Starting a business can be one of the most exciting adventures of your life, but before you dive headfirst into your entrepreneurial journey, there’s a crucial step you can’t overlook: obtaining a business license. It might sound a bit daunting, but don’t worry—we’re here to break it down for you. In this comprehensive guide, we’ll walk you through everything you need to know about securing your business license, state by state. Whether you’re dreaming of opening a cozy coffee shop, an online boutique, or a tech startup, understanding the licensing process is essential to turning that dream into reality. Along the way, we’ll share valuable tips and insights tailored to your specific state, making it easier for you to navigate the requirements. So grab a cup of coffee, get comfortable, and let’s turn that business idea into a legitimate venture!

Understanding the Importance of a Business License

A business license is not just a piece of paper; it’s a vital component of any legitimate operation. This important document serves as a formal permission from the government, allowing you to conduct business in a particular area. Without it, you could face hefty fines, legal complications, and even the shutdown of your enterprise.

One of the main reasons to secure a business license is to ensure compliance with local laws and regulations. Different states and municipalities have their own requirements, and understanding these can save you from unnecessary headaches down the road. By obtaining a license, you’re not only following the rules but also showcasing your commitment to operating ethically and responsibly.

Moreover, having a business license enhances your credibility. Customers are more likely to trust a licensed business, as it demonstrates that you’re serious about your operations. This trust can be a significant differentiator in a competitive market, encouraging more customers to choose you over unlicensed competitors.

Additionally, a business license can offer you access to certain business benefits, including:

- Legal Protection: A license can help protect your business from lawsuits related to operating without permission.

- Access to Funding: Many banks and investors require proof of a business license before approving loans or investments.

- Networking Opportunities: Licensed businesses may have access to exclusive local business networks, events, and resources.

It’s also important to note that maintaining your business license is an ongoing responsibility. Many licenses require renewal after a certain period, and failing to renew can lead to penalties. Staying on top of these obligations reflects your professionalism and dedication to your business.

obtaining a business license is a foundational step for any entrepreneur. It demonstrates compliance, builds trust, and opens doors to numerous opportunities. Whether you are a seasoned business owner or just starting out, understanding the significance of a business license will pave the way for long-term success and sustainability.

Navigating the Basics of Business Licensing

Starting a business can be exhilarating, but navigating the maze of business licensing can feel daunting. Understanding the various types of licenses and permits required in your state is essential to legally operate your business. It’s not just about checking off boxes; it’s about laying a solid foundation for your business’s success. Here’s what you need to know to ensure you’re on the right track.

First and foremost, identify the type of business you plan to run. Different industries have distinct requirements. Here are some common types of licenses you might encounter:

- Business Operating License: Most municipalities require this basic license to operate any type of business.

- Professional Licenses: Certain professions, like doctors, lawyers, and real estate agents, need specialized licenses.

- Health Permits: If your business deals with food or health-related services, you’ll need permits from health departments.

- Sales Tax Permit: This allows you to collect sales tax from customers and is crucial for retail businesses.

Next, research the specific requirements for your state. Each state has its own regulations, and what works in one place may not in another. Here’s a quick overview of how some popular states define their licensing requirements:

| State | Common License Types | Key Considerations |

|---|---|---|

| California | Business License, Seller’s Permit | Local city regulations may vary significantly. |

| Texas | General Business License, Sales Tax Permit | No state license required, but local permits must be checked. |

| Florida | Business Tax Receipt, Professional License | Some professions may require additional certifications. |

Once you’ve identified the necessary licenses, the next step is to gather the required documentation. This often includes personal identification, business plans, and proof of any relevant training or certifications. Make sure to double-check the submission guidelines — some states allow online applications, while others may require paper forms sent via mail.

It’s also crucial to consider the fees involved. Business licensing costs can vary widely based on your location and the type of license. Some licenses involve one-time fees, while others may require annual renewals. Budgeting for these expenses from the outset can prevent unexpected financial strain as you launch your business.

Lastly, keep in mind that compliance doesn’t end with receiving your licenses. Regularly review your licenses and permits to ensure you remain compliant with any changes in regulations. This proactive approach not only keeps you in good standing but also helps establish your business as reputable and trustworthy in the eyes of customers and partners.

Exploring Different Types of Business Licenses

When venturing into the world of business, one of the first hurdles you will encounter is obtaining the appropriate licenses. The type of business license you need can vary significantly based on several factors, including the nature of your business, its location, and the industry in which you operate. Here’s a look at some common types of business licenses that entrepreneurs should be aware of.

1. General Business License

This is the most basic license required for operating a business. It registers your business with the local government, allowing you to legally conduct commercial activities. Most small businesses will need this license, but requirements can differ from one city or county to another.

2. Professional Licenses

Certain professions require specialized licenses to ensure compliance with state regulations and industry standards. These can include occupations like doctors, lawyers, accountants, and cosmetologists. Obtaining a professional license usually involves meeting specific educational and experiential criteria, along with passing exams.

3. Sales Tax Permit

If your business involves selling goods or services that are subject to sales tax, you’ll need a sales tax permit. This allows you to collect sales tax from customers and remit it to the state. Keep in mind that not all states have a sales tax; knowing your state’s regulations is crucial.

4. Health Department Permits

Businesses in the food industry, such as restaurants and caterers, must obtain health department permits. These permits ensure that your establishment meets health and safety standards. Regular inspections may also be required to maintain compliance.

5. Zoning Permits

Before you start a business, particularly one that operates out of a physical location, check local zoning laws. A zoning permit ensures that your business activity complies with local land use regulations. This is particularly important for businesses that may generate noise, traffic, or other disruptions.

It’s essential to understand that requirements for these licenses can change based on state and local laws. Therefore, always check with your local government or a legal professional to ensure you’re meeting all necessary regulations.

Here’s a quick reference table summarizing the common types of business licenses:

| License Type | Typical Requirement | Who Needs It? |

|---|---|---|

| General Business License | Registration with local government | Most small businesses |

| Professional License | Education and exam qualification | Doctors, lawyers, etc. |

| Sales Tax Permit | State tax registration | Retail businesses |

| Health Department Permit | Health inspections and compliance | Food service businesses |

| Zoning Permit | Compliance with local zoning laws | Any physical location business |

By understanding the different types of business licenses, you can ensure that you’re fully compliant, paving the way for a successful launch and operation of your business. Remember, being proactive in obtaining the right licenses can save you from potential legal troubles down the road!

Step-by-Step Guide to Applying for Your Business License

Applying for a business license can seem daunting, but breaking it down into manageable steps makes the process much easier. Here’s a straightforward guide to help you navigate your way through obtaining that all-important license. Start by understanding your business type, as different businesses may require different types of licenses.

1. Determine Your Business Structure

Your first step is to decide the legal structure of your business. This could be a sole proprietorship, partnership, LLC, or corporation. Each structure has its own licensing requirements, so make sure you choose one that aligns with your goals. Research the implications of each structure to find the best fit for your needs.

2. Check Local Requirements

Next, dive into the specific requirements of your local area. Business licenses can vary by city and state, so it’s crucial to check:

- Your city’s business office website

- State regulations

- Any federal licenses required for your industry

Use online resources or visit your local government office to gather essential information. This will save you time and headaches later on.

3. Gather Necessary Documentation

Before you start filling out applications, you’ll want to gather all necessary documents. Commonly required documents include:

- Proof of identity (such as a driver’s license)

- Business name registration

- Tax identification number (EIN)

- Proof of insurance

Having these documents ready will streamline the application process.

4. Complete the Application

With your documents in hand, it’s time to fill out the application. Most applications can be submitted online, but some areas may require in-person submission. Ensure that you provide:

- Your business name and address

- Type of business or industry

- Details of business ownership

Double-check your application to avoid any mistakes that could delay processing.

5. Pay the Fees

After submitting your application, you’ll usually need to pay a fee. Fees can vary significantly based on your location and the type of business you’re operating. Prepare for potential costs by consulting the local guidelines available on your municipality’s website.

6. Await Approval

Once your application is submitted, it’s time to wait. Approval times can range from a few days to several weeks, depending on your local government’s workload. If there are any issues with your application, they will contact you for further information, so keep an eye on your email.

7. Obtain Additional Permits if Necessary

Remember, obtaining a business license might not be the end of your licensing process. Depending on your business activities, you may need additional permits such as:

- Health permits for food-related businesses

- Building permits for physical locations

- Environmental permits if applicable

Always verify the full scope of licenses and permits required for your business type to remain compliant.

| State | Business License Fee | Processing Time |

|---|---|---|

| California | $70 – $800 | 2-6 weeks |

| Texas | $15 – $300 | 1-4 weeks |

| New York | $50 – $2,000 | 3-8 weeks |

Following these steps will put you on the right path to securing your business license and starting your entrepreneurial journey. Remember, local regulations can vary widely, so staying informed and organized is key to a smooth application process!

Key Documents Needed for Your License Application

Applying for a business license can be an overwhelming process, especially when it comes to gathering the necessary documentation. Having the right documents at your fingertips is crucial to streamline your application and avoid potential delays. Here’s what you typically need:

- Business Plan: A clear outline of your business goals, target market, and financial projections can strengthen your application.

- Identification: A government-issued ID (like a driver’s license or passport) is usually required to verify your identity.

- Employer Identification Number (EIN): If you’re hiring employees or running a corporation, you’ll need an EIN from the IRS.

- Proof of Address: Documents such as a lease agreement or utility bill can be used to verify your business location.

- Legal Structure Documentation: Depending on your business type (LLC, corporation, etc.), you may need to submit articles of incorporation or a partnership agreement.

- Licenses and Permits: Certain industries require additional local, state, or federal licenses, so ensure you have those ready as well.

- Financial Statements: Some applications may ask for your business’s financial history or bank statements.

Different states may have specific requirements, so it’s essential to check local regulations. To make this process easier, consider creating a checklist tailored to your state’s guidelines. Below is a simple overview of common requirements by state:

| State | Common Requirements |

|---|---|

| California | Business plan, EIN, proof of address |

| Texas | ID, legal structure documentation, financial statements |

| New York | Licenses and permits, proof of address |

| Florida | Business plan, EIN, ID |

Remember, incomplete applications are often rejected or delayed, so double-check that you have all the required documents prepared and correctly filled out. Once you have your documents gathered, you can approach the licensing authority with confidence. Don’t hesitate to ask for clarification if you’re unsure about what’s needed—most offices are eager to assist applicants to ensure they’re meeting all requirements.

being organized and thorough in preparing your documents not only expedites the licensing process but also sets a professional tone for your new venture. You’ll be well on your way to launching your business and turning your entrepreneurial dreams into reality!

Common Mistakes to Avoid When Applying for a License

When embarking on the journey to acquire your business license, it’s easy to stumble upon a few common pitfalls that could delay your application or even lead to rejection. To streamline your application process and increase your chances of approval, keep an eye out for the following mistakes:

- Incomplete Documentation: One of the most frequent errors applicants make is submitting incomplete paperwork. Double-check that you have all the required forms, signatures, and supporting documents. Missing even a single item can result in significant delays.

- Ignoring Local Regulations: Each state and locality can have specific licensing requirements. Many applicants overlook local regulations, leading to confusion and complications. Always research the regulations that apply to your specific area.

- Procrastination: Waiting until the last minute to gather documents or submit your application can be detrimental. Start early to ensure you have ample time to address any issues that may arise.

- Misunderstanding Fees: Fees vary widely based on the type of business and location. Make sure you are aware of all associated costs to avoid surprises. Not budgeting for these expenses can derail your plans.

- Neglecting to Follow Up: After submitting your application, it’s crucial to follow up with the relevant authorities. Many applicants assume everything is in order without checking the status of their application, which can lead to unnecessary delays.

- Overlooking Renewals: Some licenses require renewal after a certain period. Failing to keep track of renewal deadlines can result in penalties or having to reapply from scratch. Set reminders well in advance!

Understanding and avoiding these common mistakes can save you time and frustration in your quest for a business license. By being thorough, proactive, and organized, you’ll be better positioned to successfully navigate the licensing process.

| Error Type | Impact | Solution |

|---|---|---|

| Incomplete Documentation | Delays in processing | Checklists and thorough reviews |

| Ignoring Local Regulations | Rejection or additional requirements | Research local laws before applying |

| Procrastination | Last-minute stress | Start early and set timelines |

| Misunderstanding Fees | Unforeseen costs | Detailed fee breakdowns |

| Neglecting to Follow Up | Application lost or stalled | Regular status checks |

| Overlooking Renewals | License expiration | Set reminders for renewal dates |

State-Specific Licensing Requirements You Should Know

When venturing into the world of business, it’s crucial to understand that licensing requirements vary significantly by state. Each state has its own regulations, so being informed can save you time, money, and the headache of compliance issues later on. Here’s what you need to keep in mind regarding state-specific licensing:

- Research Your State’s Requirements: Start with your state’s official website. Most state governments provide comprehensive guides detailing the licensing process.

- Determine Your Business Type: The nature of your business (e.g., retail, construction, healthcare) may dictate the specific licenses needed. Be clear on what you’re planning to do.

- Check Local Regulations: State licenses are just the beginning. Don’t forget to check local city or county requirements as well.

- Gather Necessary Documents: Most states require specific documentation, such as proof of identity, business formation documents, and potentially insurance certificates.

To give you a clearer picture, here’s a simple comparison of licensing requirements in a few different states:

| State | Business License Type | Estimated Processing Time |

|---|---|---|

| California | General Business License | 2-4 weeks |

| Texas | Assumed Name Certificate | 1-3 weeks |

| Florida | Business Tax Receipt | 1-2 weeks |

| New York | Business Certificate | 2-6 weeks |

Additionally, some states have specific licenses for particular industries, such as:

- Healthcare: Medical professionals often require state-specific healthcare licenses.

- Food Service: Restaurants or food trucks typically need health permits and food handler certifications.

- Construction: Contractors may need special licenses or bonds depending on the work they perform.

While the requirements might feel overwhelming, consider leveraging online resources and state-provided platforms for guidance. Many states offer online application systems, making the process smoother. Furthermore, consulting with a legal professional can provide clarity and ensure you’re on the right path.

remember that licenses need to be renewed periodically. Stay ahead of the game by marking your calendar for renewal dates and any continuing education requirements that may come with your specific license.

How to Maintain and Renew Your Business License

Maintaining and renewing your business license is vital for staying compliant with local regulations and ensuring the smooth operation of your business. Each state has its own requirements, so it’s important to familiarize yourself with the specific rules that apply to your location. Here’s a step-by-step guide to keep your business license in good standing.

Understand Your Renewal Timeline

Most business licenses need to be renewed annually or biannually. To avoid any lapses, mark your calendar with key dates. Here’s how to keep track:

- Check the expiration date: Most licenses have a clear expiration date that is provided at issuance.

- Set reminders: Use digital calendars or apps to remind you well in advance of the renewal date.

- Review local regulations: Regulations can change, so staying informed will help you anticipate any changes that could affect your renewal.

Gather Required Documentation

Renewing your business license typically involves submitting specific documentation. Here’s a list of common items you might need:

- Previous license: Keep a copy of your last business license for reference.

- Proof of business address: This can be a utility bill or a lease agreement.

- Identification: Personal identification of the business owner(s) may be required.

- Financial statements: In some cases, you may need to provide recent financial information.

Complete and Submit Renewal Application

After gathering your documentation, it’s time to fill out the renewal application. Make sure to:

- Follow instructions carefully: Each state may have different forms and submission guidelines.

- Double-check for accuracy: Errors can lead to delays or rejections, so review your application thoroughly.

- Submit on time: Aim to submit your renewal application well before the expiration date.

Pay the Renewal Fees

Most license renewals require the payment of fees. Here are some tips for managing this process:

- Know the fee structure: Fees can vary based on the business type and location, so check your local government’s website.

- Keep a record of payments: Store receipts and confirmation emails for your records.

- Consider electronic payment options: Many municipalities offer online payment to streamline the process.

Stay Informed About Compliance Changes

Regulations can change, affecting your license requirements. To stay compliant, consider the following:

- Subscribe to updates: Many local governments offer newsletters or alerts for business owners.

- Join local business associations: These groups often provide valuable insights and networking opportunities.

- Engage with consultants or legal advisors: If needed, professionals can help you navigate any complex changes.

Utilize a License Management System

Consider using a license management system to streamline the process. This can help you:

- Track all licenses: Keep an organized record of all your licenses and their renewal dates.

- Automate reminders: Set up alerts to notify you of upcoming renewals.

- Store documents securely: Ensure all your renewal documents are easily accessible and safe.

Seek Professional Help When Necessary

If you find the renewal process overwhelming or confusing, don’t hesitate to seek help. Consider:

- Consulting an attorney: A lawyer specializing in business law can provide guidance specific to your situation.

- Working with a business consultant: These professionals can offer insights and help with paperwork.

Tips for Fast-Tracking Your License Approval

When it comes to obtaining your business license, speed can be just as important as accuracy. Here are some practical strategies to help you fast-track your approval process:

- Research Requirements Thoroughly: Each state and locality has its own specific requirements. Make sure you have a clear understanding of what’s needed by visiting official websites or consulting local business offices.

- Prepare Your Documents: Gather all necessary paperwork in advance. Common documents include identification, proof of business address, and any industry-specific licenses. Consider creating a checklist to ensure you don’t miss anything.

- Use Online Resources: Take advantage of online applications and e-filing options when available. Many states offer streamlined online services that can save you time by reducing processing delays.

- Check for Expedited Services: Some jurisdictions offer expedited processing for a fee. If time is of the essence, inquire about this option to speed up your approval.

Additionally, don’t underestimate the power of strong communication:

- Reach Out to Local Authorities: Don’t hesitate to contact the local licensing office directly. They can provide insights and clarifications that may help avoid common pitfalls, ensuring you submit everything correctly the first time.

- Follow Up Regularly: After submission, be proactive. Regularly check the status of your application and follow up with the office if you haven’t received updates within their stated timeframes.

Another essential element is maintaining organization throughout the process:

- Track Deadlines: Use a calendar to monitor important deadlines, including application submissions and any follow-up actions you need to take.

- Stay Compliant: Familiarize yourself with ongoing compliance requirements post-approval. Staying ahead of future regulations can prevent delays in your business operations.

For a clearer perspective, consider this simple table to visualize the typical licensing process:

| Step | Description | Timeframe |

|---|---|---|

| Research | Understand local requirements | 1-2 days |

| Prepare Documents | Collect necessary paperwork | 2-5 days |

| Submit Application | Apply online or in-person | 1 day |

| Follow Up | Check application status | 1 week |

By implementing these strategies, you can significantly reduce the time it takes to get your business license. Being prepared, organized, and proactive will not only simplify the process for you but also allow you to focus on what truly matters—growing your business!

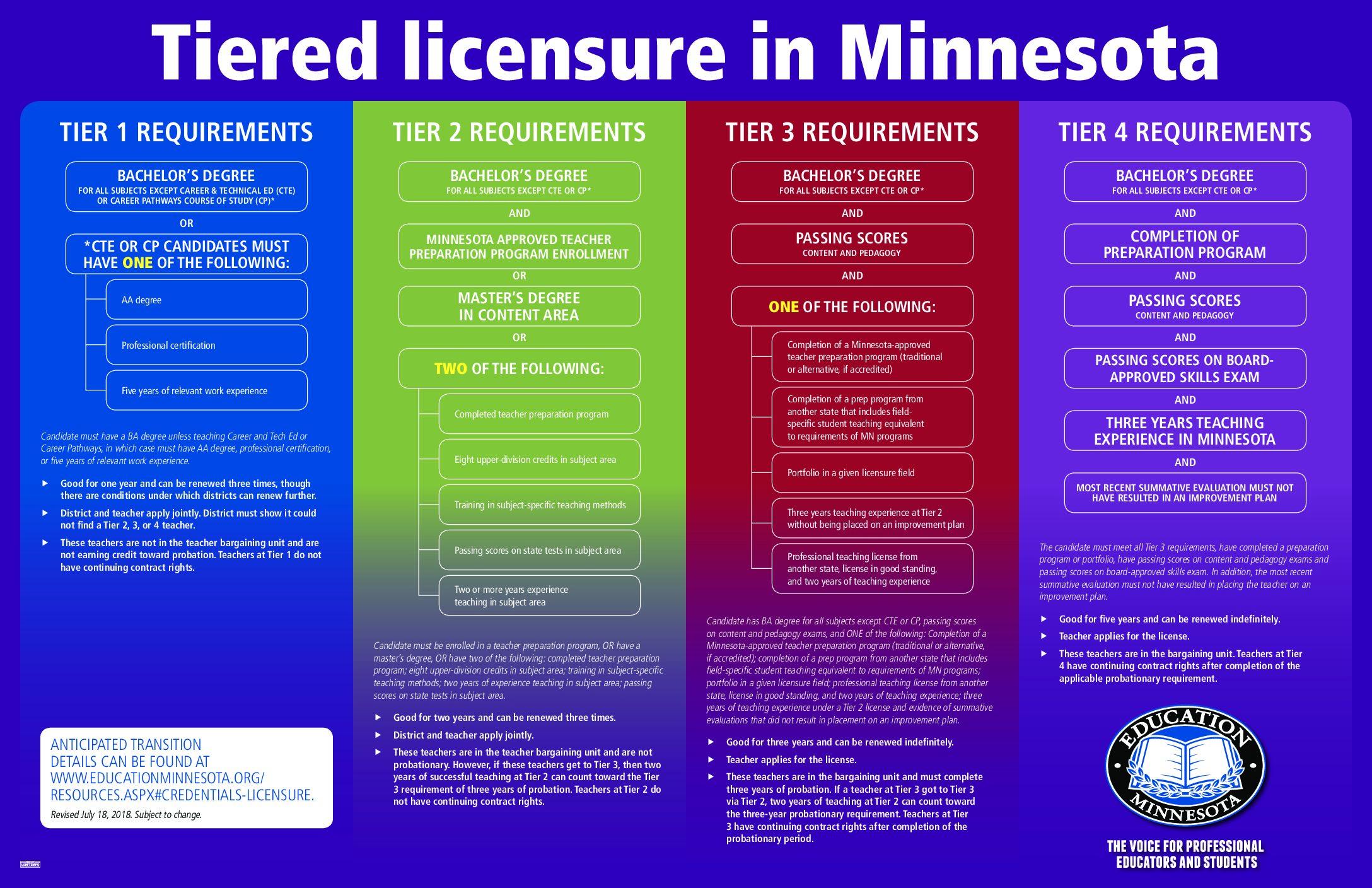

Understanding Fees and Costs Associated with Business Licenses

When embarking on the journey to secure a business license, it’s crucial to understand the various fees and costs that can arise. These fees can vary significantly based on your location, the type of business you’re operating, and the specific licenses you require. Knowing what to expect can help you budget effectively and avoid any surprises down the road.

First, let’s break down some common types of fees associated with business licenses:

- Application Fees: Most jurisdictions charge an upfront fee when you submit your application. This fee can range from a modest amount to several hundred dollars, depending on your state and the type of business.

- Renewal Fees: Business licenses often need to be renewed periodically, which means you’ll need to budget for renewal fees as well. These can be annual or biennial, and they typically mirror the initial application fee.

- Late Fees: Failing to renew your license on time can lead to additional late fees, which can add an unnecessary burden to your budget. Make sure to keep track of renewal dates!

- Inspection Fees: Depending on your business type, you may require inspections (such as health or safety inspections). These inspections can also come with their own set of fees.

- Additional Permits: Sometimes, a business license is just one part of the equation. You may need to secure additional permits that can incur extra costs.

Let’s take a closer look at how these fees can vary across different states:

| State | Application Fee | Renewal Fee |

|---|---|---|

| California | $70 – $100 | $50 – $75 |

| Texas | $300 | $300 (every 2 years) |

| Florida | $50 – $100 | $50 |

| New York | $100 - $200 | $100 – $200 |

It’s also important to note that some industries may have specific regulations that could lead to higher fees. For instance, businesses in food service or healthcare often face more stringent requirements and therefore higher costs. Always research the specific needs of your industry in your state to ensure you’re fully aware of what you might be charged.

Lastly, consider the hidden costs that might not be immediately obvious. These can include:

- Consultation Fees: Hiring a business consultant or attorney to help navigate licensing requirements can be a worthwhile investment, but be aware of those costs.

- Time Costs: The time spent gathering documents, filling out applications, and following up can add up. It’s an investment of your time that should be factored into your overall costs.

- Compliance Costs: Keeping up with ongoing compliance requirements can lead to additional expenses, such as training or further certifications.

Understanding the fees and costs associated with obtaining and maintaining a business license can save you time, money, and stress. By factoring these figures into your business plan, you’ll be much more prepared to launch your venture effectively.

Resources for Finding Local Licensing Information

Finding accurate and up-to-date information about business licensing can feel overwhelming, especially when navigating the myriad of regulations across different states and localities. However, there are several resources that can simplify your search. Here are some essential tools and platforms you can utilize:

- State Government Websites: Each state has its own official website where you can find comprehensive information about business licenses, permits, and regulations specific to your location. Look for sections dedicated to business services.

- Local Chamber of Commerce: Your local Chamber of Commerce is a treasure trove of information. They often provide resources, guides, and even personal assistance to help you navigate the licensing process.

- Small Business Administration (SBA): The SBA offers a variety of resources, including local assistance offices that can guide you through the licensing requirements. Their website also features a wealth of articles and tools for budding entrepreneurs.

- Online License Databases: Websites like BusinessLicenses.com allow you to search for licensing requirements by state and city, making it easier to find specific information tailored to your business type.

- Industry Associations: Many industries have their own associations that provide specific licensing information. Joining these organizations can also offer networking opportunities and additional resources.

To further assist you in your search, here’s a simple comparison table of resources based on accessibility and type of information provided:

| Resource | Type of Information | Accessibility |

|---|---|---|

| State Government Websites | Licensing and tax information | High (Online) |

| Local Chamber of Commerce | Local business regulations | Medium (In-person/Online) |

| Small Business Administration (SBA) | General business advice | High (Online) |

| Online License Databases | Specific licensing requirements | High (Online) |

| Industry Associations | Industry-specific regulations | Medium (Membership required) |

Don’t forget to explore social media platforms and online forums where local business owners share their experiences and insights on obtaining licenses. Websites like Reddit’s small business subreddit can be particularly helpful for real-world advice and tips.

Lastly, consider reaching out to a legal professional or a consultant specializing in business formation. They can provide tailored guidance and ensure that you meet all local requirements efficiently.

How to Handle License Denials and Appeals

Receiving a license denial can be disheartening, especially after investing time and resources into the application process. However, it’s essential to approach the situation strategically. The first step is to read the denial letter thoroughly. This document typically outlines the reasons for the denial, which can range from missing documentation to failure to meet specific criteria.

Once you understand the reasons behind the denial, you can take the following steps:

- Gather Documentation: Compile all relevant documents that support your case. This may include previous applications, correspondence with licensing authorities, and any supporting evidence that addresses the reasons for denial.

- Consult Regulations: Review the local business regulations and requirements. Make sure you fully understand what is expected and identify any areas where your application may have fallen short.

- Seek Professional Guidance: If you’re feeling overwhelmed, consider consulting with a business attorney or a licensing expert who can provide insights and advice tailored to your situation.

After you’ve prepared your appeal, the next step is to formally submit it. Ensure your appeal letter is clear and concise, directly addressing each reason for the denial. Here’s a simple structure you can follow:

| Section | Description |

|---|---|

| Introduction | State your purpose and briefly mention the denial. |

| Addressing Denial Reasons | Respond to each reason given in the denial letter with supporting evidence. |

| Conclusion | Express your hope for reconsideration and include contact information. |

After submitting your appeal, be patient but proactive. It’s important to follow up with the licensing authority to confirm they’ve received your appeal and to inquire about the timeline for a decision. Keep a record of all communications, as this may be helpful in case of further issues.

In addition to your formal appeal, consider enhancing your application for future submissions. This might involve additional training, obtaining further certifications, or improving your business plan. Demonstrating a commitment to compliance can make a significant difference in how your application is viewed.

remember that each state may have different procedures and timelines for license appeals. Research local laws and regulations to ensure you are following the correct process. If you find that your appeal is denied again, you still have options, such as seeking further legal recourse or investigating alternative licensing pathways.

Best Practices for Staying Compliant with Licensing Laws

Staying compliant with licensing laws is crucial for any business owner. Ignoring these regulations can lead to hefty fines, legal issues, and even closure of your business. Here are some best practices to ensure you remain compliant:

- Understand the Requirements: Each state has different licensing requirements based on the type of business. Research your specific industry and locality thoroughly.

- Regularly Review Regulations: Laws can change. Make it a habit to stay informed about local and state regulations related to your business.

- Keep Documentation Organized: Collect and maintain all necessary documents, such as your business license, permits, and any correspondence with licensing authorities.

- Set Reminders for Renewals: Licensing often comes with expiration dates. Use calendar reminders to keep track of when to renew your licenses and permits.

- Consult with Professionals: Don’t hesitate to reach out to a legal advisor or a compliance specialist who can provide clarity on complicated regulations.

- Join Industry Associations: These organizations often provide resources and updates about compliance and licensing issues relevant to your sector.

Moreover, implementing a compliance checklist can significantly reduce the chances of overlooking important requirements. Consider creating a table that lists all necessary licenses, their renewal dates, and any associated fees:

| License Type | Renewal Date | Fee |

|---|---|---|

| Business License | Annual | $100 |

| Health Permit | Biannual | $75 |

| Sales Tax Permit | Every 2 Years | $50 |

In addition to these practices, it’s essential to foster a culture of compliance within your team. Educate your staff on licensing laws relevant to their roles and encourage them to report any concerns regarding compliance. This proactive approach can mitigate risks and enhance your business’s overall integrity.

Lastly, consider leveraging technology to assist with compliance. There are various software solutions available that can help track licensing requirements, deadlines, and changes in regulations, ensuring you never miss a beat.

Conclusion: Your Path to Successful Business Licensing

Embarking on the journey of securing a business license can sometimes feel overwhelming, but understanding the steps involved can simplify the process and set you up for success. A well-planned approach not only streamlines your efforts but also enhances your credibility in the eyes of customers and regulatory bodies alike. Here’s how you can pave your way to effective business licensing.

Understand Your Requirements: Each state has its own regulations regarding business licenses. It’s crucial to research the specific requirements for your location and industry. Consider the following:

- Type of business (e.g., LLC, corporation, sole proprietorship)

- Industry-specific permits (e.g., health permits, construction permits)

- Local zoning laws

- Federal licensing requirements, if applicable

Gather Necessary Documentation: Once you’ve identified what’s required, compile all necessary documentation before submitting your application. Common documents include:

- Proof of identity (e.g., driver’s license, passport)

- Business plan

- Financial statements

- Tax identification number

Choose the Right Licensing Authority: Your local government, state agency, or federal body may issue business licenses. Make sure to apply to the correct authority to avoid delays. This could involve:

- Visiting city or county offices

- Checking online resources for state agencies

- Consulting with industry associations

Be Prepared for Fees and Timeframes: Licensing often comes with associated costs and processing times. Being financially prepared can help you avoid unexpected hurdles. Here’s a quick overview:

| Type of License | Typical Fees | Processing Time |

|---|---|---|

| General Business License | $50 – $400 | 2 – 6 weeks |

| Professional License | $100 – $900 | 4 – 12 weeks |

| Special Permits (e.g., Health) | $100 - $1,000 | 6 – 8 weeks |

Stay Informed and Renew: After obtaining your license, remember that it requires periodic renewal. Keep track of renewal dates and any changes in local laws that may affect your business. Setting reminders can help you stay compliant and avoid penalties.

Leverage Resources: Utilize available resources such as local business development centers, online forums, and mentoring programs. Engaging with fellow entrepreneurs can provide valuable insights and support as you navigate the licensing landscape.

successful business licensing is about being informed, organized, and proactive. By following the steps outlined above and remaining committed to compliance, you can focus on what truly matters—growing your business and serving your customers effectively.

Frequently Asked Questions (FAQ)

Q: What is a business license, and why do I need one?

A: A business license is essentially your ticket to operate legally within your city, county, or state. It proves to the local government that you’re following the rules and regulations pertaining to your business. Without it, you could face hefty fines or even shutdowns, which is definitely not how you want to start your entrepreneurial journey!

Q: How do I know if I need a business license?

A: Great question! The need for a business license largely depends on your location and the type of business you plan to run. Most businesses require some form of licensing, especially those in industries like food service, healthcare, or construction. It’s always a good idea to check with your local government or a business advisor to clarify your specific requirements.

Q: What steps should I take to get a business license?

A: The process can vary by state, but generally, here’s the rundown:

- Choose Your Business Structure: Decide if you’re going to be a sole proprietor, LLC, corporation, etc.

- Select a Business Name: Make sure it’s unique and compliant with state regulations.

- Register Your Business: Depending on your structure, you may need to register your business with the state.

- Apply for Required Licenses and Permits: This is where you’ll gather specific licenses based on your industry and location.

- Pay the Fees: Be prepared for some costs, as licensing fees can vary significantly.

Q: Are there any tips specific to certain states that I should be aware of?

A: Absolutely! Every state has its own set of rules. For example, California requires additional permits for businesses in specific industries, while Texas has a more straightforward application process. Research your state’s unique requirements, and don’t hesitate to consult local business resources or forums for insider tips.

Q: How long does it usually take to receive a business license?

A: This can vary widely, depending on your location and the type of business. Some licenses can be issued in just a few days, while others may take several weeks or even months. To expedite the process, make sure you have all your paperwork in order and submit your application accurately the first time around!

Q: What if I run a home-based business? Do I still need a license?

A: Yes, many home-based businesses still require licenses. Local zoning laws often apply, and you may need a home occupation permit. It’s crucial to check with your local government to ensure compliance, as operating without the necessary licenses can lead to fines or being forced to shut down.

Q: Are there any common mistakes to avoid when applying for a business license?

A: You bet! Here are a few pitfalls to steer clear of:

- Incomplete Applications: Make sure all information is accurate and complete to avoid delays.

- Ignoring Local Regulations: Don’t just focus on state requirements; local rules can be equally important.

- Underestimating Time and Costs: Plan for both time and expenses, as these can add up quickly.

Q: Any final tips for someone looking to obtain a business license?

A: Absolutely! Stay organized, do your research, and don’t hesitate to reach out to local business development centers or legal advisors if you have questions. Networking with other entrepreneurs in your area can also provide invaluable insights. Remember, obtaining your business license is a significant first step in making your dream a reality—so don’t rush it, but don’t let it hold you back either!

In Summary

And there you have it—your comprehensive guide to obtaining a business license! Armed with the information and tips provided, you’re well on your way to turning your entrepreneurial dreams into reality. Remember, while the process may seem daunting at first, breaking it down step by step makes it manageable.

Before you dive in, make sure you take the time to research your specific state’s requirements, as they can vary widely. Don’t hesitate to reach out to local business resources or even consult with professionals if you find yourself in a bind. After all, a little guidance can go a long way!

Investing the effort to get your business license not only keeps you compliant but also sets a solid foundation for your venture. Whether you’re starting a trendy café, launching an online store, or offering freelance services, having that license can boost your credibility and help you attract customers.

So, what are you waiting for? Take the plunge, follow the steps outlined in this guide, and get that business license! Your entrepreneurial journey is just around the corner, and the first step starts with you. Good luck, and here’s to your future success!