Introduction: Navigating the World of Ecommerce Payment Processing

Hey there, fellow online entrepreneur! If you’re diving into the world of ecommerce, you already know that a seamless shopping experience is key to keeping your customers happy. But what’s often overlooked is the powerhouse behind those smooth transactions: payment processing. With so many options available, it can feel overwhelming to choose the right service for your business. That’s where we come in! In this guide, we’re breaking down the top seven ecommerce payment processing services that can elevate your online store and boost your sales. Whether you’re just starting out or looking to optimize your existing setup, we’ll cover everything you need to know to make an informed choice. So grab a cup of coffee, get comfy, and let’s explore how the right payment processor can transform your ecommerce game!

Understanding the Basics of Ecommerce Payment Processing

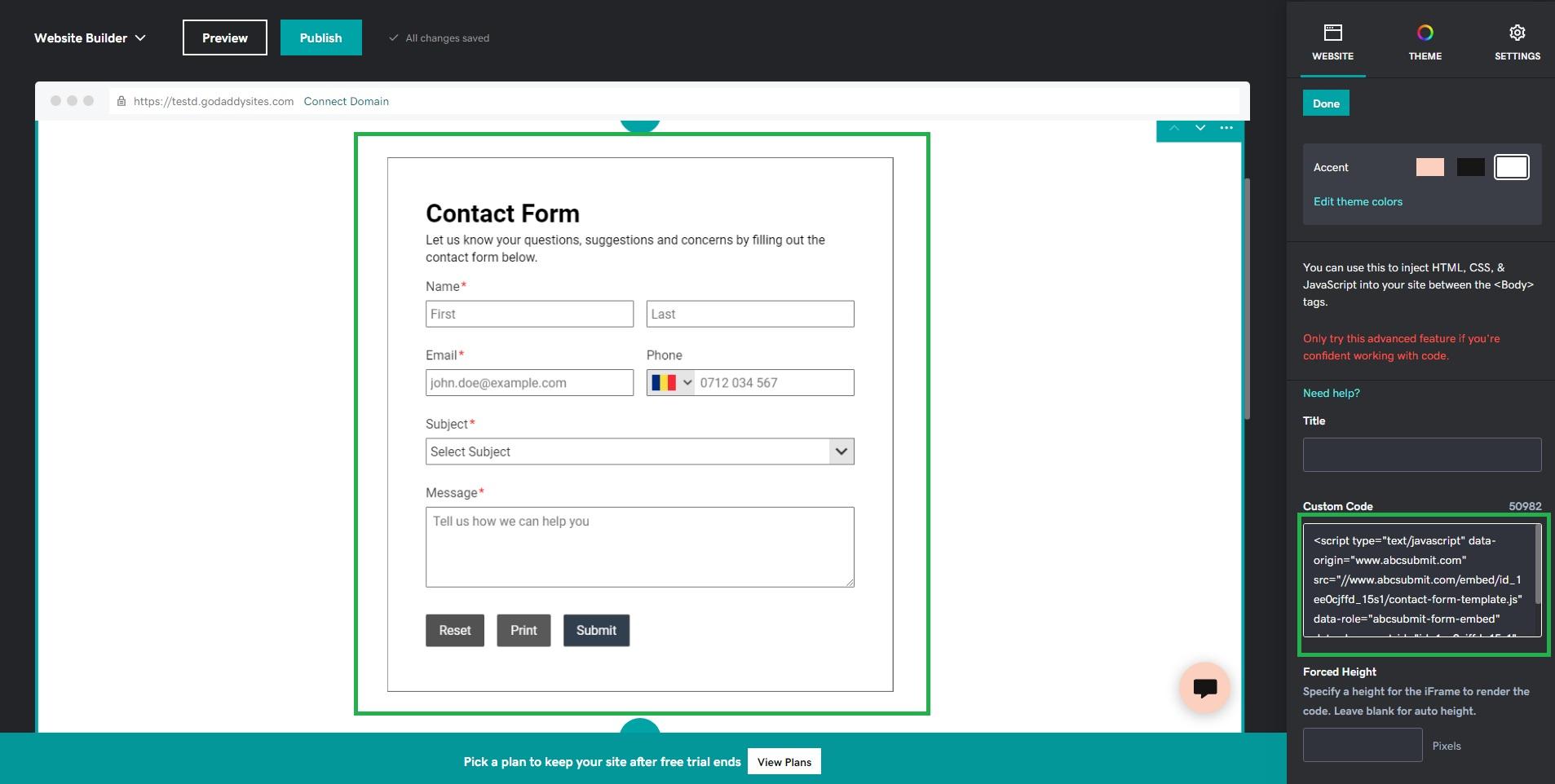

In the world of online commerce, understanding how payment processing works is crucial for any business owner looking to succeed. At its core, ecommerce payment processing involves the steps that allow customers to securely pay for goods and services over the internet. This process not only ensures that transactions are completed smoothly but also protects sensitive customer information.

Payment processing generally includes a few key components:

- Payment Gateway: This is the technology that captures and transfers payment data from the customer to the merchant. It acts as a middleman, securely transmitting the transaction information.

- Merchant Account: A merchant account is a type of bank account that allows a business to accept payments via credit or debit cards. It’s essential for facilitating transactions.

- Payment Processor: This service handles the transaction, ensuring that funds are transferred from the customer’s bank account to the merchant’s account.

- Security Protocols: Payment processing must adhere to strict security standards, including encryption protocols like SSL and compliance with PCI DSS to protect customer data.

When a customer makes a purchase, the journey of their payment begins with the payment gateway. The gateway encrypts the transaction details and sends them to the payment processor. Here, the processor verifies the transaction with the customer’s bank, checks for sufficient funds, and ensures that no fraudulent activity is taking place. Once everything checks out, the transaction is approved, and the payment is settled into the merchant account.

Moreover, it’s important to consider the various types of payment methods customers prefer, as this can significantly impact your sales. Offering a variety of payment options can enhance the customer experience and increase conversion rates. Common methods include:

- Credit and Debit Cards

- Digital Wallets (PayPal, Apple Pay, Google Pay)

- Bank Transfers

- Buy Now, Pay Later services

Each payment processor has its unique features, fees, and processing times. To help you make an informed decision, here’s a simple comparison table of some popular payment processors:

| Processor | Transaction Fee | Settlement Time | Best For |

|---|---|---|---|

| Stripe | 2.9% + 30¢ | 2 business days | Online startups |

| PayPal | 2.9% + 30¢ | Instant or up to 3 days | Freelancers & small businesses |

| Square | 2.6% + 10¢ | 1-2 business days | Brick-and-mortar stores |

| Authorize.Net | 2.9% + 30¢ | 1-2 business days | Established businesses |

Understanding these elements of payment processing not only helps you choose the right service but also equips you to create a seamless shopping experience for your customers. Remember, a smooth checkout process can lead to higher customer satisfaction and increased loyalty. In the fast-paced world of ecommerce, adopting the right payment processing strategies is not just an option; it’s a necessity.

Why Choosing the Right Payment Service Matters for Your Business

In today’s fast-paced digital marketplace, the payment service you choose can make or break your eCommerce venture. Having the right payment processing system not only enhances the customer experience but also ensures your business operates smoothly. When customers encounter friction during the checkout process—be it through slow transactions, complicated interfaces, or limited payment options—they are likely to abandon their carts, leading to lost sales.

One of the key factors to consider when selecting a payment service is security. Today’s consumers are increasingly concerned about the safety of their financial information. A robust payment gateway that complies with PCI DSS (Payment Card Industry Data Security Standard) can instill confidence in your customers, making them more likely to complete their purchases. This trust translates directly into increased conversion rates.

Another important aspect is transaction fees. Different services have varying fee structures, which can significantly impact your bottom line. When evaluating payment processors, take the time to analyze:

| Payment Service | Transaction Fee | Monthly Fee |

|---|---|---|

| Service A | 2.9% + $0.30 | $0 |

| Service B | 2.5% + $0.20 | $10 |

| Service C | 3.0% + $0.25 | $20 |

Consider your business model and sales volume when evaluating these fees. A service with lower transaction fees might be advantageous for high-volume sales, while a flat monthly fee could benefit businesses with fewer transactions.

Additionally, the flexibility of payment options can greatly enhance your sales potential. Make sure your chosen provider supports various payment methods, including credit cards, digital wallets, and even cryptocurrencies. This variety allows you to cater to different customer preferences, making it easier for them to complete their purchases.

Moreover, integration capabilities with your existing eCommerce platform cannot be overlooked. A payment service that seamlessly integrates with your website can streamline operations and reduce the likelihood of technical issues that might deter potential buyers. Look for services that offer plugins or APIs that facilitate easy setup and maintenance.

Lastly, customer support is an essential factor that often goes unnoticed until problems arise. Reliable and responsive support can save you time and stress during critical moments, such as peak sales periods or during a system outage. Always check for availability of support channels and read reviews to gauge the reliability of the service.

Exploring the Top Payment Processing Services You Should Consider

When it comes to running a successful eCommerce business, choosing the right payment processing service is crucial. With the plethora of options available, it’s essential to find a solution that aligns with your business goals, customer preferences, and budget. Let’s dive into some of the top payment processing services that can enhance your online store’s capabilities.

1. PayPal

One of the most well-known names in online payments, PayPal offers a user-friendly interface and robust security features. It’s a great choice for small to medium-sized businesses, allowing you to accept credit cards, debit cards, and PayPal transactions without a lengthy approval process. Additionally, PayPal’s extensive buyer protection policies can help build customer trust.

2. Stripe

Loved by developers for its flexibility, Stripe is ideal for businesses looking to customize their payment solutions. It supports a wide array of payment methods and currencies, making it a global favorite. The seamless integration with various eCommerce platforms allows you to manage transactions efficiently. Plus, its transparent fee structure means no hidden surprises.

3. Square

Square is particularly popular among brick-and-mortar businesses transitioning online. It offers a comprehensive suite of tools, from payment processing to inventory management. With its intuitive dashboard, you can track sales and customer data effortlessly. Square’s flat-rate pricing model makes it easy to budget your costs, especially for new businesses.

4. Authorize.Net

A veteran in the payment processing game, Authorize.Net is a reliable choice that excels in customer support. It provides a secure platform for various payment options, including eChecks. With its advanced fraud detection tools, you can rest easy knowing that your transactions are safe. Its user-friendly interface allows for easy integration into your existing eCommerce solution.

5. Braintree

Owned by PayPal, Braintree is designed for businesses that want to offer a seamless payment experience. It supports a variety of payment options, from credit cards to digital wallets like Apple Pay and Google Pay. Braintree’s easy-to-navigate dashboard helps you manage transactions and customer data in real-time. Plus, its advanced features like recurring billing make it ideal for subscription-based businesses.

6. Adyen

Adyen is a global payment processing service that caters to businesses of all sizes. It allows you to accept payments in over 150 currencies and offers a unified platform for online, mobile, and in-store transactions. With advanced analytics and reporting tools, Adyen empowers you to make data-driven decisions to enhance customer experience and sales.

7. 2Checkout (now Verifone)

2Checkout provides a comprehensive payment solution for eCommerce businesses aiming for international reach. Its multi-currency support and localization features can help you connect with customers worldwide. The platform also offers detailed reporting tools to help you track revenue and customer behavior more efficiently.

Choosing the right payment processing service can make or break your online store. Make sure to consider factors like transaction fees, payment options, and customer support when making your selection. The right service not only streamlines your operations but also enhances customer satisfaction, paving the way for your eCommerce success.

A Closer Look at PayPal: Is It Right for Your Ecommerce Store?

PayPal has long been a staple in the realm of online payment processing, and for good reason. With its widespread recognition and trust, it has become synonymous with ecommerce transactions. But is it the right fit for your store? Let’s break it down.

One of the biggest advantages of using PayPal is its ease of use. Setting up an account takes minutes, and integrating it into your ecommerce platform can often be done with just a few clicks. Here’s what makes it stand out:

- Instant transaction approval: Customers appreciate the instantaneous nature of transactions, which can lead to reduced cart abandonment rates.

- Multiple payment options: Customers can pay using credit cards, bank accounts, or their PayPal balance, offering flexibility that many shoppers desire.

- Mobile-friendly: With a growing number of purchases made on mobile devices, PayPal’s responsive design helps ensure a smooth checkout experience.

However, it’s essential to weigh these benefits against some potential drawbacks. PayPal does charge fees that can add up, particularly for international transactions or when using certain payment methods. Here’s a quick overview of the fee structure:

| Transaction Type | Fee |

|---|---|

| Domestic Sales | 2.9% + $0.30 per transaction |

| International Sales | 4.4% + fixed fee based on currency |

| Micropayments | 5% + $0.05 per transaction |

Moreover, PayPal’s customer service can sometimes leave users wanting more. Reports of lengthy resolution times and difficulties in obtaining support can be frustrating, especially when you’re relying on their services for your business operations. It’s crucial to consider how much support you might need.

Another factor to consider is security. PayPal is known for its strong fraud protection measures, which can instill confidence in your customers. However, as with any platform, there are always risks. Ensuring that your ecommerce store complies with security standards is essential to protect your business and your customers.

consider your target audience. PayPal is popular in many regions, but if your primary market is in an area where alternative payment methods are favored, it may be worth exploring other options. Understanding your customers’ preferences can guide you in selecting the best payment processor for your ecommerce store.

Stripe Uncovered: The Benefits of Using This Payment Solution

When it comes to choosing a payment solution for your ecommerce business, Stripe stands out as a front-runner. This platform is not just about payment processing; it offers a suite of features designed to enhance the customer experience and streamline your operations.

One of the most significant advantages of using Stripe is its seamless integration with various ecommerce platforms. Whether you’re using Shopify, WooCommerce, or Magento, Stripe can be effortlessly embedded into your existing setup. This means you can start accepting payments without the hassle of lengthy technical configurations.

Another remarkable feature of Stripe is its robust security measures. Stripe provides advanced fraud detection tools that help safeguard both your business and your customers. With SSL encryption and PCI compliance, you can rest easy knowing that sensitive payment information is protected. This not only builds trust with your customers but also minimizes chargebacks and fraud-related losses.

Stripe also offers flexible payment options, allowing businesses to accept various forms of payment, including credit cards, digital wallets like Apple Pay and Google Pay, and even cryptocurrencies. This versatility means you can cater to a broader audience and provide a more convenient shopping experience, potentially increasing your conversion rates.

One aspect that often goes unnoticed is Stripe’s in-depth analytics and reporting tools. The platform provides you with detailed insights into your transactions, customer behaviors, and sales trends. These analytics are invaluable for making informed decisions about marketing strategies and inventory management, ultimately driving your business growth.

Additionally, Stripe’s subscription billing options make it an excellent choice for businesses with a recurring revenue model. You can easily set up subscription plans, manage billing cycles, and even offer trial periods, all within a user-friendly dashboard. This functionality can help you foster customer loyalty and generate consistent revenue streams.

Furthermore, Stripe is known for its excellent customer support. Whether you encounter technical issues or have questions regarding features, their dedicated support team is readily available to assist. The comprehensive documentation and active community forums also provide resources that can help you troubleshoot and optimize your payment processing.

| Feature | Benefit |

|---|---|

| Seamless Integration | Easy setup with various ecommerce platforms |

| Security | Advanced fraud detection and PCI compliance |

| Payment Flexibility | Supports multiple payment methods including cryptocurrencies |

| Analytics | In-depth reporting to inform business decisions |

| Subscription Management | Facilitates recurring billing for stable revenue |

| Customer Support | Responsive support and extensive resources |

choosing Stripe as your payment solution can pave the way for a more efficient and customer-friendly ecommerce experience. With its robust features and commitment to security, it’s a choice that can significantly benefit your business in today’s competitive market.

Square’s Advantages and How It Fits into Your Ecommerce Strategy

When it comes to choosing a payment processor for your online store, Square stands out as a robust option that seamlessly integrates with various ecommerce platforms. One of its primary advantages is its simplicity; Square offers an intuitive interface that allows you to manage your transactions effortlessly, making it perfect for both seasoned pros and newcomers in the ecommerce space.

Another significant advantage is transparent pricing. Square employs a straightforward fee structure that eliminates the headaches associated with hidden charges. You pay a flat rate per transaction, which helps you budget effectively and understand where your costs are going. This transparency fosters trust with your customers, as they won’t encounter unexpected fees during checkout.

Moreover, Square provides a range of tools and features that cater specifically to ecommerce needs. From inventory management to customer engagement tools, Square equips you with everything necessary to streamline your operations. Here’s a quick look at some key features:

- Inventory Management: Track stock levels in real time.

- Analytics: Gain insights into sales trends and customer behaviors.

- Invoicing: Create professional invoices quickly and easily.

- Multi-channel Selling: Integrate with various platforms like Shopify and WooCommerce.

Another compelling aspect of Square is its robust security measures. The platform is PCI compliant, ensuring that sensitive customer data is protected. This builds confidence among your consumers, knowing that their information is secure, which can lead to higher conversion rates.

Importantly, Square’s mobile payment options cater to the growing trend of mobile commerce. With the Square app, customers can make purchases directly from their smartphones, enhancing the shopping experience. This is especially beneficial for businesses that engage in pop-up shops or local markets, as you can process payments on-the-go without missing a beat.

Lastly, Square continuously evolves by offering new features and integrations. Whether you need email marketing tools, loyalty programs, or even appointment scheduling, Square’s ecosystem grows with your business needs. This adaptability ensures that you’re not just investing in a payment processor but a partner in your ecommerce journey.

integrating Square into your ecommerce strategy can offer significant benefits that enhance both your operational efficiency and customer satisfaction. By leveraging its features, transparent pricing, and strong security measures, you can create a smoother, more trustworthy shopping experience that encourages repeat business and builds brand loyalty.

The Convenience of Authorize.Net: A Trusted Option for Merchants

If you’re a merchant looking for a reliable and efficient payment processing solution, Authorize.Net stands out as a formidable option. With its long-standing reputation in the industry, it offers a suite of features designed to streamline transactions and enhance customer experiences.

One of the major advantages of using Authorize.Net is its robust security measures. The platform employs advanced fraud detection tools and end-to-end encryption, ensuring that both merchants and customers are protected from potential threats. This level of security not only fosters trust but also helps in maintaining compliance with PCI DSS standards.

Another key feature is the user-friendly interface. Navigating through the dashboard is a breeze, whether you’re processing payments, generating reports, or managing customer data. This simplicity helps merchants focus more on growing their businesses rather than getting bogged down in technical details.

Authorize.Net also provides excellent customer support. Their dedicated team is available 24/7 to assist with any issues that may arise, ensuring that merchants can resolve payment-related concerns quickly. This reliability is invaluable in an eCommerce environment where time is money.

In terms of integration, Authorize.Net seamlessly connects with a variety of shopping carts and eCommerce platforms. This flexibility allows merchants to choose their preferred tools and workflows without worrying about compatibility issues. A few popular integrations include:

- WooCommerce

- Shopify

- Magento

- BigCommerce

Another noteworthy aspect is its transaction options. Merchants can accept various payment methods, including credit and debit cards, eChecks, and digital wallets. This wide range of accepted payments accommodates different customer preferences, leading to higher conversion rates.

To further illustrate the advantages of using Authorize.Net, here’s a brief comparison of its pricing models:

| Plan | Monthly Fee | Transaction Fee |

|---|---|---|

| Starter | $25 | 2.9% + $0.30 |

| Advanced | $49 | 2.5% + $0.30 |

| Enterprise | Custom Pricing | Negotiable |

Ultimately, Authorize.Net offers merchants a blend of reliability, security, and flexibility that few can match. With its comprehensive services, it empowers businesses to thrive in the competitive eCommerce landscape. If you’re considering a payment processing solution, Authorize.Net deserves a close look.

Shopify Payments: Seamless Integration for Your Online Store

When it comes to setting up your online store, choosing the right payment processing solution can be a game changer. Shopify Payments offers a seamless integration that simplifies the entire process, allowing you to focus on growing your business rather than navigating complex payment setups.

With Shopify Payments, you can enjoy a range of benefits, including:

- Instant Setup: Get started quickly with no third-party accounts needed.

- Integrated Experience: All transactions are managed directly from your Shopify dashboard.

- Competitive Rates: Transparent transaction fees that allow you to keep more of your profits.

- Multiple Payment Options: Accept credit cards, Apple Pay, and Google Pay, providing flexibility for your customers.

One of the standout features of Shopify Payments is its ability to provide detailed analytics. You can track sales and revenue in real-time, enabling you to make informed decisions to enhance your store’s performance. This deep integration means you won’t have to juggle data between different systems, saving you time and reducing errors.

Security is also a top priority with Shopify Payments. The platform complies with PCI DSS standards, ensuring that all sensitive customer data is protected. With Shopify handling the security aspects, you can ease any worries about data breaches or fraud.

Another significant advantage is the ability to manage chargebacks efficiently. Shopify Payments offers an easy-to-navigate system for handling disputes, which can save you both time and stress as you work to resolve any issues that might arise.

| Feature | Description |

|---|---|

| Instant Setup | No third-party accounts—quick and easy to start. |

| Integrated Dashboard | Manage all transactions in one place. |

| Security Compliance | Meets PCI DSS standards for data protection. |

| Customer Flexibility | Supports various payment methods for customer convenience. |

Shopify Payments is designed to take the hassle out of ecommerce transactions. By integrating this payment solution, you not only enhance your customer’s shopping experience but also equip your business with the tools needed for success in the competitive online marketplace. It is a robust option that meets the evolving needs of your store, making it a top choice for ecommerce entrepreneurs.

Evaluating Transaction Fees: What to Expect with Different Services

When it comes to ecommerce, understanding transaction fees is crucial for maintaining healthy profit margins. Each payment processing service has its own fee structure, which can significantly affect your bottom line. Here’s a breakdown of what you can expect with various services:

Percentage-Based Fees: Most services charge a percentage of each transaction, typically ranging from 1.5% to 3.5%. This model means that as your sales increase, so do your fees. Be sure to calculate how these percentages will impact your overall revenue. For example:

| Service | Percentage Fee | Example Fee on $100 Sale |

|---|---|---|

| Service A | 2.9% | $2.90 |

| Service B | 2.5% | $2.50 |

| Service C | 3.1% | $3.10 |

Flat Fees: Some services may offer a flat fee per transaction. This can be beneficial for businesses with lower average order values, as you know exactly what to expect. For instance, if a service charges a flat fee of $0.30 plus a percentage, this can be more predictable and manageable.

Monthly Fees: Other payment processors might charge a monthly fee in addition to transaction fees. This can be worthwhile if the service provides additional features such as advanced reporting or fraud protection. Be sure to weigh the cost of these monthly fees against the potential benefits they offer.

Hidden Fees: Watch out for hidden fees that can sneak up on you! Some services may charge for chargebacks, refunds, or even account maintenance. Always read the fine print and ask questions before committing to a processor. Transparency is key.

Discounted Rates: If you process high volumes of transactions, some providers may offer discounted rates. This can be a great incentive for growing businesses, ensuring that you keep more of your hard-earned revenue as you scale.

International Transactions: If you’re selling globally, be aware that international transactions often come with higher fees due to currency conversion rates and cross-border charges. Consider whether the potential sales from international customers outweigh the additional costs.

Ultimately, evaluating transaction fees requires a careful analysis of your business model and sales projections. By understanding the fee structures of different services, you can make an informed decision that supports your growth and maximizes your profits.

Security Matters: Protecting Your Customers Payment Information

Why Security Should Be Your Top Priority

In the digital age, safeguarding your customers’ payment information is not just a regulatory requirement; it’s an essential aspect of maintaining trust and credibility. When customers share their sensitive financial data, they expect you to handle it with the utmost care. A breach can not only lead to financial losses but can also severely damage your brand’s reputation.

Understanding Payment Security

Payment security revolves around protecting the data that is exchanged during a transaction. Here are some key components to consider:

- Encryption: This technology scrambles data, making it unreadable to unauthorized users.

- Tokenization: Replacing sensitive information with unique identifiers or tokens helps minimize the risk of exposure.

- Secure Sockets Layer (SSL): An SSL certificate encrypts information sent over the internet, ensuring that all data remains private.

Implementing Best Practices

To create a secure environment for online transactions, adhere to these best practices:

- Regular Security Audits: Conduct frequent assessments of your payment processing systems to identify vulnerabilities.

- Compliance with Standards: Follow PCI DSS (Payment Card Industry Data Security Standards) to ensure your business meets necessary security benchmarks.

- Customer Education: Inform your customers about safe online practices and how they can protect their own information.

Choosing the Right Payment Processor

Not all payment processors are created equal when it comes to security. Look for providers that offer robust security features. Here’s a quick comparison table to highlight essential security attributes:

| Payment Processor | Encryption | Tokenization | Fraud Detection |

|---|---|---|---|

| Processor A | Yes | Yes | Advanced |

| Processor B | Yes | No | Basic |

| Processor C | Yes | Yes | Comprehensive |

Monitoring and Response

Even with the best security measures in place, the possibility of a data breach exists. Therefore, it’s crucial to establish a response plan. This plan should include:

- Incident Detection: Use automated systems to monitor transactions for suspicious activity.

- Immediate Response: Have a dedicated team ready to act swiftly in the event of a breach.

- Customer Notification: Inform affected customers promptly about any breaches, detailing steps they should take to protect themselves.

Building Trust Through Transparency

Trust is the cornerstone of any successful eCommerce business. By being transparent about your security measures, you can reassure customers that their payment information is in safe hands. Consider adding a dedicated security page on your website, detailing your practices, technologies, and compliance standards.

Your Commitment to Security

Ultimately, your commitment to protecting customer payment information reflects your brand’s integrity. By prioritizing security, not only do you comply with regulations, but you also convert potential customers into loyal advocates who feel secure and valued while shopping on your platform.

Mobile Payment Solutions: Adapting to the Shift in Consumer Preferences

As the digital landscape evolves, so do consumer preferences, especially when it comes to payment methods. Mobile payment solutions have surged in popularity, driven by the convenience they offer and the increasing reliance on smartphones. Consumers today are looking for efficient, secure, and user-friendly ways to transact online. This shift presents a significant opportunity for e-commerce businesses to adapt and thrive.

Why Mobile Payment Solutions Matter

Mobile payments cater to the on-the-go lifestyle of today’s consumer. With just a few taps, shoppers can complete transactions without the hassle of entering card details repeatedly. This streamlined process not only enhances the shopping experience but also reduces cart abandonment rates—a crucial factor for e-commerce success. Companies that fail to integrate mobile payment options risk losing out on a substantial segment of potential buyers.

Key Features to Look For

- Security: Ensure the payment solution offers robust encryption and fraud detection systems to protect customer information.

- User Experience: A simple and intuitive interface can significantly boost conversion rates.

- Multiple Payment Options: Support for various mobile wallets, credit cards, and even cryptocurrencies can cater to diverse customer preferences.

- Integration: The solution should seamlessly integrate with your existing e-commerce platform and other tools.

Popular Mobile Payment Solutions

| Service | Key Features | Best For |

|---|---|---|

| PayPal | Wide acceptance, buyer protection | Small to large businesses |

| Apple Pay | Fast payments, privacy-focused | Apple device users |

| Google Pay | Integrated with Google services | Android users |

| Square | Point of sale and online capabilities | Retail and service-oriented businesses |

Incorporating mobile payment options isn’t just a trend; it’s a necessity. Customers are increasingly gravitating towards merchants that provide the flexibility to pay via their preferred methods. Additionally, offering these solutions can foster customer loyalty and encourage repeat business, as consumers feel more comfortable shopping with brands that prioritize their convenience.

As you explore mobile payment solutions, remember to keep an eye on emerging trends. Contactless payments and biometric authentication methods are becoming mainstream, further enhancing security and convenience. Adapting to these innovations is vital for staying competitive in the fast-paced e-commerce environment.

Ultimately, the success of your e-commerce venture hinges on your ability to meet consumer expectations. By embracing mobile payment solutions, you not only streamline the transaction process but also position your business as forward-thinking and customer-centric, which is essential for building long-term success in the digital marketplace.

Integrating Multiple Payment Options to Boost Sales

In today’s competitive ecommerce landscape, offering a range of payment options is not just a luxury; it’s a necessity. Shoppers have diverse preferences when it comes to making purchases online, and integrating multiple payment solutions can significantly enhance their buying experience. When customers find their preferred payment method available, they are more likely to complete their transactions, thereby increasing your conversion rates.

Consider the following benefits of incorporating various payment options:

- Increased Customer Trust: When customers see familiar payment methods, they feel more secure and are more inclined to trust your website.

- Wider Audience Reach: Different demographics have varying payment preferences. By accommodating these differences, you tap into a broader customer base.

- Reduced Abandoned Carts: A significant number of online shoppers abandon their carts due to limited payment options. By providing more choices, you can minimize this issue.

- Enhanced User Experience: A seamless and varied payment process contributes to a positive shopping experience, encouraging repeat business.

When deciding which payment options to integrate, it’s essential to consider a mix of traditional and modern solutions. A combination of credit and debit cards, digital wallets, and even Buy Now, Pay Later (BNPL) services can cater to different shopper preferences. Below is a simple comparison of popular payment methods:

| Payment Method | Pros | Cons |

|---|---|---|

| Credit/Debit Cards | Widely accepted, instant processing | Potential for fraud, fees for merchants |

| PayPal | Easy to use, buyer protection | Transaction fees, account setup required |

| Apple Pay | Fast checkout, high security | Limited to Apple device users |

| BNPL Services | Flexible payment options, attracts younger consumers | Can encourage overspending, fees for late payments |

Integrating these diverse payment options often requires collaborating with payment processors that simplify the process. Look for services that offer smooth onboarding, comprehensive reporting features, and reliable customer support. This can make a world of difference in how efficiently your ecommerce store operates.

Furthermore, don’t underestimate the power of mobile payments. As mobile shopping continues to rise, ensuring that your payment systems are optimized for mobile transactions can lead to substantial sales increases. Make sure your payment options are easy to access and use, regardless of the device your customers are using.

Ultimately, the goal is to create a frictionless purchasing experience. By offering an array of payment options, you not only cater to individual preferences but also pave the way for increased sales and customer loyalty. Stay ahead of the competition by regularly reviewing and updating your payment methods to reflect current trends and customer expectations.

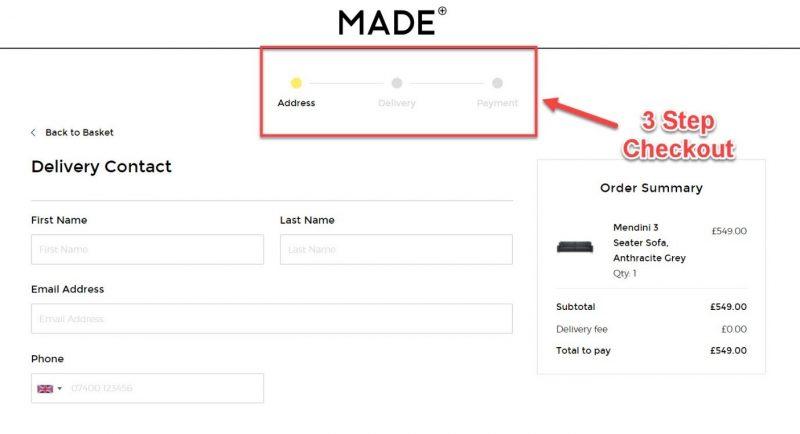

Tips for Optimizing Your Checkout Process for Higher Conversions

Streamlining your checkout process can dramatically enhance conversion rates, turning potential buyers into satisfied customers. Here are some effective strategies to consider:

- Simplify the Form Fields: Reduce the number of fields to the bare essentials. Customers appreciate a straightforward checkout experience, so only ask for necessary information like shipping address, payment details, and contact information.

- Guest Checkout Option: Allow users to complete their purchases without creating an account. Many shoppers abandon carts if they feel pressured to sign up, so providing a guest checkout can significantly lower drop-off rates.

- Visual Progress Indicators: Use a progress bar to show customers where they are in the checkout process. It reduces anxiety and encourages them to complete the transaction.

- Multiple Payment Options: Cater to a diverse audience by offering various payment methods, including credit cards, digital wallets, and buy-now-pay-later services. This flexibility can be the tipping point for a sale.

To visualize how different payment options can impact customer satisfaction, consider the following table:

| Payment Option | Customer Preference (%) |

|---|---|

| Credit Cards | 70% |

| PayPal | 45% |

| Apple Pay | 30% |

| Buy Now, Pay Later | 25% |

Mobile Optimization: With an increasing number of shoppers using mobile devices, ensuring that your checkout process is mobile-friendly is crucial. Test your checkout flow on various devices to ensure that it is responsive and easy to navigate.

Clear Shipping Options: Provide transparent shipping information upfront. Display costs and estimated delivery times clearly to avoid surprises at the end of the checkout process, which can lead to cart abandonment.

Trust Signals: Incorporate trust signals like security badges, customer reviews, and return policies prominently on the checkout page. These elements reassure customers that their data is secure, fostering confidence in your brand.

consider implementing an exit-intent popup that offers a discount or incentive when a customer attempts to leave the checkout page. This can be a powerful nudge to encourage them to complete the purchase.

The Future of Ecommerce Payments: Trends to Watch and Prepare For

Emerging Payment Technologies

As we look ahead in the ecommerce landscape, several emerging payment technologies are set to redefine the way transactions are processed. Digital wallets, for instance, have gained immense popularity due to their convenience. They allow customers to store payment methods securely and make transactions with a simple tap or click. Here are a few key players to watch:

- Apple Pay – Integrates seamlessly with iOS devices, making it easy for users to shop on the go.

- Google Pay – Offers a user-friendly experience for both merchants and consumers.

- PayPal – Continues to innovate with features like “Pay in 4”, allowing flexible payment options.

Cryptocurrency Integration

With the rise of cryptocurrencies, many online retailers are beginning to accept digital currencies as a form of payment. Accepting cryptocurrencies like Bitcoin and Ethereum can attract a tech-savvy demographic looking for alternative payment options. This trend not only provides a modern payment solution but also enhances privacy for consumers.

Subscription-Based Payment Models

The subscription economy is booming, and ecommerce businesses need to adapt. Implementing recurring payment systems allows businesses to provide continuous value while ensuring a steady revenue stream. Consider these aspects when evaluating subscription models:

- Flexible billing cycles to cater to diverse customer needs.

- Options for trial periods, giving customers a taste of the service before committing.

- Easy cancellation processes to build trust and customer loyalty.

Enhanced Security and Fraud Prevention

As ecommerce grows, so does the need for robust security measures. Consumers are increasingly concerned about their data privacy and security. In response, many payment processors are implementing advanced fraud prevention technologies, such as:

- Tokenization - Protects sensitive payment information by substituting it with a non-sensitive equivalent.

- Two-Factor Authentication – Adds an extra layer of security during transactions.

- AI-Driven Fraud Detection – Uses machine learning to identify and block suspicious transactions in real time.

Global Payment Solutions

As businesses expand globally, the demand for diverse payment options has surged. A one-size-fits-all approach won’t suffice; instead, ecommerce platforms must cater to local payment preferences. Offering region-specific payment methods can significantly enhance the customer experience. Here’s a quick overview of popular global payment options:

| Region | Popular Payment Methods |

|---|---|

| North America | Credit/Debit Cards, PayPal, Venmo |

| Europe | iDEAL, SEPA, Klarna |

| Asia | Alipay, WeChat Pay, Paytm |

Personalized Payment Experiences

Creating a personalized shopping experience is key to retaining customers. Leveraging data analytics can help businesses understand consumer preferences and tailor payment options accordingly. For instance, offering preferred payment methods based on previous purchases can enhance user experience and increase conversion rates.

Frequently Asked Questions (FAQ)

Q&A: Ecommerce Payment Processing Guide: Top 7 Services and More

Q1: Why is choosing the right payment processing service crucial for my ecommerce business?

A: Choosing the right payment processing service is vital because it directly impacts your sales, customer experience, and overall business efficiency. A reliable payment processor ensures secure transactions, minimizes cart abandonment, and can even boost your conversion rates. Think of it as the backbone of your ecommerce operations—if it’s strong, everything else runs smoothly!

Q2: What are the top services I should consider for payment processing?

A: There are several excellent options out there, but here are the top seven services you should consider:

- PayPal - Widely recognized and trusted by consumers.

- Stripe – Offers flexibility and great developer tools.

- Square – Ideal for businesses that also have a physical presence.

- Authorize.Net - Great for established ecommerce businesses needing robust features.

- Adyen – A favorite among larger enterprises for global reach.

- Braintree – A PayPal subsidiary that excels in mobile transactions.

- Shopify Payments - Perfect for those already using Shopify for their ecommerce platform.

Each of these services has its unique strengths, so the best choice depends on your specific business needs.

Q3: How do transaction fees impact my bottom line?

A: Transaction fees can significantly affect your profits, especially for small businesses. Most payment processors charge a percentage of each sale plus a fixed fee. It’s essential to analyze these fees and choose a provider that offers competitive rates while still delivering the features you need. A small percentage difference can add up over time, impacting your margins.

Q4: What should I look for in terms of security features?

A: Security is non-negotiable in ecommerce! Look for services that offer robust encryption, PCI compliance, and fraud detection tools. Features like 3D Secure and tokenization can provide extra layers of security for your transactions. A secure checkout process not only protects your business but also builds trust with your customers.

Q5: Can I integrate payment processing with my existing ecommerce platform?

A: Absolutely! Most modern payment processors offer seamless integrations with popular ecommerce platforms like Shopify, WooCommerce, and Magento. Just check their documentation or support channels to ensure compatibility. A smooth integration means you can start processing payments quickly and efficiently, allowing you to focus on growing your business.

Q6: What about mobile payment options?

A: With the rise of mobile shopping, offering mobile payment options is essential. Many payment processors, like Stripe and Braintree, provide excellent mobile solutions that allow customers to check out easily on their smartphones. This convenience can lead to higher sales and improved customer satisfaction. Plus, integrating mobile wallets like Apple Pay or Google Pay can further enhance the shopping experience!

Q7: How can I enhance the checkout experience for my customers?

A: A smooth and straightforward checkout process can make all the difference! Here are a few tips:

- Minimize the number of steps in the checkout process.

- Offer guest checkout options.

- Display security badges to reassure customers.

- Provide multiple payment options to cater to different preferences.

By focusing on these aspects, you can create a checkout experience that encourages customers to complete their purchases rather than abandon their carts.

Q8: What’s the first step I should take after choosing a payment processor?

A: Once you’ve chosen a payment processor, the first step is to set it up and integrate it into your ecommerce platform. This usually involves creating an account, configuring your payment settings, and testing transactions to ensure everything works flawlessly. Don’t skip the testing phase—it’s crucial for avoiding issues when your customers start checking out!

Q9: Any final thoughts on selecting the right payment processing service?

A: Remember, the right payment processing service can elevate your ecommerce business to new heights. Take your time to evaluate your options, consider your business model, and don’t hesitate to reach out for demos or trials. Trust me, investing the effort upfront will pay off with happier customers and improved sales in the long run!

To Conclude

As we wrap up our deep dive into the world of ecommerce payment processing, it’s clear that choosing the right service can make all the difference for your online business. With the top 7 services we explored, you now have a solid foundation to make an informed decision that aligns with your unique needs.

Remember, the right payment processor doesn’t just facilitate transactions; it enhances customer trust, boosts sales, and ultimately contributes to your bottom line. So, take your time, weigh your options, and don’t hesitate to explore the features that matter most to you—whether it’s low fees, security, or seamless integration with your existing systems.

Armed with the insights from this guide, you’re now ready to take your ecommerce game to the next level. Go ahead and make that choice with confidence! Your customers are waiting, and with the right payment processing service, you’ll be ready to meet their expectations and grow your business like never before. Happy selling!