Starting your own business can be one of the most exciting adventures of your life, but it can also feel overwhelming—especially when it comes to the costs involved. If you’re considering launching a Limited Liability Company (LLC), you’re likely asking yourself, “How much is this going to set me back?” The truth is, the cost to start an LLC can vary significantly based on a variety of factors, including your location and the specific services you choose. But don’t let the numbers scare you! In this article, we’ll break down the essential expenses you need to consider, as well as share some savvy tips to help you save money along the way. Whether you’re a first-time entrepreneur or a seasoned pro, understanding the financial landscape of starting an LLC can empower you to make smart choices and set your business up for success. Let’s dive in and demystify those costs!

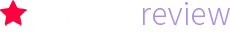

Understanding the Basics of LLC Formation Costs

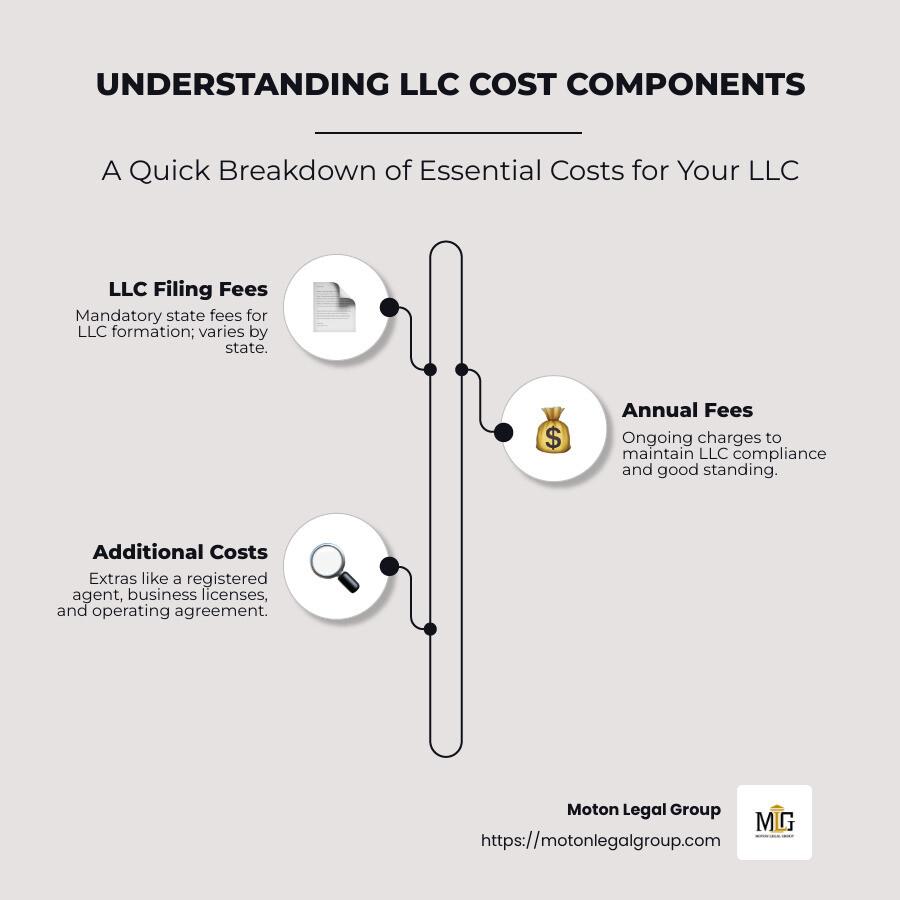

When diving into the world of Limited Liability Companies (LLCs), understanding the various costs involved in formation is crucial. While the potential for protecting your personal assets and gaining tax advantages is appealing, these benefits come with a price tag. Let’s break down the typical expenses associated with starting an LLC so you can plan accordingly and possibly save some cash along the way.

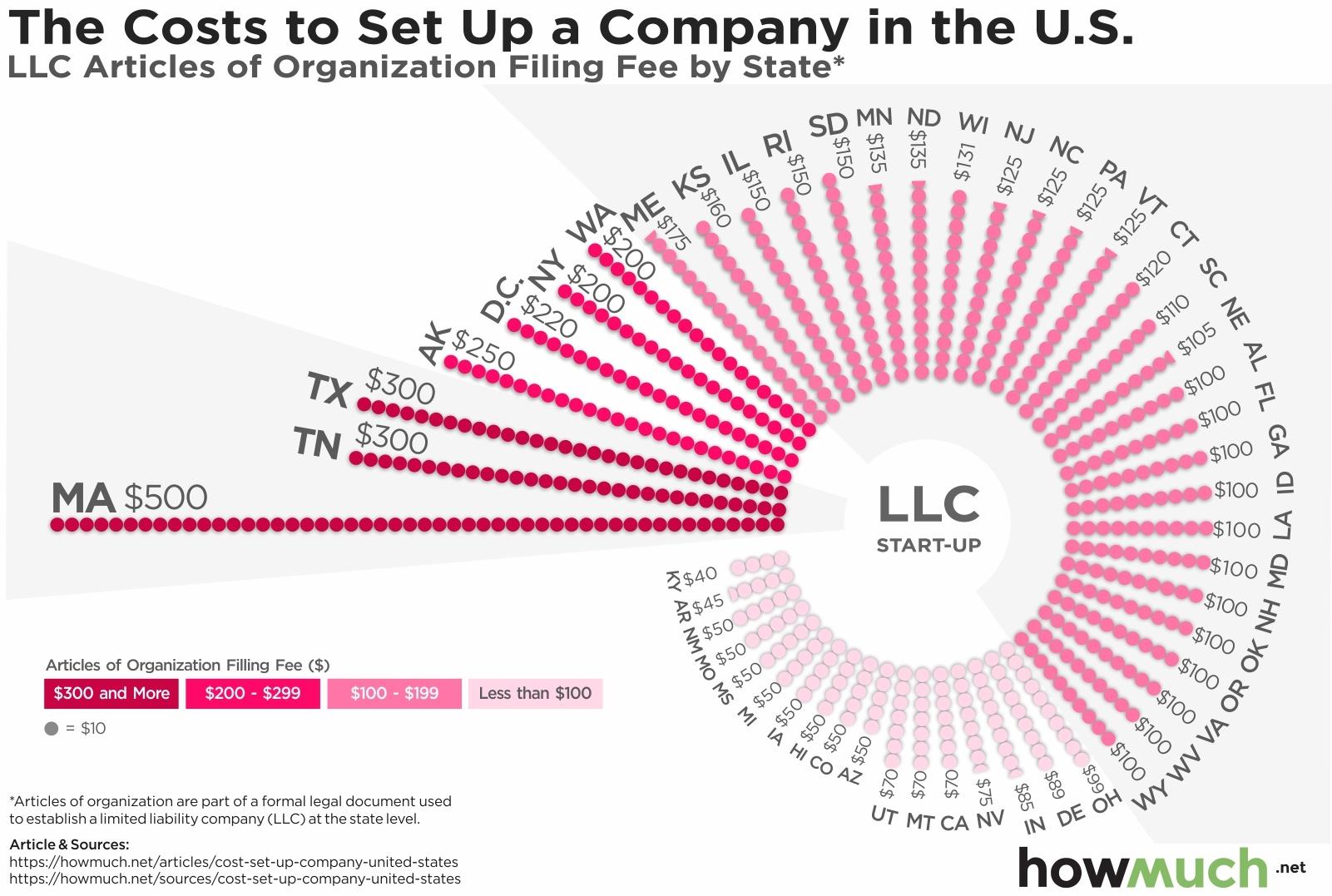

First and foremost, the most significant expense you’ll encounter is the state filing fee. This fee varies significantly from state to state, generally ranging from $50 to $500. It’s essential to check your state’s specific requirements, as some states have additional fees or taxes that may apply.

In addition to the filing fee, many entrepreneurs opt for professional assistance when forming their LLC. Hiring a lawyer or a formation service can help ensure that all documents are completed correctly. However, this convenience comes at a cost. Legal fees can range from $300 to $1,500, depending on the complexity of your business and the level of support you need.

| Cost Type | Estimated Range |

|---|---|

| State Filing Fee | $50 – $500 |

| Legal Assistance | $300 – $1,500 |

| Operating Agreement | $100 – $500 |

| Business Licenses | $50 – $400 |

Another important consideration is whether to draft an operating agreement. While not legally required in most states, this document outlines the management structure and operational procedures of your LLC. Costs for creating an operating agreement can range from $100 to $500, depending on whether you choose to do it yourself or hire a professional.

Don’t forget about the potential costs of business licenses and permits. Depending on your industry and location, these can add another layer of expense, varying from $50 to $400. It’s vital to research the specific licenses required to operate legally in your area.

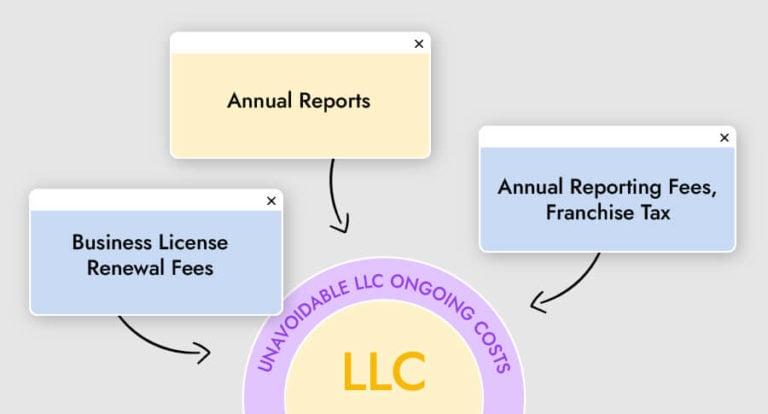

keep in mind that there may be ongoing costs associated with maintaining your LLC. Many states require an annual report or franchise tax, which can range from $0 to several hundred dollars each year. By understanding these recurring expenses, you can better budget for the long-term sustainability of your business.

Being aware of these costs will not only help you prepare financially but also guide you in making informed decisions when establishing your LLC. By carefully considering your options and doing thorough research, you can minimize unnecessary expenditures and maximize your resources as you embark on this exciting entrepreneurial journey.

Breaking Down the Initial Costs of Starting an LLC

Starting an LLC can be an exciting venture, but it’s essential to be aware of the initial costs involved. These costs can vary significantly based on your location and the nature of your business, but understanding them can help you budget effectively and avoid any surprises.

First and foremost, the filing fees are an unavoidable expense. Every state requires you to file Articles of Organization or a similar document to legally establish your LLC. The cost typically ranges from $50 to $500, depending on the state. Here’s a quick breakdown of filing fees across a few popular states:

| State | Filing Fee |

|---|---|

| California | $70 |

| New York | $200 |

| Texas | $300 |

| Florida | $125 |

In addition to filing fees, you may also incur publication costs. Some states, like New York, mandate that LLCs publish their formation in local newspapers for a certain period. This can set you back anywhere from $100 to $2,000 depending on the publication rates in your area. While this may feel like an unnecessary expense, it’s crucial for compliance.

Don’t forget about the registered agent fees. A registered agent acts as your LLC’s official point of contact for service of process and other legal communications. You can act as your own agent, but many choose to hire a service for convenience, which typically costs between $100 to $300 annually.

Next, consider the operating agreement. While not always required by law, having one is highly advised to outline the management structure and operational guidelines for your LLC. You can draft one yourself for free, or hire a professional, which can cost around $200 to $500. Investing in a well-drafted operating agreement can save you potential headaches and conflicts down the line.

If you plan to apply for any business licenses or permits, keep in mind these can also add to your initial expenses. Licensing costs vary widely by business type and location but can range from $50 to several hundred dollars. Check local regulations to ensure you’re fully compliant.

it’s wise to set aside a budget for accounting and legal advice. Consulting with professionals can save you money in the long run by ensuring that you comply with all state and federal requirements. Initial consultations can cost around $100 to $300, but this investment can be invaluable.

By breaking down these initial costs, you can gain a clearer picture of what to expect when starting your LLC. Keeping track of all expenses and planning ahead can help you launch your business without financial stress, allowing you to focus on what matters most—growing your new venture.

State-Specific Fees You Need to Consider

When you’re planning to launch an LLC, understanding the various state-specific fees is crucial. These costs can vary significantly from one state to another, impacting your overall startup budget. Here’s a breakdown of some essential fees you should keep in mind:

- Formation Fees: Every state requires a fee to file your Articles of Organization. This fee can range from as low as $50 to over $500, depending on where you’re setting up shop.

- Annual Report Fees: Most states mandate that LLCs file annual reports, which usually come with a fee. This can be a flat rate or a percentage of your business income.

- Registered Agent Fees: If you decide to hire a registered agent service, this can add to your costs. Prices typically range from $100 to $300 annually.

- Business Licenses and Permits: Depending on your business type and location, you may need various licenses, each with its own fee structure.

- State Taxes: Don’t forget about possible state income taxes or franchise taxes that may apply to your LLC.

To give you a clearer picture, here’s a simple comparison of formation fees and annual report fees in select states:

| State | Formation Fee | Annual Report Fee |

|---|---|---|

| California | $70 | $20 |

| Florida | $125 | $138.75 |

| New York | $200 | $25 |

| Delaware | $90 | $300 |

Keep in mind that while some states may have low initial filing fees, they might have higher ongoing costs like annual fees or taxes. This can affect your long-term budgeting. Always conduct thorough research on your specific state’s requirements.

Another factor to consider is the potential for expedited service fees. If you need your LLC approved quickly, most states offer expedited processing for an additional fee. This can be a worthwhile investment for entrepreneurs eager to get their business up and running.

Lastly, don’t forget about the costs that could arise from legal assistance or consulting services. While you might feel confident handling the paperwork yourself, consulting with a legal expert can help ensure you’re meeting all requirements, potentially saving you from costly mistakes down the line.

Hidden Costs That Can Catch You Off Guard

When starting an LLC, it’s easy to focus on the obvious fees like state filing costs and initial setup charges. However, there are several hidden costs that can quickly add up and catch you off guard. Being aware of these costs can save you a lot of headaches—and money—down the line.

Annual State Fees: Many states require LLCs to pay annual or biennial fees to maintain their status. These fees can vary significantly from one state to another. For instance, some states charge as low as $50, while others can demand up to $800 just to keep your LLC active. Don’t forget to factor these into your yearly budget!

Registered Agent Services: If you choose to hire a registered agent to handle your legal correspondence, this service can come with a price tag of anywhere from $100 to $300 per year. While you can act as your own registered agent, it’s worth considering the benefits of having a professional handle this task for you.

Business Licenses and Permits: Depending on your industry and location, you may need various licenses and permits, which can come with their own associated fees. These can include local business permits, health department permits, or even zoning permits. It’s essential to research what’s required in your area to avoid any unexpected costs that could crop up later.

Taxes: LLCs are generally treated as pass-through entities for tax purposes, but that doesn’t mean you’re off the hook. Depending on your business structure and income, you might find yourself liable for additional taxes such as franchise taxes, self-employment taxes, and even local business taxes. These can be complex, so it’s wise to consult a tax professional to understand your obligations fully.

Accounting and Bookkeeping: While you might feel confident handling your own finances, the reality is that hiring an accountant or bookkeeper can save you time and money in the long run. Professional services can range from $300 to $2,000 annually, depending on the complexity of your financial situation. Plus, they’ll help ensure that you stay compliant with tax regulations and avoid costly mistakes.

Insurance Costs: Depending on your business, you may need various types of insurance, such as general liability insurance or professional liability insurance. These costs can range widely but expect to budget at least several hundred to a few thousand dollars a year. Proper insurance can protect your business from unexpected liabilities that could incur hefty expenses.

| Cost Type | Estimated Range |

|---|---|

| Annual State Fees | $50 – $800 |

| Registered Agent Services | $100 - $300 |

| Licenses and Permits | Varies by location/industry |

| Accounting Services | $300 – $2,000 |

| Insurance Costs | $500+ |

By keeping these hidden costs in mind, you can set a more accurate budget and ensure that your dream of starting an LLC doesn’t come with unwanted financial surprises. Planning ahead is key to maintaining your business’s health and longevity.

Choosing the Right Business Structure for Your Needs

When embarking on the journey of starting your business, one of the most critical decisions you’ll face is choosing the right business structure. This choice not only impacts your legal liability but also affects your taxes, funding options, and operational complexity. For many entrepreneurs, forming a Limited Liability Company (LLC) strikes a balance between simplicity and protection.

One of the standout features of an LLC is its limited liability protection. This means that your personal assets are generally protected from business debts and legal actions. If your LLC faces a lawsuit or financial troubles, your personal savings and property are usually off the table, which can provide peace of mind as you navigate the business world.

Another benefit is the flexible taxation options. LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation. This allows you to pick the structure that minimizes your tax burden. For example, many small business owners opt for pass-through taxation, where profits are taxed only at the individual level, avoiding the double taxation that can burden corporations.

However, it’s essential to consider the initial and ongoing costs associated with forming an LLC. While the fees vary by state, common expenses include:

- Formation Fees: The cost to file your Articles of Organization can range from $50 to $500, depending on your state.

- Operating Agreement: Although not required in all states, having an operating agreement can help outline your business structure and operations; legal fees for this can vary.

- Annual Fees: Some states charge an annual fee or franchise tax to maintain your LLC status, which can add to your yearly expenses.

To help you better understand the cost implications, here’s a quick comparison of formation fees in selected states:

| State | Formation Fee | Annual Fee |

|---|---|---|

| California | $70 | $800 |

| Florida | $125 | $138.75 |

| Texas | $300 | $0 (No annual franchise tax for most small businesses) |

While the costs may seem daunting, there are several strategies to save money during the formation process:

- DIY Formation: Consider filing your LLC paperwork yourself instead of hiring a lawyer, which can save you hundreds of dollars.

- Research State Fees: Understand the fees involved in your state versus others; some states are more business-friendly.

- Utilize Online Services: Platforms like LegalZoom or Rocket Lawyer can offer affordable packages to assist in the LLC formation process.

Ultimately, the right business structure for you will depend on your unique situation. Take the time to research your options and consider consulting with a legal professional to ensure you’re making the best decision for your new venture.

DIY vs Hiring a Professional: What’s Best for You?

When it comes to starting an LLC, one question many entrepreneurs face is whether to tackle the formation process themselves or hire a professional. Both options have their merits, and the decision often hinges on your specific circumstances, budget, and comfort level with legal processes.

Going the DIY route can be quite appealing for those looking to save money. Here are some key benefits:

- Cost Savings: Filing your LLC paperwork yourself can save you hundreds of dollars in professional fees.

- Control: You have complete control over your business formation process, allowing you to research and make decisions that are best suited for your business model.

- Learning Experience: The process can provide valuable insights into your business structure and legal obligations.

However, there are also significant challenges associated with DIY LLC formation:

- Complexity: Legal documents can be complicated, and a mistake can lead to delays or even fines.

- Time-Consuming: The learning curve can be steep, and you might find it takes longer than anticipated.

- Lack of Expertise: Without a legal background, you may overlook important details that could cost you later.

On the other hand, hiring a professional can alleviate many of these concerns. Here’s why it might be worth the investment:

- Expert Guidance: Professionals understand the legal landscape and can guide you through the nuances of forming an LLC.

- Efficiency: They can handle the paperwork much faster, allowing you to focus on other aspects of your business.

- Peace of Mind: Knowing that everything is done correctly can alleviate stress and let you concentrate on your business goals.

Yet, before you decide, consider some factors that can influence your choice:

| Factor | DIY | Professional |

|---|---|---|

| Budget | Lower initial costs | Higher initial costs |

| Time | Time-consuming | More efficient |

| Complexity | May be overwhelming | Expertise available |

| Control | Full control | Less control |

Ultimately, the choice between DIY and hiring a professional boils down to your unique situation. If you have prior experience or a straightforward business model, going it alone might be viable. However, if you’re launching a business with multiple stakeholders or complex legal needs, hiring a professional could save you time, money, and hassle in the long run. Evaluate your options carefully, and choose the path that aligns best with your goals and capabilities.

Tips to Save on LLC Formation Fees

Starting an LLC can be a significant financial commitment, but there are ways to cut down on those formation fees without sacrificing the quality of your business setup. Here are some effective strategies to help you save money while ensuring your LLC is established correctly.

- Do It Yourself: Save on attorney fees by handling the paperwork yourself. Most states offer straightforward online filing options, and you can find abundant resources and templates to guide you through the process.

- Choose Your State Wisely: Depending on where you live, the formation fees can vary. Some states are more business-friendly with lower fees and taxes. Research and consider forming your LLC in a state that offers the best financial benefits for your business.

- Take Advantage of Promotions: Many online services that help with LLC formation often run promotions or discounts. Keep an eye out for these to save on filing fees or service costs.

- Utilize Local Resources: Check with local small business associations or chambers of commerce. They often provide free workshops, resources, and sometimes even free consultations to help new business owners.

Another way to save money is by carefully evaluating any ongoing services you may need after forming your LLC. Many companies offer annual services for compliance and maintenance, but not all are necessary. Consider these options:

| Service | Necessity | Cost |

|---|---|---|

| Registered Agent | Optional (if you can act as one) | $100 – $300/year |

| Operating Agreement | Recommended (but can DIY) | $0 – $200 |

| Annual Report Filing | Mandatory | $50 – $500/year |

- Use Free Resources: Websites like the Small Business Administration (SBA) and local government sites offer free templates and information on forming an LLC. Make the most of these resources before considering paid options.

- Combine Services: If you need multiple services (like formation and ongoing compliance), look for bundles that can save you money instead of purchasing each separately.

- Tax Deductions: Don’t forget to keep track of all your formation expenses. Many of these costs can be deductible as business expenses, which can offset your overall tax bill.

By following these tips, you can establish your LLC efficiently and effectively while keeping a tight reign on costs. With careful planning and resourcefulness, you’ll set your business up for success without breaking the bank.

Utilizing Online Resources for Cost-Effective Solutions

When it comes to launching your LLC, the internet is a treasure trove of resources that can help you save money and streamline the process. From official state websites to reputable online service providers, utilizing these online tools can significantly cut down the costs associated with starting your business.

One of the best ways to kick off your LLC journey is by visiting your state’s business portal. Most state governments have user-friendly websites packed with information on forming an LLC, including:

- Step-by-step guides on the registration process

- Required forms that can often be downloaded for free

- Fee structures specific to your state

- Contact information for customer support if you need help

In addition to state resources, consider using online formation services. These platforms provide comprehensive packages that can simplify the LLC formation process at a fraction of the cost of hiring a lawyer. Common options include:

- LegalZoom

- IncFile

- ZenBusiness

These services often offer features such as registered agent services, operating agreement templates, and even ongoing compliance help, all bundled into one affordable package.

If you’re looking to keep costs low, don’t overlook the power of DIY legal documents. Websites like Rocket Lawyer and Nolo provide templates and guides that allow you to fill in your information and create legally sound documents without the hefty price tag of a lawyer. Here’s a quick comparison of what you might find:

| Service | Cost Range | Highlights |

|---|---|---|

| Rocket Lawyer | $39.99/month | Legal advice, document library |

| Nolo | $20-$50 per document | DIY forms, comprehensive guides |

| LegalZoom | $79-$399 | Full-service options available |

Moreover, don’t forget to tap into community resources. Websites like SBA.gov and local Chamber of Commerce sites often provide workshops, forums, and networking opportunities that can equip you with valuable insights and connections. These resources can be instrumental in not only saving money but also gaining knowledge from those who have successfully navigated the same path.

Lastly, consider leveraging social media groups and forums. Platforms such as Facebook, Reddit, and LinkedIn have communities dedicated to entrepreneurs and small business owners. You can share experiences, ask questions, and get recommendations for cost-effective solutions from people who have been there before. Engaging with these communities can provide you with tips that you won’t find in any handbook.

The Importance of an Operating Agreement and Its Cost Implications

When starting an LLC, one of the most critical yet often overlooked documents is the operating agreement. This legal document outlines the management structure and operational procedures of your LLC, serving as a blueprint for how your business will function. While it may seem like an extra step, having an operating agreement can save you from potential disputes and misunderstandings down the line.

One of the key reasons to invest in an operating agreement is that it clearly delineates the roles and responsibilities of each member. This clarity helps avoid conflicts by providing a solid reference point for decision-making processes. Without it, disagreements can escalate quickly, potentially leading to costly legal battles. By spending a little on drafting this document, you can prevent much larger expenses in the future.

Moreover, an operating agreement helps establish your LLC’s credibility. While most states do not require you to file this document with the state, having one in place can make your business appear more organized and professional. This can be especially beneficial when seeking funding or partnerships, as it demonstrates that you have a formal structure and are serious about your venture.

In terms of cost, creating an operating agreement doesn’t have to break the bank. You can choose to draft one yourself using templates available online, which can range from $50 to $200. Alternatively, hiring a lawyer for a more tailored approach could cost anywhere from $300 to $1,000, depending on the complexity of your business and the attorney’s fees.

Here’s a simple breakdown of potential costs associated with creating an operating agreement:

| Method | Estimated Cost |

|---|---|

| Self-Generated Using Templates | $50 – $200 |

| Legal Consultation | $300 – $1,000 |

| Online LLC Service | $100 – $500 |

Additionally, consider the following tips to keep your costs manageable:

- Use Online Resources: Many legal websites offer templates for operating agreements at a fraction of the cost you would pay a lawyer.

- Collaborate with Members: If your LLC has multiple members, work together to draft the agreement, which can save time and money.

- Keep It Simple: If your LLC’s structure is straightforward, avoid overcomplicating the agreement with unnecessary clauses.

Investing in an operating agreement is not just about meeting legal requirements; it’s about setting your business up for success. The potential cost savings from avoiding disputes and establishing a clear framework are well worth the initial investment. Remember, the time and money spent now could save you from significant headaches in the future.

Ongoing Costs to Keep in Mind After Formation

Starting an LLC is an exciting venture, but the initial formation costs are just the tip of the iceberg. Once your business is up and running, you’ll want to keep an eye on ongoing expenses that can affect your bottom line. Understanding these costs will help you budget effectively and maintain the health of your company.

One of the most significant ongoing costs to consider is annual fees and reports. Many states require LLCs to file annual reports, which often come with a hefty filing fee. This fee can vary significantly by state, so it’s crucial to research your state’s requirements. For instance, states like Delaware and Nevada are known for their business-friendly environments, but they still charge fees that can add up over time.

Additionally, you’ll want to factor in business licenses and permits. Depending on your industry and location, certain licenses or permits may be necessary to operate legally. These costs can range from a few dollars for a basic permit to hundreds for more specialized licenses. Ensure you stay compliant to avoid penalties, which can be costly!

Don’t forget about taxes. While LLCs offer liability protection and flexible taxation options, you may still face state and local taxes. Some states impose franchise taxes on LLCs, while others have additional tax obligations. Consulting a tax professional can help you navigate this landscape and avoid any unpleasant surprises come tax season.

Another ongoing expense to keep in mind is insurance. Protecting your business with the right insurance coverage is essential. General liability insurance, property insurance, and, if you have employees, workers’ compensation insurance are all important. The costs can vary widely based on your business type and location, so getting multiple quotes can help you find the best deal.

If your LLC has multiple members or employees, consider the costs associated with payroll services or software. Managing payroll can be a complex task, and outsourcing it or using software comes with its own fees. However, investing in good payroll management can save you time and reduce the risk of costly errors.

you may want to invest in professional services such as accounting or legal assistance. While it can seem like an unnecessary expense, having a solid accounting system or a lawyer on retainer can save you money in the long run. They can help you navigate regulations and ensure that your financial practices are sound, reducing your risk of audits or penalties.

Ongoing Expenses Summary:

| Expense Type | Estimated Cost |

|---|---|

| Annual Fees/Reports | $50 – $500+ |

| Business Licenses/Permits | $10 - $1,000+ |

| Insurance | $500 – $2,500+ |

| Payroll Services | $30 – $200/month |

| Professional Services | $100/hour+ |

By keeping these ongoing costs in mind, you’ll be better prepared to manage your finances and ensure the long-term success of your LLC. Planning ahead will not only help you save money but also position your business for growth and stability in the years to come.

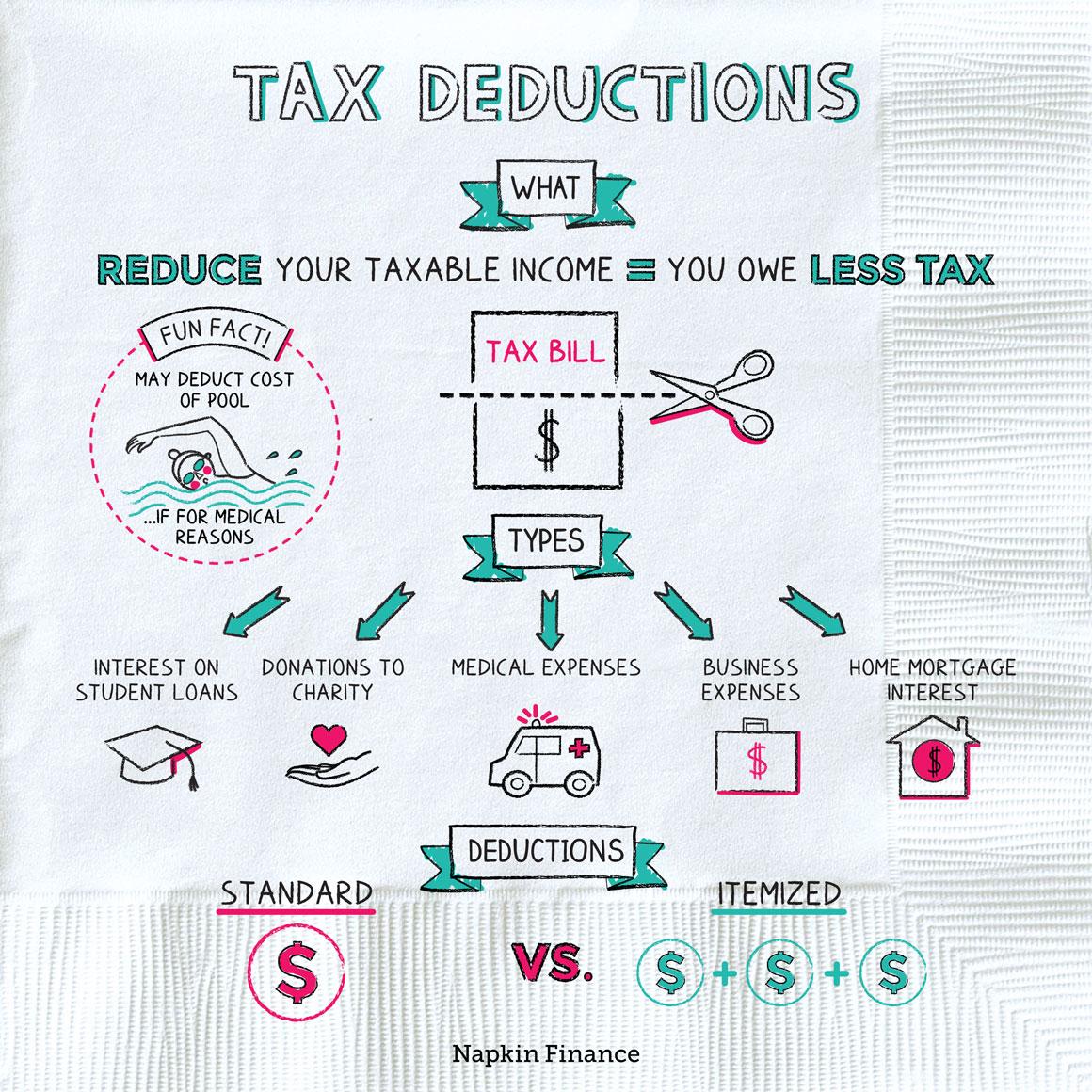

Tax Benefits of an LLC That Can Save You Money

Starting an LLC not only provides legal protection but also opens up a world of tax advantages that can significantly impact your bottom line. Understanding these benefits is crucial if you want to maximize your savings and grow your business effectively.

One of the most appealing aspects of an LLC is its pass-through taxation feature. This means that the profits of the LLC are not taxed at the corporate level. Instead, they pass directly through to the owners’ personal tax returns. As a result, you avoid the double taxation often seen in traditional corporations. This can lead to substantial savings, especially in the early years when profits are typically lower.

Another advantage is the ability to deduct business expenses. As an LLC, you can write off a variety of expenses that are necessary for running your business. This includes:

- Office supplies

- Utilities

- Travel expenses

- Marketing costs

- Professional fees

By taking advantage of these deductions, you lower your taxable income, which can lead to substantial tax savings.

LLCs also offer flexibility in taxation. Depending on the number of members, an LLC can choose to be taxed as a sole proprietorship, partnership, or even a corporation. This versatility allows you to select the tax structure that works best for your financial situation. For instance, electing to be taxed as an S-Corporation can sometimes reduce self-employment taxes, further enhancing your savings.

Moreover, when you form an LLC, you may qualify for various tax credits that are unavailable to sole proprietors or traditional corporations. These can include credits for hiring employees, investing in renewable energy, or making certain improvements to your business premises. Keeping an eye on available credits can lead to unexpected savings each tax season.

It’s also worth noting that LLCs can offer self-employment tax advantages. As an owner, you may only pay self-employment taxes on your salary rather than the entire profits of the business. This can lead to significant reductions in your overall tax burden.

here’s a quick comparison of the different tax structures available to LLCs:

| Tax Structure | Taxation Level | Self-Employment Tax |

|---|---|---|

| Sole Proprietorship | Personal | Yes |

| Partnership | Personal | Yes |

| Corporation | Corporate and Personal | No (on salary only) |

| S-Corporation | Corporate and Personal | No (on salary only) |

the tax benefits of forming an LLC can provide significant financial advantages. From pass-through taxation to various deductions and credits, being an LLC can help you keep more of your hard-earned money in your pocket. Embracing these strategies is essential for any entrepreneur looking to thrive.

How to Avoid Common Pitfalls When Starting an LLC

Starting an LLC can be a rewarding venture, but it’s essential to navigate the process carefully to avoid costly mistakes. Here are some common pitfalls to watch out for:

- Neglecting Research: Before diving in, take the time to research the requirements for forming an LLC in your state. Each state has different rules, fees, and processes, and overlooking these can lead to delays and unexpected costs.

- Choosing the Wrong Name: Your LLC name must be unique and comply with state regulations. Failing to check name availability can result in legal issues or the need to rebrand later, which can be expensive.

- Ignoring Operating Agreements: Even if it’s not legally required in your state, having an operating agreement can save you from future disputes among members. This document outlines ownership and operating procedures and helps clarify responsibilities.

- Overlooking Licenses and Permits: Depending on your business type and location, you may need specific licenses or permits. Neglecting this step can lead to fines or even the closure of your business.

Another common mistake is underestimating ongoing costs. Many new business owners focus only on initial startup expenses, forgetting to budget for:

| Cost Item | Estimated Monthly Cost |

|---|---|

| Business Insurance | $50 – $150 |

| Accounting Software | $25 – $50 |

| Website Hosting | $10 – $30 |

Don’t forget about tax implications either. Consult with a tax professional to understand how your LLC structure affects your personal taxes. This guidance can prevent financial surprises down the line and help you make informed decisions about your business finances.

As you move forward, consider utilizing free or low-cost resources for education. Check out local Small Business Development Centers (SBDCs) or online courses that provide valuable knowledge without breaking the bank. Networking with other local entrepreneurs can also offer insights and support as you establish your LLC.

Lastly, be cautious about DIY filings. While it might seem like a way to save money, mistakes in paperwork can lead to re-filing fees and delays. Consider investing in a reputable LLC formation service or consulting with a lawyer to ensure a smooth start.

Final Thoughts on Budgeting for Your LLC Journey

Embarking on the journey to establish your LLC can feel overwhelming, especially when you’re keeping a close eye on costs. However, with a solid budgeting plan in place, you can not only navigate the expenses but also find ways to save money along the way. Understanding the various fees associated with forming an LLC is crucial, but it’s equally important to think strategically about your finances.

When budgeting for your LLC, consider breaking down your costs into several categories:

- Formation Fees: These are the initial costs you’ll incur when registering your LLC, including state filing fees and legal assistance if necessary.

- Ongoing Expenses: Don’t forget to account for annual fees, taxes, and any required permits or licenses.

- Operational Costs: Think about costs related to running your business, such as marketing, office supplies, and technology.

- Emergency Fund: It’s wise to set aside a portion of your budget for unforeseen expenses that may arise in the first few months.

One effective way to maximize your savings is to conduct thorough research before spending. For instance, comparing various service providers for legal and accounting services can reveal significant differences in cost. Don’t hesitate to leverage online resources or local business associations that may offer discounts or free workshops.

Another tip is to utilize online tools and software designed for budgeting and accounting. Many of these tools are affordable or even free, providing you with the means to keep track of your expenses without breaking the bank. Properly managing your finances from the get-go can prevent larger issues down the line.

To give you a clearer picture of potential costs, here’s a simplified breakdown of the expenses you might encounter:

| Cost Type | Estimated Range |

|---|---|

| State Filing Fee | $50 – $500 |

| Operating Agreement | $0 – $200 |

| Business Licenses | $10 – $400 |

| Annual Report Fee | $0 – $300 |

| Miscellaneous (insurance, etc.) | Varies |

Staying organized and regularly reviewing your budget will help you identify patterns in your spending. This diligence not only aids in saving money but also positions your LLC for growth. As your business starts to thrive, revisiting your budget and adjusting as necessary ensures that you continue to operate within your financial means while investing in critical areas for expansion.

Ultimately, remember that every dollar counts. By taking a proactive approach to budgeting, not only do you pave the way for your LLC’s success, but you also create a sustainable financial future. Keep your eye on the prize, and don’t let unexpected costs derail your entrepreneurial aspirations.

Frequently Asked Questions (FAQ)

Q: What is an LLC and why should I consider starting one?

A: An LLC, or Limited Liability Company, is a popular business structure that combines the liability protection of a corporation with the tax flexibility of a sole proprietorship or partnership. If you want to protect your personal assets from business debts and liabilities while enjoying greater tax benefits, then an LLC might be the perfect fit for you!

Q: So, how much does it actually cost to start an LLC?

A: The cost can vary significantly depending on where you live. Typically, you can expect to spend between $50 to $500 for filing fees alone. However, remember that there could be additional costs such as legal fees, licensing, and permits. In some states, it might even go up to $1,000 or more when you factor in everything!

Q: What are some of the main costs associated with starting an LLC?

A: Great question! Here are some of the most common costs:

- State Filing Fees: The primary expense, varying by state.

- Registered Agent Fees: If you hire a professional service, this can range from $100 to $300 per year.

- Operating Agreement Costs: While you can draft one yourself, hiring a lawyer can cost between $200 to $1,000.

- Business Licenses and Permits: These can range from $50 to several hundred dollars, depending on your business type.

Q: Are there any hidden costs I should be aware of?

A: Absolutely! Keep an eye out for annual fees, which some states require. Plus, if you’re in a regulated industry, you might need extra licenses or permits that can add to your costs. Always research your state’s requirements to avoid unpleasant surprises!

Q: How can I save money when starting my LLC?

A: There are several ways to cut costs:

- DIY Filing: If you’re comfortable with paperwork, consider filing the formation documents yourself instead of hiring a lawyer.

- Use Online Services: Platforms like LegalZoom or IncFile can help simplify the process at a lower cost.

- Bundling Services: Some providers offer bundled packages that include filing, registered agent services, and more for a discounted rate.

- Research State Resources: Some states offer resources or websites that guide you through the LLC formation process for free or at a reduced cost.

Q: What if I still have questions about the process?

A: No worries! It’s completely normal to have questions. Consider reaching out to a business attorney or accountant who specializes in LLC formation. They can provide tailored advice that fits your specific situation. Additionally, many online forums and resources are dedicated to helping small business owners navigate the process.

Q: Is forming an LLC worth the cost?

A: Absolutely! The peace of mind that comes from knowing your personal assets are protected is invaluable. Plus, with the potential for tax benefits and credibility with clients and customers, the investment can pay off in the long run. Remember, starting a business is a journey, and taking the right steps from the get-go can set you up for success!

Feel free to ask more questions or dive deeper into any of these topics! Starting your LLC is an exciting step, and with the right information, you’ll navigate the costs like a pro.

The Way Forward

As we wrap up our deep dive into the costs of starting an LLC, it’s clear that while there are expenses involved, there are also plenty of ways to save. From choosing the right state for formation to utilizing online resources and professional services, being strategic can significantly reduce your startup costs.

Remember, investing in your LLC is investing in your future. With careful planning and smart choices, you can set your business up for success without breaking the bank. So, take a moment to assess your options, weigh the potential savings, and don’t hesitate to seek help if you need it.

Starting your LLC can be a pivotal step toward achieving your entrepreneurial dreams, and with the right approach, you’ll find that it’s more affordable than you might think. Now, go forth and turn those business ideas into reality! Happy entrepreneuring!