SMS Codes | Moderate | Easy |

| Email Codes | Moderate | Easy |

| Authenticator Apps | High | Moderate |

| Hardware Tokens | Very High | Moderate |

adopting two-factor authentication is not just a trend; it is a necessary step in the fight against ecommerce fraud. By implementing this robust security measure, you not only protect your business but also enhance your customers’ overall shopping experience, making them feel valued and secure.

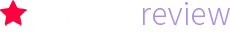

Leveraging AI and Machine Learning to Spot Fraud Patterns

In the world of ecommerce, where transactions happen at lightning speed, the ability to identify fraudulent activities before they escalate is crucial. Artificial Intelligence (AI) and Machine Learning (ML) are game changers in this domain, offering sophisticated tools to analyze vast datasets and detect anomalies that may indicate fraud. These technologies can sift through countless transactions in real-time, providing ecommerce businesses with a significant edge in fraud prevention.

One of the primary benefits of utilizing AI and ML in fraud detection is their capacity for pattern recognition. By learning from historical data, these systems can identify typical purchasing behaviors and flag unusual activities that deviate from the norm. For example, if a user suddenly makes a high-value purchase from a new device or location, AI algorithms can automatically trigger a verification process. This proactive approach not only enhances security but also improves customer trust.

Moreover, AI and ML systems can continuously evolve. As fraudsters change their tactics, these technologies can quickly adapt by recalibrating their models. This adaptability is vital in maintaining effective fraud prevention strategies. For instance, an AI model trained on last year’s data may not be effective in spotting new forms of fraud that have emerged in recent months. Machine learning algorithms, however, can integrate fresh data and refine their analysis, ensuring that your defenses remain robust and relevant.

Implementing these technologies also allows for a more nuanced understanding of risk assessment. Rather than relying solely on hard rules that may lead to false positives, AI and ML can analyze multiple factors, such as:

- Transaction history

- User behavior

- Geographic location

- Device fingerprinting

This multifaceted approach enables businesses to differentiate between legitimate and fraudulent transactions more effectively, reducing unnecessary friction for genuine customers while tightening security against potential threats.

Furthermore, integrating AI and ML into your fraud prevention strategy can yield significant cost savings. Traditional methods often require extensive manual reviews, which can be labor-intensive and slow. By automating these processes, ecommerce companies can allocate resources more efficiently, focusing on high-risk transactions rather than drowning in a sea of data. This streamlined process enhances overall operational efficiency and allows for quicker response times.

For an effective implementation of AI and ML in fraud detection, consider the following strategies:

- Invest in quality data: The accuracy of AI and ML models heavily relies on the quality of the data fed into them. Ensure you have a robust data collection and cleaning process.

- Collaborate with experts: Partner with data scientists and machine learning experts who understand both the technology and the nuances of fraud detection.

- Monitor performance: Continuously assess the effectiveness of your AI and ML models and make adjustments as necessary to adapt to new fraud trends.

the application of AI and ML in fraud detection not only enhances your security framework but also improves customer experience and operational efficiency. By embracing these advanced technologies, ecommerce businesses can stay one step ahead of fraudsters, ensuring a safer shopping environment for their customers.

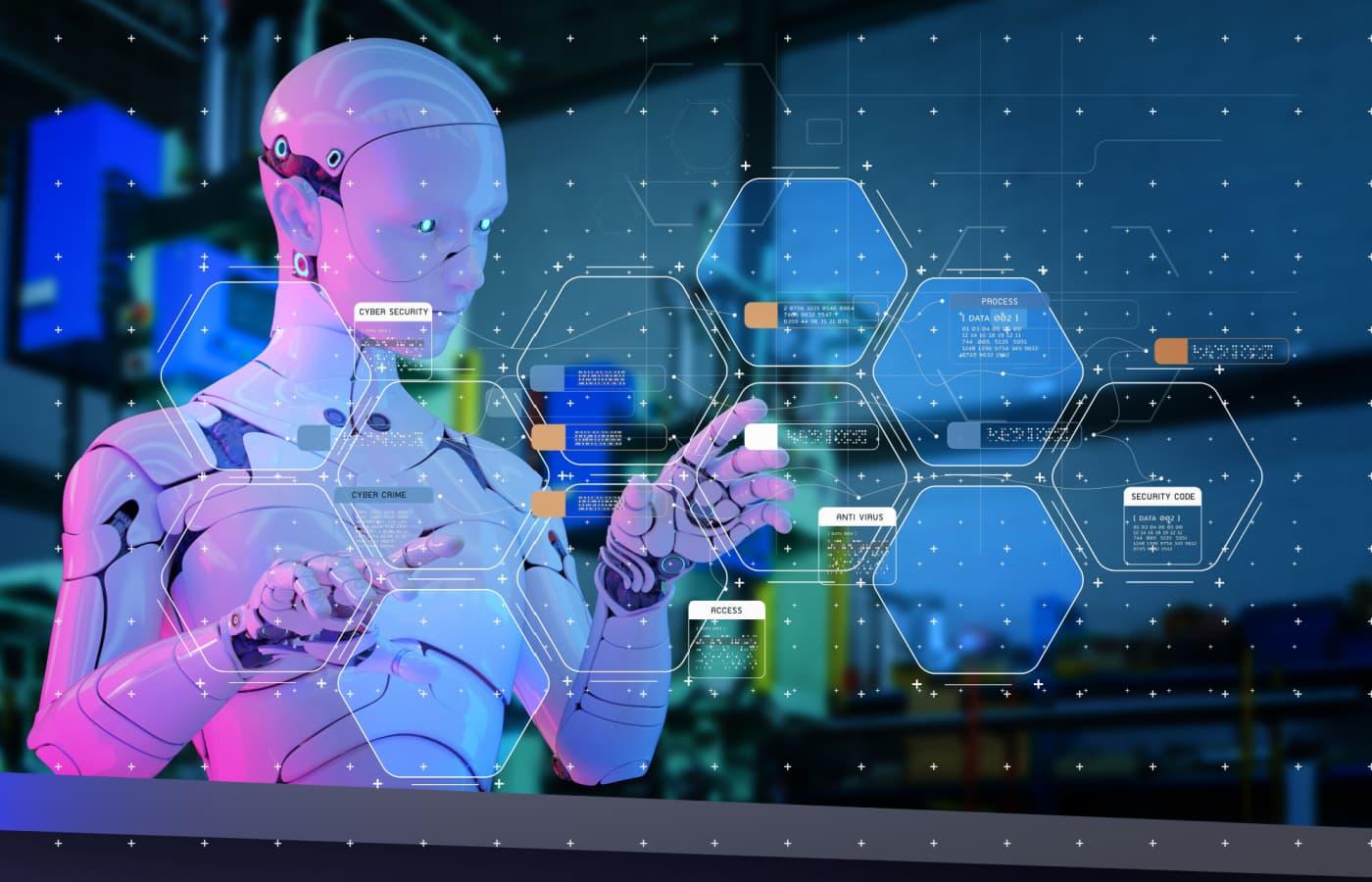

Monitoring User Behavior and Anomalies in Real-Time

In the ever-evolving world of ecommerce, understanding user behavior is crucial for preventing fraud. By monitoring interactions in real-time, businesses can identify irregular patterns that signal potential fraudulent activity. This proactive approach not only protects financial assets but also enhances customer trust and loyalty.

Implementing advanced analytics tools enables ecommerce platforms to track user behavior comprehensively. These tools can analyze a myriad of data points, including:

- Geolocation data – Identifying if a user’s location aligns with their historical behavior.

- Device recognition – Noting changes in devices used for transactions.

- Order velocity – Monitoring the speed of purchases, as unusually fast transactions can raise red flags.

By establishing baselines for typical user behavior, businesses can detect anomalies swiftly. For instance, if a customer usually makes smaller purchases but suddenly attempts a large transaction, this could indicate fraud. To effectively implement this, consider creating a user behavior matrix that highlights normal patterns versus anomalies. This type of visual representation can simplify the identification process for your fraud detection team.

| User Behavior Indicators | Normal Range | Anomalous Behavior |

|---|---|---|

| Average Order Value (AOV) | $50 – $200 | Above $500 |

| Transaction Frequency | 2 – 5 times a week | 20+ times in a day |

| Login Device | Home Computer, Mobile | Public Wi-Fi, Unknown Device |

Furthermore, incorporating machine learning algorithms can significantly enhance monitoring efforts. These algorithms learn from historical data and continuously improve their detection capabilities. By analyzing trends and behaviors, they can flag suspicious activity without human intervention, allowing your team to focus on high-risk cases that require immediate attention.

One effective practice is to set up real-time alerts for anomalies detected by your analytics and machine learning systems. These alerts can notify your security team instantly, enabling them to act quickly. For example, if a user’s account shows an abrupt change in their purchase behavior or if a transaction exceeds a predefined amount, a notification can be sent out to review the activity before processing the order.

Lastly, remember that communication with your customers is key. Informing them of any unusual activity on their accounts fosters transparency and builds trust. By proactively reaching out to verify transactions, you not only mitigate risks but also enhance the overall customer experience. An empowered customer is one who feels secure, leading to increased loyalty and, ultimately, higher sales.

Educating Your Team on the Latest Fraud Trends

Staying ahead of fraud trends is crucial in today’s fast-paced ecommerce landscape. As fraudsters evolve their tactics, it’s essential that your team is not just informed, but also equipped to respond effectively. This begins with comprehensive education on the latest fraud trends that can impact your business. Here are some key strategies for ensuring your team is knowledgeable and proactive.

- Regular Training Sessions: Organize monthly or quarterly training sessions to keep your team updated on the latest fraud tactics. Invite industry experts to share insights and real-life case studies.

- Interactive Workshops: Consider hands-on workshops that simulate fraud scenarios. This enables team members to practice identifying and preventing fraudulent activities in a controlled environment.

- Access to Resources: Provide access to articles, webinars, and whitepapers focused on ecommerce fraud. Encourage your team to engage with these materials regularly to deepen their understanding.

- Utilize Technology: Implement fraud detection tools and software that will help your team learn through experience. Familiarity with these systems can enable quicker reactions to suspicious activities.

One effective approach to educate your team is to create a centralized knowledge base. This can include a collection of the latest fraud trends, case studies, and prevention strategies. By having a dedicated resource, your team can easily reference information and stay informed as new threats emerge.

Additionally, fostering a culture of communication within your team is vital. Encourage team members to share their experiences and insights regarding suspicious activities they encounter. This collaborative approach not only enhances learning but also strengthens your overall fraud prevention strategy.

| Fraud Type | Description |

|---|---|

| Account Takeover | Fraudsters gain unauthorized access to user accounts, often through stolen credentials. |

| Payment Fraud | Fake or stolen payment methods are used to complete transactions. |

| Refund Fraud | Requesting refunds for fraudulent purchases or items never received. |

| Friendly Fraud | Customers dispute legitimate charges, claiming they did not authorize the transaction. |

Lastly, it’s beneficial to establish a feedback loop. After training sessions or workshops, collect feedback to understand what resonated with your team and what areas may need further exploration. This iterative approach ensures that your educational initiatives remain relevant and effective.

Creating a Comprehensive Return and Refund Policy

When it comes to online shopping, customers appreciate transparency and clarity. A well-defined return and refund policy not only builds trust but can also deter potential fraud. Here are essential elements to consider when crafting your policy:

- Clear Return Window: Specify the timeframe within which returns are accepted. A common practice is to allow returns within 30 days of purchase. This timeframe should be mentioned prominently.

- Conditions for Returns: Outline the condition in which items can be returned. State whether items must be unopened, unused, or in original packaging. This can help prevent fraudulent claims.

- Refund Process: Describe how refunds are processed. Will it be a full refund, store credit, or an exchange? Clearly outline each option so customers know what to expect.

- Return Shipping Costs: Indicate whether customers are responsible for return shipping fees. If you cover shipping, make sure to explain that as a customer-friendly incentive.

- Exceptions: Not all items may be eligible for return. Clearly list any exceptions (e.g., clearance items, personalized goods) to avoid confusion.

Additionally, including a section on how to initiate a return can streamline the process:

| Step | Description |

|---|---|

| 1 | Visit our returns portal or contact customer service. |

| 2 | Fill out the return form with your order details. |

| 3 | Repackage the item securely and include the return form. |

| 4 | Send your package to the address provided. |

Be sure to highlight your commitment to customer satisfaction. A section like “Our Promise” can reassure customers that their happiness is your priority:

“We strive to make your shopping experience enjoyable. If you’re not completely satisfied with your purchase, we’re here to help.”

regularly revisit and update your policy. As your business evolves, so should your return and refund practices. This not only keeps your customers informed but also strengthens your defenses against potential fraud.

Enhancing Customer Trust with Transparency and Communication

In the landscape of eCommerce, where trust can make or break a purchase decision, transparency and communication stand as critical pillars in the fight against fraud. When customers feel informed and secure, they are more likely to engage with a brand. This not only mitigates fraud risks but also fosters a deep-rooted loyalty that can carry your business through tough times.

One effective strategy is to clearly outline your policies regarding data protection and returns. When customers understand how their information is used and what recourse they have in case of dissatisfaction, it removes apprehension from the shopping experience. Consider creating a dedicated section on your website that highlights these policies. Use straightforward language, avoiding legal jargon that could alienate potential buyers.

Another key aspect is consistent communication throughout the customer journey. From the moment a customer places an order to the delivery of their product, keeping them informed is crucial. Automated emails can serve this purpose well, providing timely updates on order status, tracking information, and shipment confirmations. These communications not only reassure customers but also deter potential fraudsters who thrive in environments of uncertainty.

Building a transparent relationship with customers involves:

- Regularly updating customers on system updates and security measures.

- Encouraging feedback and being receptive to customer inquiries.

- Sharing insights about how customer data is protected.

Utilizing social proof is another powerful tool. Showcasing customer testimonials, reviews, and even case studies on your website can amplify trust. Prospective buyers are more inclined to make a purchase when they see others endorsing your brand. This is especially effective when reviews highlight your commitment to transparency and excellent customer service.

Consider implementing a live chat feature on your site to address customer concerns in real-time. This immediate access to support can alleviate fears about online shopping and fraud. Customers appreciate knowing they can reach out at any moment, and this proactive approach can enhance their overall experience.

Lastly, don’t underestimate the power of visual content. Infographics that simplify complex policies or illustrate security measures can be extremely effective. By presenting information in a clear, attractive manner, you can ensure that customers leave your site feeling informed and confident in their purchase decisions.

fostering customer trust through transparency and communication is not only a protective measure against fraud; it is also a strategic business approach. By prioritizing clarity and connection, you create an environment where customers feel valued and secure, ultimately leading to increased loyalty and sales.

Utilizing Address Verification Services to Reduce Risk

In the ever-evolving landscape of ecommerce, the risk of fraud looms large. One of the most effective ways to combat this risk is by leveraging address verification services. These tools not only serve as a first line of defense against fraudsters but also enhance the overall customer experience by ensuring that transactions are legitimate.

Address verification services work by cross-referencing the provided address against various databases to confirm its validity. This process helps in identifying fraudulent activities before they escalate. Here are some key benefits:

- Enhanced Validation: By verifying that the address exists and is associated with the credit card used, businesses can significantly reduce the chances of chargebacks.

- Improved Shipping Accuracy: Correct addresses lead to successful deliveries, minimizing delays and reducing costs associated with returns.

- Fraud Detection: Unusual patterns, such as mismatched addresses and payment methods, can be flagged, allowing for further investigation.

Implementing these services can be a game-changer for online retailers. Without them, businesses may unknowingly ship products to addresses that don’t exist or, worse, to those that are tied to fraudulent activity. This not only impacts the bottom line but can also tarnish a brand’s reputation.

Moreover, many address verification systems offer real-time processing. This means that as soon as a customer inputs their shipping information, the service checks its authenticity, allowing for immediate feedback. This instant validation enhances the user experience, encouraging customers to complete their purchase without hesitation.

When selecting an address verification service, consider the following:

- Integration Capabilities: Ensure that the service seamlessly integrates with your existing ecommerce platform.

- Coverage: The service should cover a wide range of addresses, including international locations, to cater to a diverse customer base.

- Cost-Effectiveness: Look for a solution that offers value without compromising on quality.

Additionally, combining address verification with other fraud prevention measures can create a robust defense strategy. For instance, using this service alongside advanced machine learning algorithms to assess transaction risks can provide an extra layer of security.

Here’s a simple comparison table of popular address verification services to help you make an informed decision:

| Service | Features | Pricing |

|---|---|---|

| Service A | Real-time verification, International coverage | Starts at $50/month |

| Service B | Batch processing, API integration | Contact for pricing |

| Service C | Address correction, Fraud alerts | Free trial available |

Incorporating address verification services into your ecommerce strategy is not just about preventing fraud; it’s about building trust. When customers know that their information is protected and their orders are accurately fulfilled, they are more likely to return and recommend your business to others. In the competitive world of ecommerce, this trust is invaluable.

Establishing Clear Fraud Reporting and Incident Response Plans

Every effective fraud prevention strategy hinges on the establishment of clear reporting and incident response plans. When an incident occurs, swift action is crucial, and having a predefined process can save your business time, money, and reputation.

Start by designating a fraud response team. This team should consist of members from diverse departments, including IT, customer service, and legal. By bringing together different perspectives, you create a well-rounded approach to handling incidents. Ensure that every team member understands their role and responsibilities; doing so will streamline the response process and minimize confusion.

Next, develop a step-by-step reporting protocol. Here’s a simplified outline that your team can follow:

- Identify the Incident: Recognize what type of fraud has occurred.

- Document Evidence: Gather all relevant information and data about the incident.

- Notify Relevant Parties: Inform your internal fraud response team and, if necessary, external authorities.

- Implement Immediate Actions: Take steps to mitigate further damage.

- Review and Analyze: After the incident, conduct a debriefing to analyze what happened and how to prevent a recurrence.

To enhance your protocol, consider using a reporting template for incidents. This ensures that essential details are captured consistently. Here’s a simple example of what such a template could include:

| Incident Date | Type of Fraud | Details | Actions Taken | Follow-up Required |

|---|---|---|---|---|

| YYYY-MM-DD | Carding | Multiple failed transactions | Blocked suspicious IPs | Monitor for repeat attempts |

| YYYY-MM-DD | Phishing | Customer reported fraudulent email | Updates sent to customers | Review email security |

Furthermore, ensure that your incident response plan includes communication strategies. Informing affected customers and stakeholders promptly can help maintain trust and transparency. Use clear, empathetic language to explain the situation and what steps you’re taking to resolve it.

Lastly, never underestimate the importance of ongoing training. Regularly updating your staff on the latest fraud trends and response protocols ensures they are well-equipped to handle incidents. Consider running simulation exercises that present various fraud scenarios, allowing your team to practice their responses in a controlled environment.

By , you not only protect your ecommerce business but also foster a culture of vigilance and accountability. Being prepared is half the battle won in the ongoing fight against fraud.

Regularly Updating Security Measures and Software

In the fast-paced world of eCommerce, staying ahead of cyber threats requires a proactive approach to security. Regular updates to your security measures and software are crucial in fortifying your online store against evolving fraud tactics. Cybercriminals are constantly hunting for vulnerabilities, and outdated systems can serve as gateways for their malicious activities.

To ensure your eCommerce platform remains secure, consider the following strategies:

- Scheduled Updates: Implement a routine schedule for checking and applying updates to all software, including your eCommerce platform, plugins, and any third-party integrations.

- Patching Known Vulnerabilities: Keep an eye on security bulletins for your software. Promptly apply patches released to address known vulnerabilities, as these can be prime targets for fraudsters.

- Utilizing Security Tools: Invest in advanced security tools that can scan for vulnerabilities and provide real-time alerts on potential threats. These tools can significantly reduce your cyber risk.

Equally important is the need to update your security protocols. Regularly reviewing and enhancing your security policies can help you adapt to new fraud schemes. This may include:

- Implementing Multi-Factor Authentication (MFA): Add an extra layer of security by requiring multiple forms of verification before granting access to sensitive areas of your site.

- Conducting Regular Security Audits: Periodically evaluate your security measures to identify weaknesses. This proactive approach allows you to address vulnerabilities before they can be exploited.

- Engaging with Security Experts: Consult cybersecurity professionals who can offer insights and recommendations tailored to your specific eCommerce environment.

Don’t overlook the importance of user awareness and training as part of your security strategy. Educate your staff about the latest phishing scams and social engineering tactics. An informed team can act as your first line of defense against fraud.

Consider also maintaining a centralized dashboard where you can monitor the status of all your security measures. This can be a valuable tool for tracking updates and consolidating security alerts. A well-organized approach helps ensure no area is left unprotected.

| Security Measure | Update Frequency | Importance |

|---|---|---|

| eCommerce Platform | Monthly | Critical |

| Plugins & Extensions | Bi-Weekly | High |

| Security Software | Weekly | Essential |

Incorporating these practices will not only safeguard your business but also build trust with your customers. When clients know you are committed to protecting their information, they are more likely to engage with your brand confidently. Remember, in the realm of eCommerce, security is not just an option; it’s a requirement for sustainable success.

Analyzing Data to Refine Your Fraud Prevention Tactics

In the ever-evolving landscape of ecommerce, staying ahead of fraudsters requires more than just implementing basic prevention measures. A proactive approach involves analyzing data meticulously to refine your fraud prevention strategies. By harnessing the power of analytics, you can identify patterns, discern anomalies, and make informed decisions that bolster your defenses.

One effective technique is to segment your transaction data. By breaking it down into specific categories, you can uncover insights that may not be visible in aggregate data. Consider focusing on:

- Geographic Trends: Understand where fraudulent transactions are originating from and adjust your risk assessments accordingly.

- Customer Behavior: Analyze purchasing patterns to identify unusual activities that deviate from typical consumer behavior.

- Time of Purchase: Investigate if certain times of day or specific days of the week are more prone to fraudulent activity.

Integrating advanced analytics tools can significantly enhance your fraud detection capabilities. Machine learning algorithms can sift through massive data sets, pinpointing suspicious transactions based on previously learned behaviors. It’s crucial to continually train these models with fresh data, ensuring they remain effective against newly emerging fraud tactics.

Moreover, establishing a feedback loop can be vital in refining your strategies. By collecting data on resolved fraudulent cases, you can gain insights into how fraudsters operate, allowing you to adjust your tactics. Consider implementing regular reviews and updates of your fraud detection criteria based on this feedback.

| Data Points | Analysis Method | Expected Outcome |

|---|---|---|

| Transaction Amounts | Outlier Detection | Identify high-risk transactions |

| Customer IP Addresses | Geolocation Analysis | Detect mismatches in shipping and billing locations |

| Return Rates | Trend Analysis | Spot patterns indicating potential fraud |

Utilizing fraud score systems can also aid in assessing the risk level of transactions in real-time. By assigning a score based on various parameters, you can make quick decisions about whether to approve or flag a transaction for further review. This not only streamlines your operations but also minimizes the chance of false positives that could frustrate legitimate customers.

Lastly, collaboration with other businesses and sharing insights through industry networks can be incredibly beneficial. Fraudsters often target multiple businesses, so pooling information about emerging threats can help everyone stay vigilant. Participating in forums or groups dedicated to ecommerce security can provide valuable peer support and collective wisdom.

Cultivating a Culture of Security Awareness Among Customers

In today’s digital landscape, where online transactions are becoming increasingly common, it’s crucial for ecommerce businesses to foster a strong culture of security awareness among their customers. This not only protects their sensitive information but also builds trust and loyalty. By actively engaging customers in discussions about security practices, businesses can empower them to recognize potential threats and respond proactively.

One effective way to cultivate this culture is through educational content. Providing customers with regular updates, articles, and guides related to ecommerce security can play a significant role. Here are some ideas:

- Blog posts that explain common fraud techniques and how to spot them.

- Infographics that visualize the steps customers can take to protect their information.

- Video tutorials demonstrating secure online shopping practices.

Additionally, consider implementing interactive elements on your website. Quizzes and assessments that test customers’ knowledge about security can be both engaging and informative. This not only makes learning fun but also reinforces their understanding of best practices.

Another key component is communication. Make it a point to keep customers informed through newsletters or alerts about potential threats and security incidents. Transparency is vital; when customers feel included in the conversation, they’re more likely to take security seriously. Providing tips on recognizing phishing attempts or secure password creation can lead to a more vigilant customer base.

Furthermore, consider hosting webinars or live Q&A sessions with security experts. This creates an opportunity for customers to ask questions directly, providing them with personalized advice and insights. Customers appreciate businesses that invest in their safety, and such initiatives can distinguish your brand as a leader in security awareness.

It’s also essential to create a responsive support system for customers who may encounter security issues. Clear channels for reporting suspicious activity or seeking help can instill confidence in your customers. By addressing their concerns promptly and effectively, you reinforce a security-first mentality.

To summarize, building a culture of security awareness is not a one-time effort but an ongoing commitment. By utilizing educational resources, maintaining open communication, and providing accessible support, ecommerce businesses can cultivate a vigilant customer base that actively participates in protecting their own interests.

Frequently Asked Questions (FAQ)

Q&A: Ecommerce Fraud Prevention: 19 Practices for All Fraud Types

Q1: What is ecommerce fraud, and why is it such a big deal?

A1: Ecommerce fraud refers to any deceptive practice that takes advantage of online transactions for financial gain. It can involve stolen credit card information, false accounts, or even return scams. It’s a big deal because it not only leads to financial losses for businesses but also erodes customer trust. In today’s competitive marketplace, maintaining trust is essential for success!

Q2: How prevalent is ecommerce fraud?

A2: Unfortunately, ecommerce fraud is on the rise, with estimates suggesting that it will cost businesses over $20 billion by 2024. Cybercriminals are constantly evolving their tactics, making it crucial for businesses to stay one step ahead. Ignoring this problem is not an option!

Q3: What are some common types of ecommerce fraud?

A3: There are several types of ecommerce fraud, including credit card fraud, account takeover, friendly fraud (where a customer makes a purchase and then disputes the charge), and fake returns or exchanges. Each type requires a tailored prevention strategy to effectively combat it.

Q4: What are some key practices to prevent ecommerce fraud?

A4: Great question! Here are a few crucial practices:

- Use Two-Factor Authentication: This adds an extra layer of security to customer accounts.

- Monitor Transactions: Keep an eye on unusual purchasing patterns; they can be red flags.

- Install Secure Payment Gateways: These encrypt sensitive data during transactions.

- Implement AI and Machine Learning: These technologies can analyze patterns and flag suspicious activities in real-time.

- Educate Customers: Inform them about safe online practices, like recognizing phishing attempts.

These are just a starting point; we’ve outlined 19 comprehensive practices in our article!

Q5: Why should small businesses care about ecommerce fraud prevention?

A5: Small businesses often think they are too small to be targeted, but that’s a misconception! Fraudsters are opportunistic, and a successful attack can have devastating effects, including financial losses and damage to your reputation. Establishing strong fraud prevention practices is not just for big players; it’s essential for every business!

Q6: How can I tell if my ecommerce site is vulnerable to fraud?

A6: Look for signs like an increase in chargebacks, frequent customer complaints, or a spike in returns. If you notice these trends, it may be time to assess your security measures. Regular audits of your website and payment processes can also help identify potential vulnerabilities.

Q7: What role does customer education play in fraud prevention?

A7: Huge! Well-informed customers are your first line of defense. When you educate them on recognizing suspicious activities, utilizing strong passwords, and reporting fraud, you’re not just protecting them; you’re protecting your business as well. It creates a safer online shopping environment for everyone!

Q8: Can technology really help in preventing fraud?

A8: Absolutely! Advanced technologies, like artificial intelligence and machine learning, can analyze vast amounts of data to detect anomalies and flag suspicious transactions much faster than humans can. Automation reduces human error and allows for quicker responses to potential threats.

Q9: How can I start implementing these fraud prevention practices today?

A9: Start with a comprehensive risk assessment of your current processes. Identify vulnerabilities and create a plan to address them using some of the practices we mentioned earlier. Engage your team in training sessions and make customer education a priority. The sooner you act, the better protected your business will be!

Q10: What’s the takeaway message regarding ecommerce fraud prevention?

A10: Don’t wait until it’s too late! Investing in ecommerce fraud prevention not only safeguards your finances but also helps build trust with your customers. By adopting a proactive approach and implementing the practices we’ve discussed, you’ll be well on your way to creating a secure online shopping experience. Read our full article for all 19 practices and make fraud prevention a priority today!

Future Outlook

As we wrap up our deep dive into ecommerce fraud prevention, it’s clear that arming yourself with knowledge and proactive strategies is your best defense against the myriad of fraud types lurking in the digital marketplace. The 19 practices we’ve explored are more than just tips—they’re your toolkit for building a safer, more resilient online business.

Remember, the stakes are high. Every dollar lost to fraud is not just a hit to your bottom line, but also a risk to your reputation and customer trust. By implementing these practices, you’re not just protecting your business; you’re investing in a secure shopping experience for your customers, which can ultimately lead to increased loyalty and sales.

So, take a moment to assess where you stand today. Are there gaps in your current strategy? Which practices can you implement immediately? Whether you’re a seasoned ecommerce veteran or just starting out, it’s never too late to bolster your defenses.

Stay vigilant, be proactive, and remember: in the world of ecommerce, prevention is always better than cure. Let’s turn the tables on fraudsters and create a safer online shopping environment for everyone. Here’s to your success in building a fraud-proof ecommerce empire!