Are you tired of the daily grind, clocking in and out of a job that barely gives you the freedom or financial stability you dream of? If so, you’re not alone! Many people are on a quest for a better way to earn money—one that doesn’t require trading hours for dollars. Enter residual income, the game-changing concept that can help you build wealth while enjoying more time for the things you love. But what exactly is residual income, and how can you tap into its potential? In this article, we’ll break it down for you in simple terms, share compelling examples, and provide you with nine actionable ways to start generating your own residual income. So, grab a cup of coffee, get comfy, and let’s dive into a world where your money works for you!

Understanding Residual Income and Its Importance

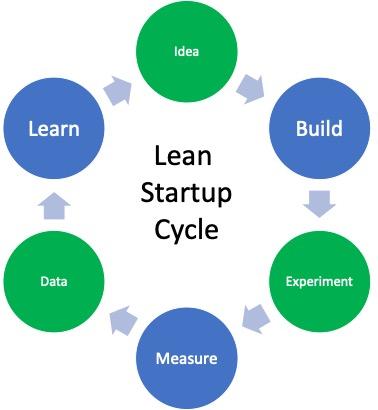

Residual income is a term that often sparks curiosity, especially among those eager to enhance their financial well-being. At its core, residual income refers to the money you continue to earn after the initial effort has been invested. This concept is essential because it allows individuals to build wealth over time without the continuous cycle of trading time for money.

Think of residual income as a river that keeps flowing even after you stop paddling. Once your work is done—be it through creating a product, developing a service, or establishing a rental property—the income continues to flow in. This means that you can enjoy financial freedom, pursue new ventures, or simply relish your leisure time without the constant worry of generating a paycheck.

Understanding the importance of residual income can be transformative. Here are a few reasons why it should be on everyone’s radar:

- Financial Security: With multiple streams of residual income, you can enhance your financial stability. This reduces the risk associated with relying solely on a job for your income.

- Time Freedom: By establishing income sources that don’t require constant attention, you gain the flexibility to spend your time on what truly matters to you.

- Wealth Building: Residual income can help in accumulating wealth over time, allowing you to invest in other opportunities, such as stocks, real estate, or even starting a new business.

There are various forms of residual income, each catering to different interests and skill sets. For instance, creative individuals might find success in writing books or creating online courses, while others may choose to invest in real estate or dividend-yielding stocks. The beauty of residual income lies in its diversity; there’s something for everyone.

When considering how to generate residual income, it’s crucial to remember the initial investment of time or resources. Although the goal is to create an income stream that requires minimal effort in the long run, the foundation is laid with dedication and hard work. This can involve researching, creating high-quality content, or effectively managing properties.

As you explore different avenues for earning residual income, consider these popular options:

- Real estate investments

- Dividend stocks

- Online courses or e-books

- Affiliate marketing

- Rental income from properties

residual income is not just a financial concept; it’s a pathway to freedom, security, and a brighter future. By understanding its principles and actively seeking ways to cultivate these income streams, you can position yourself for long-term success and enjoyment of life’s treasures.

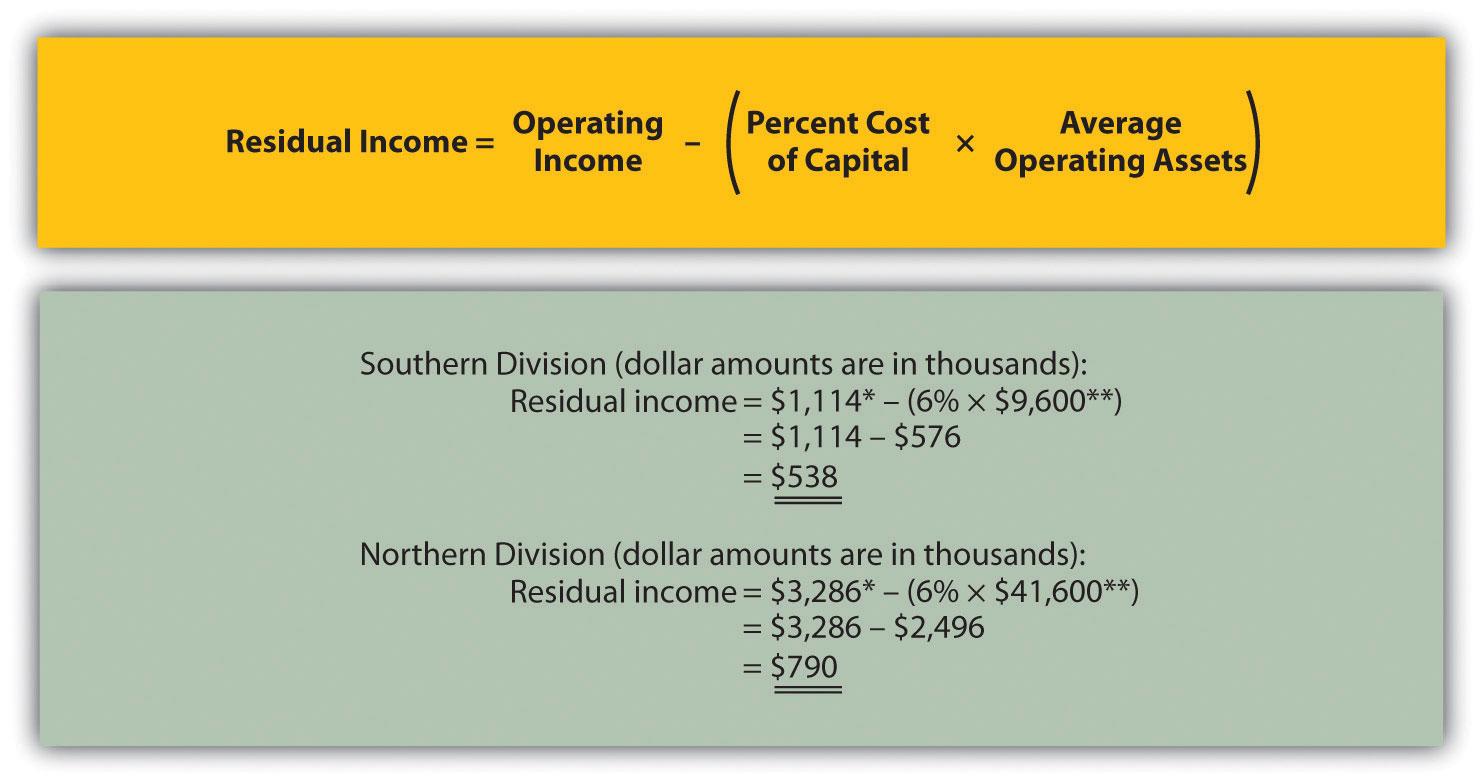

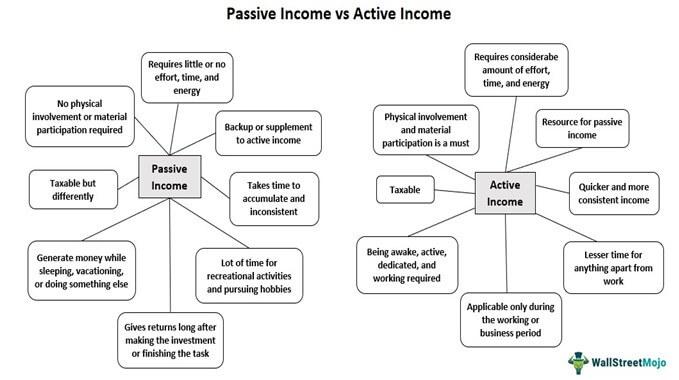

The Key Differences Between Active and Passive Income

When it comes to generating income, understanding the contrast between active and passive income can significantly impact your financial strategy. Active income is the money you earn through direct involvement in your work. Think of your paycheck from a job, commission from sales, or fees for freelance services. Essentially, if you stop working, the income stops flowing. This type of income requires continuous effort and time, making it less scalable and often more stressful.

On the flip side, passive income is the result of investments or business models that generate revenue with minimal ongoing effort. This allows you to earn money without being directly involved in the day-to-day operations. Here are some key characteristics that differentiate the two:

- Time Investment: Active income demands your time and energy consistently. In contrast, passive income often requires an upfront investment of time or money but can yield returns with little to no effort later on.

- Scalability: While active income is limited by the number of hours you can work, passive income has the potential to be scalable. You can create multiple streams without a proportional increase in effort.

- Risk and Reward: Active income usually feels secure since you know what to expect each pay period. Passive income, however, can come with higher risks, but also the potential for substantial rewards over time.

- Engagement Level: With active income, you are fully engaged in your work, which can be rewarding but can also lead to burnout. Passive income, on the other hand, allows for more freedom and flexibility, letting you engage in other pursuits or investments.

The mindset between the two types of income is crucial. Those who rely solely on active income may find themselves in a cycle of working for money, while those who embrace passive income can shift their focus to making money work for them. The long-term benefits of creating passive income streams can lead to financial independence, enabling you to enjoy life on your terms.

In essence, while both active and passive income have their places in your financial portfolio, striking a balance can be the key. Leveraging the strengths of passive income can free up time for personal interests, hobbies, or even more lucrative opportunities, ultimately enhancing your overall quality of life.

| Aspect | Active Income | Passive Income |

|---|---|---|

| Effort | Requires constant effort | Minimal ongoing effort |

| Source | Job, freelance gigs | Investments, royalties |

| Scalability | Limited | High potential |

| Risk | Generally low | Higher but rewarding |

How Residual Income Can Help You Achieve Financial Freedom

Residual income is a powerful tool in your financial toolkit, offering the promise of wealth without the constant grind of a traditional job. By generating income streams that require minimal ongoing effort after the initial setup, you can free up time for other pursuits, whether it’s spending time with family, traveling, or exploring new hobbies. Imagine waking up each day knowing that your bank account is still growing, all because of efforts you’ve made in the past.

One of the most compelling aspects of residual income is its potential to create a safety net. In today’s unpredictable economy, relying solely on a paycheck can be risky. By diversifying your income sources, you can mitigate this risk. If one income stream falters, others can continue to provide. This not only enhances your financial security but also boosts your confidence in making bigger life decisions, like pursuing your passions or even retiring early.

Consider the power of passive investments. Many investors generate residual income through stocks that pay dividends, real estate investments that yield rental income, or peer-to-peer lending. These investments require some initial capital and research, but once established, they can churn out income for years with little additional effort. This is wealth-building at its finest, allowing your money to work for you rather than the other way around.

Another avenue is digital products. Think of e-books, online courses, or apps that once created, can be sold repeatedly. After the initial creation phase, the efforts needed to maintain these products are often minimal, yet the income potential is substantial. Creatives and entrepreneurs who embrace this model can enjoy a steady stream of income while doing what they love.

It’s also worth mentioning how residual income can foster long-term wealth. The sooner you start building these income streams, the more significant the compounding effect can be. For example, investing in real estate can provide both cash flow from tenants and appreciation in property value over time. This dual benefit can lead to substantial financial growth, especially if properties are managed well.

Here’s a simple comparison of different types of residual income streams:

| Type | Initial Effort | Ongoing Maintenance | Income Potential |

|---|---|---|---|

| Dividend Stocks | High (research & investment) | Low | Moderate to High |

| Real Estate | High (purchase & management) | Moderate | High |

| Online Courses | High (creation) | Low | High |

| Affiliate Marketing | Moderate (setup) | Low | Variable |

the journey toward financial freedom is greatly enhanced by embracing residual income. It offers the possibility of earning money while enjoying life’s moments without the constant pressure of a 9-to-5 job. By strategically choosing your income streams and dedicating time to building them, you can secure your financial future and enjoy the benefits of truly passive income. So why wait? Start exploring the various ways to create residual income today and take control of your financial destiny!

Exploring Common Examples of Residual Income Streams

Residual income streams are an excellent way to build wealth while maintaining financial freedom. These income sources require minimal effort once they are established, allowing you to enjoy the fruits of your labor without constant oversight. Here are some common examples that can help you kickstart your journey toward financial independence.

Real Estate Investments are a popular choice for generating residual income. Whether you own rental properties or invest in real estate investment trusts (REITs), the rental payments can provide a steady stream of income. With the right property management, this can be a hassle-free source of cash flow, allowing you to earn while you sleep.

Dividend Stocks are another appealing option. By investing in companies that pay dividends, you can earn a portion of the company’s earnings without having to sell your shares. Many investors build a portfolio of dividend-paying stocks to create a reliable income stream that can be reinvested or taken as cash.

Peer-to-Peer Lending platforms have emerged as an innovative way to earn residual income. By lending money to individuals or small businesses, you can receive interest payments over time. While there are risks involved, the returns can be significantly higher than traditional savings accounts or bonds.

Online Courses or E-books can generate passive income once created. If you have expertise in a particular field, packaging your knowledge into an online course or e-book allows you to earn money without ongoing effort. Platforms like Udemy or Amazon Kindle Direct Publishing make it easy to reach potential customers.

Affiliate Marketing is another effective strategy. By promoting products or services through a blog or social media, you can earn commissions on sales generated through your affiliate links. This can be especially lucrative if you focus on a niche audience and build a trusted platform.

| Income Stream | Initial Effort | Potential Returns |

|---|---|---|

| Real Estate | High | Moderate to High |

| Dividend Stocks | Moderate | Moderate |

| Peer-to-Peer Lending | Low | High |

| Online Courses | High | High |

| Affiliate Marketing | Moderate | Variable |

Print on Demand services enable you to sell custom designs on merchandise like t-shirts, mugs, and more. Once your designs are created and uploaded, the platform handles production and shipping, allowing you to earn royalties with minimal ongoing effort.

Creating a Blog or YouTube Channel can also turn into a significant residual income stream. Once you build an audience, monetization through ads, sponsorships, and merchandise sales can provide consistent income. The key is to regularly produce engaging content that resonates with your audience.

Lastly, Licensing Your Photography or Art can generate residual income. If you have a knack for capturing stunning images or creating beautiful art, consider licensing your work to stock photo websites or galleries. Each time someone purchases your work, you earn a royalty, creating a continuous income stream from your creativity.

Investing in Real Estate for Long-Term Residual Income

Investing in real estate is one of the most effective strategies for generating long-term residual income. Unlike the fluctuations seen in other investment markets, real estate typically offers stability and a steady cash flow. Here are some key reasons why diving into real estate can be a smart move for your financial future:

- Consistent Cash Flow: Rental properties can provide a reliable monthly income, which can significantly contribute to your overall financial health.

- Appreciation: Over time, real estate tends to appreciate in value, allowing you to build equity and increase your net worth.

- Tax Benefits: Property owners can take advantage of numerous tax deductions, such as mortgage interest and depreciation, which can enhance your profitability.

- Diverse Investment Opportunities: From single-family homes to multi-unit buildings, there are various types of real estate investments to suit different budgets and risk tolerances.

One effective way to start investing in real estate is through rental properties. By buying properties and leasing them out, you can create a consistent income stream. However, it’s crucial to select properties in desirable locations with strong rental demand. Consider factors such as proximity to schools, transportation, and amenities to ensure your investment remains attractive to potential tenants.

Another option is to invest in Real Estate Investment Trusts (REITs). REITs allow you to invest in real estate without directly owning properties. By purchasing shares in a REIT, you can earn dividends from the income generated by the properties in the trust. This method also provides liquidity, as you can buy and sell REIT shares like stocks.

For those looking to take a more hands-on approach, house hacking can be a viable strategy. This involves purchasing a multi-unit property, living in one unit, and renting out the others. This not only helps cover your mortgage but can also generate a profit. It’s a great way to ease into real estate investing while minimizing your living expenses.

Additionally, consider the potential of flipping houses. This strategy involves buying undervalued properties, renovating them, and selling them at a profit. Although it requires more effort and carries more risk, successful flips can yield substantial returns and contribute to your long-term wealth accumulation.

Lastly, don’t forget to leverage financing options to maximize your purchasing power. By using mortgages, you can acquire properties with a smaller upfront investment. This strategy allows you to invest in multiple properties simultaneously, exponentially increasing your income potential over time.

| Investment Strategy | Pros | Cons |

|---|---|---|

| Rental Properties | Steady income, appreciation potential | Management responsibilities |

| REITs | Liquidity, no management | Limited control, market fluctuations |

| House Hacking | Reduced living costs, cash flow | Less privacy |

| Flipping Houses | High profit potential | High risk, requires capital |

Creating Digital Products That Keep Paying You

In the digital age, the landscape of income generation has dramatically evolved, offering countless opportunities to build wealth through innovative products. By creating digital products, you can set yourself up for residual income that flows in while you focus on other pursuits. Here are some popular avenues to consider:

- E-books: Write and publish an e-book on a topic you’re passionate about. Once it’s complete, sales can provide ongoing income.

- Online Courses: Share your expertise through video or written courses. Platforms like Udemy or Teachable enable you to reach a global audience.

- Membership Sites: Create a community around exclusive content, charging members a recurring fee for access.

- Stock Photos: If you’re a photographer, selling stock images can yield continuous royalties whenever someone uses your work.

- Printables: Design and sell planners, checklists, or other printable materials that customers can purchase and download instantly.

One of the most appealing aspects of digital products is the potential for scalability. Unlike physical goods, which require production and shipping, digital products can be replicated effortlessly. Once you’ve created your product, it can be sold an infinite number of times with minimal ongoing effort.

Moreover, leveraging various platforms increases your reach and sales opportunities. Consider using platforms such as:

| Platform | Type of Product | Revenue Model |

|---|---|---|

| Amazon Kindle | E-books | Royalty per sale |

| Udemy | Online Courses | Revenue share |

| Patreon | Membership Content | Monthly subscriptions |

| Adobe Stock | Stock Photos | Royalties per download |

Marketing your digital products is key to ensuring they continue to generate income. Use social media, email newsletters, and SEO strategies to attract traffic and convert visitors into buyers. Content marketing can be particularly effective; share valuable insights related to your product to build trust and establish yourself as an authority in your niche.

don’t forget about the power of automation. Tools like email marketing services and sales funnels can help you nurture leads and push customers toward purchasing without needing constant attention. Once set up, these systems can run in the background, allowing you to enjoy the fruits of your labor.

The Power of Affiliate Marketing for Ongoing Earnings

Affiliate marketing stands out as an incredibly powerful avenue for generating ongoing earnings. By leveraging the reach of your audience and the credibility of the brands you promote, you can create a sustainable income stream that grows over time. It’s not just about making a quick buck; it’s about building long-term relationships and a steady flow of revenue.

One of the most alluring aspects of affiliate marketing is its passive income potential. Once you have created content that integrates affiliate links, your work continues to earn money as long as it remains relevant and gets traffic. This means that you can earn commissions while you sleep, travel, or focus on other ventures. Imagine an income source that works for you, even when you are not actively engaging with it.

To harness the power of affiliate marketing effectively, consider the following strategies:

- Choose the Right Products: Partner with brands that resonate with your audience. Your recommendations should feel genuine and align with your content’s theme.

- Content Variety: Create a mix of content types—blogs, videos, podcasts, or social media posts—to keep your audience engaged and expose them to your affiliate links in various formats.

- Build Trust: Establish authority and trust with your audience. Authenticity is key; only promote products you believe in.

- Monitor Performance: Use analytics tools to track which products or strategies yield the best results. Adjust your approach based on data to maximize earnings.

Furthermore, affiliate marketing enables you to diversify your income sources. Instead of relying solely on one channel or product, you can partner with multiple brands across different niches. This diversification not only spreads risk but also increases your potential for earnings. For example, if one product line doesn’t perform well, others may compensate, ensuring a more consistent income stream.

Consider this simplified comparison of potential earnings across different affiliate programs:

| Affiliate Program | Commission Rate | Potential Monthly Earnings |

|---|---|---|

| Tech Gadgets | 10% | $500 |

| Online Courses | 40% | $800 |

| Fashion Brands | 15% | $300 |

As illustrated, even a small number of sales in high-commission niches can lead to significant earnings. Each affiliate partnership has its unique offerings, and the key is to explore opportunities that align with your audience’s interests and needs. With dedication and the right strategies, you can unlock the full potential of affiliate marketing, turning it into a lucrative source of residual income.

affiliate marketing is not merely a side hustle; it can evolve into a robust income-generating strategy. As you grow your online presence, nurture your relationships with both your audience and your affiliate partners, and continuously adapt your approach based on feedback and analytics, the potential for ongoing earnings is limitless. Start exploring and harnessing this powerful tool today!

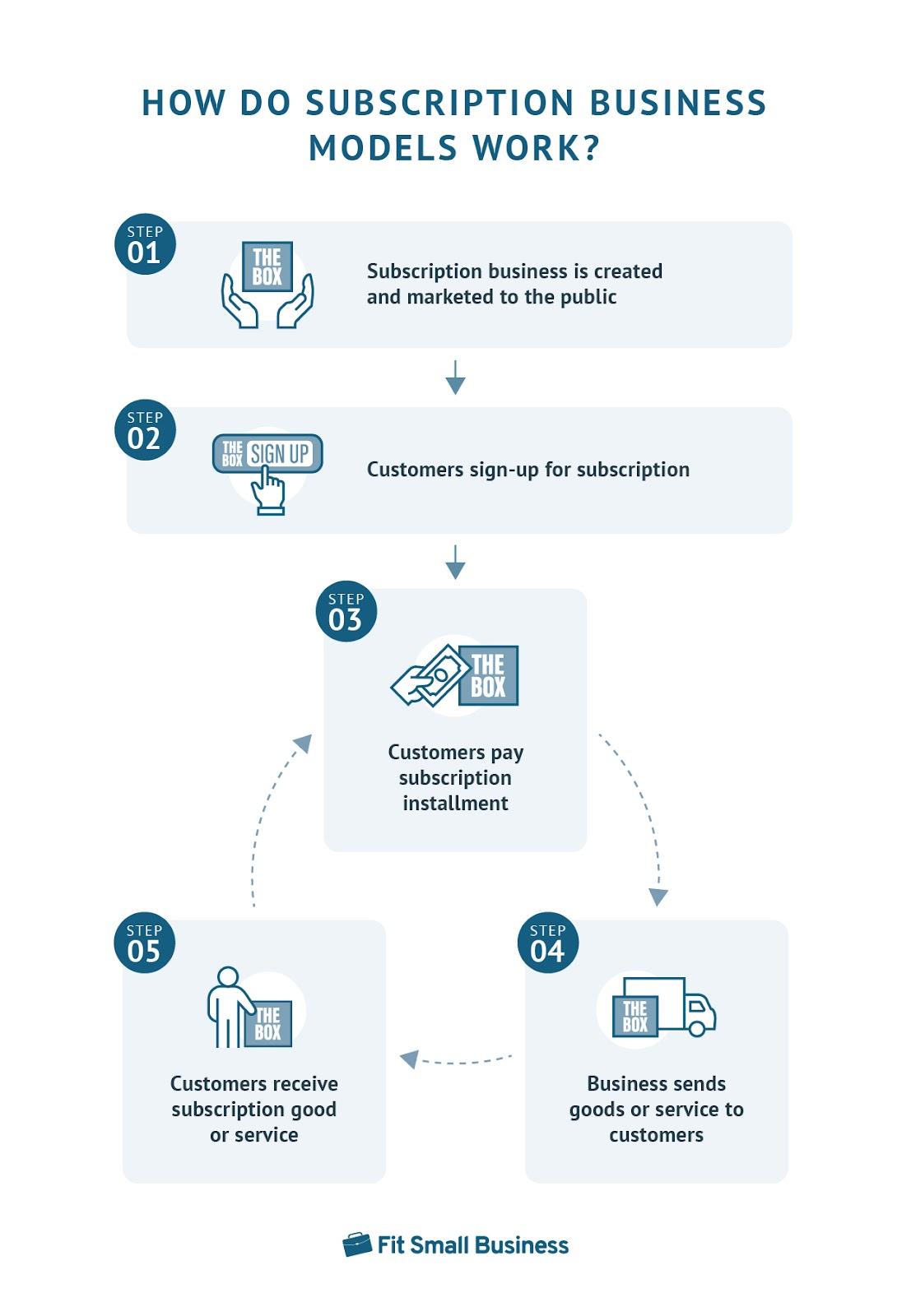

Building a Subscription-Based Business Model

One of the most effective ways to generate residual income is by creating a subscription-based business model. This approach not only provides a consistent revenue stream but also allows you to build lasting relationships with your customers. Unlike traditional sales models that rely on one-time transactions, subscriptions foster a sense of loyalty and recurring revenue, making them highly attractive for entrepreneurs.

When designing a subscription service, it’s crucial to identify a niche that resonates with your target audience. Here are some popular types of subscription models:

- Product Subscriptions: Monthly delivery of curated products, such as beauty boxes or snack packs.

- Service Subscriptions: Ongoing access to services like online courses, streaming platforms, or software tools.

- Memberships: Exclusive access to communities, content, or events for a fee.

Creating value is key to retaining subscribers. Ensure your offerings provide benefits that exceed the subscription cost. This could include:

- Regular updates or new content to keep subscribers engaged.

- Personalized experiences based on user preferences.

- Exclusive discounts or early access to new products.

Another essential aspect of a subscription model is pricing strategy. Consider a tiered pricing approach that offers different levels of service or product access. This can cater to varying customer preferences and budgets, maximizing your reach. Here’s a simple breakdown:

| Tier | Monthly Price | Benefits |

|---|---|---|

| Basic | $9.99 | Access to standard content and products. |

| Pro | $19.99 | Includes Basic benefits + exclusive content. |

| Premium | $29.99 | All benefits + personalized support and discounts. |

Marketing your subscription service effectively is crucial. Implement strategies such as:

- Social Media Campaigns: Showcase user experiences and testimonials to build trust.

- Email Marketing: Send regular newsletters with updates, tips, and promotional offers.

- Referral Programs: Encourage current subscribers to refer friends in exchange for discounts or freebies.

Ultimately, a subscription-based model is about creating a community around your brand. Engage with your customers consistently to gather feedback, understand their needs, and adapt your offerings accordingly. The more connected they feel, the more likely they are to stay subscribed and advocate for your brand, paving the way for sustained residual income.

Leveraging Your Skills for Freelance Residual Income

In today’s gig economy, many individuals are discovering the power of leveraging their unique skills to create streams of freelance residual income. This approach not only harnesses your talents but also provides financial stability beyond the traditional 9-to-5 job. Here are some effective strategies to turn your skills into passive income.

- Online Courses: If you excel in a particular subject, consider creating an online course. Platforms like Udemy and Teachable allow you to share your knowledge while earning money each time someone enrolls.

- E-books: Writing an e-book can be a lucrative way to package your expertise. Once published, it can generate sales long after the writing process is complete.

- Stock Photography: If photography is your forte, sell your images on stock photography websites. Every time someone downloads your photo, you earn a commission without any further effort.

- Membership Sites: Offer exclusive content or services through a membership site. This can be especially effective for niche markets where users are willing to pay for premium access.

- Affiliate Marketing: Use your blog or social media channels to promote products and earn commissions on sales made through your referral links.

Additionally, consider creating a YouTube channel or a podcast. Both platforms allow you to monetize your content through ads, sponsorships, and merchandise. Once set up, you can continue generating income from past episodes or videos as new viewers come in.

Another innovative way is to provide templates or digital products related to your skills. Whether it’s graphic design templates, resumes, or business plans, these can be sold repeatedly without incurring additional costs after the initial creation.

To assist you in visualizing your potential earnings from these avenues, here’s a quick overview of some popular options:

| Income Stream | Initial Effort | Long-term Earnings Potential |

|---|---|---|

| Online Courses | High | Very High |

| E-books | Medium | High |

| Stock Photography | Low | Medium |

| Membership Sites | Medium | Very High |

| Affiliate Marketing | Low | Variable |

Lastly, don’t underestimate the power of networking and collaboration. Partnering with others can amplify your reach and help you penetrate markets you may not have accessed alone. By synthesizing your talents with those of others, you can co-create products or services that benefit both parties while generating passive income.

Utilizing High-Yield Savings Accounts for Effortless Earnings

When it comes to building a stream of residual income, high-yield savings accounts (HYSAs) can serve as a solid foundation. These accounts provide a straightforward way to grow your savings while enjoying the benefits of liquidity. Unlike traditional savings accounts, HYSAs offer significantly higher interest rates, allowing your money to work harder for you without any extra effort.

Understand the Benefits:

- Higher Interest Rates: With rates often surpassing 1% or 2%, HYSAs can dramatically increase your earnings compared to standard accounts.

- Low Risk: These accounts are typically FDIC-insured, meaning your money is protected up to $250,000.

- Ease of Access: Your funds are easily accessible, so you can withdraw or transfer money as needed without penalties.

One of the most appealing aspects of HYSAs is the effortless nature of the income generated. Simply open your account, deposit your funds, and watch the interest accumulate. It’s almost like having a personal assistant working for you, tirelessly generating residual income without requiring your constant attention.

To maximize your earnings, consider these strategies:

- Automate Deposits: Set up automatic transfers from your checking account to your HYSA. This way, you consistently contribute to your savings without having to think about it.

- Shop Around: Not all HYSAs are created equal. Compare rates and features from different banks to find the best fit for your needs.

- Keep an Eye on Rates: Financial institutions can change interest rates, so make it a habit to regularly check if your bank is still offering competitive rates.

Another smart move is to use a HYSA as a temporary holding spot for funds you plan to invest later. This way, while you’re waiting to make the next investment, your cash isn’t just sitting idly; it’s earning interest. Additionally, HYSAs can serve as an emergency fund, ensuring that you have quick access to cash when unexpected expenses arise.

To illustrate the potential earnings, here’s a simple comparison table of savings over a year in different types of accounts:

| Account Type | Interest Rate | Amount Deposited | Interest Earned After 1 Year |

|---|---|---|---|

| Traditional Savings | 0.05% | $10,000 | $5 |

| High-Yield Savings | 2.00% | $10,000 | $200 |

As you can see, the difference is substantial. By simply choosing a high-yield savings account, you could boost your earnings significantly without any extra work. This makes it an attractive option for anyone looking to create a more passive stream of income.

integrating a high-yield savings account into your financial strategy can be a game changer. Whether you’re saving for a specific goal, looking to build an emergency fund, or simply wanting to earn more from your cash reserves, HYSAs provide a no-fuss solution. Embrace this opportunity to let your money grow effortlessly, paving the way for a more secure financial future.

Maximizing Your Investments Through Dividends

When it comes to optimizing your financial portfolio, tapping into the power of dividends can be a game-changer. Dividends are not just a reward for investing in stocks; they can be a significant source of residual income. Imagine receiving a steady stream of income simply for holding onto your investments! This is precisely what dividends offer.

Investing in dividend-paying stocks means you have the potential to earn money without selling your shares. Companies that pay dividends tend to be stable and well-established, often leading to less volatility in your investment portfolio. Plus, dividends can serve as a cushion during market downturns, providing you with cash flow when you need it most.

One of the most compelling aspects of dividends is the phenomenon known as compounding. By reinvesting dividends, you can purchase more shares, which in turn generates even more dividends. Over time, this can lead to exponential growth in your investment. To illustrate, consider the following hypothetical scenario:

| Year | Investment Value ($) | Annual Dividend ($) | Total Value ($) |

|---|---|---|---|

| 1 | 1,000 | 50 | 1,050 |

| 2 | 1,050 | 52.50 | 1,102.50 |

| 3 | 1,102.50 | 55.13 | 1,157.63 |

As shown in the table above, a small investment can grow significantly over time when you reinvest your dividends. This strategy not only augments your principal but also enhances your future dividend payouts.

Additionally, dividends can provide a hedge against inflation. While prices may rise, your dividends can also increase, especially if you invest in companies that have a history of raising their dividend payments. Here are a few tips to maximize your dividends:

- Research Dividend Aristocrats: These are companies that have consistently increased their dividends for 25 years or more.

- Look for High Dividend Yield: While a high yield can be tempting, ensure the company has strong fundamentals to sustain those payments.

- Diversify Your Holdings: Spreading your investments across different sectors can minimize risk.

- Stay Informed: Keep up with news about your investments, as changes in management and market conditions can impact dividend payments.

integrating dividend-paying investments into your strategy not only helps in generating passive income but also builds long-term wealth. The more you understand how to leverage dividends effectively, the closer you’ll be to achieving your financial goals.

Creating a Blog to Generate Passive Income Over Time

Starting a blog is one of the most effective ways to generate passive income over time. With the right strategy and dedication, you can create a platform that not only shares your passion but also allows you to earn money while you sleep. Here’s how you can set yourself up for success.

First and foremost, choose a niche that you are passionate about and that has a potential audience. This could be anything from travel, personal finance, or health and fitness, to niche topics like gaming or sustainable living. The key is to find a balance between your interests and what people are actively searching for. Use tools like Google Trends or keyword planners to identify popular topics within your chosen niche.

Once you’ve established your niche, it’s time to create high-quality content. Engaging and informative posts are what will attract readers to your blog. Aim for a mix of content types, such as how-to guides, listicles, and personal stories. Remember, consistency is vital; consider setting a schedule for posting new content, whether that’s weekly or bi-weekly. This not only keeps your audience engaged but also signals to search engines that your site is active.

Next, you’ll want to optimize your blog for search engines (SEO). Use relevant keywords throughout your posts, optimize your images with alt text, and ensure your site is mobile-friendly. Leverage meta descriptions and headings to improve your visibility. The better your blog ranks on Google, the more organic traffic you will attract, which is crucial for generating passive income.

Monetization strategies are essential for creating passive income. Here are a few avenues to consider:

- Affiliate Marketing: Promote products related to your niche and earn a commission for every sale made through your referral links.

- Sponsored Posts: Collaborate with brands that align with your values and get paid to write about their products or services.

- Digital Products: Create and sell eBooks, online courses, or printables that provide value to your audience.

- Ad Revenue: Join ad networks like Google AdSense to earn money from display ads on your blog.

It’s important to analyze the performance of your blog regularly. Use tools like Google Analytics to track visitor behavior and identify which content resonates most with your audience. This data can help you refine your strategy and focus on what generates the most traffic and income. Adjusting your approach based on analytics ensures that your blog continues to grow and attracts new readers.

| Income Stream | Pros | Cons |

|---|---|---|

| Affiliate Marketing | Low startup costs, passive income potential | Requires trust-building, can be competitive |

| Sponsored Posts | Good for established blogs, high payouts | Can be time-consuming to negotiate |

| Digital Products | High profit margins, scalable | Time-intensive to create initially |

| Ad Revenue | Passive income, easy to set up | May require high traffic for significant earnings |

Lastly, building a community around your blog can also enhance your passive income potential. Engage with your readers through social media, email newsletters, and comment sections. Foster relationships with your audience, and they will be more likely to support your monetization efforts. The more you connect, the more loyal your audience will become, ultimately leading to greater financial success.

Understanding the Risks and Rewards of Residual Income

Residual income, often seen as the holy grail of personal finance, represents earnings that continue to flow in after the initial effort has been put in. Understanding both the risks and rewards associated with this type of income can empower you to make informed decisions about your financial future. While the potential for financial freedom is enticing, it’s essential to approach residual income opportunities with a clear perspective.

Rewards:

- Financial Freedom: The most significant reward is the ability to earn money without actively working for it. This freedom opens doors to pursue passions, travel, or invest more time in family and friends.

- Scalability: Many residual income streams, such as online courses or e-books, can be scaled. Once created, they can continue to generate income with minimal extra effort.

- Diversification: By establishing multiple streams of residual income, you can reduce financial risk. If one source falters, others can help maintain your overall financial health.

- Legacy Building: Creating a residual income source can provide long-term benefits for you and your family, ensuring financial stability for future generations.

Risks:

- Initial Investment: Many residual income opportunities require upfront investment, whether it’s time, money, or both. If the venture fails, this investment could be lost.

- Market Volatility: Dependence on market conditions can impact certain residual income streams, such as real estate investments or dividend stocks.

- Time Commitment: While residual income can provide long-term benefits, establishing a stream often requires considerable initial time and effort. If you’re not prepared for this, results might be disappointing.

- Changing Trends: What’s popular today may not be tomorrow. Continuous learning and adaptation are vital to maintaining income sources that can be affected by shifts in consumer behavior.

To truly capitalize on the rewards while mitigating the risks, it’s essential to conduct thorough research and planning before diving into any residual income venture. A well-thought-out strategy might include:

- Identifying your skills and interests that could translate into residual income opportunities.

- Creating a budget that allows for initial investments without jeopardizing your financial stability.

- Regularly assessing your income streams and being willing to pivot when necessary.

Ultimately, the journey toward creating residual income is not just about generating wealth—it’s about achieving a lifestyle that aligns with your values and aspirations. Embrace the process, stay informed, and leverage both the risks and rewards to build a robust financial future.

Taking the First Steps Towards Your Residual Income Journey

Embarking on the journey of earning residual income can feel overwhelming, but taking the first steps doesn’t have to be complicated. The key is to start small and build your knowledge as you progress. Here’s how you can initiate your path towards financial freedom:

Define Your Goals: Before you dive into the various methods of generating residual income, take a moment to clarify your goals. Ask yourself:

- What amount of extra income do you want to generate?

- How much time can you dedicate to this endeavor?

- What skills or resources do you currently possess?

Educate Yourself: Knowledge is power. Invest in courses, read books, or consume content about residual income streams. Understanding the landscape will help you identify opportunities that align with your interests. Look for:

- Online courses on passive income strategies

- Podcasts featuring successful entrepreneurs

- Blogs and articles that outline actionable steps

Assess Your Financial Situation: It’s crucial to know where you stand financially before pursuing residual income. Create a simple budget that outlines your current expenses and income. This will help you determine how much you can invest in your new ventures. Consider:

| Income Source | Amount ($) |

|---|---|

| Salary | 3,000 |

| Investments | 500 |

| Side Hustle | 200 |

| Total | 3,700 |

Choose Your Income Stream: Once you have a clearer picture of your goals and finances, it’s time to select a residual income stream that resonates with you. Some popular options include:

- Real estate investments

- Creating digital products like e-books or courses

- Affiliate marketing

- Investing in dividend-paying stocks

Start Small: There’s no need to go all-in right away. Begin with one stream of income and gradually expand as you gain confidence and experience. This approach reduces risk and gives you a chance to learn from any missteps along the way.

Network and Collaborate: Surround yourself with like-minded individuals. Join online communities or local groups focused on passive income. Sharing ideas and experiences can accelerate your growth and provide support when challenges arise.

Frequently Asked Questions (FAQ)

Q: What is residual income?

A: Great question! Residual income, sometimes called passive income, is the money you continue to earn after the effort has been put in. Think of it like a stream of income that flows to you long after you’ve completed the hard work. For example, if you create a digital product, like an eBook, you put in the effort upfront, and then you can continue to earn from it every time someone buys it without additional work.

Q: Why is residual income important?

A: Residual income is crucial because it can help you achieve financial freedom. Unlike traditional income, which requires you to trade time for money, residual income allows you to make money while you sleep. It gives you the flexibility to pursue other passions or spend more time with loved ones, ultimately leading to a more balanced and fulfilling life.

Q: Can you give me some examples of residual income?

A: Absolutely! Here are a few examples:

- Royalties from creative work: If you write a book or produce music, you earn royalties every time someone purchases your work.

- Rental income: Owning rental properties allows you to earn monthly rent without having to work for it continuously.

- Dividends from stocks: Investing in dividend-paying stocks means you earn a portion of the company’s profits simply because you own the shares.

- Affiliate marketing: If you run a blog or a website, you can earn commissions by promoting products and services, sometimes long after the initial content creation.

Q: How can I start earning residual income today?

A: There are plenty of ways to start! Here are nine effective methods:

- Create an online course: Share your expertise while earning money from course sales.

- Invest in dividend stocks: Build a portfolio that pays you dividends regularly.

- Write an eBook: Leverage your knowledge in a particular area and sell it online.

- Start a blog: Use ads, affiliate links, and sponsorships to generate income from your content.

- Develop an app: Create an app that provides value and earns through ads or subscriptions.

- Real estate investments: Consider investing in rental properties or real estate funds.

- License your photography: Sell your images on stock photography sites to earn royalties.

- Peer-to-peer lending: Lend money through platforms and earn interest.

- Create a YouTube channel: Monetize your videos through ads and sponsorships.

Q: Is it really possible to earn residual income without much effort?

A: While the idea of “earning money while you sleep” is appealing, it does require effort upfront! The key is to choose a method that aligns with your skills and interests. With a solid plan and persistence, you can build a reliable stream of residual income that enhances your life.

Q: What’s the biggest mistake people make when trying to earn residual income?

A: The biggest mistake is expecting quick results without putting in the hard work initially. Many people jump in thinking it’s easy, only to get discouraged when it takes time to see returns. Building residual income is like planting a tree; you must nurture it before you can enjoy the shade and fruits it provides.

Q: How long does it take to start seeing residual income?

A: It varies based on the method you choose and the effort you put in. Some avenues, like blogging or creating an online course, can take months to build up before you see substantial income. Others, like real estate, may take longer due to the initial investment. Patience and consistency are key!

Q: Can anyone earn residual income?

A: Yes! With the right mindset, dedication, and a willingness to learn, anyone can earn residual income. It doesn’t matter your background or current financial situation; what matters is your commitment to taking action and exploring opportunities.

Q: How can I stay motivated while building my residual income streams?

A: Setting clear, achievable goals can keep you motivated. Celebrate your milestones, no matter how small, and remind yourself of the bigger picture—financial freedom and the ability to enjoy life on your terms. Surround yourself with like-minded individuals or communities that inspire and encourage you through your journey.

By taking the time to understand and implement residual income strategies, you’re not just earning money; you’re building a lifestyle that supports your dreams and aspirations. So what are you waiting for? Dive in and start exploring those opportunities!

In Retrospect

As we wrap up our exploration of residual income, it’s clear that this financial strategy can be a game changer for anyone looking to build wealth and achieve greater financial freedom. Whether you’re just starting out or looking to diversify your income streams, incorporating residual income into your financial plan can pave the way for a more secure and fulfilling future.

Remember, the beauty of residual income lies in its potential to work for you, even while you sleep. From rental properties to digital products, the possibilities are vast and varied. By investing time and effort into one or more of these avenues, you can create a steady cash flow that does not depend solely on your active work hours.

So, why not take the plunge? Start exploring the options that resonate with you, and take actionable steps towards building your own residual income streams. The journey may require some patience and perseverance, but the rewards—both financial and personal—can be truly life-changing.

Thanks for joining us on this journey into the world of residual income! Here’s to your future financial success and the freedom that comes with it. Happy earning!