Introduction:

In today’s fast-paced digital marketplace, choosing the right payment gateway can make or break your online business. With the landscape constantly evolving, it’s crucial to stay informed about the top providers that will dominate the industry in 2025. Whether you’re a budding entrepreneur, a seasoned eCommerce veteran, or someone simply curious about the ins and outs of online transactions, understanding these gateways is key to enhancing your customer experience and maximizing your profits.

In this article, we’ll dive deep into the world of payment gateways, comparing the leading players in the market. We’ll break down their features, fees, and functionalities, all while keeping your unique business needs in mind. Join us as we analyze the top providers for 2025, helping you make a well-informed decision that could open doors to new opportunities and streamlined transactions. Ready to unlock the potential of your online business? Let’s get started!

Understanding the Basics of Payment Gateways for Your Business Needs

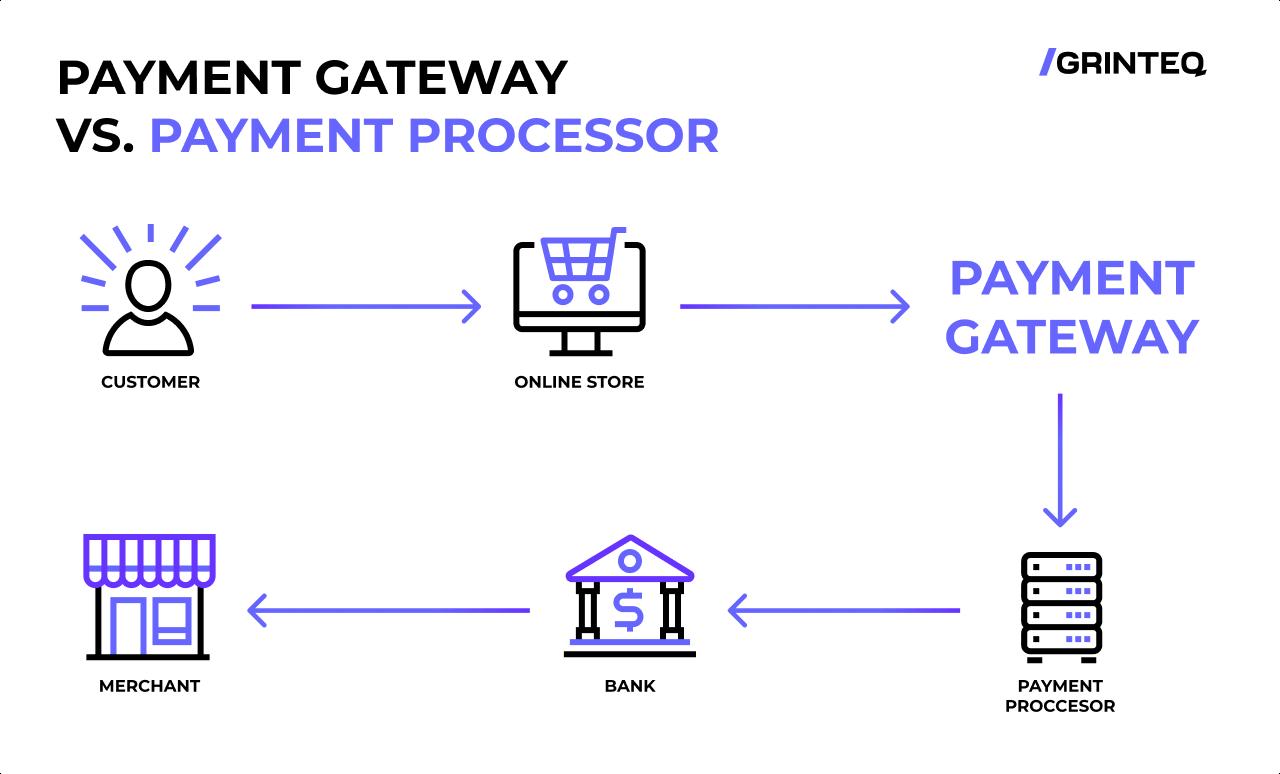

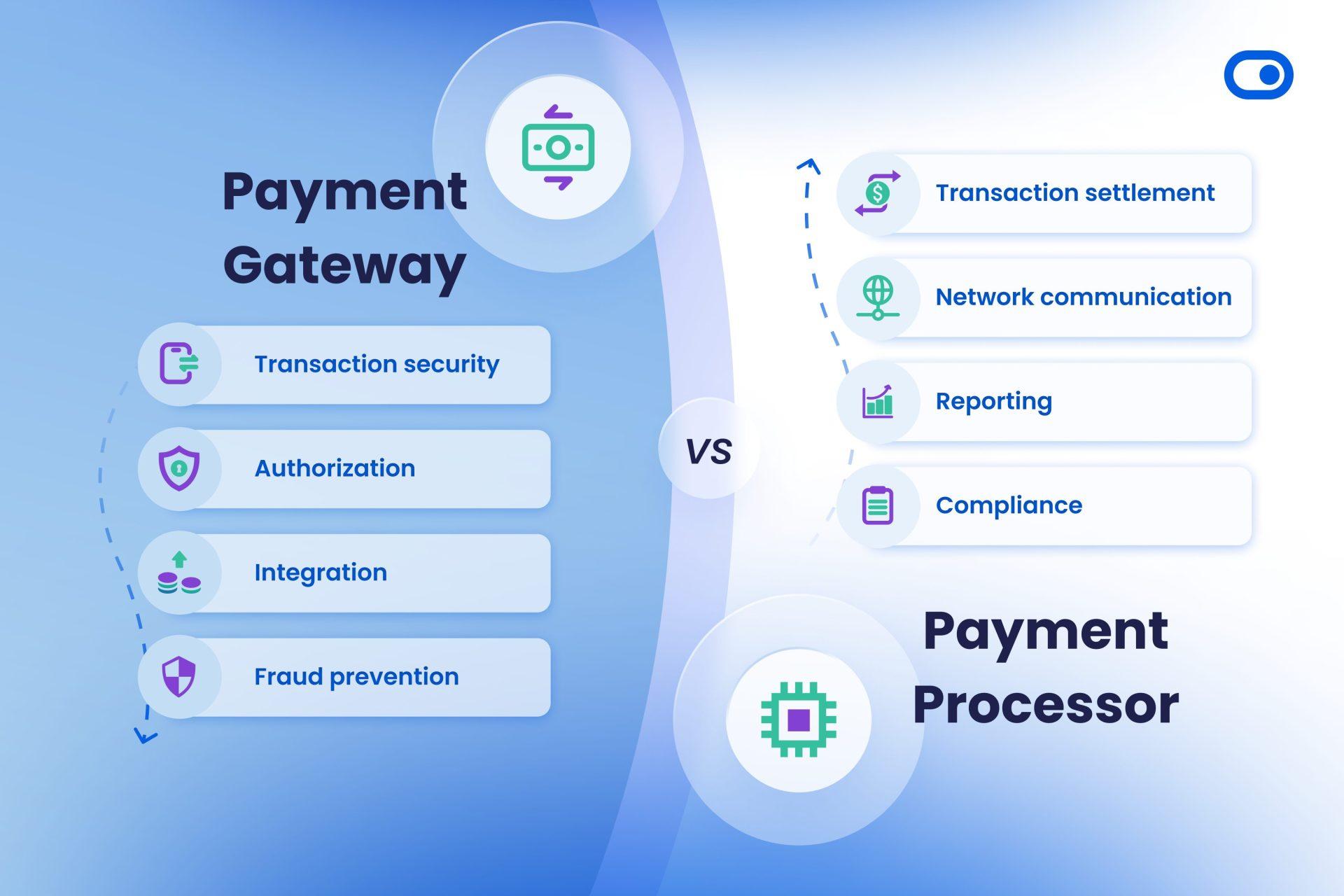

When navigating the world of online payments, understanding how a payment gateway works is essential for your business’s financial health and customer satisfaction. A payment gateway is essentially the technology that captures and transfers payment data from the customer to the merchant and then to the bank. It’s what enables your customers to seamlessly make transactions on your website, and picking the right provider can make all the difference.

Here are some key elements to consider when evaluating payment gateways:

- Security: Security should be your top priority. Look for gateways that provide robust encryption and fraud prevention measures. Ensure they comply with PCI DSS standards to protect sensitive customer data.

- Integration: The best payment gateways easily integrate with your existing e-commerce platform or website. Ensure the gateway can be set up without technical headaches or significant additional costs.

- Transaction Fees: Different providers have varying fee structures. Some charge a flat fee per transaction, while others have percentage-based fees. Analyze these costs to understand how they will affect your bottom line.

- Customer Support: Reliable customer support can save you a lot of frustration. Opt for providers known for their responsive and knowledgeable support teams to assist you when issues arise.

- Payment Options: The more payment methods you can offer, the better. Look for gateways that support credit cards, digital wallets, and local payment methods to cater to a broader audience.

| Payment Gateway | Transaction Fees | Integration Ease | Security Features |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | Easy | SSL Encryption, Fraud Protection |

| Stripe | 2.9% + $0.30 | Very Easy | Tokenization, PCI Compliance |

| Square | 2.6% + $0.10 | Simple | End-to-End Encryption |

| Authorize.Net | $0.10 per transaction + monthly fee | Moderate | Fraud Detection Suite |

Another aspect to consider is the user experience. A payment gateway should provide a smooth and intuitive checkout process. If customers face hurdles or delays, they’re likely to abandon their carts. Choose a gateway that allows for a quick and easy payment process, ideally with options for guest checkout.

In addition, pay attention to international capabilities. If you plan to sell globally, ensure your payment gateway can handle multiple currencies and offers support for international transactions. This can expand your customer base and increase sales opportunities.

always keep an eye on emerging trends in payment technology. As we move forward, advancements such as cryptocurrency payments and enhanced mobile payment options can provide your business with a competitive edge. Staying ahead of these trends will help you adapt and thrive in an ever-evolving digital economy.

Key Features to Look for When Choosing a Payment Gateway

When selecting a payment gateway for your business, several essential features can significantly impact your operations, customer satisfaction, and overall success. Here are some key aspects to consider:

- Security: The safety of your transactions should be a top priority. Look for gateways that comply with PCI DSS standards and offer fraud detection tools to protect your customers’ sensitive information.

- Integration: Ensure the payment gateway can easily integrate with your existing systems, such as e-commerce platforms, CRM solutions, and accounting software. This streamlines your workflow and enhances operational efficiency.

- Payment Options: A good gateway should support a wide range of payment methods, including credit/debit cards, digital wallets, bank transfers, and even cryptocurrency. This variety can cater to your customers’ preferences, leading to better conversion rates.

- Fees and Pricing: Be aware of transaction fees, monthly fees, and any hidden costs. Understanding the fee structure will help you choose a provider that aligns with your budget and won’t eat into your profits.

- Customer Support: Reliable customer service can save you from headaches down the line. Choose a gateway that offers 24/7 support through various channels, such as phone, email, or live chat. Quick resolution of issues is crucial for maintaining customer trust.

- User Experience: The checkout process should be smooth and intuitive. A complicated payment experience can lead to cart abandonment. Look for gateways that prioritize a seamless user interface for both you and your customers.

- Reporting and Analytics: Choose a payment gateway that provides comprehensive reporting tools to track sales, monitor transaction trends, and analyze customer behavior. This data can be invaluable for making informed business decisions.

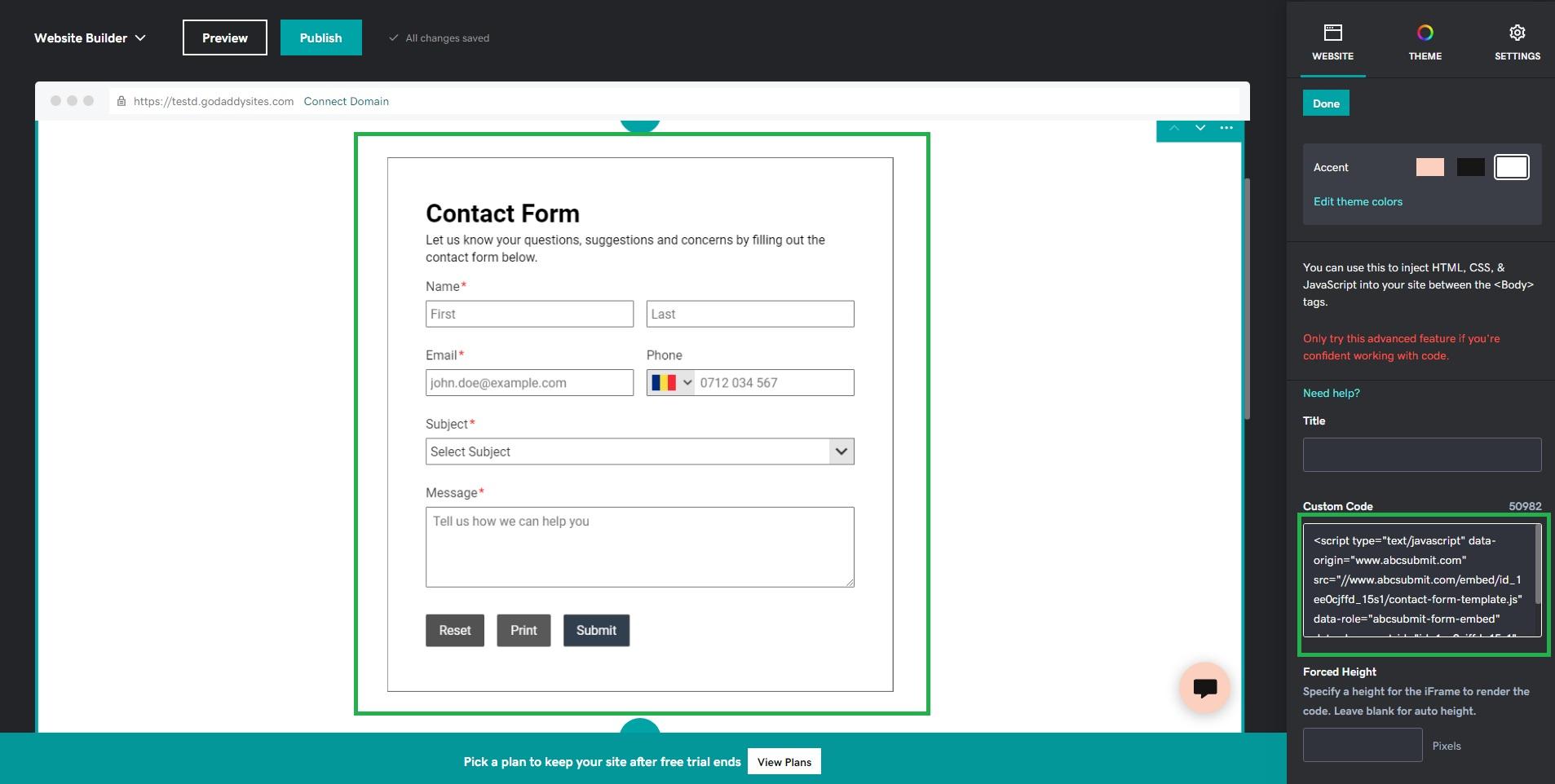

To further guide your decision, consider the following table summarizing some top payment gateway providers and their standout features:

| Provider | Key Features | Pricing Structure |

|---|---|---|

| Stripe | Custom integrations, recurring payments | 2.9% + $0.30 per transaction |

| PayPal | Global reach, trusted brand | 2.9% + $0.30 per transaction |

| Square | Point of sale integration, inventory management | 2.6% + $0.10 per transaction |

| Braintree | Mobile optimization, extensive payment options | 2.9% + $0.30 per transaction |

Taking all these elements into account can help you choose a payment gateway that not only meets your immediate needs but also supports your business’s growth in the long term. Analyze each feature carefully and consider what is most important to your operations and customer base.

A Deep Dive into Security Features: Keeping Your Transactions Safe

In today’s digital landscape, security is not just a feature; it’s a necessity. With online transactions soaring, the risks associated with payment processing have simultaneously escalated. Choosing a payment gateway that prioritizes security can make a significant difference not only in protecting sensitive data but also in enhancing customer trust. Here’s a breakdown of the key security features you should consider when evaluating different payment providers.

Encryption Technologies

One of the most critical aspects of any payment gateway is its use of encryption. Strong encryption ensures that sensitive information, such as credit card numbers and personal identification details, are encoded during transmission, making it nearly impossible for hackers to decipher. Look for gateways that employ:

- SSL (Secure Socket Layer): Provides a secure connection between the customer’s browser and the payment processor.

- TLS (Transport Layer Security): The latest protocol enhancing data security over the internet.

Tokenization

Tokenization is a game-changer in payment security. Instead of storing actual card details, payment gateways use a unique token to represent that data. This means that even if a breach occurs, the stolen tokens would be useless to cybercriminals. Consider gateways that emphasize this technology, as it minimizes the risks associated with data breaches.

Fraud Detection Tools

Advanced fraud detection tools play a pivotal role in safeguarding transactions. These tools can analyze patterns in transaction data to identify suspicious activity. Look for features like:

- Real-time monitoring: Identifies and alerts you to potentially fraudulent transactions as they happen.

- AI and machine learning: Adapts and improves detection rates over time by learning from past transactions.

Compliance with Standards

Your chosen payment gateway must comply with industry standards and regulations, such as PCI DSS (Payment Card Industry Data Security Standard). This framework outlines the necessary security measures to protect card information. Non-compliance can result in hefty fines and increased liability. Always verify that your provider maintains this certification.

Multi-Factor Authentication (MFA)

MFA adds an additional layer of security by requiring two or more verification factors to access an account. This can include a combination of something you know (password), something you have (a mobile device), or something you are (biometric data). This feature significantly reduces the risk of unauthorized access.

Customer Support and Incident Response

Even with the best security measures in place, issues can arise. A reliable payment gateway should offer robust customer support and a clear incident response plan. Quick response times can mitigate damages significantly, so look for providers that offer:

- 24/7 customer support: Immediate assistance can be crucial during a security incident.

- Detailed incident reports: Helps you understand breaches and improve your security posture.

Comparative Security Feature Table

| Payment Gateway | Encryption | Tokenization | Fraud Detection | Compliance |

|---|---|---|---|---|

| Gateway A | SSL/TLS | Yes | AI-based | PCI DSS |

| Gateway B | SSL | No | Real-time alerts | PCI DSS |

| Gateway C | SSL/TLS | Yes | Pattern recognition | PCI DSS |

Choosing the right payment gateway is critical for not only ensuring secure transactions but also for fostering customer confidence in your business. Prioritize these security features to create a safe and trustworthy environment for your customers.

Cost Breakdown: What You Really Pay for Payment Processing

Understanding the true costs of payment processing can sometimes feel like navigating a labyrinth. Many businesses start with a simple question: how much will it really cost me to accept payments? However, the answer isn’t always straightforward, as various factors contribute to the overall expense. Here’s a closer look at what you might encounter.

- Transaction Fees: Most providers charge a flat fee or a percentage of each transaction. Depending on your sales volume, this could add up significantly over time. Expect fees to range from 1.5% to 3.5% for card transactions.

- Monthly Fees: Some gateways impose a monthly subscription or service fee, which can vary based on the level of service offered. These fees may range from $0 to $50+, depending on the provider and features included.

- Chargeback Fees: When customers dispute charges, you may incur chargeback fees, which can be anywhere from $15 to $100 per incident. It’s crucial to keep these potential costs in mind.

- Setup Fees: Some providers will charge an initial setup fee. These can range from $0 to $500, though many modern gateways are moving towards waiving this fee to attract businesses.

Beyond these direct costs, it’s essential to consider hidden fees that can surface throughout your dealings with a payment processor. These might include fees for:

- Cross-border transactions: If your business sells internationally, expect additional charges for currency conversion and international processing.

- PCI Compliance: Maintaining compliance with the Payment Card Industry standards may require additional services, which can have their own costs.

- Upgrades and enhanced features: As your business grows, you might need advanced features such as fraud protection or analytics tools, which can come with increased fees.

To give you a clearer picture of costs across various providers, here’s a simple comparison table:

| Provider | Transaction Fee | Monthly Fee | Chargeback Fee |

|---|---|---|---|

| Provider A | 2.9% + $0.30 | $0 | $20 |

| Provider B | 2.5% + $0.25 | $10 | $15 |

| Provider C | 3.1% + $0.45 | $20 | $30 |

| Provider D | 1.9% + $0.20 | $0 | $25 |

the total expense of payment processing encompasses much more than just transaction fees. Keep an eye out for those additional costs and always read the fine print. By doing so, you can select a payment processor that aligns with your budget and business needs. The right choice can help streamline your operations and improve your bottom line, so it’s worth taking the time to evaluate all aspects of each provider’s offerings.

User Experience Matters: How to Choose a Gateway That Your Customers Will Love

When it comes to selecting a payment gateway, the user experience is paramount. It’s not just about processing transactions; it’s about creating a seamless journey for your customers. A well-designed payment gateway can enhance trust, boost sales, and increase customer retention. Here’s what to consider to ensure you choose a gateway that your customers will love:

- Simplicity and Intuitiveness: Your payment process should be straightforward. Look for gateways that offer a clean, user-friendly interface. Complicated forms or unnecessary steps can frustrate customers, leading to cart abandonment.

- Mobile Optimization: With more consumers shopping on mobile devices, choose a gateway that is fully optimized for mobile. Test the checkout process on different devices to ensure a smooth experience.

- Speed and Efficiency: Customers value efficiency. A payment gateway that processes transactions quickly can significantly reduce drop-off rates. Ensure the gateway you choose minimizes loading times and keeps the checkout flow fast.

- Variety of Payment Options: People have different preferences when it comes to payment methods. A good gateway should support a range of options, including credit cards, digital wallets, and even cryptocurrencies. This flexibility can cater to a broader audience.

- Security Features: In an era of increasing cyber threats, security is a non-negotiable feature. Look for gateways that offer robust security measures, such as two-factor authentication and PCI compliance, to protect your customers’ sensitive information.

Let’s take a look at a comparison of some top payment gateways for 2025, focusing on their user experience features:

| Payment Gateway | Mobile Friendly | Payment Options | Speed | Security |

|---|---|---|---|---|

| Gateway A | ✔️ | Credit, PayPal, Crypto | Very Fast | High |

| Gateway B | ✔️ | Credit, Debit, Apple Pay | Fast | Very High |

| Gateway C | ❌ | Credit, Google Pay | Moderate | High |

| Gateway D | ✔️ | All Major Cards | Very Fast | Very High |

Each gateway has its strengths, but remember, the ultimate goal is to enhance the customer experience. Testing the user interface and gathering feedback from real users can provide invaluable insights. Consider conducting A/B tests to see which payment gateway performs best with your audience.

Additionally, keep an eye out for customer support options. A gateway that offers 24/7 support can help resolve issues swiftly, minimizing disruptions for your customers. This added layer of service can be a game changer, especially during peak shopping seasons.

Ultimately, a great payment gateway is one that aligns with your business goals while prioritizing customer satisfaction. By focusing on user experience, you can not only optimize transactions but also build lasting relationships with your customers.

Integration Ease: Finding a Payment Gateway That Fits Your Tech Stack

Choosing the right payment gateway is crucial for any business, especially when considering how seamlessly it integrates with your existing tech stack. The last thing you want is a payment solution that disrupts your operations or complicates your processes. Here’s what to keep in mind as you navigate through top providers.

First, assess your current systems. Does your e-commerce platform or accounting software have specific requirements? A great payment gateway should fit like a glove within your existing infrastructure. Make sure to look for solutions that offer:

- API Flexibility: A robust API allows for custom integrations, enabling you to tailor the payment experience to your needs.

- Pre-Built Integrations: Providers that offer plugins for popular platforms like WooCommerce, Shopify, and Magento can save you time and headaches.

- Mobile Compatibility: With mobile shopping on the rise, ensure that the gateway supports mobile transactions effortlessly.

Another factor to consider is the user experience for both you and your customers. An intuitive interface can significantly reduce friction during the checkout process. Be on the lookout for:

- Streamlined Checkout: Options for guest checkout can minimize cart abandonment rates.

- Customization: The ability to brand the checkout page can enhance customer trust and loyalty.

- Multi-Currency Support: If you have an international customer base, this feature is invaluable.

Security features must also be a priority. The ideal gateway will not only protect your business but also instill confidence in your customers. Look for:

- PCI Compliance: Ensure that the provider adheres to Payment Card Industry Data Security Standards.

- Fraud Detection Tools: Advanced algorithms can help identify suspicious transactions before they become an issue.

- Encryption Protocols: Strong encryption keeps sensitive data safe during transactions.

To help you visualize the differences between gateways, consider this brief comparison table:

| Provider | Integration Type | Mobile Friendly | Security Features |

|---|---|---|---|

| PayPal | API & Plugins | ✔️ | PCI DSS, Fraud Monitoring |

| Stripe | API | ✔️ | PCI DSS, Two-Factor Authentication |

| Square | Plugins | ✔️ | PCI DSS, End-to-End Encryption |

don’t forget to evaluate cost structures and transaction fees. Some payment gateways charge monthly fees, while others may only take a percentage from each transaction. Aligning this with your business model can make a significant impact on your bottom line.

find a payment gateway that not only meets your technical requirements but also enhances your customer’s experience. With the right choice, you’ll have one less thing to worry about as you focus on growing your business in 2025 and beyond.

Top Payment Gateway Providers Reviewed: Who Comes Out on Top

As the eCommerce landscape continues to evolve, choosing the right payment gateway can significantly impact your business’s success. With a myriad of options available, identifying the best provider for your specific needs is essential. Let’s dive into a few of the top contenders in 2025 and see how they stack up against each other.

PayPal

PayPal remains a household name in digital payments. Known for its user-friendly interface and wide acceptance, it’s ideal for small to medium-sized businesses. Key features of PayPal include:

- Instant transactions

- Global reach with 25 currencies supported

- Robust security measures including fraud detection

However, be prepared for transaction fees that can add up, especially if you process a large volume of sales.

Stripe

Stripe has gained immense popularity among developers for its customizable API and seamless integration with various platforms. Here’s what makes Stripe stand out:

- Flexible billing options

- Support for multiple payment methods including cryptocurrencies

- Advanced analytics and reporting tools

While its features are extensive, it may require more technical knowledge to set up effectively compared to other providers.

Square

Square is another strong player, especially favored by brick-and-mortar businesses looking to expand online. Its standout features include:

- Integrated point-of-sale (POS) solutions

- No monthly fees for basic services

- Easy inventory management tools

However, businesses with high transaction volumes should be cautious of Square’s transaction fees, which can be higher than some competitors.

Authorize.Net

Authorize.Net has been around for over two decades and is known for its reliability and customer support. Here’s why it remains a key player:

- Comprehensive fraud detection tools

- Option for recurring billing

- Support for invoicing

It does come with a monthly gateway fee, but many businesses find the peace of mind worth the cost.

Comparative Overview

| Provider | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 | Instant transactions, global reach |

| Stripe | 2.9% + $0.30 | Custom API, cryptocurrency support |

| Square | 2.6% + $0.10 | POS integration, no monthly fees |

| Authorize.Net | 2.9% + $0.30 + $25/month | Fraud detection, recurring billing |

the right payment gateway largely depends on your business model and specific needs. Whether you prioritize low fees, ease of integration, or comprehensive features, understanding what each provider brings to the table will empower you to make an informed decision that supports your growth in 2025 and beyond.

Mobile Payment Solutions: Catering to the On-the-Go Customer

In an era where convenience is king, mobile payment solutions have become a cornerstone for businesses aiming to meet the needs of customers on the go. As consumers increasingly rely on their smartphones for everyday transactions, integrating a seamless payment experience is no longer optional—it’s essential. By adopting the right mobile payment gateway, businesses can enhance customer satisfaction and drive sales like never before.

Why Mobile Payments Matter

As mobile payments continue to rise in popularity, understanding their significance is vital:

- Convenience: Customers appreciate the ability to make quick transactions without needing cash or cards.

- Speed: Faster checkouts lead to less waiting time, improving the overall shopping experience.

- Security: Modern mobile payment solutions employ robust encryption techniques, making transactions safer.

- Integration: Most mobile payment gateways easily integrate with existing e-commerce platforms.

Key Features to Look For

When selecting a mobile payment solution, focus on features that enhance usability and security:

- Multiple Payment Options: Ensure the gateway supports various payment methods, including credit cards, digital wallets, and cryptocurrencies.

- Mobile Optimization: The gateway should offer a mobile-friendly interface, facilitating smooth transactions on smartphones.

- Real-Time Analytics: Monitor sales data and customer behavior to tailor marketing strategies effectively.

- Customer Support: Reliable customer support is crucial for troubleshooting any issues that may arise.

Comparing Top Providers

To help you navigate the landscape of mobile payment solutions, here’s a quick comparison of some leading providers for 2025:

| Provider | Key Features | Fees | Best For |

|---|---|---|---|

| Stripe | Customizable API, Multi-currency support | 2.9% + $0.30 per transaction | Startups & Developers |

| Square | POS integration, Instant transfers | 2.6% + $0.10 per transaction | Small Businesses |

| PayPal | Wide recognition, Pay Later options | 2.9% + $0.30 per transaction | Global Reach |

| Adyen | Unified commerce, Advanced fraud protection | Custom pricing | Large Enterprises |

Adopting a mobile payment solution not only caters to the evolving preferences of customers but also positions your business as a modern, forward-thinking entity. As we move toward 2025, ensuring an efficient payment process should be at the forefront of your business strategy, ready to engage with tech-savvy consumers who demand speed and security in their transactions.

International Payments: How to Choose a Gateway for Global Sales

Choosing the right payment gateway for international sales is crucial for maximizing your online business potential. With a plethora of options available, understanding your needs and the features offered by each provider is essential. Here are some key factors to consider when evaluating payment gateways for global transactions:

- Currency Support: Ensure the gateway supports multiple currencies, allowing customers to pay in their local currency. This not only enhances user experience but can improve conversion rates.

- Transaction Fees: Take note of the transaction fees and any additional charges for international payments. Some gateways offer flat rates, while others may charge a percentage based on transaction volumes.

- Payment Methods: Look for gateways that offer various payment options, including credit/debit cards, e-wallets, and localized payment methods that are popular in specific regions.

- Security Features: Prioritize gateways with robust security measures such as PCI compliance, fraud detection, and encryption protocols to protect sensitive customer data.

- Integration Capabilities: Ensure the gateway integrates seamlessly with your existing e-commerce platform and other business tools, making it easy to manage transactions.

Another critical aspect to consider is the level of customer support offered by the payment gateway. A responsive and knowledgeable support team can help resolve issues quickly, which is vital for maintaining customer trust and satisfaction. Look for providers that offer:

- 24/7 customer support

- Multilingual support options

- Extensive documentation and resources for troubleshooting

It’s also wise to evaluate the gateway’s reputation and reliability. Look for testimonials, reviews, and case studies from other businesses in your industry. A gateway with a solid track record can save you from potential complications down the road.

| Provider | Currency Support | Transaction Fees | Customer Support |

|---|---|---|---|

| Provider A | 150+ currencies | 2.9% + $0.30 | 24/7, multilingual |

| Provider B | 100+ currencies | 3.5% + $0.25 | Business hours only |

| Provider C | 200+ currencies | 2.7% + $0.20 | 24/7 support |

consider the scalability of the payment gateway. As your business grows, you’ll want a solution that can adapt to increasing transaction volumes and evolving needs. Opt for a provider that can handle a wide range of sales levels and offers tools to help analyze and optimize your payment processes.

By focusing on these essential factors, you can make a well-informed decision that aligns with your business goals and enhances your customers’ shopping experience. Taking the time to research and choose the right payment gateway can lead to smoother transactions, greater customer satisfaction, and ultimately, increased sales in the global marketplace.

Customer Support: Why It Matters and Which Providers Excel

In the fast-paced world of online transactions, customer support is not just an add-on; it’s a fundamental pillar that can make or break a payment gateway experience. When businesses and their customers face issues—be it payment failures, refunds, or compatibility concerns—having robust customer support can turn a frustrating situation into a smooth resolution. The significance of excellent customer support cannot be understated, as it fosters trust, enhances user experience, and ultimately drives customer loyalty.

Why is Customer Support Crucial?

- Problem Resolution: Quick and effective support can resolve issues in real-time, minimizing transaction downtime.

- Building Trust: Reliable assistance reassures customers that their transactions are safe and well-managed.

- Improving User Experience: A seamless support experience can enhance the overall satisfaction of both merchants and customers.

- Competitive Edge: Exceptional customer support can differentiate a payment gateway in a crowded market.

When considering different payment gateway providers, it’s essential to evaluate their customer support offerings. Are they available 24/7? Do they provide multiple channels for assistance, such as live chat, email, and phone support? The best providers understand that support is not just about answering questions; it’s about proactively helping customers navigate challenges.

Top Payment Gateway Providers and Their Support Features

| Provider | Support Channels | Availability | Response Time |

|---|---|---|---|

| Stripe | Live Chat, Email, Phone | 24/7 | Within 1 hour |

| PayPal | Live Chat, Email, Phone | 24/7 | Within 2 hours |

| Square | Email, Phone | Mon-Fri | Within 2-3 hours |

| Authorize.Net | Email, Phone | 24/7 | Within 1 hour |

It’s clear from this comparison that providers like Stripe and Authorize.Net stand out for their comprehensive customer support structures. Having the option for live chat means that urgent issues can be addressed almost instantaneously, which is vital for merchants relying on smooth transactions. Furthermore, a quicker response time means that businesses can get back on track faster, preventing potential losses.

Another factor to consider is the quality of the support staff. It’s not just about having support available; it’s about having knowledgeable representatives who can provide effective solutions. Many leading payment gateways invest in training their support teams rigorously, ensuring they are equipped to handle a wide range of queries and technical issues.

when selecting a payment gateway for your business, don’t overlook the significance of customer support. The right provider can make a substantial difference in both operational efficiency and customer satisfaction. By focusing on firms that prioritize robust, responsive support, businesses can ensure they are covered, no matter what challenges arise in the fiscal landscape of 2025.

Future-Proofing Your Business: Payment Gateway Trends to Watch in 2025

As we step into 2025, understanding the evolving landscape of payment gateways is essential for businesses aiming to stay competitive. The rapid advancements in technology, combined with changing consumer expectations, means that relying on outdated systems is no longer an option. Here are some crucial trends to keep an eye on:

- Mobile Payment Solutions: With the surge in smartphone usage, mobile wallets and payment apps are becoming the norm. Adopting a payment gateway that integrates seamlessly with mobile technology will enhance user experience and drive sales.

- Cryptocurrency Integration: As cryptocurrencies gain more acceptance among consumers, payment gateways that support crypto transactions will be at the forefront. This trend not only attracts tech-savvy customers but also positions your business as innovative.

- Contactless Payments: The pandemic accelerated the shift to contactless payments, and this trend is here to stay. Businesses must ensure their payment gateways support near field communication (NFC) for a smooth checkout process.

- Enhanced Security Features: With cyber threats growing in sophistication, integrating advanced security measures like biometric authentication and tokenization will be vital in protecting customer data and building trust.

- AI and Machine Learning: These technologies are transforming payment gateways by improving fraud detection and personalizing customer experiences. By leveraging AI, businesses can analyze transaction patterns and tailor services to individual needs.

Investing in a versatile and future-ready payment gateway can yield significant benefits. Here’s a quick comparison of some top providers as of 2025:

| Provider | Mobile Support | Crypto Support | Transaction Fees | Security Features |

|---|---|---|---|---|

| PayPal | Yes | No | 2.9% + $0.30 | Fraud Protection, Encryption |

| Square | Yes | Yes | 2.6% + $0.10 | PCI Compliance, Real-Time Monitoring |

| Stripe | Yes | Yes | 2.9% + $0.30 | Adaptive Authentication, Machine Learning |

| Shopify Payments | Yes | No | 2.9% + $0.30 | SSL Certification, Data Encryption |

as you evaluate your options for payment gateways in 2025, it’s crucial to choose a provider that not only meets today’s demands but also anticipates future trends. By aligning your business strategy with these innovations, you’ll not only enhance customer satisfaction but also set the stage for long-term success.

Our Recommendations: Best Payment Gateways for Different Business Models

Choosing the right payment gateway is crucial for maximizing sales and providing a seamless customer experience. Different business models have unique needs, so here’s a breakdown of our top recommendations tailored to specific types of businesses.

E-commerce Stores

For e-commerce sites, where transactions must be quick and secure, we recommend:

- Stripe: Known for its user-friendly interface and extensive API, Stripe is perfect for online retailers aiming for customization.

- PayPal: A household name that offers trust and security; it’s ideal for businesses seeking to attract customers who prefer familiar payment methods.

- Square: Great for small to medium-sized businesses, Square integrates seamlessly with online storefronts and offers built-in analytics.

Subscription-Based Services

If your business model revolves around recurring payments, consider the following:

- Braintree: A PayPal service that offers advanced features like recurring billing and easy integration with mobile apps.

- Chargebee: Specifically designed for subscription management, it automates invoicing and revenue recognition.

Mobile Apps

For businesses operating primarily through mobile apps, these gateways stand out:

- Adyen: Offers a fully integrated payment platform that supports various payment methods, ensuring a frictionless user experience.

- Authorize.Net: A solid choice for mobile transactions, with robust fraud protection tools that keep your transactions secure.

Nonprofits and Donations

Nonprofit organizations often seek low-cost solutions with transparent fee structures, so we recommend:

- Donorbox: Specifically tailored for nonprofits, it allows for easy setup and offers recurring donation options.

- PayPal Giving Fund: Offers the ability to process donations without taking a cut, ensuring more funds go directly to your cause.

International Businesses

If you’re catering to a global audience, ensure you select a gateway that supports multiple currencies:

- Wise: Formerly TransferWise, it’s excellent for cross-border transactions with transparent fees and real exchange rates.

- Worldpay: Comprehensive global solutions that support a wide range of currencies and payment types.

Comparison Table

| Business Model | Recommended Gateway | Key Features |

|---|---|---|

| E-commerce | Stripe | Customizable API, Secure Transactions |

| Subscription | Braintree | Recurring Billing, Mobile Integration |

| Mobile Apps | Adyen | Integrated Payment Platform, User-friendly |

| Nonprofits | Donorbox | Low Fees, Recurring Donations |

| International | Wise | Transparent Fees, Multi-currency Support |

Selecting the right payment gateway not only enhances your operational efficiency but also builds trust with your customers. Evaluate your business needs, and choose a gateway that aligns with your goals for optimal results.

Making the Final Decision: Key Questions to Ask Before Choosing a Provider

Choosing the right payment gateway is crucial for the success of your online business. With so many options available, it’s essential to ask the right questions to ensure you select a provider that aligns with your needs and goals. Here are some key questions that will guide you in making an informed decision:

- What fees are involved? Payment gateways often come with a variety of fees, including transaction fees, monthly fees, and setup costs. Understanding these can help you avoid unexpected expenses down the line.

- What payment methods are supported? Your customers will expect to use different payment methods, from credit cards to digital wallets. Make sure the payment gateway you choose supports the methods most relevant to your target audience.

- How secure is the service? In today’s digital landscape, security is paramount. Look for providers that offer robust security measures, such as encryption and PCI compliance, to protect sensitive customer data.

- What is the integration process like? You want a payment gateway that easily integrates with your existing systems. Ask about APIs, plugins, and any required technical support to ensure a smooth setup.

- How reliable is their customer support? Issues can arise at any time, so having reliable customer support is critical. Investigate the available support channels and their responsiveness to ensure you have help when needed.

- Are there any limitations on transaction volumes? If your business scales quickly, you don’t want to be restricted by your payment gateway. Confirm any transaction limits and how they might affect your growth.

- What reporting and analytics tools are provided? Data-driven decisions are key in today’s market. Look for gateways that offer insightful reporting and analytics that can help you understand customer behavior and optimize your sales.

To help visualize your options, consider this table comparing some of the top payment gateways for 2025:

| Provider | Transaction Fee | Supported Methods | Customer Support |

|---|---|---|---|

| Provider A | 2.9% + $0.30 | Credit, PayPal, Apple Pay | 24/7 Live Chat |

| Provider B | 2.5% + $0.25 | Credit, Debit, Google Pay | Email & Phone |

| Provider C | 3.0% + $0.15 | Credit, Bitcoin | Limited Hours |

Asking these questions will not only help you narrow down your choices but will also empower you to negotiate better terms with potential providers. Remember, the right payment gateway should not only fit your current needs but also support your future growth.

Wrapping Up: Choosing the Right Payment Gateway for Your Success

In today’s fast-paced digital landscape, selecting the right payment gateway can be the linchpin of your online success. With numerous options available, it’s essential to pinpoint which one aligns best with your business goals and customer needs. Here are some key factors to consider when making your choice:

- Transaction Fees: Different gateways charge varying fees per transaction. Ensure you understand the fee structure and how it impacts your bottom line.

- Integration Ease: Look for a solution that seamlessly integrates with your existing platforms, whether that’s an e-commerce site or a mobile app.

- Security Features: Since payment gateways handle sensitive customer information, prioritize providers that offer robust security measures, including PCI compliance and fraud detection tools.

- Customer Support: Choose a gateway that offers reliable customer service. A responsive support system can save you time and stress when issues arise.

- Supported Payment Methods: Make sure the gateway supports a variety of payment options, including credit cards, digital wallets, and even cryptocurrencies, to cater to your diverse clientele.

Another crucial aspect is to consider the user experience. A smooth checkout process can significantly enhance customer satisfaction and reduce cart abandonment rates. Look for gateways that offer customizable solutions, allowing you to create a seamless experience tailored to your brand.

Let’s take a quick look at a comparison of some top payment gateways for 2025:

| Provider | Transaction Fee | Integration | Security | Customer Support |

|---|---|---|---|---|

| PayPal | 2.9% + $0.30 | Easy | PCI DSS Compliant | 24/7 Support |

| Stripe | 2.9% + $0.30 | Developer-friendly | Advanced Fraud Protection | Email & Chat |

| Square | 2.6% + $0.10 | Simple Setup | Encryption Technology | Phone Support |

| Authorize.Net | 2.9% + $0.30 | Compatible with Many Platforms | Fraud Detection Suite | Extensive Hours |

Ultimately, the right payment gateway should evolve with your business. As your operations scale, your payment processing needs may change. Look for a provider that not only meets your current requirements but also offers scalability for future growth.

don’t forget to take advantage of free trials or demos offered by many providers. This hands-on experience can be invaluable in assessing which platform feels right for your business and which one you can trust to deliver an optimal customer experience.

Frequently Asked Questions (FAQ)

Q&A: Payment Gateway Comparison: Top Providers Analyzed for 2025

Q: What is a payment gateway, and why is it important for businesses?

A: Great question! A payment gateway is a service that processes credit card transactions for online and brick-and-mortar stores. Think of it as the digital equivalent of a point-of-sale terminal. It’s crucial for businesses because it not only facilitates payments but also ensures security, compliance, and a smooth customer experience. In today’s fast-paced online marketplace, having a reliable payment gateway can be the difference between a sale and an abandoned cart!

Q: What should businesses consider when choosing a payment gateway?

A: There are several key factors to keep in mind. First, look for transaction fees—these can vary widely among providers. Next, consider the types of payment methods supported; offering more options can increase conversion rates. Also, check for security features like encryption and fraud protection. Lastly, integration capabilities with your existing platforms and customer support services should be top of your list to ensure smooth operations.

Q: Who are the top payment gateway providers for 2025, and what makes them stand out?

A: Some of the top players include PayPal, Stripe, Square, and Authorize.Net. PayPal is known for its widespread recognition and trust among consumers. Stripe offers advanced customization options for tech-savvy businesses. Square is fantastic for small businesses due to its simple pricing model and in-person payment capabilities. Authorize.Net provides robust fraud protection features, making it ideal for larger enterprises. Each has its unique strengths, so the best one for you will depend on your specific needs!

Q: How does the pricing structure of payment gateways work?

A: Pricing can often be a hot topic! Most payment gateways charge a combination of transaction fees (a percentage of the sale), monthly fees, and sometimes setup costs. Some may have flat-rate pricing, while others offer tiered plans. Understanding these structures is essential, as they can significantly affect your bottom line. It’s always wise to calculate potential costs based on your expected sales volume before making a decision.

Q: Can payment gateways enhance the customer experience?

A: Absolutely! A seamless payment process can make all the difference in a customer’s shopping experience. Features like one-click payments, digital wallets, and customizable checkout pages can significantly reduce cart abandonment rates. Plus, offering multiple payment options caters to customer preferences, making them feel valued. Ultimately, a user-friendly payment gateway can boost your sales and foster customer loyalty.

Q: Are there any security concerns with payment gateways?

A: Security is a top priority when it comes to payment processing. Reputable payment gateways comply with PCI DSS (Payment Card Industry Data Security Standard), which means they adhere to strict security protocols to protect customer data. Look for features like end-to-end encryption and tokenization to further safeguard transactions. It’s crucial to choose a provider with a solid reputation and a proven track record in security.

Q: How can businesses evaluate which payment gateway is the best fit for them?

A: Start by assessing your business model and customer base. Consider factors like your average transaction size, sales volume, and target demographic. Then, compare the features, pricing, and customer support of different providers. Reading customer reviews and case studies can provide valuable insights, and don’t hesitate to reach out for demos or trials to get a firsthand experience. The right payment gateway should align with your business goals while keeping your customers happy.

Q: Is it too late to switch payment gateways if a business is already using one?

A: Not at all! While switching can seem daunting, it’s never too late to reevaluate your options. If your current gateway isn’t meeting your needs—whether due to high fees, limited features, or poor customer support—considering a switch can be beneficial. Just be sure to plan the transition carefully to minimize disruptions. Your business deserves the best tools to thrive!

Q: What are the key takeaways for businesses looking into payment gateways for 2025?

A: Keep your eyes on trends like increased mobile payments and enhanced security features. Do your research, compare providers, and choose a gateway that aligns with your business objectives and customer expectations. Remember, investing in the right payment gateway can enhance your operations, boost sales, and improve customer satisfaction. Don’t settle—find the payment solution that’s perfect for you!

Future Outlook

As we wrap up our deep dive into the landscape of payment gateways for 2025, it’s clear that choosing the right provider is more crucial than ever. With the rise of e-commerce and digital transactions, businesses need a gateway that not only meets their current needs but also adapts to future trends and technologies.

From our analysis, it’s evident that while options abound, your choice should hinge on factors like security, user experience, fees, and integration capabilities. Whether you’re a small startup or an established enterprise, understanding these nuances is essential to ensure that you’re not just keeping up with the competition but staying ahead of it.

We hope this comparison has illuminated the strengths and weaknesses of each provider, empowering you to make an informed decision. Remember, the right payment gateway can be a game-changer for your business, simplifying transactions and enhancing customer satisfaction.

So, take your time, assess your options, and choose wisely. Your ideal payment partner is out there, waiting to help you fuel your growth in 2025 and beyond. Happy gateway hunting!