Are you considering starting a business and feeling overwhelmed by the options? If you’ve found yourself torn between forming a Limited Liability Company (LLC) and going the partnership route, you’re not alone! Choosing the right business structure is a crucial decision that can impact everything from liability to taxes, and even how you make decisions. In this complete guide, we’re diving deep into the key differences between LLCs and partnerships, breaking down each option to help you make an informed choice. Whether you’re a solo entrepreneur or teaming up with friends, understanding these distinctions is essential for setting your business on the right path. So, let’s explore the pros and cons of each structure and find out which one might be the perfect fit for you!

Understanding the Basics of LLC and Partnership

When it comes to choosing a business structure, understanding the differences between a Limited Liability Company (LLC) and a partnership is essential for any entrepreneur. Both of these options present unique advantages and drawbacks, and making an informed decision can significantly impact your business’s future.

Limited Liability Company (LLC):

An LLC is a popular choice among small business owners due to its flexible structure and personal liability protection. Here are some key characteristics:

- Liability Protection: Members are generally not personally liable for the company’s debts.

- Tax Flexibility: An LLC can choose how it wants to be taxed – as a sole proprietorship, partnership, or corporation.

- Management Structure: LLCs allow for a flexible management structure, which can accommodate varying degrees of involvement from members.

One of the most appealing aspects of an LLC is its ability to separate personal and business assets. This means if your business faces legal issues or debt, your personal belongings are typically safe from creditors. Additionally, LLCs often have fewer compliance requirements than corporations, making them easier to manage for new business owners.

Partnership:

On the other hand, partnerships are relatively straightforward and involve two or more individuals sharing ownership and responsibilities. Here’s what to consider:

- Shared Control: All partners typically share decision-making authority.

- Pass-Through Taxation: Income is taxed at the individual partners’ tax rates, avoiding double taxation.

- Simplicity: Forming a partnership is usually less formal and requires fewer regulatory hurdles.

While partnerships offer ease of setup and operational simplicity, they come with potential risks. Partners are often personally liable for business debts, which can endanger personal assets. To mitigate these risks, many partners opt for a Limited Partnership (LP), which allows for some partners to have limited liability.

| Feature | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No (unless LP) |

| Tax Structure | Flexible | Pass-through |

| Formation Complexity | Moderate | Low |

| Management | Flexible | Shared |

both LLCs and partnerships offer distinct features that cater to different business needs. If personal liability protection is a priority, an LLC may be the better choice. However, if you’re looking for simplicity and shared decision-making, a partnership could be the way to go. Ultimately, understanding these fundamentals will empower you to choose the right structure for your business journey.

Key Differences Between LLCs and Partnerships

When considering the right business structure, understanding the distinctions between a Limited Liability Company (LLC) and a partnership is crucial. While both offer unique advantages, they cater to different business needs and levels of liability protection.

Liability Protection: One of the main differences lies in the liability exposure of the owners. In a partnership, each partner typically shares liability for debts and obligations incurred by the business. This means that personal assets could be at risk if the business faces legal issues or significant debt. Conversely, an LLC provides limited liability protection, shielding personal assets from business liabilities. This is particularly beneficial for entrepreneurs looking to safeguard their financial security.

Taxation Differences: Another key aspect relates to taxation. Partnerships often benefit from pass-through taxation, meaning profits and losses are reported on the partners’ individual tax returns. This can simplify tax obligations but may lead to higher personal tax rates depending on income levels. In an LLC, owners can choose how they want to be taxed—either as a pass-through entity or as a corporation. This flexibility can lead to tax savings, depending on the business’s financial situation and the owners’ tax strategies.

Management Structure: The management dynamics also set these two structures apart. Partnerships typically have a more straightforward management approach where all partners are involved in decision-making. However, this can lead to potential conflicts if partners have differing visions. An LLC offers more versatile management options. Owners can decide to manage the business themselves or appoint managers, allowing for more structured governance and potentially reducing disputes.

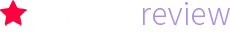

Formation and Regulatory Requirements: Establishing an LLC involves more formalities compared to a partnership. An LLC requires filing articles of organization with the state and adhering to ongoing compliance measures, such as annual reports and fees. In contrast, partnerships are generally easier to form, often requiring only a partnership agreement. However, this simplicity can sometimes lead to misunderstandings if the terms are not clearly outlined.

Continuity and Transferability: The future of the business can also be affected by the structure chosen. In a partnership, the departure of a partner may dissolve the business unless otherwise stated in the partnership agreement. This lack of continuity can create instability. An LLC, however, can continue to exist even if a member leaves, providing greater long-term stability and the ability to transfer ownership shares more easily.

| Feature | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No |

| Tax Flexibility | Yes | Limited |

| Management Structure | Flexible | Shared |

| Formation Complexity | More Complex | Simple |

| Continuity | Continues | May Dissolve |

while both LLCs and partnerships have their merits, the choice largely depends on your business goals, the level of liability protection required, and the desired management structure. Carefully considering these differences can lead you to the most suitable option for your entrepreneurial journey.

The Legal Structure: What You Need to Know

When deciding between forming an LLC or establishing a partnership, understanding the legal structures involved is crucial. Each option has unique characteristics that can significantly impact your business operations, liability, and taxation.

Limited Liability Company (LLC):

- Provides limited liability protection to its owners (members), meaning personal assets are generally protected from business debts and claims.

- More complex to set up than a partnership, often requiring filing Articles of Organization with the state.

- Offers flexibility in management structure, which can be member-managed or manager-managed.

- Pass-through taxation is available, but LLCs can also choose to be taxed as a corporation.

Partnership:

- Typically easier and less expensive to establish, often requiring just an oral or written agreement among partners.

- Partners share personal liability for business debts, which can put personal assets at risk.

- Management and operational decisions are usually made collectively, which can lead to conflicts if not managed properly.

- Income is typically taxed at the individual partner level, leading to potential tax advantages in certain situations.

| Feature | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No |

| Formation Complexity | Moderate | Low |

| Management Flexibility | High | Moderate |

| Tax Structure | Flexible (Pass-through or corporate) | Pass-through |

Both structures offer unique benefits and drawbacks, depending on the specific needs of your business. It is essential to consider factors such as your tolerance for risk, the nature of your business, and your long-term goals. If personal liability protection is a priority, an LLC might be the better choice, whereas partnerships may be suitable for those looking for simplicity and shared decision-making.

Ultimately, seeking advice from a legal or financial professional can help clarify the best path for your business structure, ensuring you make a well-informed decision that aligns with your vision and protects your interests.

Liability Protection: Who’s Responsible?

When it comes to liability protection, understanding who is responsible in an LLC versus a partnership is crucial for any entrepreneur. Both business structures handle liability differently, which can significantly impact your financial security and personal assets.

In a Limited Liability Company (LLC), members typically enjoy personal liability protection. This means that if the business faces a lawsuit or incurs debts, the owners’ personal assets like homes and savings accounts are generally protected. However, this protection is not absolute and can be compromised under certain conditions:

- Personal Guarantees: If a member personally guarantees a loan, they can be held liable for that debt.

- Fraudulent Activities: Engaging in illegal or unethical conduct can lead to losses of liability protections.

- Improper Management: Failing to follow LLC regulations or formalities can also expose members to personal liability.

On the other hand, a Partnership does not provide the same level of protection. In a general partnership, each partner is personally liable for the debts and obligations of the business. This means that if the partnership faces financial trouble or legal issues, partners’ personal assets may be at risk. Here’s how liability works in a partnership:

- Joint Responsibility: All partners share liability, meaning one partner’s actions can affect all.

- Unlimited Liability: Each partner is personally liable for the full amount of business debts, which can lead to financial strain.

- Limited Partnerships Option: In a limited partnership, at least one partner has limited liability, but this requires a formal structure and agreement.

| Aspect | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes, typically protects personal assets | No, partners are personally liable |

| Management Structure | Flexible management options | Equal rights among general partners |

| Tax Treatment | Pass-through taxation available | Pass-through taxation |

| Formation Requirements | More complex with state filing | Generally less formal |

Choosing the right business structure is vital for ensuring that you have adequate protection against potential liabilities. If you’re looking to shield your personal assets from business-related risks, an LLC might be the way to go. Conversely, if you prefer a simpler structure and don’t mind the risk of personal liability, a partnership could be more appealing.

Ultimately, the decision between an LLC and a partnership should align with your business goals, risk tolerance, and operational preferences. Consulting with a legal or financial advisor can provide personalized insights to determine the best option for your unique situation.

Tax Implications: How Each Structure Affects Your Wallet

When deciding between forming an LLC or a partnership, understanding the tax implications is crucial, as it can significantly affect your financial health. Both structures have their own tax treatments that can either benefit or challenge business owners. Let’s break down how each structure impacts your wallet.

LLC Tax Treatment

An LLC, or Limited Liability Company, offers flexibility in how you can choose to be taxed. Here are some key points:

- Pass-Through Taxation: By default, LLCs enjoy pass-through taxation, meaning profits are reported on the owners’ personal tax returns, avoiding double taxation.

- Self-Employment Taxes: Members may be subject to self-employment taxes on their share of the profits, which can be a significant portion of your earnings.

- Tax Deductions: LLCs can deduct business expenses, which can reduce taxable income, making it a favorable option for managing taxes.

Partnership Tax Treatment

Partnerships also utilize pass-through taxation, but there are some differences to consider:

- Shared Responsibility: Partners report their share of profits and losses on their personal tax returns, similar to LLC members, but the allocation can be complex.

- Self-Employment Taxes: Partners are typically subject to self-employment taxes on their earnings, similar to LLC members.

- Losses and Deductions: A partnership allows for losses to offset personal income, which can be beneficial in the early stages of a business.

To illustrate the financial impact, consider the following comparison of potential tax liabilities for an LLC versus a partnership:

| Aspect | LLC | Partnership |

|---|---|---|

| Taxation Type | Pass-Through | Pass-Through |

| Self-Employment Tax | Yes | Yes |

| Potential Deductions | Broad | Limited |

| Complexity | Low to Medium | Medium to High |

It’s important to note that while both structures provide pass-through taxation, the way profits are distributed, and the available deductions can vary significantly. LLCs typically offer more flexibility in managing how profits are shared among members, which can be strategically advantageous.

Choosing the right structure ultimately comes down to your specific business goals, the nature of your operations, and how you plan to manage profits and losses. Thoroughly analyzing these tax implications will help ensure you’re not only compliant but also maximizing the funds that stay in your pocket.

Management Flexibility: Which Option Fits Your Style?

When it comes to choosing between an LLC and a partnership, the level of management flexibility offered by each structure can significantly shape your business operations. Understanding how each option aligns with your management style is crucial for both your day-to-day activities and long-term goals.

Limited Liability Company (LLC):

- Ownership Structure: An LLC allows for multiple owners, known as members, and can even accommodate corporations as members. This flexibility enables you to form a diverse management team tailored to your business needs.

- Management Options: Members of an LLC can choose to manage the business themselves or appoint managers. This choice offers a level of operational flexibility that is particularly beneficial if you want to focus on specific areas of the business while delegating other responsibilities.

- Profit Distribution: The ability to customize how profits are distributed among members provides a unique advantage. Unlike partnerships, where profits are typically shared equally or based on ownership percentage, an LLC allows for a more nuanced approach.

Partnership:

- Simplicity in Structure: Partnerships are generally easier to establish and manage. They require minimal formalities and ongoing paperwork, making them ideal for entrepreneurs who prefer a hands-on approach without bureaucratic hurdles.

- Direct Decision-Making: In a partnership, decisions are made collectively, allowing for quick responses to changing market conditions. If you thrive in collaborative environments and value shared leadership, this could be the right fit for you.

- Flexibility in Operations: Partnerships often enjoy a more informal operational structure, which can lead to faster execution of ideas and strategies. This can be particularly advantageous in dynamic industries where speed is essential.

Ultimately, the choice between an LLC and a partnership should reflect not just your business objectives but also your individual style of management. If you value adaptability, an LLC might be the best option, whereas if you prefer a straightforward approach with collaborative decision-making, a partnership could be the way to go.

To help visualize the differences in management styles, consider the following comparison:

| Feature | LLC | Partnership |

|---|---|---|

| Management Flexibility | High; choose members or managers | Moderate; decisions made collectively |

| Profit Sharing | Customizable | Typically equal or based on ownership |

| Ongoing Formalities | Higher; requires compliance | Lower; fewer regulations |

| Liability Protection | Yes | No |

Understanding these distinctions can empower you to make an informed choice that aligns with your management style, ensuring your business is not only successful but also a reflection of your personal values and operational preferences.

Raising Capital: Navigating Funding Options

When it comes to raising capital for your business, the choice between forming an LLC or a partnership can significantly affect your funding options. Limited Liability Companies (LLCs) and partnerships offer different structures that can either enhance or limit your ability to attract investment. Understanding these differences is crucial for entrepreneurs seeking to secure funding.

LLCs provide certain advantages that can make them more appealing to investors. Here are a few critical points:

- Limited Liability Protection: LLC owners (members) enjoy personal liability protection. This means that personal assets are shielded from business debts, making it a safer option for investors.

- Flexible Structure: An LLC can have unlimited members, and it allows for various profit-sharing arrangements, which can be tailored to attract different types of investors.

- Credibility and Professionalism: Forming an LLC can enhance your business’s credibility in the eyes of potential investors, as it shows a commitment to formalizing the business structure.

On the other hand, partnerships can also be enticing for certain types of investment but come with their own set of challenges:

- Ease of Formation: Partnerships are typically easier and cheaper to establish compared to LLCs, making them attractive for small businesses looking for quick capital.

- Direct Taxation: Partnerships are usually taxed once at the individual level, allowing profits to flow directly to partners, which can be appealing for investors looking for simpler tax implications.

- Collaboration Opportunities: Partnerships allow for shared responsibility and collaborative decision-making, which can lead to innovative funding strategies.

In terms of funding options, let’s break down the key differences:

| Funding Source | LLC | Partnership |

|---|---|---|

| Venture Capital | More likely to attract due to limited liability. | Less attractive due to personal liability. |

| Loans | More favorable terms due to structure. | May face higher interest rates. |

| Angel Investors | Preferred for structured investment agreements. | Possible, but riskier for investors. |

Ultimately, the decision between an LLC and a partnership can have a profound impact on how you raise capital. If you anticipate needing significant investment or potentially bringing on multiple investors, forming an LLC might be the better route. On the other hand, if you’re starting small and want to keep things simple, a partnership could suit your needs.

Remember, regardless of the structure you choose, having a solid business plan and a clear strategy for how you intend to use the funds will make your proposition more appealing to potential investors. Your choice of entity is just one of the many factors that can influence your success in navigating the complex world of funding.

Choosing the Right Structure for Your Business Goals

When it comes to establishing your business, selecting the right legal structure is crucial. It can significantly affect your taxation, liability, and overall operational flexibility. Both Limited Liability Companies (LLCs) and Partnerships offer unique advantages and disadvantages, making the choice dependent on your specific business goals and circumstances.

Understanding LLCs

Limited Liability Companies (LLCs) are favored for their flexibility and protection. Here are some key points to consider:

- Liability Protection: Owners (members) are typically not personally liable for business debts or liabilities, safeguarding personal assets.

- Tax Options: LLCs can choose how they want to be taxed, either as a sole proprietorship, partnership, or corporation, potentially providing significant tax savings.

- Management Flexibility: Members can choose to manage the LLC themselves or appoint managers, allowing for a tailored management structure.

- Credibility: Forming an LLC can enhance your business’s credibility with customers and potential investors.

Exploring Partnerships

Partnerships are simpler structures that come with their own benefits and challenges. Consider these factors:

- Ease of Formation: Generally easier and cheaper to set up than LLCs, with fewer formalities involved.

- Pass-Through Taxation: Income is passed through to partners, avoiding double taxation seen in some corporations.

- Shared Responsibility: Partners share the operational responsibilities and decision-making processes, fostering collaboration.

- Flexible Profit Distribution: Partners can decide how profits are distributed, which can vary from ownership percentages.

Comparative Table

| Feature | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No |

| Taxation | Flexible | Pass-Through |

| Management Structure | Flexible | Collaborative |

| Formation Complexity | Moderate | Simple |

Ultimately, the choice between an LLC and a Partnership hinges on your business goals. If liability protection and flexible management are priorities, an LLC might be the right fit. Conversely, if you value simplicity and direct income sharing, a Partnership could serve your needs better. Always consider consulting with a legal or financial advisor to tailor the decision to your specific situation.

Pros and Cons of Operating an LLC

Starting a Limited Liability Company (LLC) can be an excellent choice for many entrepreneurs, offering a variety of benefits. However, like any business structure, it has its drawbacks. Let’s explore what makes operating an LLC a compelling option, as well as some potential downsides.

Advantages of an LLC

- Limited Liability Protection: One of the primary advantages of an LLC is the protection it offers to its owners (called members). This means personal assets are generally safe from business debts and legal actions.

- Flexible Management Structure: LLCs allow members to choose how they want to manage their business, whether it’s member-managed or manager-managed, providing greater flexibility compared to a corporation.

- Tax Advantages: By default, LLCs are pass-through entities, which means profits and losses can be reported on the owners’ personal tax returns, potentially avoiding double taxation.

- Less Formality: Compared to corporations, LLCs typically have fewer ongoing formalities and compliance requirements, making it easier to maintain.

Disadvantages of an LLC

- Self-Employment Taxes: LLC members are usually subject to self-employment taxes on their earnings, which can be higher than corporate tax rates.

- Limited Life: In some states, LLCs might have a limited lifespan, meaning they can dissolve under certain conditions, such as the death or withdrawal of a member.

- Investment Limitations: If you’re looking to attract venture capital or public investment, an LLC might not be the best choice, as investors typically prefer the corporate structure.

- State-Specific Regulations: The rules governing LLCs can vary significantly from state to state, which can lead to complexity and additional costs in compliance.

Quick Comparison Table

| Feature | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No |

| Taxation | Pass-through | Pass-through |

| Management Flexibility | High | Moderate |

| Formality Requirements | Lower | Minimal |

Choosing to operate as an LLC can be an empowering decision for many business owners. It’s essential to weigh these pros and cons carefully to determine if this structure aligns with your business goals and personal circumstances.

Pros and Cons of Running a Partnership

Running a partnership can be an attractive option for many entrepreneurs. One of the primary advantages is the shared responsibility among partners. Instead of one person shouldering the entire burden of decision-making and management, partners can collaborate, leveraging each other’s strengths and skills. This often leads to enhanced creativity and innovation, as each partner brings unique perspectives to the table.

Another notable benefit is financial flexibility. Partnerships typically require less capital to start compared to corporations or LLCs. Each partner can contribute funds, reducing the financial strain on a single individual. Furthermore, profits can be directly distributed among partners, simplifying tax obligations since the partnership usually doesn’t face corporate taxation.

However, partnerships aren’t without their downsides. A significant con is the issue of shared liability. Unlike an LLC, where personal assets are generally protected, partners may find themselves personally liable for the debts and obligations of the business. This can be particularly concerning if one partner makes decisions that negatively affect the business or incurs debts.

Moreover, disputes among partners can become detrimental to the business. Differences in vision, work ethic, or management styles can lead to conflicts that may not only affect the working relationship but also the overall success of the partnership. Establishing clear agreements and communication channels is crucial, but even the best-laid plans can falter.

| Pros | Cons |

|---|---|

| Shared responsibilities | Shared liability |

| Financial flexibility | Potential for disputes |

| Combined skills and expertise | Less control for individual partners |

| Ease of formation | Limited lifespan (if a partner exits) |

Additionally, partners may face challenges related to decision-making. In a partnership, consensus is often required, which can slow down the process. While a more democratic approach can lead to better decisions, it can also result in frustrations and delays if partners are unable to agree. This balance between collaboration and efficiency is a constant challenge.

while partnerships can be simple to establish, they may lack the formal structure that other business entities like LLCs provide. This informal nature can lead to misunderstandings regarding roles, responsibilities, and profit-sharing unless outlined clearly from the beginning. while partnerships can offer exciting opportunities, they also come with their own set of challenges that need to be carefully considered.

Making the Switch: Moving from Partnership to LLC

Transitioning from a partnership to a Limited Liability Company (LLC) can be a strategic move for many business owners. While partnerships offer a straightforward structure with shared responsibilities, they can expose individual partners to significant legal and financial risks. By forming an LLC, you can maintain the collaborative spirit of a partnership while gaining valuable protections and benefits.

One of the most compelling reasons to make the switch is the liability protection that an LLC offers. In a partnership, if the business accrues debt or faces a lawsuit, personal assets of the partners are often at risk. However, an LLC creates a legal buffer, ensuring that the members’ personal liabilities are separate from the company’s obligations. This means that creditors can go after LLC assets but typically cannot pursue the personal assets of the members.

Another factor to consider is tax flexibility. Partnerships are pass-through entities, which means profits and losses are reported on the individual partners’ tax returns. While this can simplify tax filings, it can lead to higher personal tax rates depending on the income level. An LLC also benefits from pass-through taxation but offers the option to be taxed as a corporation, which can be advantageous in certain situations. This flexibility can help you strategize better tax outcomes as your business grows.

Furthermore, LLCs often benefit from a more formalized structure that can enhance credibility. With an LLC, you can establish clear operational guidelines and governance, which is particularly beneficial if you’re looking to attract investors or secure loans. This formality helps in building trust with clients and partners, showcasing that your business is serious and well-structured.

If you’re considering making this transition, here are a few steps to guide you:

- Consult with Professionals: Engage with a lawyer or accountant to understand the implications and benefits specific to your business.

- File Necessary Paperwork: Prepare and file the Articles of Organization with your state to officially form your LLC.

- Update Operating Agreements: Draft an operating agreement that outlines the management structure and member responsibilities.

- Notify Stakeholders: Inform partners, employees, and clients about the change to ensure a smooth transition.

While the process may seem daunting, the long-term benefits of operating as an LLC often outweigh the initial challenges. By prioritizing legal protection, tax advantages, and enhanced credibility, you position your business for greater success and sustainability.

| Partnership | LLC |

|---|---|

| Personal liability for debts | Limited liability protection |

| Simple tax structure | Flexible tax options |

| No formal structure required | Formal structure enhances credibility |

| Shared profits and losses | Defined profit-sharing based on agreement |

moving from a partnership to an LLC not only safeguards your personal assets but also equips your business with more opportunities for growth and professionalism. Weighing these differences can help you make an informed decision that aligns with your business goals.

Common Mistakes to Avoid When Choosing Your Business Structure

Choosing the right business structure is a crucial decision that can impact your operations, taxes, and legal liability. Many entrepreneurs make common mistakes that could be avoided with a little research and foresight. Here are some pitfalls to watch out for when selecting between an LLC and a partnership.

One of the most frequent errors is not fully understanding the differences between the two structures. An LLC offers personal liability protection, meaning your personal assets are generally safe from business debts and lawsuits. In contrast, general partners in a partnership may be personally liable for the business’s obligations. Failing to recognize this distinction can lead to significant financial risks.

Another mistake is overlooking the tax implications of each structure. An LLC can choose how it wants to be taxed: as a sole proprietorship, partnership, or corporation. Partnerships, on the other hand, are generally taxed as pass-through entities, which means income is taxed on the individual partners’ returns. Not evaluating how these differences affect your tax responsibilities can lead to unexpected tax burdens.

Not considering the management structure is also a common misstep. An LLC allows for a more flexible management structure, which can be beneficial as your business grows. Partnerships typically operate with a shared management model, which may not accommodate future needs for scalability. Failing to plan for the future can hinder your ability to adapt as your business evolves.

Moreover, many entrepreneurs neglect to think about the business’s growth potential. If you envision expanding your business or bringing in new partners, an LLC might serve you better due to its adaptability and formal structure, which can make attracting investors easier. Partnerships can be limiting if growth requires more complex arrangements.

Don’t forget to consider the formalities and compliance requirements. LLCs require more paperwork, such as operating agreements and annual reports, which can seem daunting. On the other hand, partnerships are usually simpler to set up and maintain. However, skipping these formalities can lead to misunderstandings and disputes down the road.

| Aspect | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No |

| Tax Structure | Flexible | Pass-through |

| Management Flexibility | High | Shared |

| Compliance Complexity | Higher | Lower |

Lastly, failing to seek professional advice can be a costly mistake. Consulting with a legal or financial expert can provide you with insights tailored to your specific situation. They can help you navigate the nuances of both LLCs and partnerships, ensuring you make an informed decision that aligns with your business goals.

Real-Life Examples: LLCs vs Partnerships in Action

To truly grasp the differences between LLCs and partnerships, let’s look at some real-life scenarios that illustrate how each structure operates in practice.

Take, for instance, a group of friends who decide to open a coffee shop. They form a general partnership, where each member contributes not just capital but also their expertise in coffee-making and customer service. While the venture seems promising, they quickly discover that any legal issues, such as a customer slipping on a wet floor, can expose all partners to personal liability. This means that if the coffee shop faces a lawsuit, their personal assets—like homes and savings—are at risk.

Now, contrast this with a tech startup that opts to form a Limited Liability Company (LLC). The founders are all concerned about potential liabilities, especially given the complex nature of software development. By forming an LLC, they protect their personal assets from any legal claims against the company. If a customer sues the startup for a software failure, only the assets of the LLC are at risk, not the founders’ personal wealth. This structure not only protects them but also enhances their credibility when seeking investors.

In another example, consider a small real estate investment group that operates as an LLC. They pool their resources to purchase properties, benefiting from shared risk and limited liability. Each member enjoys pass-through taxation, meaning profits and losses can be reported on their personal tax returns without facing double taxation. This is a significant advantage over a traditional partnership where income is taxed at the partnership level before being distributed to partners.

However, partnerships can also provide flexibility that many LLCs do not. For example, imagine a team of freelance graphic designers who work together on projects. They form a general partnership, allowing them to easily share income and expenses without the formalities that an LLC requires. They thrive on creative collaboration and find that the simplicity of their partnership structure suits their needs perfectly.

Here’s a quick comparison to further clarify:

| Factor | Partnership | LLC |

|---|---|---|

| Personal Liability | High | Low |

| Tax Treatment | Pass-through taxation | Pass-through taxation with potential for corporate tax |

| Management Structure | Flexible, but requires consensus | Structured, with defined roles |

| Formalities | Minimal | More formal, requires filing |

Ultimately, the choice between an LLC and a partnership will depend on the specific needs and goals of the business owners. Those who prioritize protecting their personal assets and desire a structured approach may lean towards forming an LLC. In contrast, those who value simplicity and flexibility might find a partnership more appealing. Each structure has its unique strengths, and understanding these can lead to a more informed, strategic decision.

Final Thoughts: Which Structure Is Right for You?

Choosing the right business structure is a critical decision that can have far-reaching implications for your company’s success, liabilities, and tax obligations. When weighing the options between an LLC and a partnership, it’s essential to consider your unique circumstances and future goals.

Consider Your Business Goals: Your long-term objectives can significantly influence the structure that’s best for you. If you envision rapid growth and possibly attracting investors, an LLC may offer more flexibility and protection. On the other hand, if your focus is on a smaller-scale operation, a partnership might suit your needs without the added complexity of an LLC.

Assess Your Risk Tolerance: The potential liabilities associated with your business activities should also guide your decision. An LLC provides personal liability protection, which is crucial if your business operates in a high-risk industry. In contrast, partnerships expose personal assets to potential claims, making them riskier for some entrepreneurs.

Evaluate Your Financial Situation: Tax implications play a significant role in this decision-making process. LLCs typically enjoy pass-through taxation, just like partnerships, but they may also have additional fees and requirements. Consider running the numbers to see which structure aligns better with your financial goals.

Consider Management and Control: The way your business is managed can also influence your choice. LLCs offer flexibility in management structures, allowing members to choose how they want to run the company. Partnerships, while generally simpler, may lead to conflicts if there are differing visions for the business direction. Clear communication and defined roles can help mitigate these risks.

To give you a clearer picture, here’s a quick comparison chart:

| Feature | LLC | Partnership |

|---|---|---|

| Liability Protection | Yes | No |

| Tax Treatment | Pass-through taxation | Pass-through taxation |

| Management Flexibility | High | Moderate |

| Formality | More formal requirements | Less formal |

Seek Professional Advice: There’s no one-size-fits-all answer here. Consulting with a legal or financial expert can provide personalized insights that take into account your specific situation. They can help you navigate the nuances of each structure and ensure that you make a well-informed decision.

Ultimately, the best structure for your business will depend on a combination of your goals, risk tolerance, and long-term vision. Take the time to evaluate your choices carefully, and you’ll set a strong foundation for your entrepreneurial journey.

Frequently Asked Questions (FAQ)

Q&A: LLC vs Partnership – What Are the Differences?

Q1: What’s the main difference between an LLC and a partnership?

A1: Great question! The primary difference lies in liability protection. An LLC, or Limited Liability Company, offers personal liability protection to its owners, meaning your personal assets are generally safe if the business faces legal issues or debts. In contrast, a partnership doesn’t provide that same level of protection. Partners are personally liable for business debts and obligations, putting their personal assets at risk.

Q2: How do taxes work for an LLC compared to a partnership?

A2: Taxes can be a little tricky! In a partnership, profits and losses pass directly through to the partners’ personal tax returns, which means you report your share of the income on your individual taxes. Now, with an LLC, you have options! By default, it’s taxed like a partnership (pass-through taxation), but you can also choose to be taxed as a corporation. This flexibility can be a big advantage!

Q3: Which one is easier to set up, an LLC or a partnership?

A3: Setting up a partnership is usually quicker and less formal—often just a handshake agreement between partners. But don’t let that simplicity fool you! An LLC requires filing paperwork with your state and may involve some fees, but it’s worth it for the liability protection. If you’re serious about your business, the extra steps of forming an LLC can pay off in the long run.

Q4: What about management structure? Are there differences?

A4: Absolutely! Partnerships generally have a simpler management structure where all partners typically have a say in running the business. An LLC, on the other hand, can have a more flexible management structure. You can choose to have members manage it themselves or appoint managers to run the day-to-day operations. This flexibility can make it easier to scale your business.

Q5: Can I convert my partnership into an LLC later on?

A5: Yes, you can! Many businesses start as partnerships and later decide to form an LLC for added protection and benefits. The process involves filing the appropriate paperwork and may require some adjustments to your operating agreement. It’s a smart move if you’re looking to grow and protect your personal assets!

Q6: Which option is better for a new business owner?

A6: It really depends on your goals! If you want simplicity and are starting out small, a partnership might suit you just fine. But if you’re looking for liability protection and potential growth, forming an LLC is often the better route. It shows investors and clients that you’re serious about your business, which can pay off in more ways than one!

Q7: What should I consider before making my decision?

A7: Think about your business goals, how many people you plan to involve, your willingness to handle paperwork, and your need for liability protection. Also, consider consulting with a legal or financial advisor to understand what’s best for your specific situation. Making an informed choice now can save you headaches down the road!

Final Thoughts:

Choosing between an LLC and a partnership doesn’t have to be daunting! By understanding the key differences, you can make a choice that aligns with your business vision. Whether you want the flexibility of a partnership or the protection of an LLC, what’s most important is that you choose the structure that supports your goals. Happy business building!

In Summary

As we wrap up our deep dive into the differences between LLCs and partnerships, it’s clear that choosing the right business structure isn’t just a box to check; it’s a decision that can shape the future of your enterprise. Whether you’re leaning towards the flexibility of a partnership or the liability protection of an LLC, understanding these distinctions is crucial for setting your business up for success.

Remember, it’s not just about what sounds good on paper; it’s about what aligns with your goals, protects your interests, and supports your vision for growth. Take a moment to assess your business needs, consider your long-term plans, and perhaps even consult with a legal or financial advisor to ensure you’re making the most informed choice.

Ultimately, the right structure should empower you and your business to thrive. So, whether you’re ready to roll with a partnership or safeguard your assets with an LLC, make that decision count. Happy entrepreneuring!