In today’s bustling online marketplace, providing a seamless shopping experience is more important than ever. As a savvy eCommerce business owner, you understand that the key to securing sales isn’t just about having the latest trends or the best products—it’s about offering your shoppers the most convenient and secure payment options available. Imagine a world where your customers can glide through the checkout process without a hitch, leaving them not only satisfied but eager to return. In this article, we’ll explore how to bring the best eCommerce payment solutions into your store, ensuring that you not only meet your shoppers’ needs but exceed their expectations. Let’s dive into the must-have payment options that can elevate your business, foster loyalty, and ultimately drive sales. Ready to transform your checkout experience? Let’s get started!

Understanding the Importance of Seamless Payment Solutions

In the fast-paced world of ecommerce, providing a seamless payment experience is not just a luxury; it’s a necessity. Shoppers today expect smooth transactions that save them time and effort, and any hiccup in the payment process can lead to abandoned carts and lost sales. By prioritizing efficient payment solutions, online retailers can significantly enhance customer satisfaction and foster loyalty.

When choosing payment solutions, consider the following key factors that contribute to a seamless experience:

- Variety of Payment Methods: Offering multiple payment options, such as credit cards, digital wallets, and bank transfers, caters to diverse customer preferences.

- User-Friendly Interface: A clean and intuitive checkout process minimizes confusion and keeps customers moving smoothly through their purchase.

- Security Features: Robust security measures, like encryption and fraud detection, help reassure customers that their sensitive information is safe.

- Mobile Optimization: With a growing number of shoppers using mobile devices, ensuring your payment solution is fully optimized for mobile is crucial.

Implementing these strategies can significantly reduce cart abandonment rates and, in turn, increase overall sales. For example, a recent study revealed that 69% of online shoppers abandon their carts due to complicated checkout processes. By streamlining payments, retailers can capture more of that potential revenue.

Furthermore, the importance of speed cannot be overstated. Customers value quick transactions, and a payment solution that processes transactions swiftly can lead to higher conversion rates. In fact, fast and efficient payment processing can decrease checkout times by up to 30%, providing a smoother shopping experience.

| Payment Method | Advantages |

|---|---|

| Credit Cards | Widely accepted, instant transactions |

| Digital Wallets | Convenient, fast, and secure |

| Bank Transfers | Direct, often lower fees |

| Buy Now, Pay Later | Increases affordability, boosts sales |

Customer trust is another critical component in the ecommerce landscape. By integrating reputable payment solutions, businesses can enhance their credibility. Customers are more likely to complete purchases when they recognize and trust the payment provider. This not only leads to immediate sales but also to long-term customer relationships.

keeping up with emerging payment technologies can set your business apart from the competition. Innovations such as cryptocurrency payments and biometric authentication are on the rise. Early adoption of these technologies can position your brand as a forward-thinking leader in the ecommerce space, attracting tech-savvy customers looking for modern solutions.

Investing in seamless payment solutions is not merely an operational decision; it’s a strategic move towards elevating the overall shopping experience. By focusing on ease, security, and innovation, online retailers can create an environment where customers feel valued and understood, ultimately driving growth and success.

Identifying Your Target Audiences Payment Preferences

Understanding the payment preferences of your target audience is crucial for crafting an effective eCommerce strategy. Every shopper is unique, and their comfort with various payment methods can significantly influence their purchasing decisions. By identifying these preferences, you can create a seamless checkout experience that maximizes conversions.

Start by conducting surveys or utilizing analytics tools to gather insights about your customers. Consider these key payment preferences:

- Credit/Debit Cards: Still a dominant choice for many, offering convenience and speed.

- Digital Wallets: Options like PayPal, Apple Pay, and Google Wallet are growing in popularity due to their ease of use.

- Buy Now, Pay Later: Services like Afterpay and Klarna appeal to consumers looking to manage their budgets.

- Cryptocurrency: As more people adopt digital currencies, offering this option can attract tech-savvy shoppers.

Segmenting your audience based on demographic factors can also provide valuable insights. For instance:

| Demographic | Preferred Payment Method |

|---|---|

| Millennials | Digital Wallets & BNPL |

| Gen Z | Cryptocurrency & Mobile Payments |

| Baby Boomers | Credit/Debit Cards |

Next, consider the geographical location of your audience. Payment preferences can vary significantly by region due to cultural and economic factors. For example, while credit cards may be widely accepted in the U.S., some regions may favor cash on delivery or local payment systems. Conducting research on regional trends will help you tailor your payment options accordingly.

Don’t forget about security. Many consumers are hesitant to share their payment information online. Highlighting robust security measures, such as SSL certificates or tokenization, can instill confidence in your customers, making them more likely to complete their purchases.

Lastly, it’s essential to keep your payment options updated. The eCommerce landscape is constantly evolving, and staying ahead of trends can provide a competitive edge. Regularly reviewing and adapting to new payment solutions will ensure you meet the ever-changing preferences of your shoppers.

Exploring the Latest Trends in Ecommerce Payment Methods

In the ever-evolving landscape of ecommerce, staying ahead of the game means adapting to the latest payment trends that cater to your customers’ preferences. As shopping habits shift, the demand for flexible, secure, and user-friendly payment methods is at an all-time high. Here’s a look at the most significant trends shaping the ecommerce payment sector today.

1. Digital Wallets

Digital wallets are rapidly gaining traction among consumers due to their convenience and enhanced security. With options like Apple Pay, Google Pay, and PayPal, shoppers can complete transactions with just a few taps. The seamless experience offered by these wallets reduces friction in the checkout process, making it more likely for customers to finalize their purchases.

2. Buy Now, Pay Later (BNPL)

Another rising trend is the implementation of Buy Now, Pay Later services. This method allows consumers to split their purchases into installments, making high-ticket items more accessible. Retailers that offer BNPL options not only enhance customer satisfaction but also boost their sales conversion rates. This payment solution has become particularly popular among younger consumers who value flexibility.

3. Cryptocurrencies

As digital currencies gain legitimacy, more ecommerce platforms are beginning to accept cryptocurrencies as a form of payment. Bitcoin, Ethereum, and other altcoins are appealing to a tech-savvy demographic that values privacy and security in transactions. By integrating cryptocurrency payment options, businesses can tap into a niche market and position themselves as innovative leaders in their industry.

4. Subscription Services

The subscription model is taking the ecommerce world by storm, and with it comes the necessity for reliable recurring payment solutions. Consumers appreciate the convenience of automated billing for their favorite products and services. Utilizing subscription management tools ensures smooth transactions and fosters customer loyalty, as users are more likely to remain engaged with brands that offer hassle-free payment experiences.

| Payment Method | Benefits | Considerations |

|---|---|---|

| Digital Wallets | Convenient, secure transactions | Requires user adoption |

| BNPL | Increases affordability | Potential for overspending |

| Cryptocurrencies | Appeals to tech-savvy consumers | Volatility in currency values |

| Subscriptions | Enhances customer loyalty | Management of customer churn |

5. Contactless Payments

The rise of contactless payments has transformed the way consumers shop both online and in-store. NFC technology allows for quick and secure transactions, minimizing the need for physical contact. As health and safety concerns continue to influence shopping habits, embracing contactless solutions can give your business a competitive edge.

By integrating these latest payment methods into your ecommerce platform, you position your business to cater to the evolving needs of your customers. Not only do you improve their shopping experience, but you also enhance your brand’s reputation as a forward-thinking and customer-centric retailer. Embrace these trends to ensure your ecommerce strategy remains relevant and effective.

Evaluating Security Features That Build Customer Trust

In today’s digital marketplace, customer trust is paramount. Shoppers are more discerning than ever before, and they demand not only an excellent shopping experience but also a secure one. Implementing robust security features can significantly enhance their confidence in your ecommerce platform.

First and foremost, utilizing SSL certificates is a non-negotiable step. This technology encrypts the data transmitted between your website and your customers, ensuring that sensitive information, such as credit card details, is protected from prying eyes. A visible SSL certificate can also boost your credibility, encouraging customers to complete their purchases without hesitation.

Another vital aspect is the integration of multi-factor authentication (MFA). By requiring additional verification methods, such as a text message code or an email confirmation, you add an extra layer of security that deters unauthorized access. This feature not only protects customer accounts but also demonstrates your commitment to safeguarding their data.

Consider employing fraud detection tools as well. These tools analyze transactions for unusual patterns and can alert you to potentially fraudulent activity before it escalates. By being proactive in identifying threats, you build trust with your customers, showing them that you prioritize their safety.

Moreover, providing transparent privacy policies helps customers feel more secure. Clearly outline how their data will be used, stored, and protected. If they know their information is handled responsibly, they’re more likely to engage with your business. It’s also beneficial to regularly update these policies and communicate any changes to your customers.

Lastly, consider showcasing a trust badge on your checkout page. These badges, which come from reputable security providers, serve as visual affirmations of your security measures. They reassure customers that their payment information is in safe hands, ultimately leading to lower cart abandonment rates.

| Security Feature | Customer Benefit |

|---|---|

| SSL Certificates | Protection against data interception |

| Multi-Factor Authentication | Enhanced account security |

| Fraud Detection Tools | Proactive threat identification |

| Transparent Privacy Policies | Trust through clear communication |

| Trust Badges | Visual assurance of security |

By investing in these security features, you not only protect your business but also cultivate an environment of trust. Shoppers are more likely to return and recommend your ecommerce site when they feel secure and valued. Make security a priority, and watch your customer relationships flourish.

Integrating Multiple Payment Options for Maximum Flexibility

In today’s fast-paced digital marketplace, offering a variety of payment options is no longer just a luxury; it’s a necessity. Shoppers have diverse preferences, and meeting these needs can significantly enhance their overall experience. By integrating multiple payment options, you not only accommodate different customer preferences but also increase your chances of conversion.

Consider the following popular payment methods to include in your online store:

- Credit and Debit Cards: The most widely used method, offering convenience and security.

- Digital Wallets: Options like PayPal, Apple Pay, and Google Pay provide quick, one-click transactions.

- Buy Now, Pay Later Services: Services like Afterpay or Klarna allow customers to split their payments over time.

- Cryptocurrency: Accepting digital currencies can attract tech-savvy shoppers and those looking for privacy in transactions.

- Bank Transfers: Direct bank payments are secure and can be a preferred method for higher-value purchases.

Integrating these payment options requires a thoughtful approach. Start by assessing your target audience’s preferences. Conduct surveys or analyze existing data to identify which payment methods are most popular among your shoppers. This information can guide your choices and ensure that you’re catering to your customers’ needs effectively.

Next, choose a reliable payment gateway that supports multiple methods. This will streamline the transaction process and provide a seamless experience for your users. Look for gateways that offer:

- Security: Ensure that sensitive customer information is protected with advanced encryption.

- User-Friendly Interface: A simple checkout process can reduce cart abandonment rates.

- Integration Capabilities: The ability to connect with your existing ecommerce platform easily.

- Customer Support: Access to support can help resolve issues quickly, enhancing customer satisfaction.

You might also consider creating a comprehensive payment options page. This can inform customers about the various methods available, including any benefits or incentives for using specific payment options. A well-designed payment options page can demystify the checkout process and boost customer confidence.

Lastly, keep an eye on emerging trends in payment solutions. As technology evolves, new methods may become available that can enhance your customers’ shopping experience. Staying ahead of the curve can set you apart from competitors and position your business as a forward-thinking brand.

| Payment Method | Benefits |

|---|---|

| Credit/Debit Cards | Universally accepted and trusted. |

| Digital Wallets | Fast transactions and added security. |

| Buy Now, Pay Later | Increased affordability for customers. |

| Cryptocurrency | Appeals to niche markets and tech enthusiasts. |

By embracing a diverse range of payment options, your ecommerce store can not only cater to a broader audience but also foster loyalty and encourage repeat business. Remember, a little flexibility can go a long way in today’s competitive online shopping landscape.

Mobile Payment Solutions: Catering to On-the-Go Shoppers

In today’s fast-paced world, convenience is king, especially for on-the-go shoppers. These consumers are looking for quick, efficient, and secure ways to complete their purchases without the hassle of traditional payment methods. Mobile payment solutions have emerged as a vital element in the eCommerce landscape, catering specifically to the needs of these busy individuals.

One of the most appealing aspects of mobile payment solutions is their inherent flexibility. Customers can pay using various methods, including digital wallets, mobile banking apps, and even QR codes. This flexibility is crucial for attracting shoppers who value options and want to use their preferred payment method effortlessly. Here are some key features that enhance the mobile shopping experience:

- Instant Transactions: Mobile payments provide rapid transaction processing, allowing customers to finalize their purchases in seconds.

- Secure Payments: With features like tokenization and biometric authentication, shoppers can feel confident that their financial information is safeguarded.

- User-Friendly Interfaces: A seamless and intuitive design leads to higher conversion rates as customers can navigate effortlessly through the payment process.

- Integration with Loyalty Programs: Many mobile payment solutions offer integrated rewards programs that encourage repeat business.

Moreover, the rise of contactless payments has transformed the way consumers approach shopping. With just a tap of their smartphone, shoppers can make purchases without fumbling for cash or cards. This convenience not only speeds up the checkout process but also enhances the overall shopping experience. Businesses that implement contactless payment options are more likely to attract tech-savvy customers who appreciate the modernity of their shopping environment.

To further illustrate this trend, consider the differences in transaction times between traditional payment methods and mobile payment solutions. The table below highlights how mobile payments can significantly reduce the time spent at checkout:

| Payment Method | Average Transaction Time |

|---|---|

| Cash | 30 seconds |

| Credit/Debit Card | 15 seconds |

| Mobile Payment | 5 seconds |

Implementing mobile payment solutions can also provide businesses with valuable insights into consumer behavior. By analyzing transaction data, retailers can understand purchasing patterns and preferences, allowing them to tailor promotions and inventory to meet customer demands effectively. This data-driven approach not only enhances the shopping experience but also drives business growth.

offering robust mobile payment solutions is essential for any eCommerce business looking to engage with on-the-go shoppers. By focusing on convenience, security, and integration with loyalty programs, businesses can create a shopping experience that meets the modern customer’s needs. Embracing these technologies can lead to increased customer satisfaction, loyalty, and ultimately, sales.

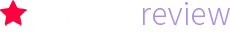

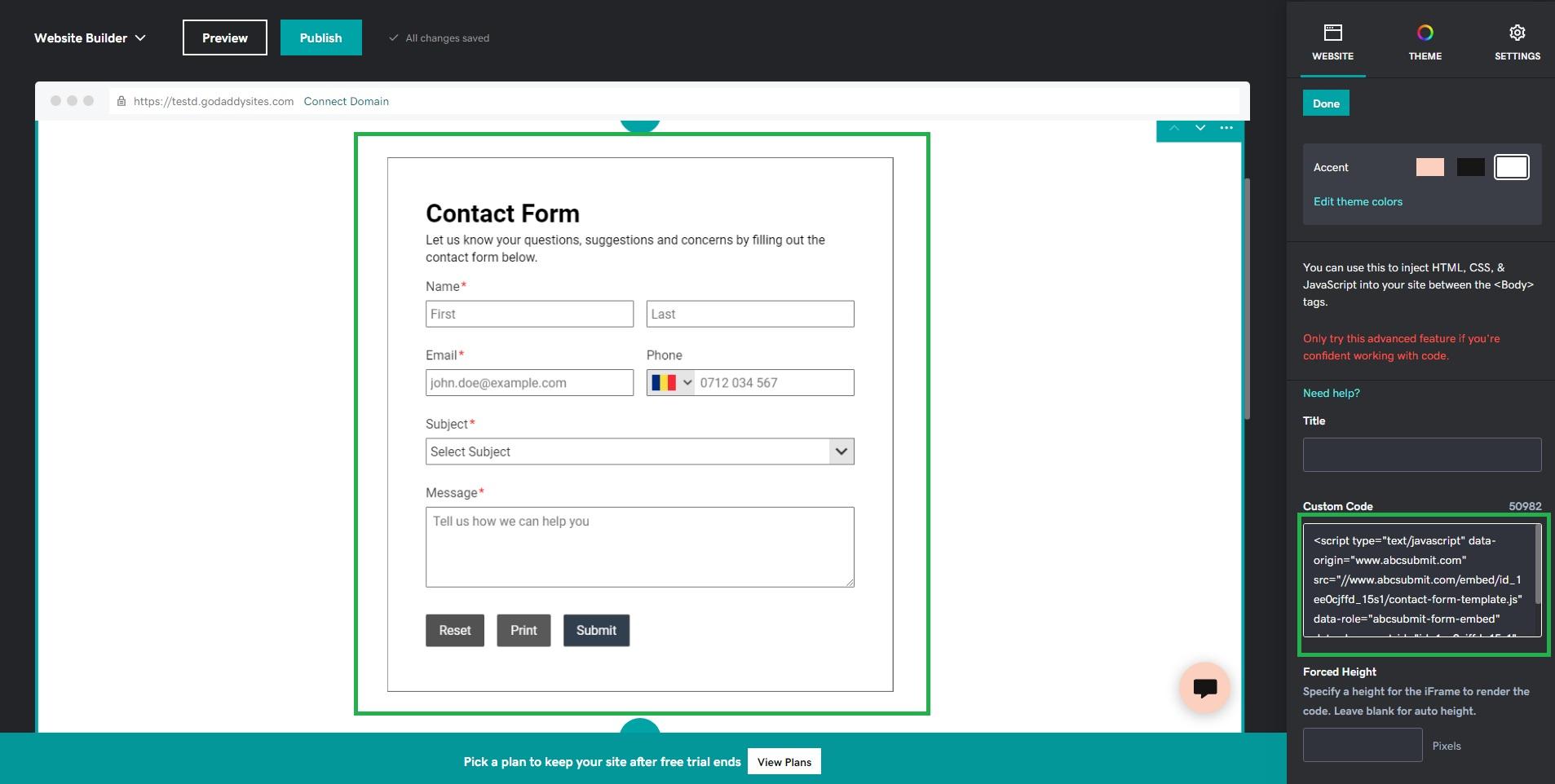

Optimizing Checkout Pages for an Effortless Experience

Creating an effortless checkout experience is about more than just aesthetics; it’s about minimizing friction and maximizing conversion rates. When shoppers land on your checkout page, they should feel comfortable and confident in completing their purchase. Here are some key strategies to enhance the checkout process:

- Streamlined Design: A clean and simple layout allows customers to navigate with ease. Avoid clutter and keep the design focused on the task at hand—making a purchase.

- Progress Indicators: Let shoppers know how many steps are left in the checkout process. A progress bar or step indicators can reduce anxiety and encourage them to complete their purchase.

- One-Page Checkout: Reduce the number of pages shoppers have to navigate. A one-page checkout can significantly increase conversion rates by making the process quicker and more straightforward.

Another critical factor in optimizing checkout pages is the variety of payment options offered. Shoppers have different preferences, and providing multiple payment solutions can cater to those varied needs:

| Payment Method | Benefits |

|---|---|

| Credit/Debit Cards | Widely accepted, trusted, and familiar to most users. |

| Digital Wallets | Convenient and fast, ideal for mobile users. |

| Buy Now, Pay Later | Encourages larger purchases by breaking payments into installments. |

| Cryptocurrency | Appeals to tech-savvy shoppers and those wanting anonymity. |

Security is paramount when dealing with online transactions. To instill trust, ensure that your checkout page displays security logos and complies with PCI DSS standards. Shoppers are more likely to complete their purchase if they feel their information is protected. Additionally, consider implementing:

- Guest Checkout: Allowing users to make a purchase without creating an account simplifies the process and can lead to higher conversion rates.

- Auto-Fill Options: Incorporate auto-fill features for returning customers. This saves time and reduces the risk of errors while entering information.

- Real-Time Validation: Instantly validate credit card numbers and addresses as they are entered, providing immediate feedback to users.

don’t overlook the importance of mobile optimization. With more shoppers using smartphones, ensuring that your checkout page is fully responsive is crucial. Test the mobile experience regularly to identify and rectify any pain points that may deter mobile users from completing their purchase.

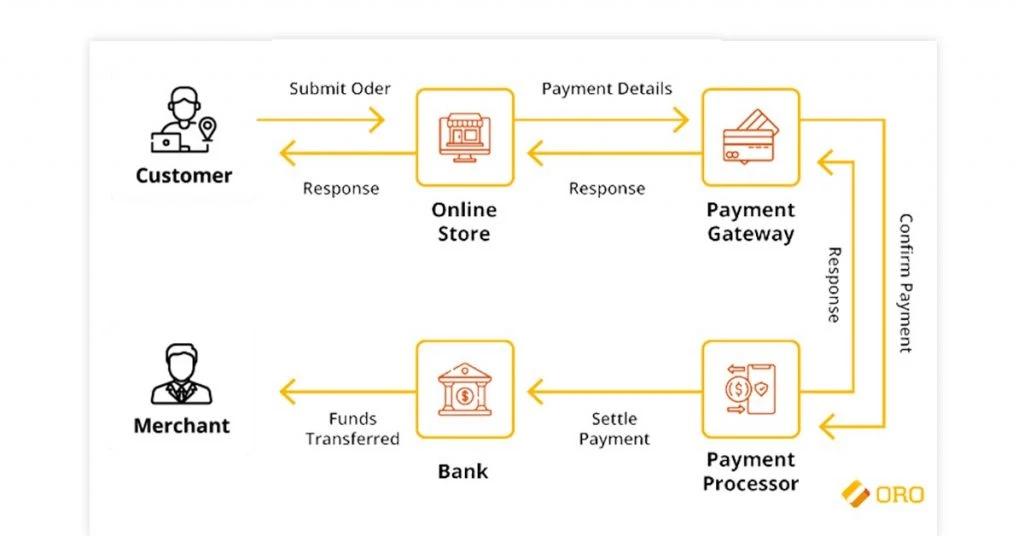

Leveraging Payment Gateways to Enhance Transaction Efficiency

In the fast-paced world of ecommerce, streamlining transaction processes is crucial for enhancing customer satisfaction and boosting sales. One impactful way to achieve this is by utilizing payment gateways that cater to the unique needs of your business and your customers. These gateways serve as the bridge between your online store and the financial institutions, facilitating secure and efficient transactions.

When selecting a payment gateway, consider these essential features:

- Security: Look for gateways that offer robust encryption and compliance with industry standards to protect sensitive customer data.

- Variety of Payment Options: Ensure the gateway supports multiple payment methods, including credit/debit cards, digital wallets, and alternative payment options, to cater to diverse shopper preferences.

- Integration Ease: Choose gateways that seamlessly integrate with your existing ecommerce platforms to minimize setup time and technical headaches.

- Transaction Fees: Evaluate the fee structure to find a balance between affordability and the features provided, ensuring it aligns with your budget.

One of the most significant advantages of modern payment gateways is their ability to facilitate faster transactions. With functionalities like one-click payments and auto-fill options, customers can complete their purchases with minimal friction, leading to increased conversion rates. A smooth checkout experience can significantly reduce cart abandonment rates, which is a common pain point for online retailers.

Additionally, many payment gateways offer real-time analytics that can provide valuable insights into your transaction processes. By analyzing data such as payment success rates, customer demographics, and peak transaction times, you can optimize your sales strategy and improve overall transaction efficiency. This data-driven approach enables you to make informed decisions that enhance customer experience and drive business growth.

Another noteworthy aspect is the potential for international sales. A payment gateway that supports multiple currencies and languages opens doors to a broader market, allowing you to attract shoppers from different regions. This not only increases your sales potential but also enhances brand visibility in a global marketplace.

| Payment Gateway | Key Features | Typical Fees |

|---|---|---|

| PayPal | Widely accepted, buyer protection | 2.9% + $0.30 per transaction |

| Stripe | Customizable API, supports subscriptions | 2.9% + $0.30 per transaction |

| Square | POS integration, inventory management | 2.6% + $0.10 per transaction |

Ultimately, leveraging the right payment gateway can transform your ecommerce site into a streamlined, efficient platform that not only meets but exceeds customer expectations. By prioritizing security, speed, and flexibility, you set the stage for a seamless shopping experience that fosters loyalty and encourages repeat business.

Emphasizing Transparency: Clear Fees and Policies Matter

In today’s digital marketplace, trust plays a crucial role in converting potential customers into loyal ones. One of the most effective ways to build this trust is through clear communication about fees and policies. When shoppers know exactly what to expect, they feel more confident in their purchasing decisions, increasing their likelihood of completing a transaction.

Imagine browsing for the perfect product, only to be surprised by hidden fees during checkout. Frustration can lead to cart abandonment, and that’s the last thing you want for your eCommerce business. By clearly outlining your fees upfront, you not only enhance the customer experience but also foster a sense of reliability. Transparency can become your competitive edge.

Here are some essential elements to consider when emphasizing clarity in your payment processes:

- Detailed Fee Structure: Provide a breakdown of all applicable fees – transaction fees, shipping costs, and any taxes. This information should be easily accessible and displayed prominently.

- Clear Return Policies: Outline your return and refund policies in simple terms. Make sure customers know how to return items and any associated costs.

- Payment Methods: List all accepted payment options. Transparency about which payment methods can be used builds shopper confidence and encourages them to complete their purchases.

- Security Assurances: Highlight the security measures you have in place for transactions. Customers need to feel safe when entering their payment information.

To help illustrate how clear communication can be structured, consider implementing a simple table on your website:

| Fee Type | Amount | Details |

|---|---|---|

| Shipping Fee | $5.99 | Flat rate for all orders under $50 |

| Transaction Fee | 2.5% | Applied to all credit card payments |

| Restocking Fee | 10% | Applicable on returns after 30 days |

Having such a table readily available not only informs customers but also minimizes confusion. This proactive approach can set you apart from competitors who may bury their fees in small print.

remember that the way you communicate these elements matters just as much as the information itself. Use language that is friendly and approachable, avoiding jargon that can alienate or confuse potential buyers. By prioritizing transparency, you create a welcoming environment that encourages shoppers to trust your brand and return for more in the future.

Creating a Personalized Payment Experience for Increased Loyalty

In today’s competitive ecommerce landscape, understanding the payment preferences of your shoppers is crucial for fostering loyalty. By tailoring the payment experience to meet the unique needs of each customer, businesses can create a seamless transaction process that encourages repeat purchases. Here are some effective strategies to personalize payment experiences:

- Offer Diverse Payment Options: Different shoppers have different preferences. Some may prefer credit cards, while others might lean towards digital wallets or even buy-now-pay-later services. By providing a wide array of payment options, you cater to a broader audience.

- Implement One-Click Checkout: Simplifying the checkout process can significantly reduce cart abandonment rates. One-click checkout allows customers to complete their purchase with a single tap, making the experience effortless and efficient.

- Leverage Customer Data: Utilizing customer data to understand purchasing behavior can help you tailor the payment experience. For instance, if a customer frequently uses a particular payment method, you can prioritize that option during checkout.

- Introduce Loyalty Programs: Create payment incentives such as cashback or points that customers can earn with each transaction. This not only enhances their shopping experience but also encourages them to return.

Furthermore, the aesthetics of the payment interface can greatly influence customer perception. A clean, visually appealing checkout page will not only engage users but also build trust. Consider the following tips:

- Maintain Consistency: Ensure that the payment page design reflects your brand’s identity. Consistent colors, fonts, and styles can reassure customers that they’re still on your site.

- Provide Clear Guidance: Use concise language and clear calls to action. Customers should never feel lost during the payment process. Incorporating tooltips or FAQs can help answer common queries.

| Payment Method | Benefits |

|---|---|

| Credit/Debit Cards | Widely accepted, instant processing |

| Digital Wallets | Fast, secure, and convenient |

| Buy Now, Pay Later | Improved conversion rates, customer flexibility |

Additionally, ensuring robust security measures is vital to creating a trustworthy payment environment. Customers are increasingly concerned about their financial information’s safety. Therefore, it is critical to:

- Utilize Advanced Security Protocols: Implement SSL certificates and comply with PCI DSS standards to protect customer data.

- Clearly Communicate Security Features: Highlight security measures on your payment page to reassure customers. A simple note can go a long way in building trust.

Incorporating these strategies into your ecommerce platform can lead to an improved payment experience that not only meets but exceeds customer expectations. When shoppers feel valued and understood, they are more likely to return, transforming one-time buyers into loyal customers.

Addressing Common Payment Issues to Minimize Cart Abandonment

It’s no secret that shopping cart abandonment is a significant hurdle for eCommerce businesses. One of the most frequent culprits behind this phenomenon is payment-related issues. By addressing these challenges head-on, retailers can create a smoother, more enjoyable checkout experience that keeps customers happy and engaged.

One major issue is the lack of payment options. Shoppers today are diverse, and so are their preferences regarding payment methods. Offering a variety of options, including credit/debit cards, digital wallets, and even buy-now-pay-later solutions, ensures that your customers can choose the method they are most comfortable with. Here are some popular payment methods to consider:

- Credit/Debit Cards

- PayPal

- Apple Pay

- Google Pay

- BNPL Solutions (like Klarna or Afterpay)

In addition to payment options, the checkout process itself often poses challenges. A lengthy or complicated checkout can frustrate customers and lead them to abandon their carts. Streamlining the process by reducing the number of steps and allowing guest checkout can significantly improve conversion rates. Consider implementing the following strategies:

- Simplify the Form Fields: Ask only for essential information.

- Progress Indicators: Let customers know how far along they are in the process.

- Auto-fill Options: Use technology to fill in information automatically when possible.

Another critical factor is transaction security. Customers will be hesitant to complete their purchases if they don’t feel their financial information is safe. Investing in SSL certificates and displaying trust badges can instill confidence in your shoppers. Here’s a quick rundown of what to showcase:

| Trust Features | Description |

|---|---|

| SSL Certificates | Encrypts data for secure transactions. |

| Secure Payment Icons | Showcase recognizable payment brands. |

| Money-Back Guarantee | Offers reassurance to hesitant customers. |

Moreover, customers often abandon their carts due to unexpected fees. Surprise charges at checkout can lead to frustration and distrust. Make sure to be transparent about all costs upfront, including shipping, taxes, and any additional fees. Consider adopting the following practices:

- Display total costs early in the checkout process.

- Offer free shipping over a certain purchase amount.

- Provide clear return policies to reduce perceived risk.

Lastly, don’t underestimate the power of customer support during the checkout process. Offering live chat assistance can help address concerns in real-time, preventing potential abandonment. Additionally, clear and accessible FAQs regarding payment issues can guide customers through any hitches they encounter.

By proactively addressing these common payment issues, eCommerce businesses can significantly reduce cart abandonment rates. A seamless, secure, and customer-friendly checkout experience not only boosts sales but also fosters long-term loyalty. After all, happy customers are repeat customers!

The Role of Customer Support in Payment Solutions

In the fast-paced world of ecommerce, offering seamless payment solutions is only half the battle; exceptional customer support is what truly transforms a transaction into a positive experience. Customers expect not only to complete their purchases effortlessly but also to feel supported throughout their journey. A robust customer support system can make all the difference in retaining loyal shoppers.

When issues arise, whether it’s a failed transaction, a billing question, or concerns about payment security, responsive and knowledgeable support staff are essential. Understanding this, businesses must prioritize training their customer support teams to handle payment-related inquiries with confidence and clarity. This empowers customers to feel secure in their purchasing decisions and enhances their overall experience.

Many customers appreciate having multiple channels through which they can seek help. Consider integrating the following into your customer support strategy:

- Live Chat: Quick and effective for immediate assistance.

- Email Support: Ideal for more detailed inquiries or follow-up questions.

- Phone Support: Personal touch for complex issues that require in-depth discussion.

- Social Media Support: Engaging with customers in real-time on platforms they use daily.

Additionally, providing comprehensive self-service options can significantly enhance the customer support experience. A well-organized FAQ section, instructional videos, or even a payment troubleshooting guide can empower customers to find solutions on their own. This not only saves time for your team but also caters to the increasing preference for self-service among consumers.

It’s also crucial to maintain transparency about payment processes and policies. Customers appreciate clear, upfront information regarding fees, refund policies, and transaction timelines. A transparent approach builds trust and encourages shoppers to complete their purchases without hesitation.

To further illustrate the importance of effective customer support in payment solutions, here’s a quick comparison of businesses with and without strong support systems:

| Business Type | Customer Retention Rate | Common Issues |

|---|---|---|

| With Strong Support | 85% | Minimal payment disputes, high satisfaction |

| Without Strong Support | 50% | Frequent billing errors, high abandonment rates |

As the data shows, investing in customer support directly correlates with enhanced customer loyalty and satisfaction. Businesses that prioritize customer relationships are more likely to thrive in a competitive ecommerce landscape.

Ultimately, your customer support team should be viewed as a critical component of your payment solutions. By fostering a supportive environment where customers feel heard and valued, you create not just transactions, but lasting relationships that encourage repeat business and positive word-of-mouth.

Analyzing the Impact of Payment Solutions on Conversion Rates

In today’s fast-paced ecommerce landscape, the choice of payment solutions can significantly influence conversion rates. Shoppers today have high expectations; they look not only for quality products but also for seamless purchasing experiences. When a customer encounters a complicated or lengthy checkout process, the likelihood of them abandoning their cart increases dramatically.

Implementing user-friendly payment options can lead to a notable uptick in completed transactions. Here are some critical aspects to consider:

- Diverse Payment Options: Offering various payment methods—from credit cards to digital wallets—accommodates different shopper preferences. This inclusivity can enhance customer satisfaction and reduce cart abandonment rates.

- Mobile Optimization: With the rise of mobile shopping, ensuring that payment solutions are optimized for mobile devices can prevent friction during the checkout process. If a payment page doesn’t display correctly on a smartphone, potential sales can slip through your fingers.

- Security Features: Customers need to feel secure when making online transactions. Displaying trust badges and SSL certificates can reassure shoppers that their data is safe, which can markedly improve conversion rates.

- Simplified Checkout Process: Reducing the number of steps required to complete a purchase can dramatically enhance user experience. Consider implementing one-click payments or guest checkout options to streamline the process.

Moreover, analyzing data surrounding your payment solutions can provide invaluable insights into shopper behavior. For instance, you might discover that a particular payment option leads to higher completion rates in specific demographics. By utilizing this information, you can tailor your offerings to meet the needs of your target audience more effectively.

| Payment Method | Typical Conversion Rate | Pros | Cons |

|---|---|---|---|

| Credit/Debit Cards | 74% | Widely accepted, familiar to users | High fraud risk, requires secure handling |

| Digital Wallets | 85% | Fast, convenient, and secure | Not universally accepted |

| Bank Transfers | 65% | Direct transfer, no chargebacks | Slower processing times |

| Buy Now, Pay Later | 78% | Increases purchase power, flexible | Possible debt accumulation for consumers |

Ultimately, providing the best ecommerce payment solutions involves understanding your customer base and continuously optimizing the checkout experience. By investing in effective payment systems, businesses can not only reduce cart abandonment but also foster customer loyalty, leading to repeat sales. Remember, every additional second spent in the checkout process could mean the loss of a potential buyer. Prioritize convenience, security, and variety to boost your conversion rates significantly.

Future-Proofing Your Ecommerce Business with Innovative Payment Technologies

As the digital shopping landscape evolves, it’s crucial for ecommerce businesses to stay ahead of the curve. One of the most significant ways to ensure your business remains competitive is by integrating the latest payment technologies. With consumers increasingly looking for seamless shopping experiences, offering innovative payment solutions can be a game-changer.

Flexible Payment Options: Shoppers today expect a variety of payment methods that cater to their preferences. By providing options such as:

- Credit and debit cards

- Digital wallets (like PayPal, Apple Pay, and Google Pay)

- Buy Now, Pay Later (BNPL) services

- Cryptocurrency payments

you not only enhance the user experience but also reduce cart abandonment rates. This flexibility can significantly increase conversion rates and foster customer loyalty.

Security and Trust: In an era where data breaches are commonplace, ensuring your payment processing is secure is non-negotiable. Utilizing technologies such as:

- End-to-end encryption

- Tokenization

- Two-factor authentication (2FA)

helps in protecting sensitive customer information. When shoppers feel secure, they are more likely to complete their purchases and return for future transactions.

Streamlined Checkout Processes: A complicated checkout process can deter potential buyers. Implementing technologies like:

- One-click payments

- Autofill for payment information

- Guest checkout options

can simplify the purchasing process, making it quick and easy. The more straightforward you make it for your customers to complete their orders, the more sales you’ll generate.

Data-Driven Insights: Utilizing advanced analytics tools allows you to track payment trends and customer preferences. By analyzing this data, you can:

- Identify popular payment methods

- Detect potential fraud

- Optimize your payment strategy based on customer behavior

This insight is invaluable for tailoring your offerings and preparing for future trends in payment technologies.

| Payment Method | Benefits | Considerations |

|---|---|---|

| Credit/Debit Cards | Widely accepted, easy to use | Transaction fees may apply |

| Digital Wallets | Fast transactions, added security | Limited availability for some users |

| Cryptocurrency | Emerging market, lower fees | Volatility and regulatory concerns |

By adapting to these innovative payment technologies, your ecommerce business can not only meet the demands of today’s consumers but also anticipate future shifts in the market. Embrace these changes to position your brand as a leader in the ecommerce space.

Frequently Asked Questions (FAQ)

Q&A: Providing the Best Ecommerce Payment Solutions for Your Shoppers

Q1: Why is choosing the right payment solution crucial for my ecommerce business?

A: Choosing the right payment solution is like choosing the right foundation for a house—it supports everything else you build on top of it. The right payment methods can enhance the shopping experience, reduce cart abandonment, and increase customer loyalty. Shoppers today expect a seamless, secure, and flexible checkout process. If you don’t meet those expectations, they’re likely to take their business elsewhere.

Q2: What payment methods should I consider offering?

A: Variety is key! You should consider offering traditional credit and debit card options, digital wallets like PayPal and Apple Pay, and newer methods like cryptocurrencies or buy-now-pay-later services. The more options you provide, the more likely you are to meet the diverse preferences of your customers. It’s all about giving them the freedom to choose how they want to pay.

Q3: How can I ensure the payment process is secure for my customers?

A: Security is paramount. Partner with reputable payment gateways that offer advanced encryption and fraud detection measures. Consider features like 3D Secure authentication and PCI compliance. Additionally, clearly communicate your security measures to shoppers to build trust. When customers feel safe, they’re more likely to complete their purchases.

Q4: What role does mobile compatibility play in payment solutions?

A: Mobile compatibility is no longer optional; it’s essential! With more shoppers using their smartphones for purchases, your payment solution must be fully optimized for mobile. This means easy navigation, fast loading times, and accommodating mobile payment options. If your checkout process isn’t mobile-friendly, you risk losing a significant chunk of potential sales.

Q5: How can I streamline the checkout process to reduce cart abandonment?

A: A streamlined checkout process is key to reducing cart abandonment. Aim for a simple, intuitive interface with minimal steps. Autocomplete forms, guest checkout options, and a clear summary of costs can make a huge difference. The goal is to make the process as quick and easy as possible—think of it as rolling out the red carpet for your customers!

Q6: Are there any emerging trends in ecommerce payment solutions that I should be aware of?

A: Absolutely! Keep an eye on trends like voice-activated payments, subscription services, and even AI-driven personalized payment experiences. Consumers are also increasingly looking for sustainability in transactions, so eco-friendly payment options are gaining traction. Staying ahead of these trends can give your business a competitive edge and resonate with modern shoppers.

Q7: What are the long-term benefits of investing in quality payment solutions?

A: Investing in quality payment solutions pays off in the long run. You’ll likely see an increase in customer satisfaction, loyalty, and ultimately, sales. A smooth payment process reduces friction and enhances the overall shopping experience, which can lead to repeat customers and positive word-of-mouth. Plus, it positions your brand as a trustworthy and professional player in the ecommerce space.

Q8: How can I measure the effectiveness of my payment solutions?

A: Track key metrics such as conversion rates, cart abandonment rates, and customer feedback. Use analytics tools to monitor transaction success rates and the time taken to complete purchases. This data can provide valuable insights into how your payment solutions are performing and where there’s room for improvement. Always be ready to adapt based on what the numbers tell you!

Q9: Can I integrate my payment solutions with other platforms or systems?

A: Yes! Most modern payment solutions offer integration with various ecommerce platforms, inventory management systems, and customer relationship management (CRM) tools. This not only simplifies your operations but also provides a more cohesive experience for your customers, allowing you to manage everything from one central hub.

Q10: What’s the first step I should take to improve my ecommerce payment solutions?

A: Start by researching your customers’ preferences and behaviors. Gather feedback through surveys or analyze purchase patterns to understand what payment methods they value most. From there, explore various payment solutions that align with those insights. Remember, the goal is to create an easy, enjoyable shopping experience that keeps your customers coming back for more!

By focusing on these aspects of payment solutions, you’ll not only meet but exceed your shoppers’ expectations, paving the way for a successful ecommerce venture.

In Retrospect

Conclusion: Elevate Your Ecommerce Game Today!

In the ever-evolving world of ecommerce, the payment process can often be the make-or-break moment for your shoppers. By offering the best ecommerce payment solutions, you’re not just simplifying transactions; you’re crafting an experience that builds trust and loyalty.

Imagine your customers breezing through the checkout process, feeling confident and secure every step of the way. When you prioritize payment solutions that cater to their needs—like multiple payment options, mobile friendliness, and top-notch security—you’re not just meeting expectations; you’re exceeding them.

So, why wait? Take the leap to enhance your ecommerce strategy today. Explore the options that work best for your business and your customers. Your shoppers deserve a seamless, enjoyable experience, and investing in the right payment solutions is the key to unlocking greater satisfaction, repeat business, and ultimately, your store’s success.

Let’s make shopping a joy, not a chore—transform your checkout process and watch your sales soar!