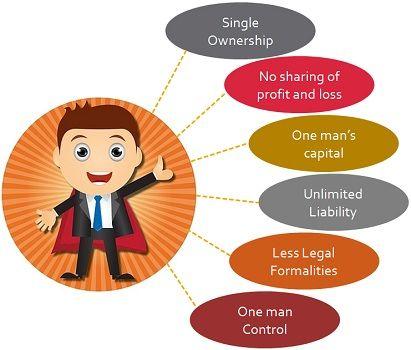

Are you ready to unleash your entrepreneurial spirit and turn your passion into profit? Starting a sole proprietorship might just be the perfect avenue for you! Whether you’ve got a brilliant idea for a side hustle or dream of launching a full-time business, going the sole proprietorship route is one of the simplest and most straightforward ways to kickstart your journey. In this beginner’s guide, we’ll walk you through five essential steps to set up your very own sole proprietorship with confidence. By the end, you’ll not only understand the basics but also feel empowered to take that exciting leap into business ownership. So, grab a cup of coffee, and let’s dive into the world of entrepreneurship together!

Understanding the Basics of a Sole Proprietorship

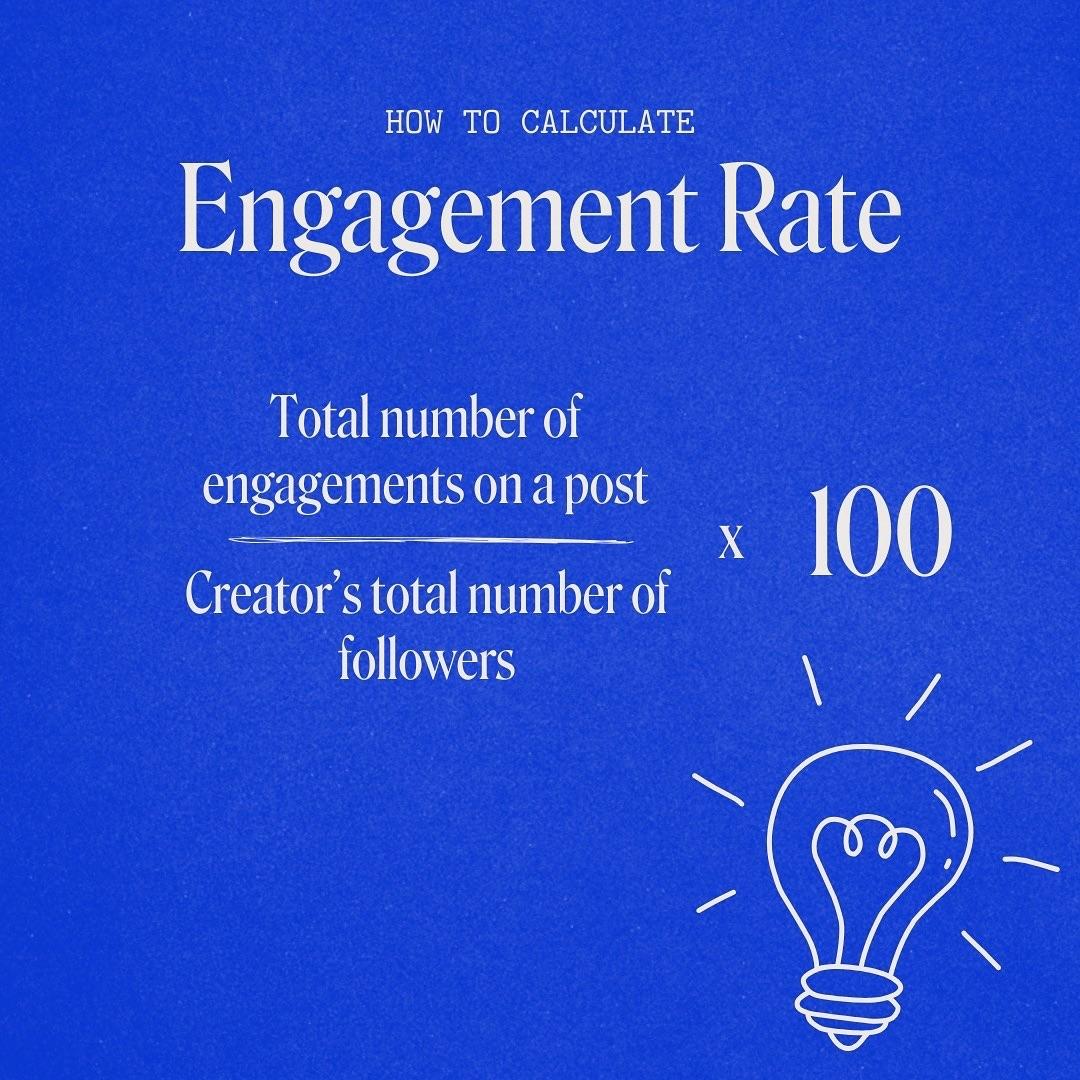

Starting a business can feel overwhelming, especially for first-time entrepreneurs. Among the various business structures available, a sole proprietorship stands out for its simplicity and ease of use. It’s perfect for those looking to dive into entrepreneurship without the complexities of partnerships or corporations. A sole proprietorship allows you to be your own boss and keep all the profits, but it also comes with certain responsibilities and risks that you need to understand.

One of the most appealing aspects of a sole proprietorship is its straightforward setup. You don’t have to register with the state in order to establish a sole proprietorship, making it an ideal choice for freelancers or small business owners. In most cases, all you really need to do is obtain any necessary licenses or permits that pertain to your business activities. This means you can focus your energy on your product or service rather than on bureaucratic paperwork.

Another key element to consider is taxation. As a sole proprietor, your business income is reported on your personal tax return. This means you avoid the double taxation that can occur with corporations. You’ll typically file a Schedule C form along with your personal 1040. However, it’s essential to keep meticulous records of your income and expenses to ensure you take advantage of any potential deductions, such as business-related costs like supplies, travel, and even a home office if applicable.

While the benefits are enticing, it’s crucial to recognize some risks associated with a sole proprietorship. Because you and your business are legally the same entity, you bear unlimited liability. This means that if your business faces lawsuits or debts, your personal assets might be at risk. Therefore, it’s advisable to consider options like business insurance to mitigate these risks and protect your hard-earned assets.

Furthermore, as a sole proprietor, you might experience limitations in funding opportunities. Traditional lenders often prefer established businesses or those with a formal structure. However, there are still ways to secure funding through personal loans, crowdfunding, or even small business grants specifically available for sole proprietors. Networking and building connections can also open doors to financial opportunities you may not have considered.

| Pros of a Sole Proprietorship | Cons of a Sole Proprietorship |

|---|---|

| Easy to create and operate | Unlimited personal liability |

| All profits go to the owner | Limited funding options |

| Simplified tax filing | Less credibility with larger clients |

is vital for anyone considering this business structure. It offers a unique blend of simplicity and control, but it’s essential to weigh the pros and cons carefully. By staying informed and proactive, you can successfully navigate the challenges and take full advantage of the opportunities it presents.

Identifying Your Business Idea and Niche

Starting a journey as a sole proprietor begins with a crucial step: . This foundational element is not just about what you want to sell or the service you wish to offer; it’s about finding a unique space in the market where you can thrive.

To uncover your ideal business idea, consider the following:

- Passion and Skills: What are you passionate about? What skills do you possess that can be transformed into a business? Your enthusiasm for a subject can serve as a powerful motivator.

- Market Demand: Research the market to see what products or services are currently in demand. What problems do potential customers face that you could solve?

- Competitor Analysis: Check out your potential competitors. Who are they? What are they doing well, and where do they fall short? Understanding your competition can help you carve out your niche.

- Target Audience: Identify your ideal customer. Who would benefit from your offerings? Understanding your audience will help you tailor your products or services to their needs.

As you sift through your ideas, it’s essential to consider the viability of your business concept. Ask yourself:

- Is there a sustainable market for my idea?

- Can I realistically execute this idea with my current resources?

- What unique value can I offer that sets me apart from others?

Once you have a list of potential ideas, it’s time to narrow it down by selecting a niche. A niche is a specialized segment of the market that allows you to focus on a particular area of expertise or interest. When selecting your niche, think about the following aspects:

| Aspect | Considerations |

|---|---|

| Market Size | Is the market large enough to support your business? |

| Competition Level | How saturated is the market? Can you stand out? |

| Profit Potential | Are there enough potential customers willing to pay for your service or product? |

| Personal Interest | Will you enjoy working in this niche long-term? |

Choosing a niche effectively helps you target your marketing efforts and establish a strong brand identity, making it easier for customers to understand what you offer. Additionally, a well-defined niche allows you to become an authority in your field, building trust and loyalty among your audience.

Ultimately, the process of should be both exciting and strategic. By taking the time to explore your passions, understand market dynamics, and define your audience, you set the stage for a successful sole proprietorship. Embrace the clarity that comes from this foundational work, as it will guide you through the subsequent steps of launching your business.

Choosing the Right Name for Your Business

When it comes to launching your sole proprietorship, one of the most critical decisions you’ll make is selecting the right name for your business. Your business name isn’t just a label; it’s the first impression you’ll create with potential customers and can have a lasting impact on your brand identity. Here are some tips to help you land on the perfect name:

- Reflect Your Brand: Choose a name that encapsulates what your business stands for. Think about the products or services you offer and try to convey that in your name. A name that resonates with your target audience will help establish trust and recognition.

- Keep It Simple: A straightforward name is easier to remember, spell, and pronounce. Avoid complicated words or phrases that may confuse potential customers. Shorter names are often more impactful and easier to share.

- Check Availability: Before you fall in love with a name, make sure it’s available. Check domain registrations and social media platforms to ensure that you can create a consistent online presence. You wouldn’t want to find out later that someone else is using the same name!

- Look for Uniqueness: A unique name helps you stand out in a crowded market. Avoid generic terms that blend in with competitors. Consider inventing a new word or combining elements from different languages to craft something original.

- Think Long-Term: Choose a name that can grow with your business. Avoid names that are too specific to a particular product or trend, as they may limit your expansion opportunities in the future.

Creating a shortlist of names is a great way to narrow down your options. You can even get feedback from friends, family, or potential customers to see how your names resonate with them. This input can provide valuable insight into how different demographics perceive your business.

Once you’ve selected a name, it’s time to secure it. Register your business name with the appropriate government authorities to protect it legally. Additionally, consider trademarking your name to prevent others from using it. This step is essential for establishing your brand’s identity and protecting your intellectual property.

Don’t forget to think about how your business name will look in your marketing materials, including your logo, business cards, and website. A strong visual representation of your name can enhance brand recognition and create a cohesive image across all platforms.

Ultimately, your business name will be a cornerstone of your brand, so take your time with this decision. By thoughtfully considering your options and ensuring the name aligns with your vision, you’ll set a solid foundation for your sole proprietorship. Happy naming!

Registering Your Business and Obtaining Licenses

After you have decided to embark on your journey as a sole proprietor, one of the first practical steps you need to take involves registering your business and obtaining the necessary licenses. This process may seem daunting, but it’s essential for ensuring that you operate legally and can build a reputable brand.

The first step in registering your business is to choose a name that reflects your services and sets you apart from competitors. Once you have your business name, you should check its availability. This can usually be done through your local government’s business registry website. If your desired name is available, consider reserving it while you complete the registration process.

Next, you’ll want to determine what type of registration is required in your area. In some regions, you may simply need to register your business name, while others may require you to file for a “Doing Business As” (DBA) designation. This is particularly important if you’re operating under a name different from your legal name. Here are some common types of registrations:

- Business Name Registration: Required to legally operate under a specific name.

- DBA Filing: Allows you to conduct business under a name other than your own.

- Employer Identification Number (EIN): Necessary if you plan to hire employees or want to open a business bank account.

Once you’ve completed the necessary registrations, it’s time to focus on licensing. Depending on your industry and location, you may need specific licenses and permits to operate legally. Here are some common licenses you might encounter:

- Business License: A general requirement for most types of businesses.

- Professional License: Required for certain professions, such as health care or law.

- Sales Tax Permit: Necessary if you will be selling goods or services subject to sales tax.

To ensure you have everything covered, you can create a checklist of required licenses based on your business type and locality. Here’s a simplified example:

| License Type | Description | Status |

|---|---|---|

| Business License | General operating license | ✔️ Required |

| Sales Tax Permit | For selling taxable goods | ✔️ Required |

| DBA Registration | If using a different business name | ✔️ Optional |

Remember that the licensing requirements can vary significantly depending on your location. It’s a smart move to consult with your local chamber of commerce or a business attorney to ensure you understand all local zoning laws and regulations that may affect your business.

keep in mind that maintaining compliance is an ongoing responsibility. Be proactive about renewing licenses and registrations as needed, and stay informed about any changes in laws that could impact your business. Getting all this sorted out enables you to focus on what really matters—growing your business!

Setting Up Your Finances Like a Pro

When you embark on the journey of starting a sole proprietorship, managing your finances effectively can make all the difference in your success. By from the get-go, you’ll create a solid foundation for your business to thrive. Here are some essential steps to ensure your financial setup is streamlined and efficient.

First and foremost, establish a dedicated business bank account. Mixing personal and business finances can lead to confusion and complicate your tax filings. Choose a bank that offers features tailored to small businesses, such as low fees and online banking capabilities. This separation not only helps in managing cash flow but also provides clarity during tax time.

Next, consider implementing a robust accounting system. This could range from using software like QuickBooks or FreshBooks to hiring a bookkeeper. Keeping accurate records of your income and expenses is crucial. By doing so, you can easily track your profitability and make informed decisions about your business’s future. Here’s a simple comparison of popular accounting software:

| Software | Features | Price |

|---|---|---|

| QuickBooks | Invoicing, expense tracking, tax calculations | From $25/month |

| FreshBooks | Time tracking, project management, simple invoicing | From $15/month |

| Xero | Bank reconciliation, invoicing, reporting | From $12/month |

Thirdly, keep a detailed budget. Your budget should outline all expected income and expenses, helping you understand your cash flow patterns. Make it a habit to review your budget regularly and adjust it as needed. This proactive approach allows you to identify potential financial challenges before they escalate.

Moreover, it’s crucial to keep track of your tax obligations. As a sole proprietor, you are required to report your business income on your personal tax return. Familiarize yourself with the tax deductions available to small businesses, such as home office expenses and business travel. You might also want to set aside a percentage of your income for taxes to avoid surprises at the end of the year.

Lastly, don’t underestimate the power of financial education. Invest in learning about financial management through books, online courses, or workshops. Understanding the basics of finance will empower you to make better decisions and help your business grow. Consider joining a community of entrepreneurs to share insights and experiences on financial management.

Crafting a Simple Business Plan That Works

Creating a business plan is an essential step for anyone looking to start a sole proprietorship. A well-crafted plan serves as your roadmap, guiding you through the complexities of launching and running your business. Plus, it’s a fantastic tool to clarify your vision and objectives.

Begin by outlining your business goals. What do you want to achieve in the short and long term? This can include financial targets, customer acquisition goals, or even personal milestones. Be specific and realistic. Here are some questions to consider:

- What products or services will you offer?

- Who is your target audience?

- What problem does your business solve for them?

Next, focus on your market analysis. Understanding your industry is crucial for success. Research your competitors, identify trends, and analyze potential challenges. This knowledge will help you carve your niche and craft compelling marketing strategies.

Don’t forget about your financial projections. Create a simple budget that outlines your startup costs, operational expenses, and expected revenue. This will not only help you manage your finances but also assist you in seeking funding if needed. Consider including:

| Item | Estimated Cost |

|---|---|

| Business License | $100 |

| Marketing | $200 |

| Supplies | $400 |

| Insurance | $300 |

Next is your marketing strategy. Outline how you plan to reach your customers. Will you use social media, local advertising, or perhaps networking events? Make sure this plan aligns with your goals and is adaptable as your business grows.

Lastly, detail your operational plan. This should include the daily functions of your business, such as where you will operate from, your hours of operation, and how you plan to deliver your products or services. Having a clear operational plan ensures you’re prepared for the day-to-day tasks and challenges that may arise.

With these elements in place, you’ll have a solid foundation for your business plan. Remember, it doesn’t have to be perfect from the start. As you grow and learn more about your market, your plan can evolve. The key is to get started and stay committed to your vision.

Marketing Your Sole Proprietorship Effectively

Once you’ve set up your sole proprietorship, the next step is to effectively market your business to attract clients and grow your brand. With the right strategies in place, you can reach your target audience and turn potential customers into loyal clients.

First, it’s crucial to define your target audience. Understanding who your ideal customer is will shape all your marketing efforts. Consider factors such as:

- Demographics: Age, gender, location, and income level

- Interests: Hobbies, social media use, and shopping habits

- Challenges: Common problems they face that your business can solve

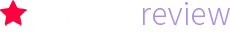

Next, harness the power of social media. Platforms like Facebook, Instagram, and LinkedIn are excellent tools for promoting your business. Here’s how to make the most of them:

- Share valuable content that showcases your expertise.

- Engage with your audience through comments and messages.

- Use targeted ads to reach specific demographics.

Another effective method is to establish a professional website. Today, having a strong online presence is non-negotiable. Your website should be user-friendly and include:

- An about page that tells your story.

- A services page detailing what you offer.

- A contact form so potential clients can easily reach you.

Consider creating a blog as part of your website. Regularly posting articles related to your industry can improve your SEO and position you as an authority in your niche. Aim for topics that resonate with your audience’s interests and challenges.

| Content Ideas | Purpose |

|---|---|

| How-to Guides | Provide valuable information |

| Industry News | Keep your audience updated |

| Customer Testimonials | Build trust and credibility |

Don’t underestimate the power of networking. Attend local business events, join community groups, or participate in online forums. Building relationships with other entrepreneurs can lead to referrals and collaborations that benefit both parties.

consider utilizing email marketing. Collect email addresses from customers and website visitors to keep them informed about your services, promotions, and updates. Personalization is key—tailor your emails to meet the interests of your audience for better engagement.

Navigating Taxes and Legal Obligations

Once you’ve set up your sole proprietorship, understanding your taxes and legal obligations is crucial for a smooth operation. Sole proprietorships are often favored for their simplicity, but this doesn’t mean you can overlook your responsibilities.

First off, as a sole proprietor, you’ll report your business income on your personal tax return using Schedule C (Profit or Loss from Business). This means your business income is taxed at your personal income tax rate. Be sure to keep meticulous records of your income and expenses, as these will directly influence your tax obligations.

Another important aspect to consider is self-employment tax. This tax covers Social Security and Medicare, and applies to net earnings from your sole proprietorship. In 2023, the self-employment tax rate stands at 15.3%. Here’s a quick breakdown:

| Tax Type | Rate |

|---|---|

| Income Tax | Based on personal tax bracket |

| Self-Employment Tax | 15.3% |

In addition to federal taxes, don’t forget about state and local tax requirements. These can vary significantly depending on your location. It’s wise to consult your state’s tax authority or a tax professional to ensure compliance.

Moreover, consider any necessary business licenses or permits that may be required for your specific industry. This could range from a general business license to specialized permits, such as health permits for food businesses or professional licenses for certain trades.

Lastly, it’s essential to keep an eye on estimated tax payments. As a sole proprietor, you’re responsible for paying taxes quarterly if you expect to owe $1,000 or more at the end of the year. Failing to make these payments can lead to penalties and interest, so plan ahead and set aside a portion of your earnings to cover them.

By staying informed about your taxes and legal obligations, you can focus more on growing your business without the worry of unexpected fines or audits. Keep learning, stay organized, and you will navigate this aspect of entrepreneurship with confidence!

Building a Strong Customer Base from Day One

As you embark on your journey as a sole proprietor, building a strong customer base from the very beginning is crucial. The foundation you set in the early days can significantly impact the success and growth of your business. Here are some effective strategies to get you started:

- Identify Your Target Audience: Understanding who your customers are is essential. Consider demographics such as age, gender, location, and interests. Conduct market research to tailor your products or services to meet their needs.

- Create a Unique Value Proposition: What sets your business apart from the competition? Clearly articulating your unique selling points will help you attract customers. Whether it’s quality, price, or exceptional service, make it known!

- Leverage Social Media: Establish a presence on platforms where your audience hangs out. Share valuable content, engage with followers, and showcase your offerings. Social media can be a powerful tool to connect with potential customers and build relationships.

- Network Locally: Attend local events, join business associations, or collaborate with other local businesses. Word-of-mouth referrals can be incredibly effective, especially in the early stages of your business.

Another crucial aspect is to focus on delivering an excellent customer experience from the outset. Happy customers are more likely to return and recommend your business to others. Here are some tips:

- Be Responsive: Answer inquiries promptly and professionally. Showing that you value your customers’ time will set a positive tone for your business.

- Seek Feedback: Encourage customers to share their experiences. Use surveys or social media polls to gather insights. This not only helps improve your offerings but also makes customers feel valued.

- Develop a Loyalty Program: Consider implementing a loyalty program to reward repeat customers. Simple rewards can encourage them to choose your business time and again.

To track your progress, it’s important to monitor key metrics. Here’s a simple way to organize this information:

| Metric | How to Measure | Importance |

|---|---|---|

| Customer Acquisition Cost | Total marketing expenses / Number of new customers | Indicates how effective your marketing strategies are. |

| Customer Retention Rate | ((End customers – New customers) / Start customers) x 100 | Helps gauge customer satisfaction and loyalty. |

| Net Promoter Score (NPS) | Survey asking customers how likely they are to recommend you | Measures customer satisfaction and potential for referrals. |

by understanding your audience, providing exceptional service, and consistently seeking feedback, you’ll lay a solid foundation for a loyal customer base. Each interaction should leave your customers feeling valued and appreciated, paving the way for growth and success in your sole proprietorship.

Staying Compliant and Adapting as You Grow

As your sole proprietorship begins to take shape, staying compliant with local, state, and federal regulations is crucial. This requires understanding the legal landscape that governs your business. Here are some core aspects to keep in mind:

- Licenses and Permits: Depending on your industry, you may need specific licenses or permits to operate legally. Research the requirements in your area to avoid any fines.

- Tax Obligations: Sole proprietors must report their business income on personal tax returns. Familiarize yourself with tax deductions available for your business to keep your expenses manageable.

- Insurance: While not always mandatory, having the right insurance can protect you from unforeseen liabilities. Explore options like general liability or professional liability insurance.

As you grow, your business may evolve, and so may the regulations that apply to it. Staying ahead of the curve means regularly revisiting your compliance checklist. Consider establishing a routine to assess your business’s compliance status, which can include:

- Annual Reviews: Set aside time each year to review your licenses, permits, and insurance policies.

- Updates on Tax Laws: Tax regulations can change, impacting your obligation. Keep informed through trusted financial news sources or consult a tax professional.

- Networking: Join local business groups or forums where you can share knowledge about compliance and learn from others’ experiences.

Adapting to changes in regulations or market conditions is vital for your business’s longevity. If your business model shifts or if you expand into new markets, your compliance requirements may change. In such cases, consider the following:

| Scenario | Action Required |

|---|---|

| Expanding Product Lines | Check for new regulations specific to those products. |

| Hiring Employees | Understand employment laws and worker’s compensation requirements. |

| Changing Locations | Revisit local zoning laws and permit needs. |

Lastly, the digital landscape is ever-changing. If you rely on online platforms to conduct business, stay updated on the rules for e-commerce, data protection, and consumer rights. Ensuring you have a solid understanding of these laws not only protects your business but also builds trust with your customers.

In a nutshell, staying compliant while adapting as you grow is a balancing act. Invest time in understanding the regulatory framework surrounding your sole proprietorship and stay proactive. Not only will this safeguard your business, but it will also position you for sustainable growth in the long run.

Leveraging Technology for Better Efficiency

In today’s fast-paced world, harnessing the power of technology can significantly streamline your journey as a sole proprietor. By integrating various tools and platforms into your daily operations, you can not only save time but also enhance your productivity. Here are some tech-savvy strategies to consider:

- Utilize Cloud-Based Tools: Cloud storage solutions like Google Drive or Dropbox allow you to access your documents anywhere, anytime. This flexibility enables you to work from home, at a café, or on the go, keeping your business operations smooth and uninterrupted.

- Automate Routine Tasks: Embrace software that can automate repetitive tasks. Tools like Zapier can connect different applications, automating workflows and freeing up your time for more critical aspects of your business.

- Invest in Accounting Software: Managing finances can be daunting, but with platforms like QuickBooks or FreshBooks, you can easily track expenses, generate invoices, and analyze your financial health with just a few clicks.

- Leverage Social Media for Marketing: Platforms such as Facebook, Instagram, and LinkedIn are essential for promoting your business. Using scheduling tools like Buffer or Hootsuite allows you to plan posts in advance, ensuring consistent engagement with your audience without the daily hassle.

To give you a clearer picture of how technology can enhance efficiency, consider the following table illustrating common tasks and their automated solutions:

| Task | Automated Solution |

|---|---|

| Invoice Generation | QuickBooks |

| Email Marketing Campaigns | Mailchimp |

| Social Media Posting | Buffer |

| Customer Relationship Management | HubSpot |

Furthermore, project management tools such as Trello or Asana can keep your tasks organized and your team aligned, even if you’re working solo. These platforms allow you to break down projects into manageable parts, set deadlines, and track your progress visually. This can significantly reduce the likelihood of tasks falling through the cracks.

Additionally, incorporating customer feedback tools like SurveyMonkey can provide invaluable insights into your products or services. Understanding what your customers appreciate or desire can guide your business decisions and drive improvements.

Lastly, consider using communication tools like Slack or Microsoft Teams to facilitate seamless interaction with clients or freelancers. These platforms can help you maintain professional relationships and ensure that everyone is on the same page, regardless of their location.

Networking with Other Sole Proprietors

can be one of the most rewarding aspects of running your own business. By connecting with like-minded individuals who share similar challenges and experiences, you can cultivate relationships that lead to collaboration, support, and growth. Here are some effective strategies to build your network:

- Join Local Business Groups: Look for local chambers of commerce or small business associations in your area. These organizations often host events and workshops that provide a platform for you to meet other sole proprietors.

- Attend Meetups: Websites like Meetup.com can help you find gatherings tailored to specific interests or industries. Attend these meetups to meet fellow entrepreneurs and share insights.

- Utilize Social Media: Engage in online communities on platforms like LinkedIn, Facebook, and Instagram. Join groups specifically for solo entrepreneurs where you can share your experiences and seek advice.

- Collaborative Projects: Consider partnering with another sole proprietor for a project or event. This can expand your network and introduce you to new clients.

When you connect with others, remember that networking is not just about what you can gain; it’s also about what you can give. Share your expertise and offer help where you can. This reciprocal approach can lead to stronger, more valuable relationships. Here are a few tips to enhance your networking skills:

- Be Genuine: Authenticity resonates. Be yourself and foster connections based on trust.

- Follow Up: After meeting someone, send a quick message expressing your pleasure in meeting them. This small gesture can leave a lasting impression.

- Keep Conversations Open-Ended: Ask open-ended questions that encourage dialogue and sharing of ideas. For example, “What challenges are you currently facing in your business?”

To help you track your networking efforts, consider maintaining a simple spreadsheet. Here’s a basic format to get you started:

| Name | Business | Contact Info | Notes |

|---|---|---|---|

| Jane Doe | Graphic Design Studio | [email protected] | Met at local chamber event |

| John Smith | Web Development | [email protected] | Interested in collaboration |

don’t underestimate the power of mentorship. Seek out more experienced sole proprietors who can provide guidance and support. Building a mentorship relationship can accelerate your growth and help you navigate the challenges of running a business.

Remember, networking is an ongoing process. Stay engaged, be open to new opportunities, and don’t shy away from putting yourself out there. With the right connections, you can create a supportive community that fosters not just your business, but also your personal growth as an entrepreneur.

Preparing for Challenges and Finding Support

Starting a sole proprietorship can be an exhilarating journey, but it often comes with its fair share of challenges. As you embark on this path, it’s essential to anticipate potential hurdles and equip yourself with the right tools and support networks to navigate them effectively.

One of the first steps in preparing for challenges is to identify common obstacles you might face. Here are some key areas to consider:

- Financial Management: Understanding your cash flow and budgeting will be crucial. Be prepared for fluctuating income, especially in the early stages.

- Marketing and Visibility: Getting your business noticed is essential. You may need to experiment with different marketing strategies to find what works best for your audience.

- Time Management: Balancing various responsibilities can be overwhelming. Prioritizing tasks and setting a schedule can help maintain focus.

- Legal Compliance: Familiarize yourself with local regulations and ensure that all your licenses and permits are in order.

Finding support is equally important as you venture into entrepreneurship. Building a network of mentors, peers, and professionals can provide invaluable guidance and encouragement. Consider the following sources of support:

- Business Associations: Joining local business groups or chambers of commerce can connect you with other entrepreneurs facing similar challenges.

- Online Communities: Platforms like forums and social media groups can offer a wealth of knowledge and shared experiences.

- Mentorship Programs: Seek out mentors who have successfully navigated the sole proprietorship landscape. Their insights can help you avoid common pitfalls.

- Professional Services: Don’t hesitate to hire accountants or business consultants when necessary. Their expertise can save you time and prevent costly mistakes.

consider creating a support plan that outlines how you will address challenges as they arise. Below is a simple structure you can use:

| Challenge | Action Plan | Support Needed |

|---|---|---|

| Cash Flow Issues | Review budget monthly, cut unnecessary expenses | Accountant, financial advisor |

| Marketing Struggles | Test different marketing strategies, gather feedback | Marketing consultant, peer feedback |

| Time Management | Create a daily schedule, set priorities | Time management coach, productivity tools |

| Compliance Issues | Regularly check local regulations, keep documents organized | Business attorney |

By proactively preparing for challenges and fostering a supportive network, you can enhance your resilience and significantly increase your chances of success in your sole proprietorship. Remember, every entrepreneur faces obstacles, but having the right support can make all the difference.

Celebrating Your Successes and Planning for the Future

As you embark on your journey as a sole proprietor, it’s essential to take a moment to recognize your achievements. Whether you’ve successfully launched your business or secured your first client, each milestone is a stepping stone toward greater success. Celebrating these moments not only boosts your confidence but also reinforces your commitment to your entrepreneurial path.

Reflecting on your successes can help you identify what strategies worked best. Consider keeping a journal or a digital log of your wins, no matter how small. This practice will serve as a motivational tool and a source of inspiration during challenging times. Here are some ways to celebrate your achievements:

- Throw a mini-celebration: Invite friends or family to acknowledge your hard work.

- Reward yourself: Treat yourself to something special, whether it’s a nice dinner or a new gadget for your business.

- Share your success: Use social media or your website to tell your audience about your milestones.

Once you’ve taken the time to celebrate, the next step is to look ahead. Planning for the future is just as crucial as acknowledging the past. Set specific, measurable goals that align with your vision for your business. Consider breaking these goals down into short-term and long-term targets to create a clear roadmap for your progress.

Here are some essential factors to consider when planning your future:

- Market Research: Stay informed about your industry trends and customer preferences.

- Financial Planning: Create a budget that allows for growth and unexpected expenses.

- Networking: Build relationships with other business owners and potential clients to expand your reach.

To help visualize your path forward, consider creating a simple table to outline your goals, action steps, and timelines:

| Goal | Action Steps | Timeline |

|---|---|---|

| Increase Sales by 20% | Launch a marketing campaign, enhance social media presence | Next 6 months |

| Expand Product Line | Research customer feedback, prototype new products | Next 12 months |

| Build a Website | Hire a web designer, outline content strategy | Next 3 months |

By celebrating your successes and proactively planning for the future, you set the stage for continuous growth and fulfillment in your entrepreneurial journey. Each step you take not only brings you closer to your goals but also enriches your experience as a sole proprietor. Remember, every entrepreneur’s path is unique; stay true to your vision and enjoy the ride!

Frequently Asked Questions (FAQ)

Q: What exactly is a sole proprietorship?

A: A sole proprietorship is the simplest type of business structure, where you, the owner, are the business. There’s no legal distinction between you and your business, which means you get to keep all the profits, but you’re also personally responsible for any debts or obligations. It’s a great way to dip your toes into entrepreneurship without the complexities of forming an LLC or corporation!

Q: Why should I consider starting a sole proprietorship?

A: Great question! Sole proprietorships are super appealing because they are easy to set up, require minimal paperwork, and have fewer regulations than other business structures. Plus, you retain full control over your business decisions. If you’ve got a fantastic idea and want to run with it, this is a fantastic way to start!

Q: What are the first steps I need to take to start my sole proprietorship?

A: Starting your sole proprietorship can be broken down into five straightforward steps:

- Choose Your Business Idea: Identify what you’re passionate about and how you can turn that into a business.

- Pick a Business Name: Make sure it’s catchy, reflects your brand, and check that it’s not already in use!

- Register Your Business: Depending on your location, you might need to register your business name or get a business license.

- Get Your Finances in Order: Open a separate bank account for your business and keep your finances organized.

- Understand Your Tax Obligations: Since you’ll be taxed on your personal income, it’s important to understand how to report your business earnings.

Q: Do I need a license or permit to operate?

A: It depends on your business type and location! Certain industries, like food services or health care, often require specific licenses or permits. It’s best to check with your local government office to see what’s needed in your area. You don’t want to get caught off guard!

Q: How do I handle taxes as a sole proprietor?

A: As a sole proprietor, you’ll report your business income on your personal tax return, typically using Schedule C. Keep good records of your income and expenses, as this will make tax time a breeze! If your business grows, consider consulting with a tax advisor to ensure you’re maximizing your deductions.

Q: Can I hire employees as a sole proprietor?

A: Absolutely! As a sole proprietor, you can hire employees. Just keep in mind that this will add some responsibilities, such as payroll taxes and complying with employment laws. It’s a great way to grow your business, but make sure you’re ready for the added commitment!

Q: Any last tips for someone just starting out?

A: Yes! Stay organized, keep learning, and don’t be afraid to seek help. Whether it’s networking with other entrepreneurs or reaching out to mentors, tapping into resources can provide invaluable support. And most importantly, believe in yourself and your vision—your passion is what will drive your success!

Insights and Conclusions

And there you have it—starting your own sole proprietorship doesn’t have to be overwhelming! By following these five straightforward steps, you’re well on your way to turning your passion into a thriving business. Remember, every successful entrepreneur started somewhere, and taking that first step is often the most crucial.

Whether you’re looking to share your craft, offer a service, or dive into the world of freelancing, embracing the sole proprietorship model can give you the freedom and flexibility to chase your dreams. Don’t hesitate to seek advice from fellow entrepreneurs, and always stay curious and open to learning as you grow your business.

So go ahead, take that leap! Your journey awaits, and we can’t wait to see where it takes you. If you have any questions or need further guidance along the way, feel free to drop a comment below. Happy entrepreneuring!